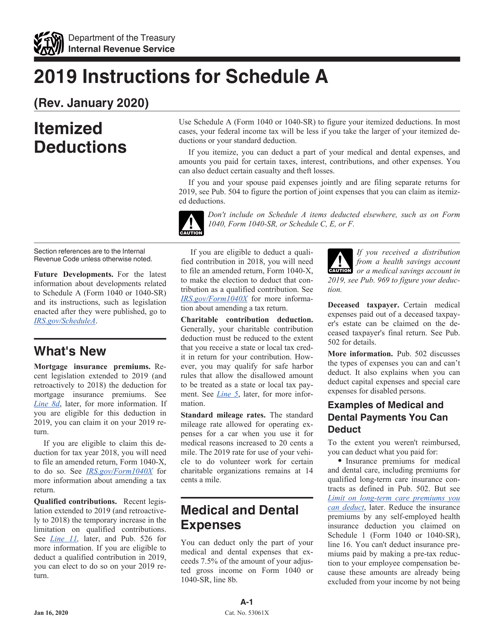

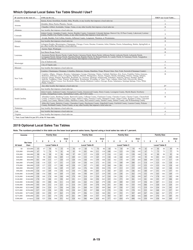

Instructions for IRS Form 1040, 1040-SR Schedule A Itemized Deductions

This document contains official instructions for IRS Form 1040 Schedule A and IRS Form 1040-SR Schedule A . Both forms are released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1040 (1040-SR) Schedule A is available for download through this link.

FAQ

Q: What is Form 1040?

A: Form 1040 is the standard individual income tax return form used in the United States.

Q: What is Form 1040-SR?

A: Form 1040-SR is a simplified version of Form 1040 for taxpayers who are 65 or older.

Q: What is Schedule A?

