This version of the form is not currently in use and is provided for reference only. Download this version of

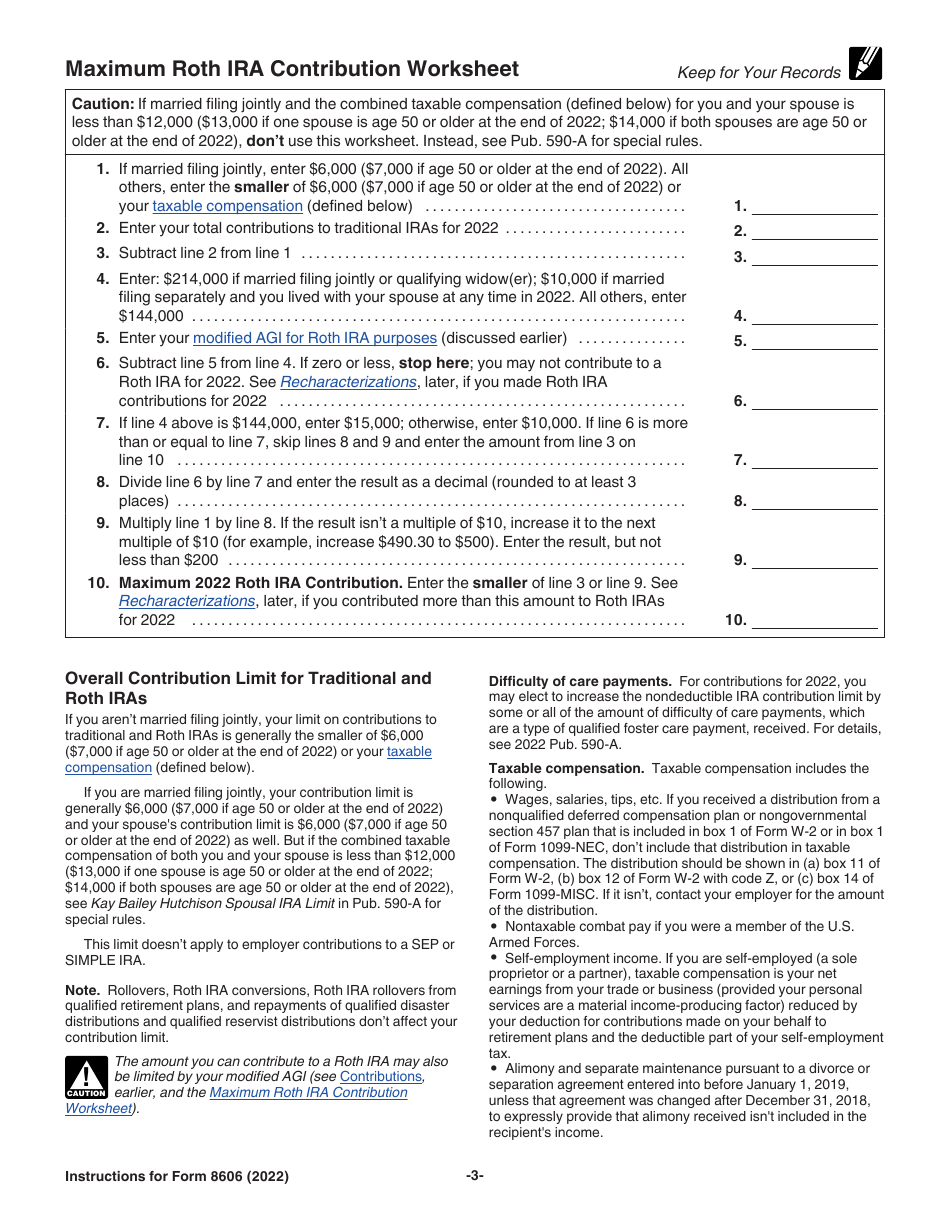

Instructions for IRS Form 8606

for the current year.

