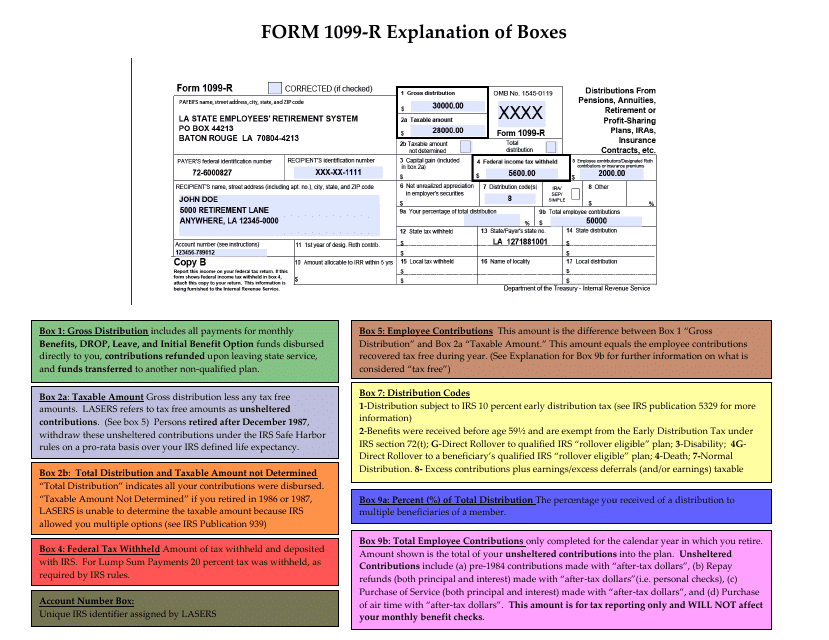

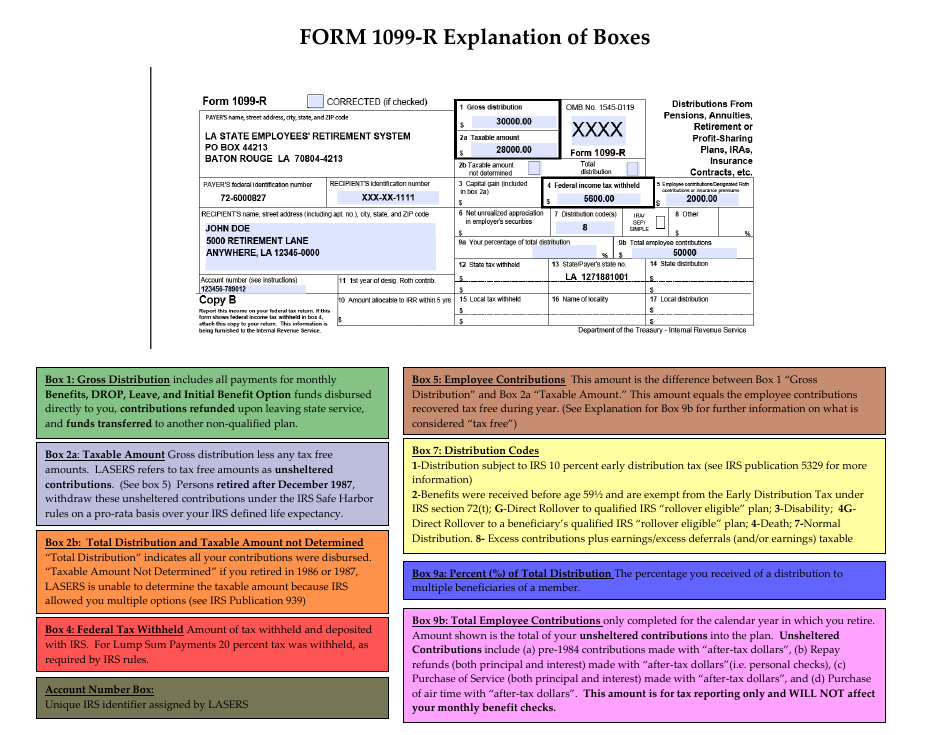

Instructions for IRS Form 1099-R Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, Etc. (Explanation of Boxes)

This document contains official instructions for IRS Form 1099-R , Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, Etc. (Explanation of Boxes) - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury.

FAQ

Q: What is IRS Form 1099-R?

A: IRS Form 1099-R is a tax form used to report distributions from pensions, annuities, retirement or profit-sharing plans, IRAs, insurance contracts, etc.

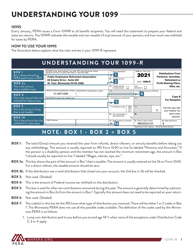

Q: What are the boxes on Form 1099-R?

A: The boxes on Form 1099-R represent different types of information to be reported, such as the distribution amount, taxable amount, and codes for the type of distribution.

Q: What information is reported in Box 1?

A: Box 1 of Form 1099-R reports the total distribution amount received during the tax year.

Q: What does Box 2a on Form 1099-R represent?

A: Box 2a reports the taxable amount of the distribution, which is the portion subject to income tax.

Q: What is reported in Box 7 of Form 1099-R?

A: Box 7 reports the distribution code that indicates the type of distribution received, such as early distribution, normal distribution, or rollover.

Q: How are distributions from IRAs reported on Form 1099-R?

A: Distributions from IRAs are reported in Box 7 with distribution code 7, which indicates a normal distribution from an IRA.

Q: Do I need to report Form 1099-R on my tax return?

A: Yes, you generally need to report the information from Form 1099-R on your tax return to accurately report your income and any taxes owed.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.