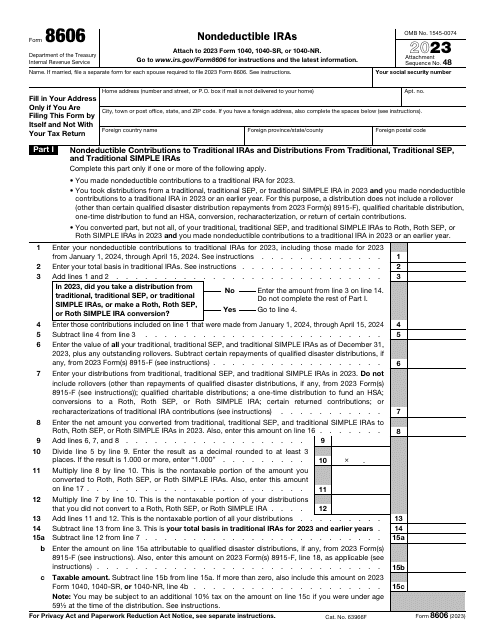

IRS Form 8606 Nondeductible Iras

What Is IRS Form 8606?

IRS Form 8606, Nondeductible IRAs , is a written document used by taxpayers that actively worked with their individual retirement accounts during the fiscal year.

Alternate Names:

- Tax Form 8606;

- Roth Conversion Form 8606.

Since the majority of contributions to those accounts can be deducted from the overall amount of income that is supposed to be taxed, it is a good idea to summarize how much money you put in those accounts, specify the value of assets you converted, and record the amount of distributions you got.

This instrument was issued by the Internal Revenue Service (IRS) in 2023 - older editions of the form are now obsolete. You can download an IRS Form 8606 fillable version via the link below.

What Is Form 8606 Used For?

IRS Form 8606 is used to inform tax authorities about all transactions the taxpayer had in relation to various individual retirement arrangements (IRAs). Prepare this statement to let the IRS know about the money you contributed to your IRA (as long as this amount cannot be deducted with the help of your annual income statement), transfers of assets from certain retirement plans to others, and distributions you received over the course of the tax period covered in the form.

Note that Form 8606 is not required when the taxpayer made no contributions that would be deducted in the future even if they got distributions from basic pension plans designed for employees or savings incentive match plans both employees and employers usually contribute to.