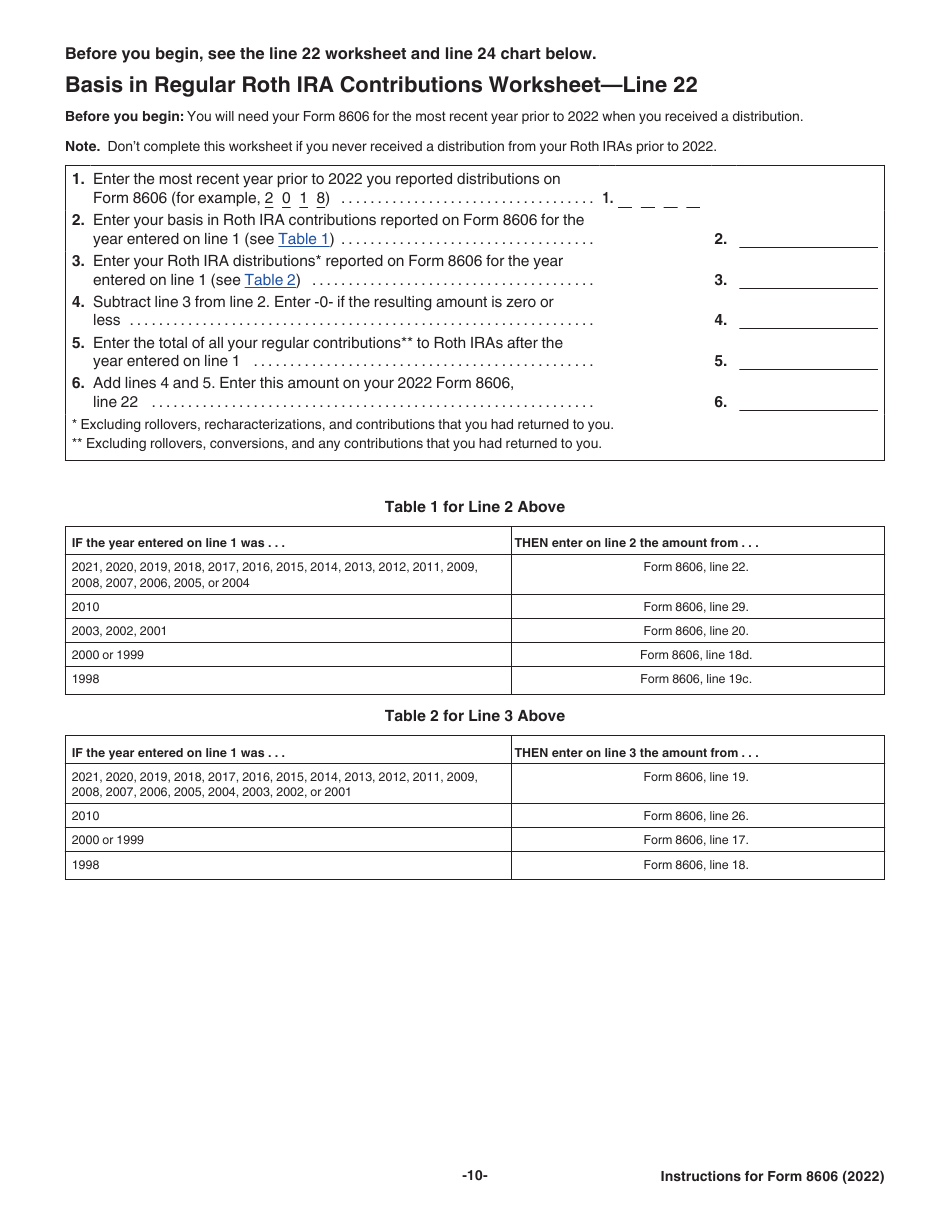

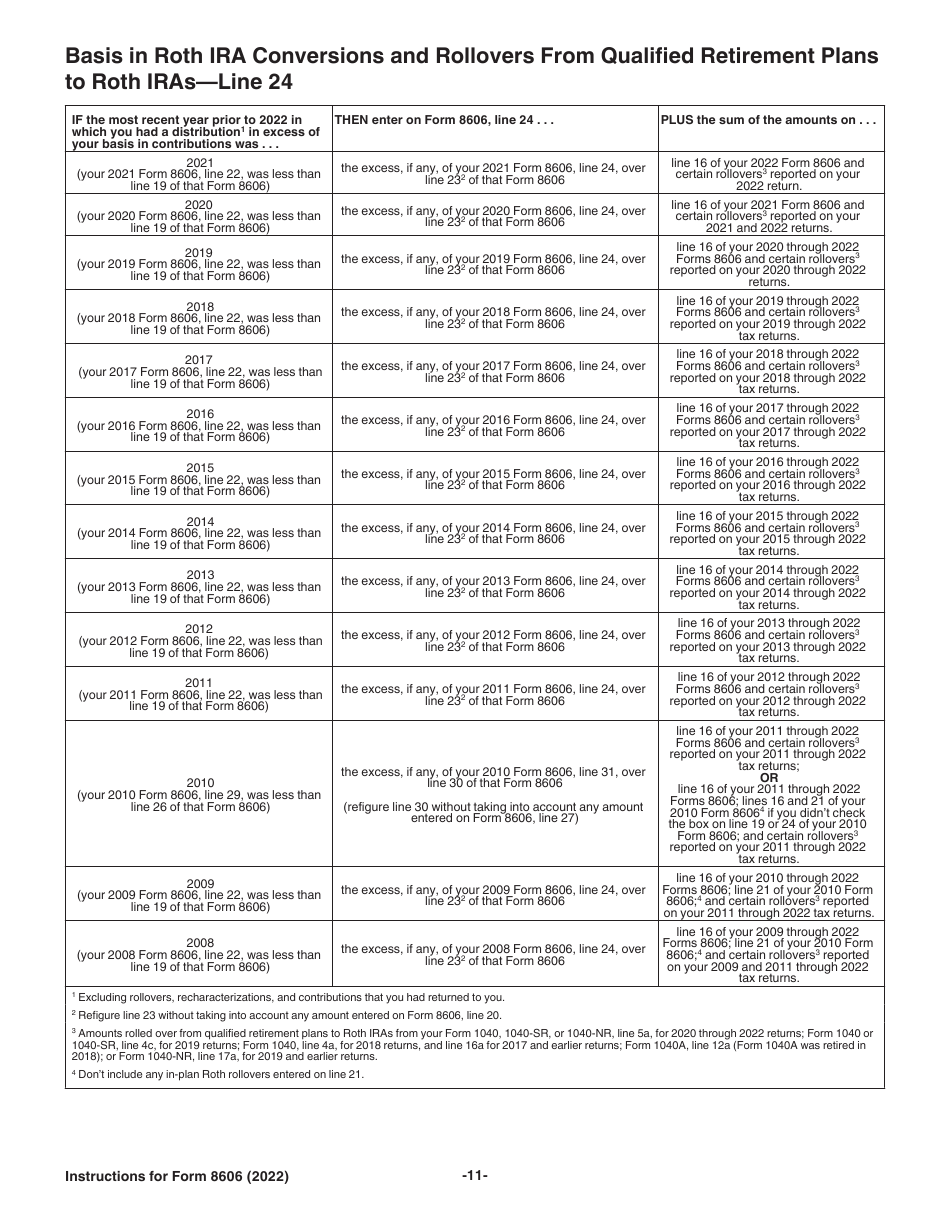

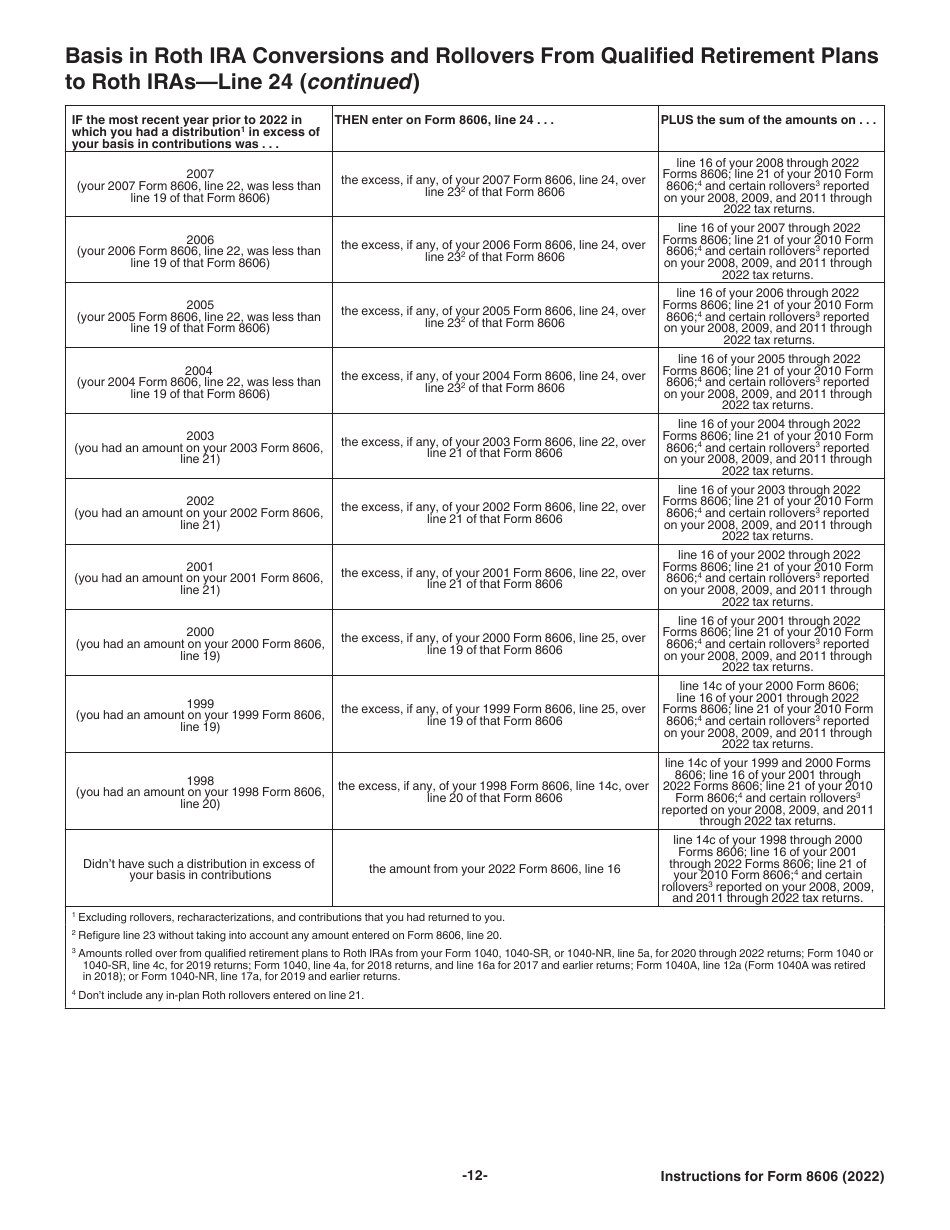

Instructions for IRS Form 8606 Nondeductible Iras

This document contains official instructions for IRS Form 8606 , Nondeductible Iras - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury.

FAQ

Q: What is IRS Form 8606?

A: IRS Form 8606 is a tax form used to report contributions and conversions to nondeductible IRAs.

Q: What are nondeductible IRAs?

A: Nondeductible IRAs are individual retirement accounts where contributions are made with after-tax dollars.

Q: Why do I need to file Form 8606?

A: You need to file Form 8606 to document any contributions or conversions made to nondeductible IRAs for tax purposes.

Q: Is there a deadline for filing Form 8606?

A: Form 8606 is generally filed with your annual tax return by the standard tax filing deadline, usually April 15th.

Q: Can I deduct contributions to a nondeductible IRA?

A: No, contributions to a nondeductible IRA are made with after-tax dollars and are not deductible.

Q: Are earnings on a nondeductible IRA taxed?

A: Earnings on a nondeductible IRA are tax-deferred until withdrawn, at which point they may be subject to taxation.

Q: What happens if I fail to file Form 8606?

A: Failing to file Form 8606 when required may result in penalties or interest on any tax owed.

Q: Can I e-file Form 8606?

A: Yes, you can e-file Form 8606 if you are using tax software that supports this form.

Q: Do I need to file Form 8606 every year?

A: You generally only need to file Form 8606 in the years when you make contributions or conversions to nondeductible IRAs.

Instruction Details:

- This 12-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.