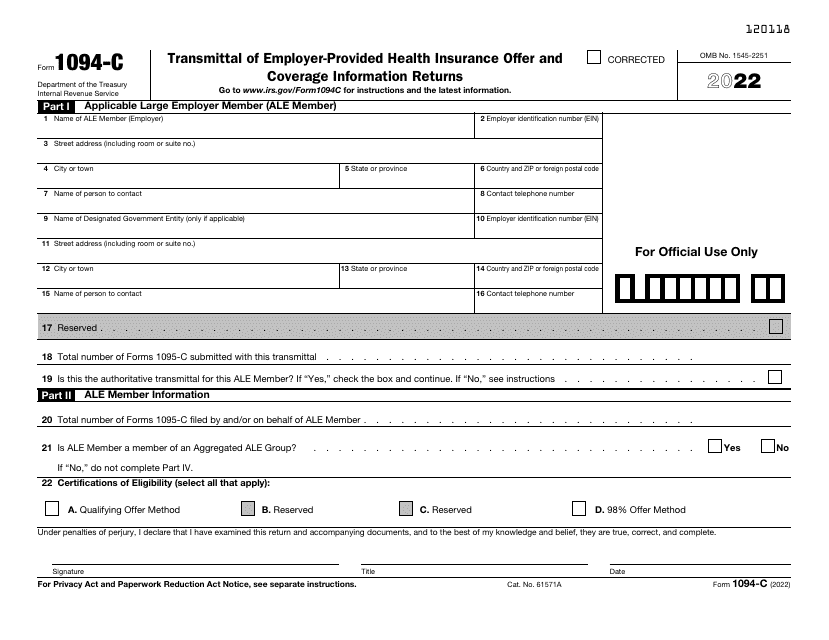

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 1094-C

for the current year.

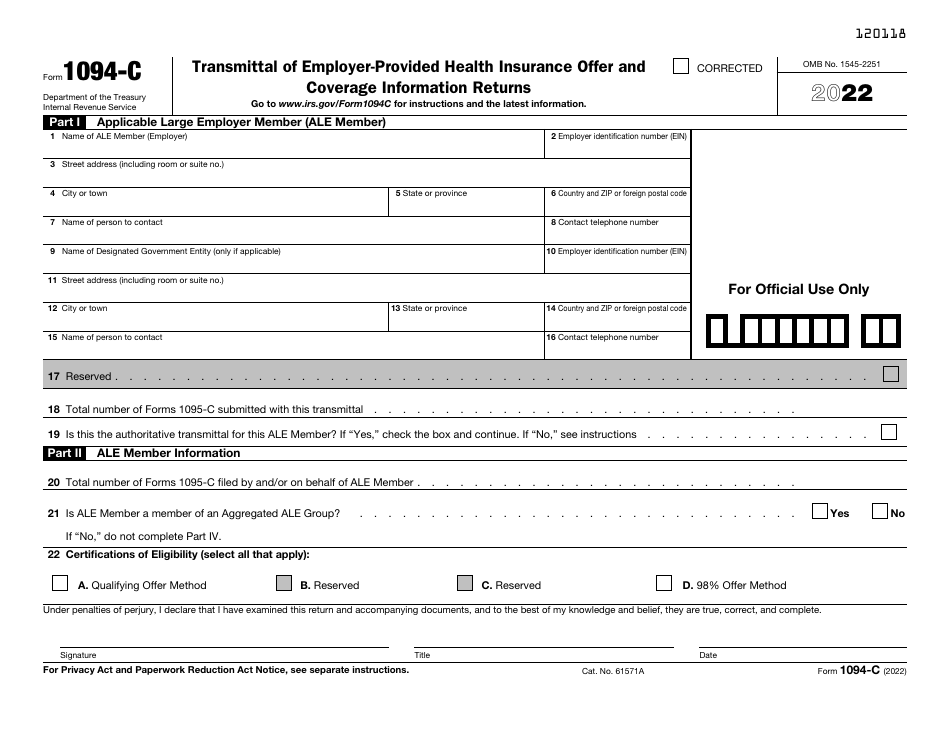

IRS Form 1094-C Transmittal of Employer-Provided Health Insurance Offer and Coverage Information Returns

What Is IRS Form 1094-C?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1094-C?

