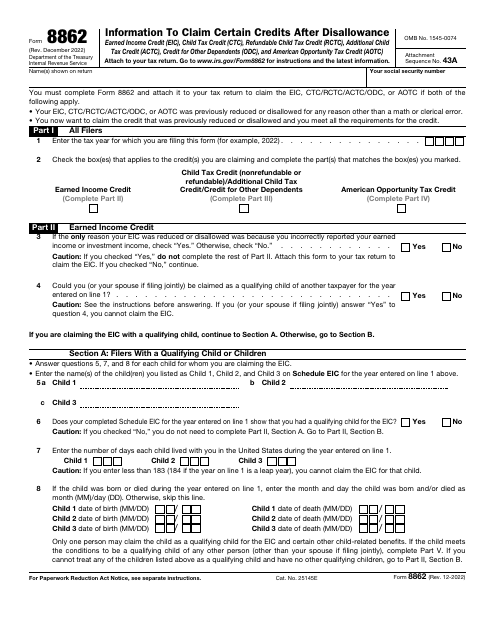

This version of the form is not currently in use and is provided for reference only. Download this version of

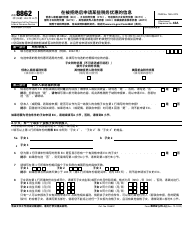

IRS Form 8862

for the current year.

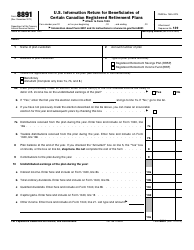

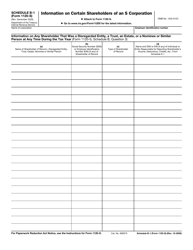

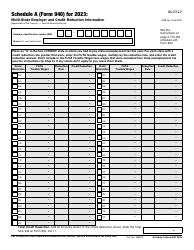

IRS Form 8862 Information to Claim Certain Credits After Disallowance

What Is IRS Form 8862?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on December 1, 2022. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

