This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 8862

for the current year.

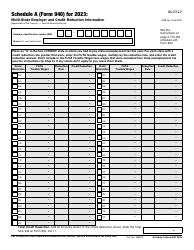

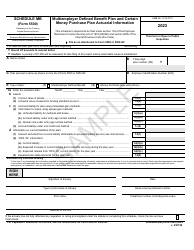

Instructions for IRS Form 8862 Information to Claim Certain Credits After Disallowance

This document contains official instructions for IRS Form 8862 , Information to Claim Certain Credits After Disallowance - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8862 is available for download through this link.

FAQ

Q: What is Form 8862?

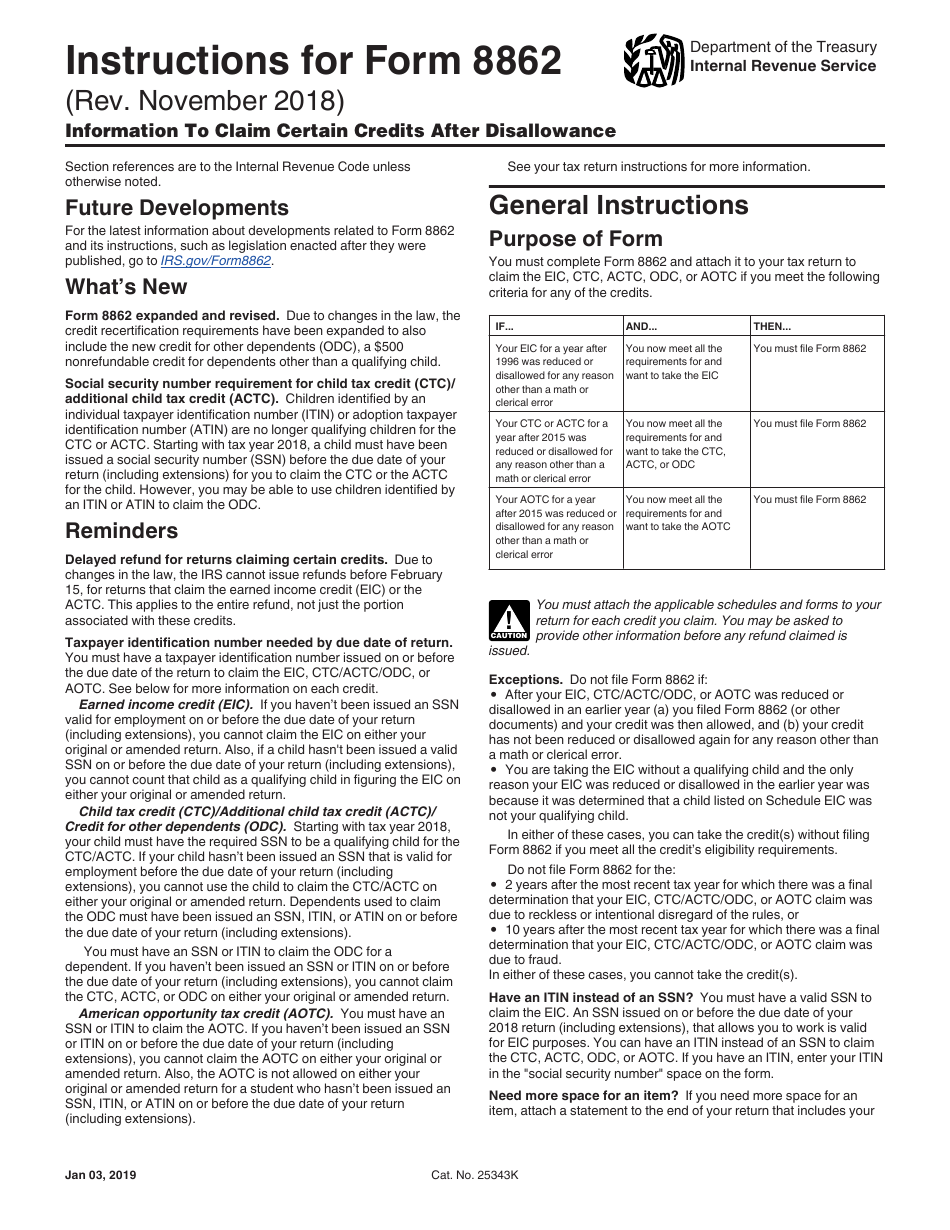

A: Form 8862 is used to claim certain credits after they have been disallowed by the IRS.

Q: Which credits can be claimed using Form 8862?

A: Form 8862 can be used to claim the Child Tax Credit, Additional Child Tax Credit, American Opportunity Credit, and the Credit for Other Dependents.

Q: When should I file Form 8862?

A: You should file Form 8862 if you are claiming certain credits that were previously disallowed and have been notified by the IRS to file this form for future claims.

Q: What information is required to complete Form 8862?

A: To complete Form 8862, you will need your personal information, information on the disallowed credit, and any changes in your circumstances that may affect your eligibility for the credit.

Q: Can I e-file Form 8862?

A: Yes, you can e-file Form 8862 if you are filing it with your tax return or as a stand-alone form.

Q: What happens after I file Form 8862?

A: After you file Form 8862, the IRS will review your information and determine if you are eligible to claim the credits.

Q: Is there a fee to file Form 8862?

A: No, there is no fee to file Form 8862.

Instruction Details:

- This 3-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.