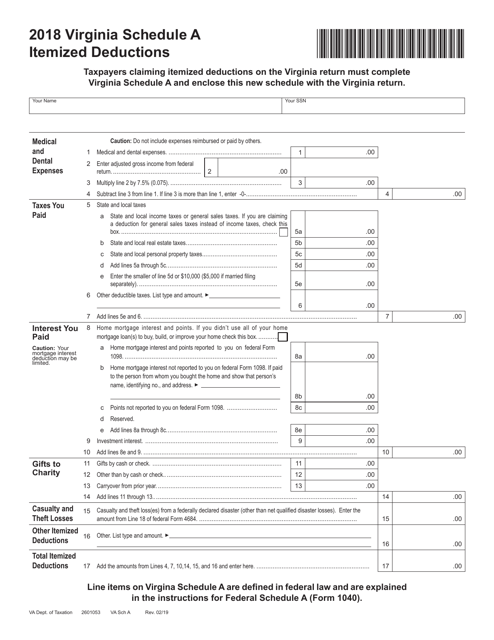

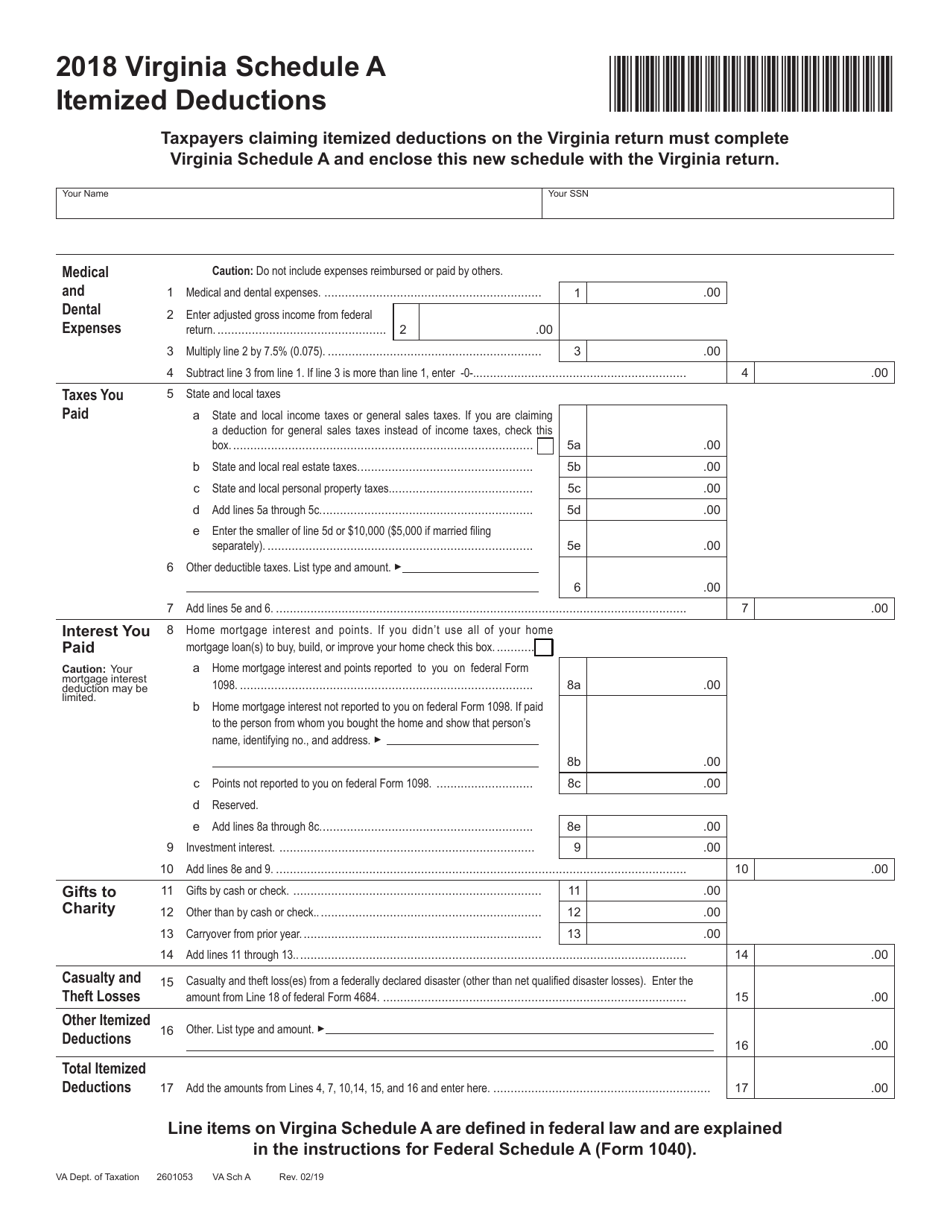

Virginia Schedule a Itemized Deductions - Virginia

Virginia Schedule a Itemized Deductions is a legal document that was released by the Virginia Department of Taxation - a government authority operating within Virginia.

FAQ

Q: What is Virginia Schedule A?

A: Virginia Schedule A is a form that is used to report itemized deductions on your Virginia state tax return.

Q: What are itemized deductions?

A: Itemized deductions are expenses that you can claim on your tax return to reduce your taxable income.

Q: What expenses can be included as itemized deductions on Virginia Schedule A?

A: Some examples of expenses that can be included as itemized deductions on Virginia Schedule A are medical expenses, state and local taxes, mortgage interest, and charitable contributions.

Q: Do I need to itemize deductions on my Virginia state tax return?

A: No, you have the option to either take the standard deduction or itemize deductions on your Virginia state tax return. You should choose the option that offers you the greater tax benefit.

Form Details:

- Released on February 1, 2019;

- The latest edition currently provided by the Virginia Department of Taxation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.