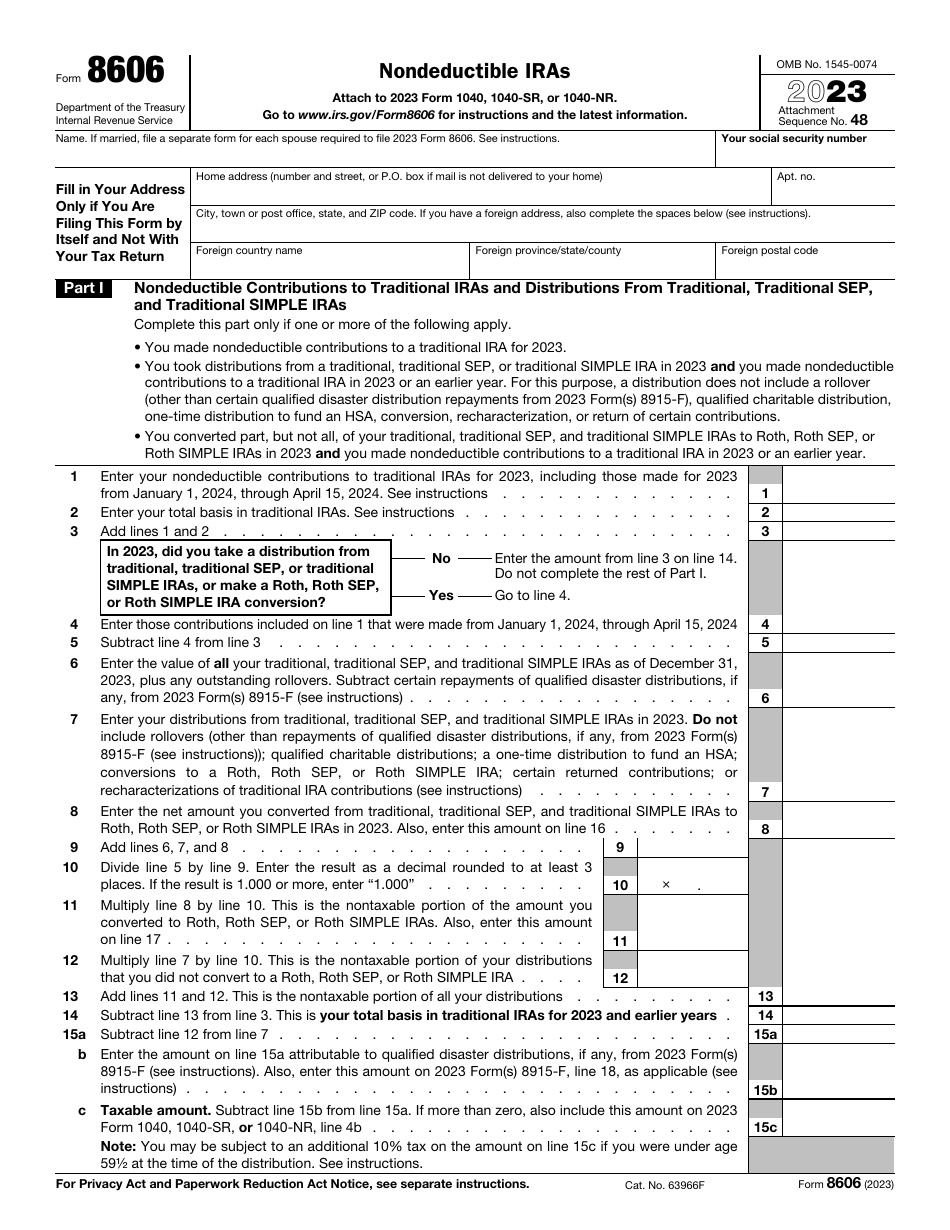

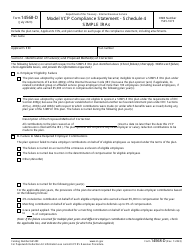

Form 8606 Instructions

The Form 8606 Instructions are as follows:

-

Start with your personal details - write down your full name, social security number, and correspondence address . Some filers live abroad at the time of filing - they are requested to elaborate on their address by adding the name of the foreign country, indicating the county, state, or province they reside in, and recording the postal code.

-

Pay attention to the rules laid down for married taxpayers who submit a tax return together . If your status is married filing jointly, the form needs to contain the name and the social security of the spouse whose details are disclosed to fiscal organs. It is likely you and your partner are obliged to submit Forms 8606 - you will be expected to furnish separate statements.