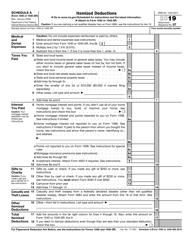

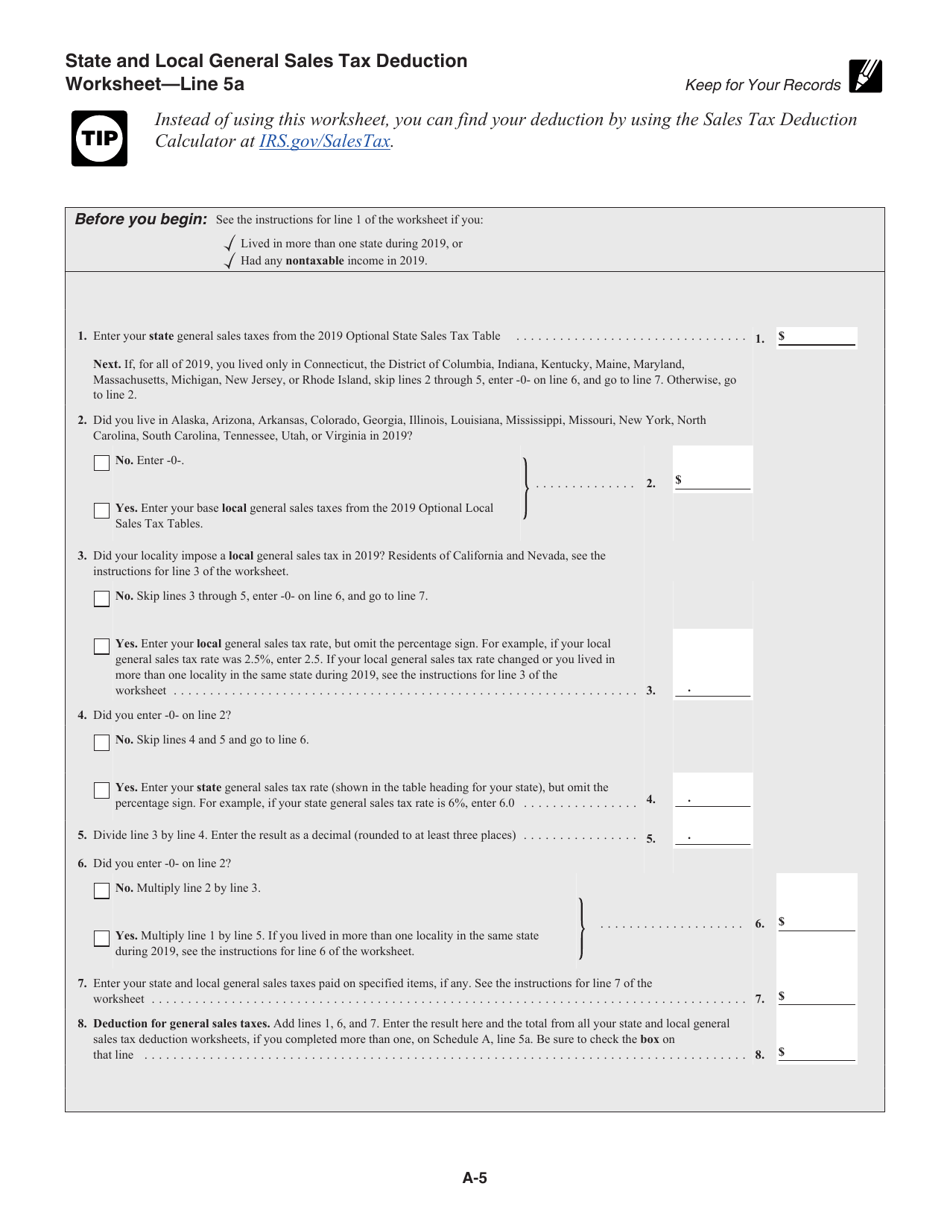

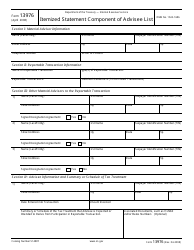

A: Schedule A is an additional form used with Form 1040 to report itemized deductions.

Q: What are itemized deductions?

A: Itemized deductions are specific expenses that eligible taxpayers can deduct from their taxable income.

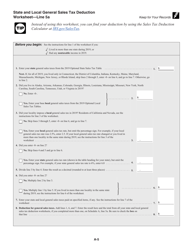

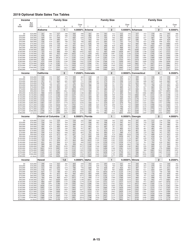

Q: What expenses can be deducted on Schedule A?