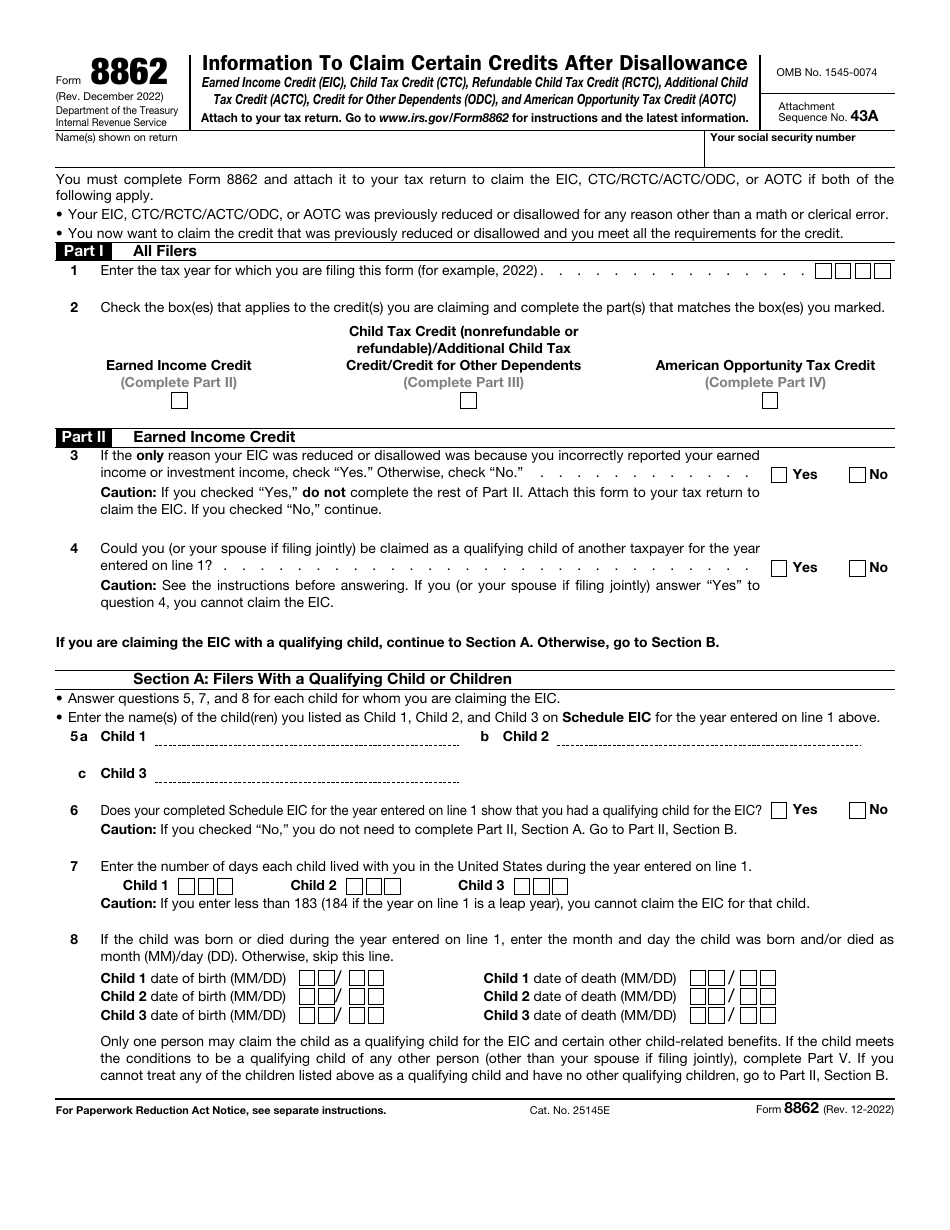

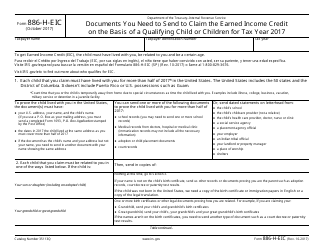

Q: What is IRS Form 8862?

A: IRS Form 8862 is used to claim certain credits after they have been disallowed.

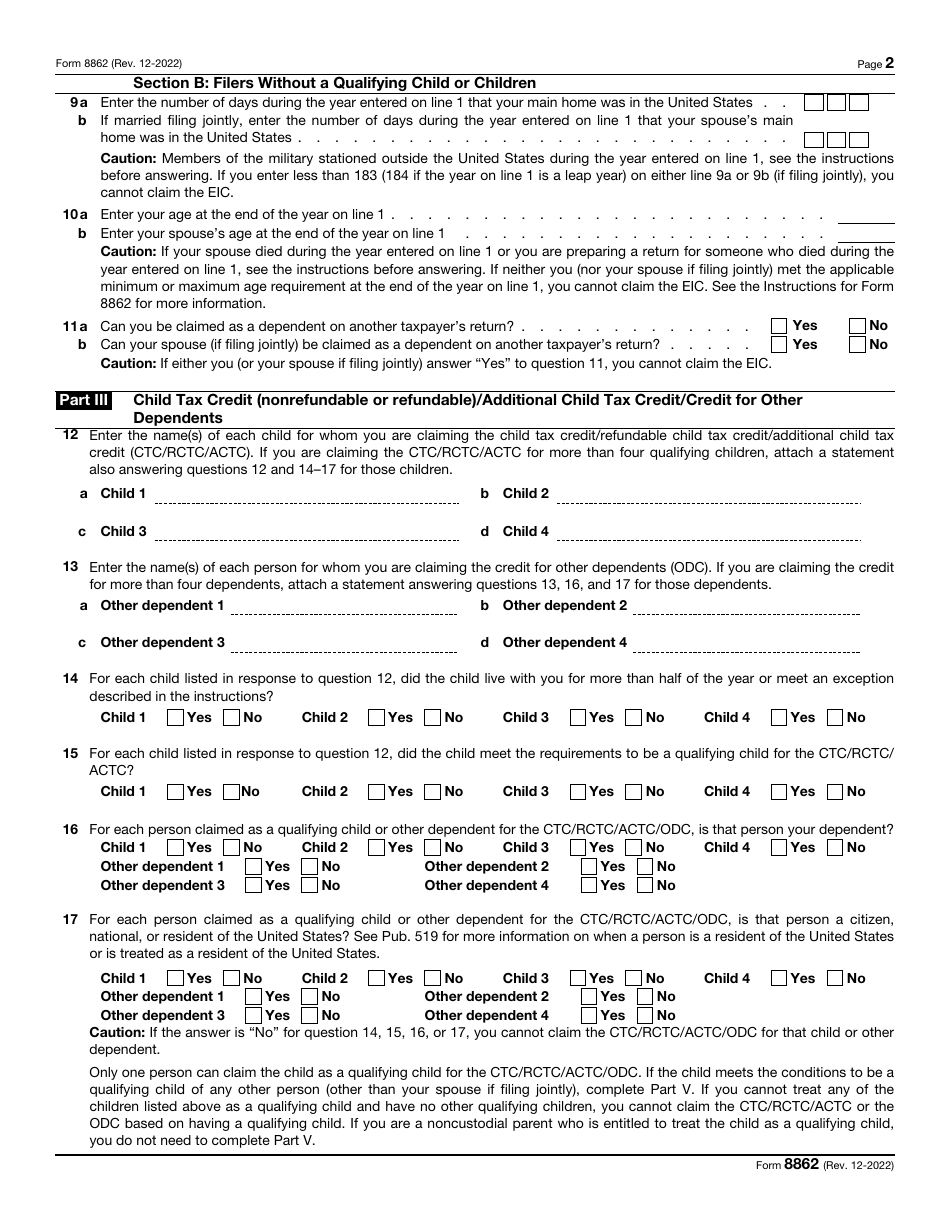

Q: What credits can be claimed using IRS Form 8862?

A: IRS Form 8862 can be used to claim Earned Income Credit (EIC), Child Tax Credit (CTC), Refundable Child Tax Credit (RCTC), Additional Child Tax Credit (ACTC), Credit for Other Dependents (ODC), and American Opportunity Tax Credit (AOTC).