-

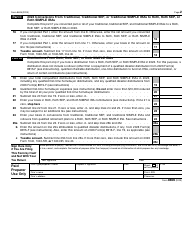

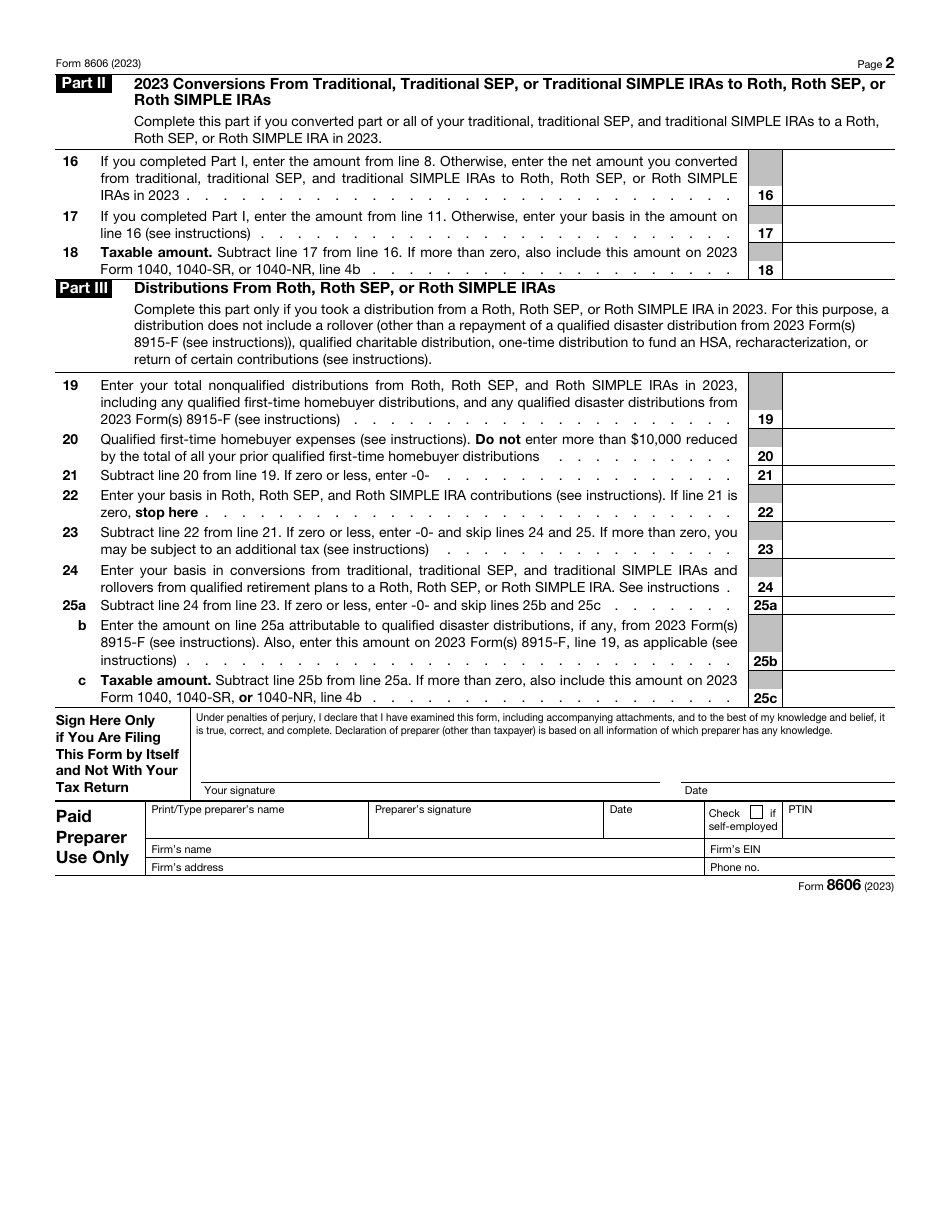

Provide information about the money you contributed to traditional retirement accounts that offer their holders tax benefits and the distributions you received from those accounts . You need to tell the IRS about the amount of contributions, state the after-tax balance relevant for your account, and use the formulas and rates in the document to learn the taxable amount of contributions.

-

If during the year you moved money and assets from a traditional account to another account, it is mandatory to state the amount that has undergone the conversion and state the taxable amount you replicate on your income statement .

-

Elaborate on distributions you took from the accounts identified in the third section of the statement . You must add the amount of nonqualified distributions, take your account basis into consideration, and compute the taxable amount of distributions.

-

Certify the document - you may only sign and date the statement if you are not attaching it to your tax return and submitting the form on its own . It is allowed to hire a tax professional to assist you with preparation and filing since certain parts of the Tax Form 8606 can be tricky for an individual unfamiliar with tax legislation - in this case, make sure this person certifies the paperwork as well identifying themselves properly.

What Happens If You Forgot to File Form 8606?

If a taxpayer failed to comply with their obligation to inform the government about contributions to and distributions from retirement accounts through Tax Form 8606, they will be subject to a penalty - nowadays, the IRS will ask you to pay $50 for every document you did not submit.

However, it is still possible to avoid the sanction in question if you manage to prove you had a reasonable cause that prevented you from mailing the papers on time - for instance, penalty relief applies when the taxpayer had a long-term illness or dealt with the consequences of a natural disaster. When you receive a formal notice from fiscal authorities asking you to pay a penalty, reach out to the sender and explain your situation - sometimes, the IRS is willing to waive the penalty.

How to File Form 8606 for Previous Years?

If for any reason you did not submit IRS Form 8606 even though you had a duty to report the IRA contributions and deductions for a particular year, you may still send the paperwork to the IRS no matter how long the delay was.

Taxpayers often receive penalties due to a failure to file on time yet they should not worry about the information included in the form impacting their taxable income and increasing their tax liability at any point in the future. It is advised to keep a copy of Form 8606 once you send the paperwork in case you ever need to refer to the documentation you filed in the past.

Where to Mail Form 8606?

It is necessary to send Roth Conversion Form 8606 alongside your tax return - it may be IRS Form 1040, U.S. Individual Income Tax Return, IRS Form 1040-SR, U.S. Tax Return for Seniors, or IRS Form 1040-NR, U.S. Nonresident Alien Income Tax Return. The due date for the documentation matches the deadline set for the forms listed above - usually, it is April 15 of the year that follows the year described in the instrument.

Nevertheless, there are taxpayers that do not have an obligation to submit an income statement to the IRS which simply means Form 8606 must be filed on its own. The mailing address is the same one you would use for your tax return - file the papers with the IRS center that accepts and reviews documentation in your current location.