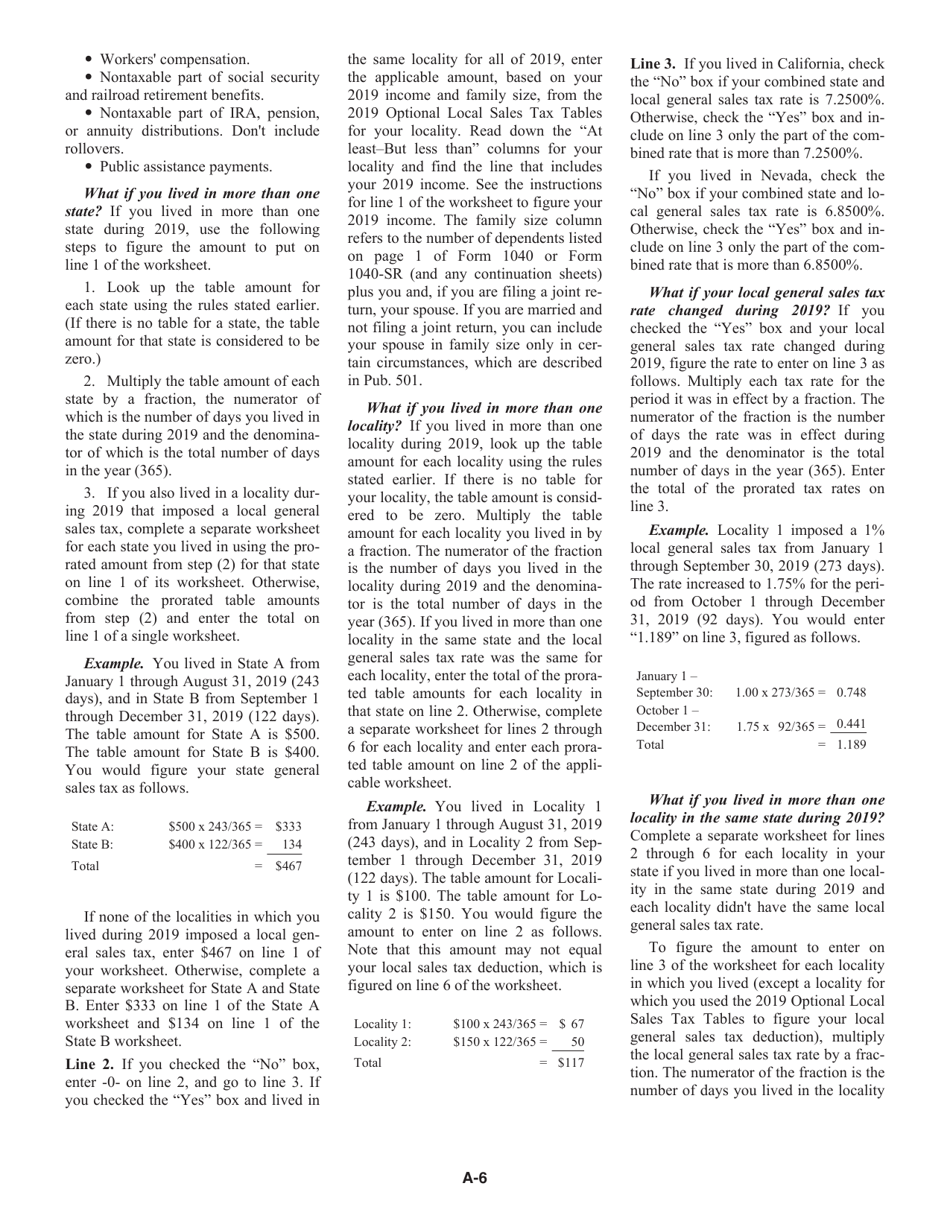

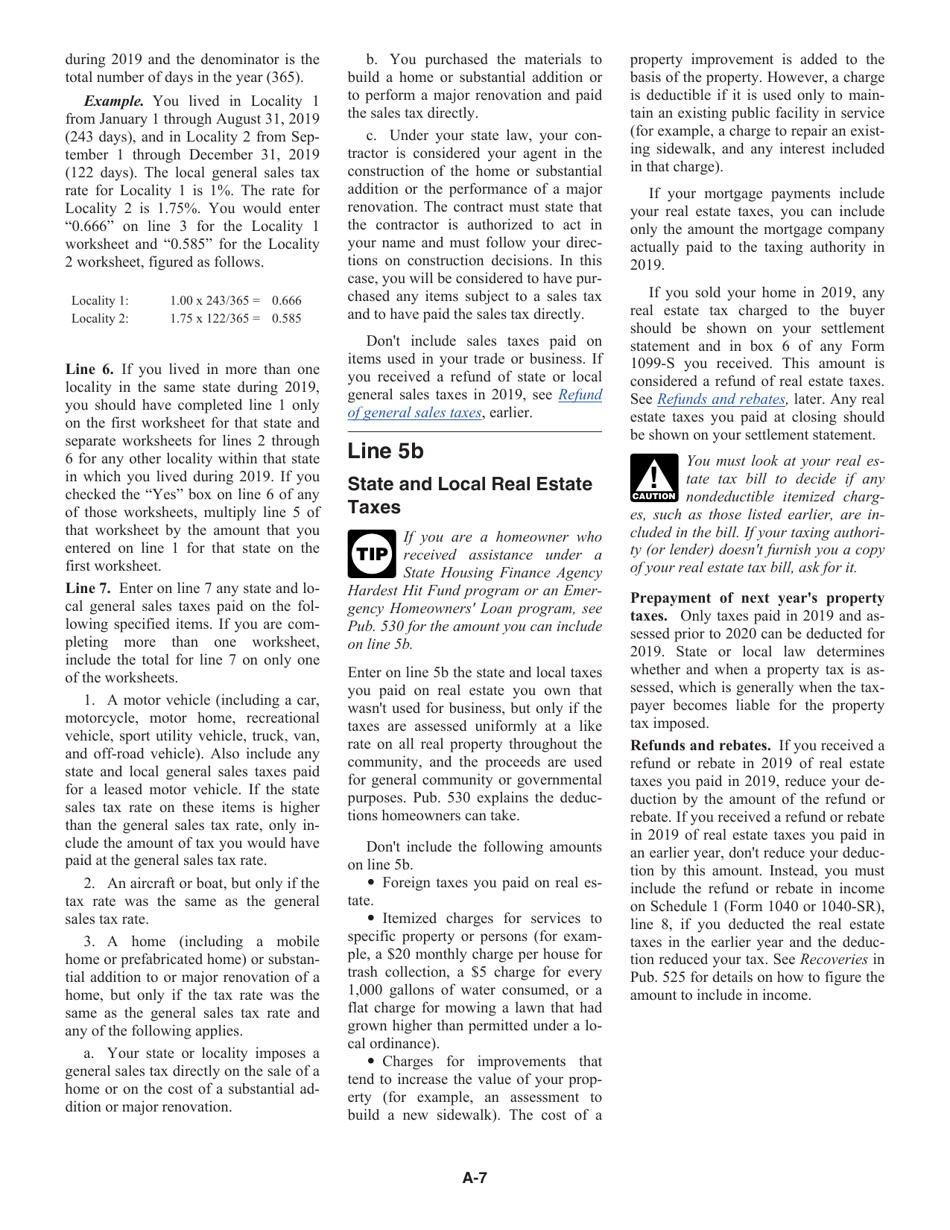

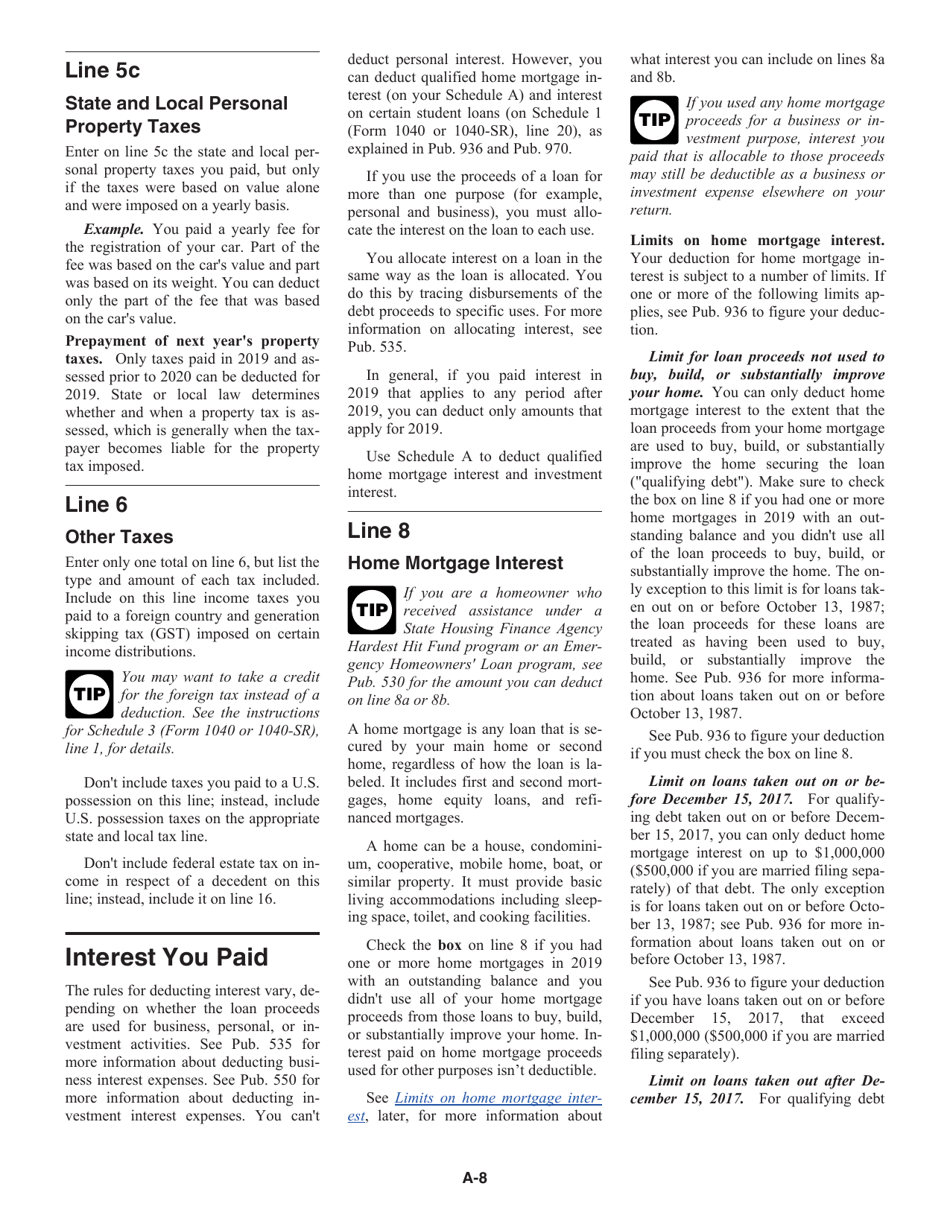

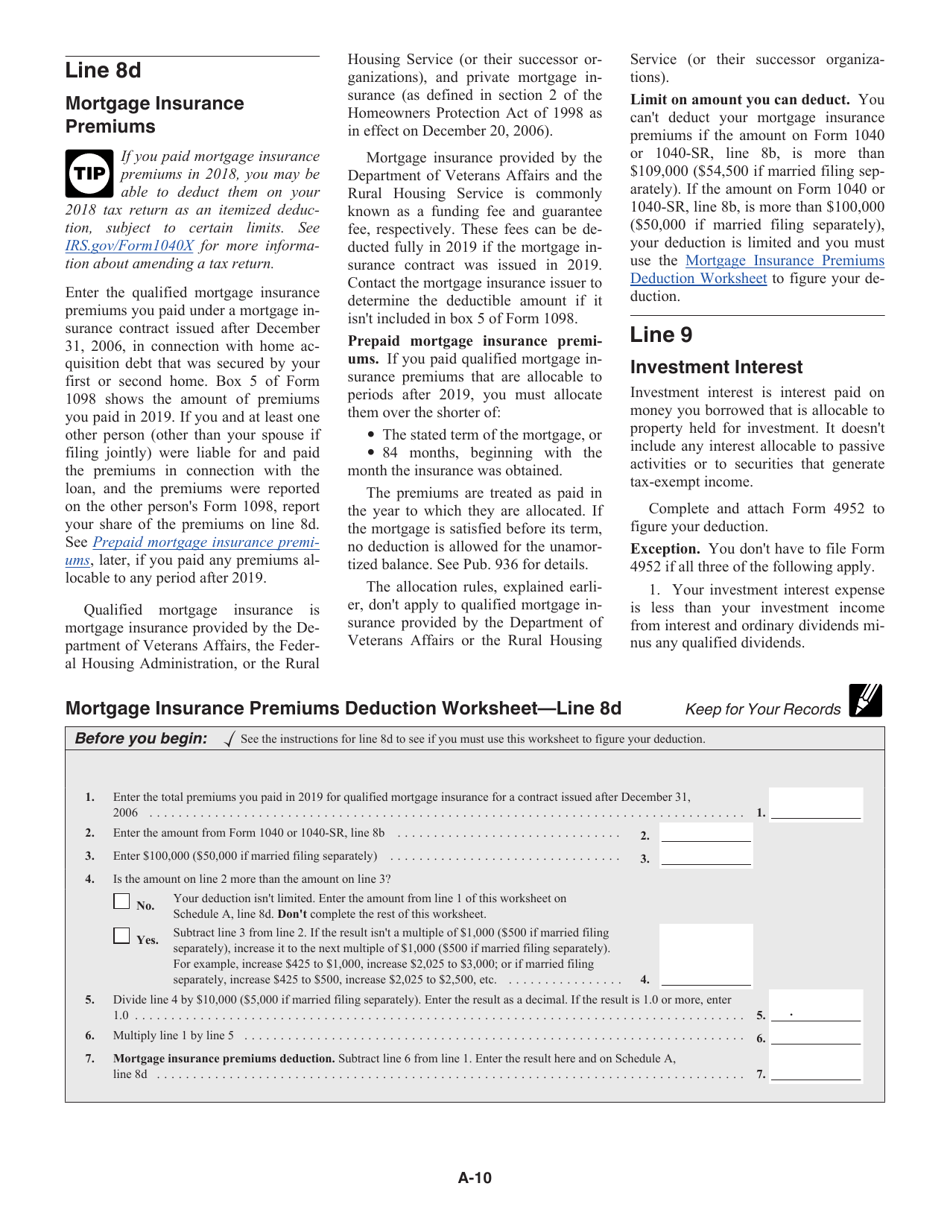

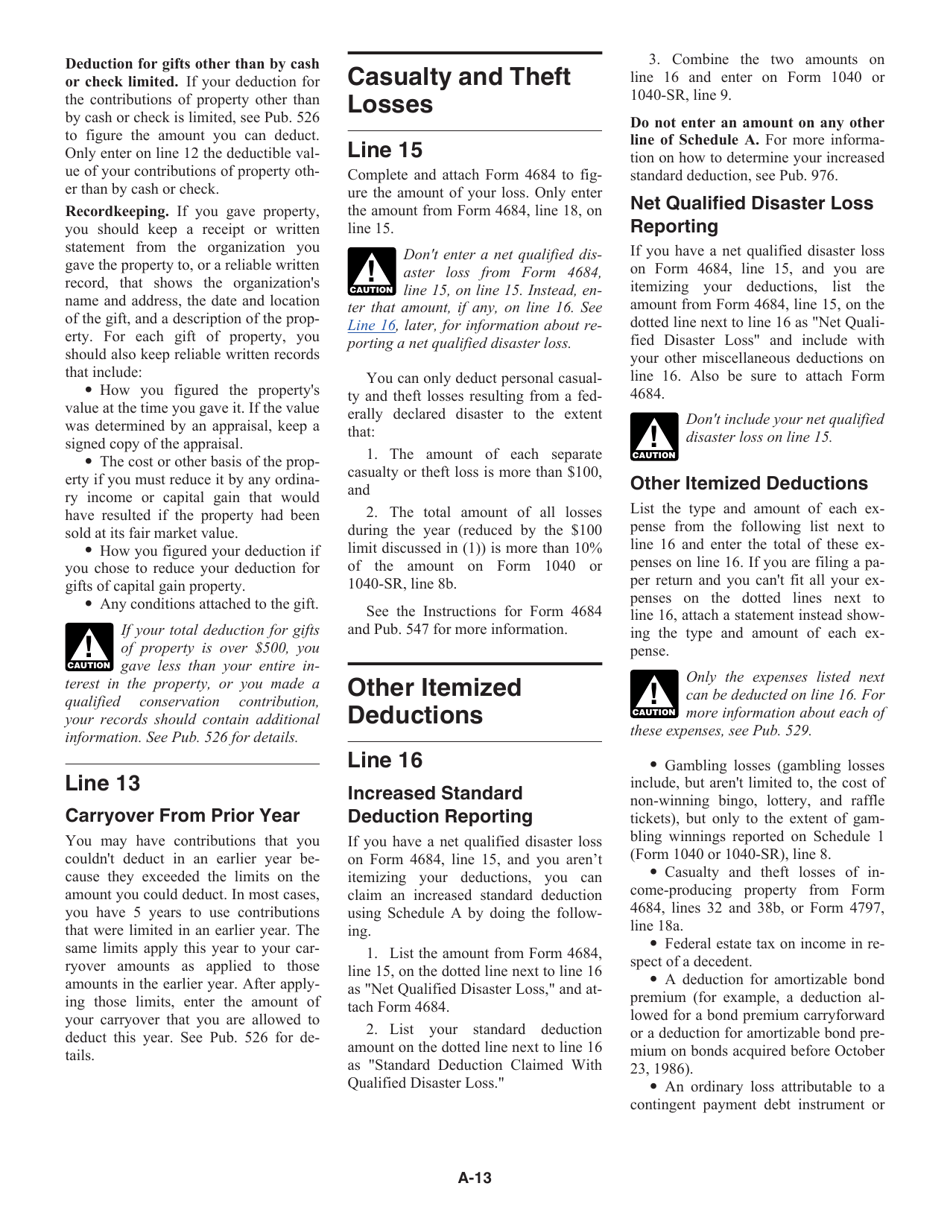