Q: Why would a credit be disallowed?

A: A credit may be disallowed if the IRS determines that the taxpayer does not meet the eligibility requirements.

Q: When should I use IRS Form 8862?

A: IRS Form 8862 should be used if your claim for a credit has been disallowed in a previous tax year.

Q: Can I claim these credits without using IRS Form 8862?

A: No, if your claim for any of these credits has been disallowed, you must use IRS Form 8862 to claim them in the future.

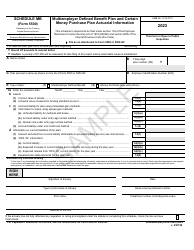

Q: Are there any additional requirements for using IRS Form 8862?

A: Yes, there may be additional requirements imposed by the IRS, such as document submission or verification.

Q: What happens after I submit IRS Form 8862?

A: The IRS will review your form and supporting documents to determine if you are eligible to claim the credits.

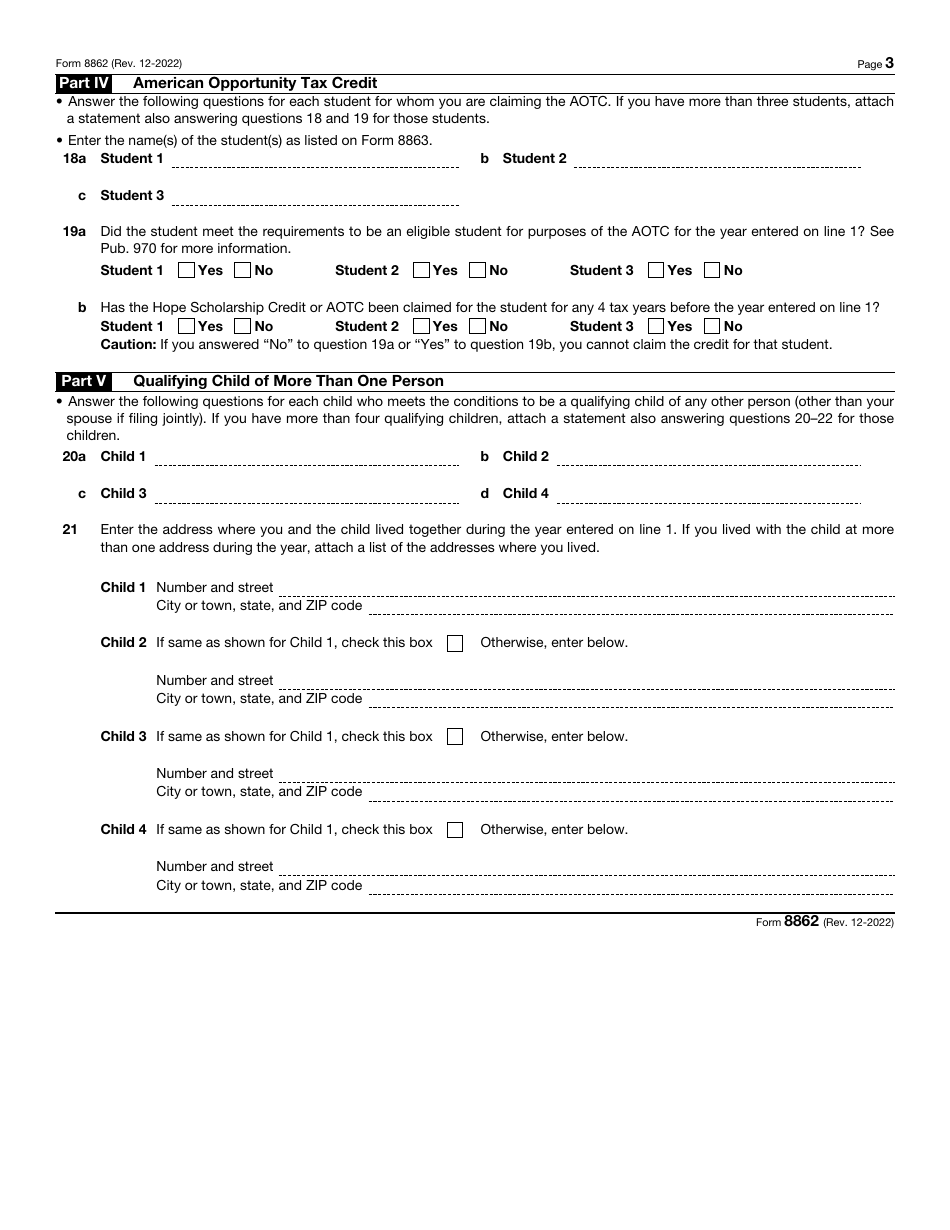

Q: Can I use IRS Form 8862 to claim other credits?

A: No, IRS Form 8862 is specifically for claiming the credits mentioned (EIC, CTC, RCTC, ACTC, ODC, AOTC) after disallowance.

Q: Is there a deadline for submitting IRS Form 8862?

A: The deadline for submitting IRS Form 8862 is generally the same as the deadline for filing your tax return.

Form Details:

- A 4-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8862 through the link below or browse more documents in our library of IRS Forms.