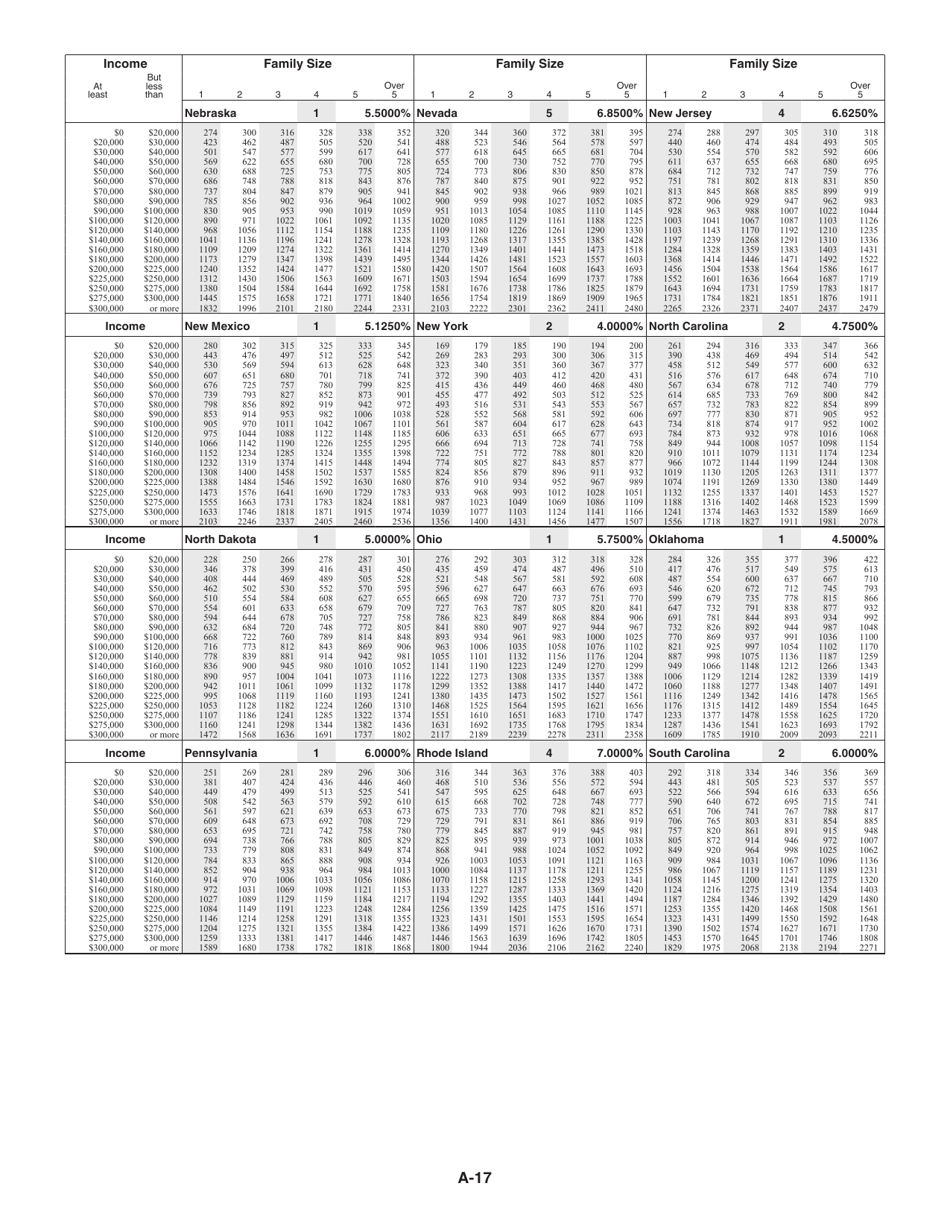

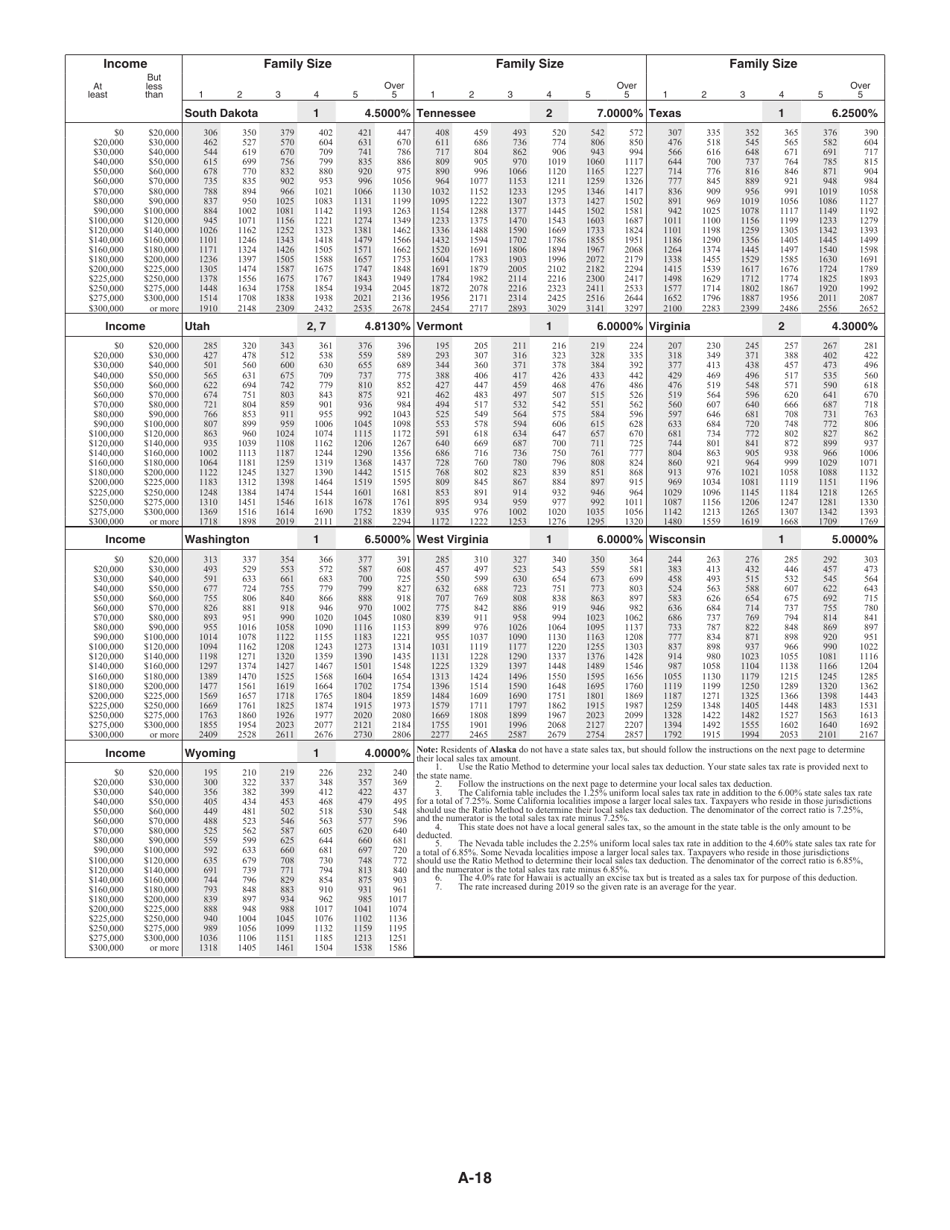

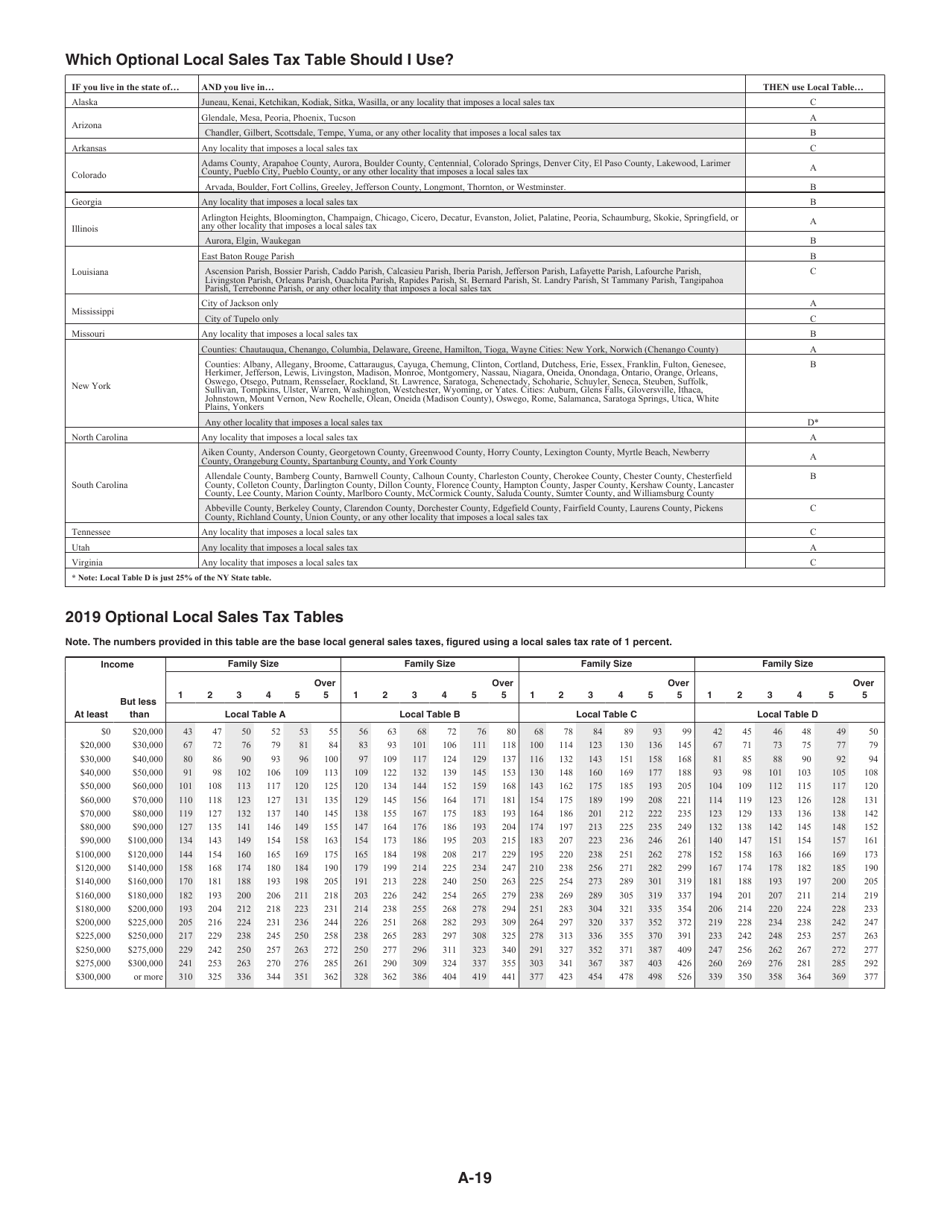

A: Common expenses that can be deducted on Schedule A include medical expenses, state and local taxes, mortgage interest, and charitable contributions.

Q: Can I use the standard deduction instead of itemizing?

A: Yes, taxpayers have the option to take the standard deduction instead of itemizing if it results in a larger deduction.

Q: How do I know if I should itemize or take the standard deduction?

A: You should compare your itemized deductions to the standard deduction and choose the option that gives you the larger deduction.

Q: Are there any income limits for using Form 1040-SR?

A: No, there are no income limits for using Form 1040-SR. It is available to all taxpayers who are 65 or older.

Q: What should I do if I have questions or need help with my tax return?

A: If you have questions or need help with your tax return, you can contact the IRS directly or consult a tax professional.

Instruction Details:

- This 19-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.