A: IRS Form 1094-C is a transmittal form used to submit Employer-Provided Health Insurance Offer and Coverage Information Returns to the IRS.

Q: What is the purpose of IRS Form 1094-C?

A: The purpose of IRS Form 1094-C is to provide information about the health insurance coverage offered by employers to their employees.

Q: Who needs to file IRS Form 1094-C?

A: Applicable large employers (ALEs) must file IRS Form 1094-C if they are required to offer health insurance to their full-time employees.

Q: When is the deadline to file IRS Form 1094-C?

A: The deadline to file IRS Form 1094-C is typically February 28th (or March 31st if filed electronically) of the year following the calendar year to which the form relates.

Q: Are there any penalties for not filing IRS Form 1094-C?

A: Yes, there can be penalties for failing to file or filing incorrect information on IRS Form 1094-C. It is important to ensure accurate and timely filing.

Q: Do I need to attach any other forms with IRS Form 1094-C?

A: Yes, you may need to attach copies of the individual 1095-C forms to IRS Form 1094-C, depending on the number of employees you have.

Q: Can I file IRS Form 1094-C electronically?

A: Yes, ALEs with 250 or more forms must file electronically. However, electronic filing is also available for smaller employers.

Form Details:

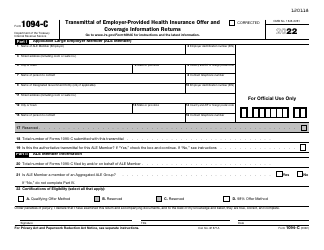

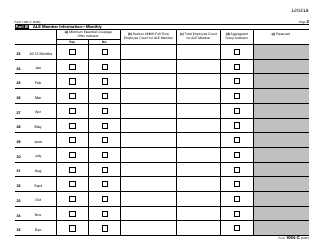

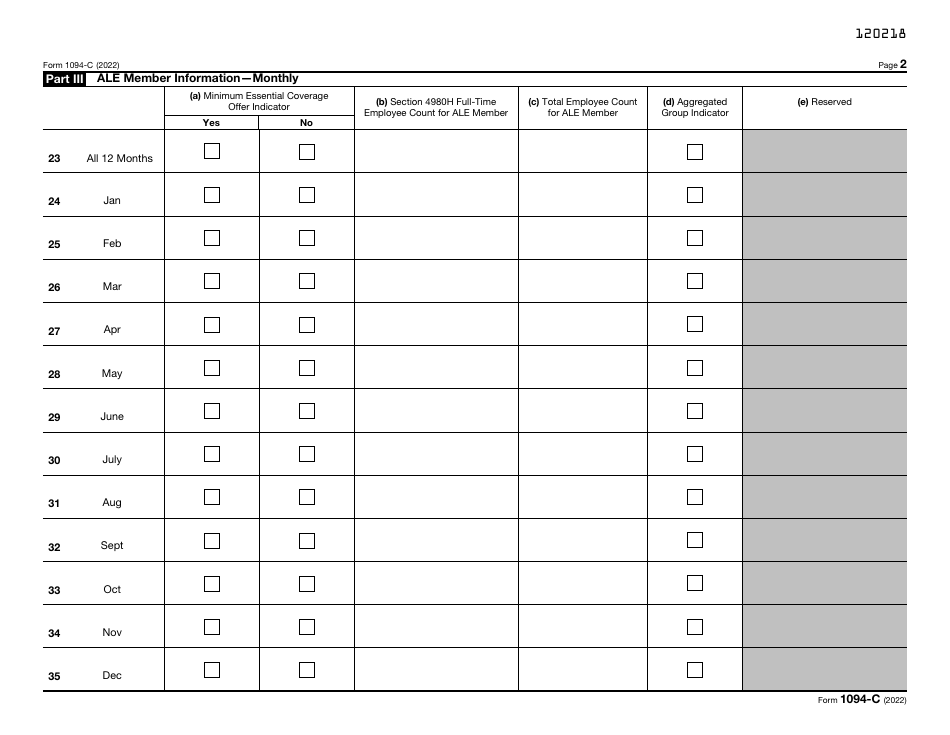

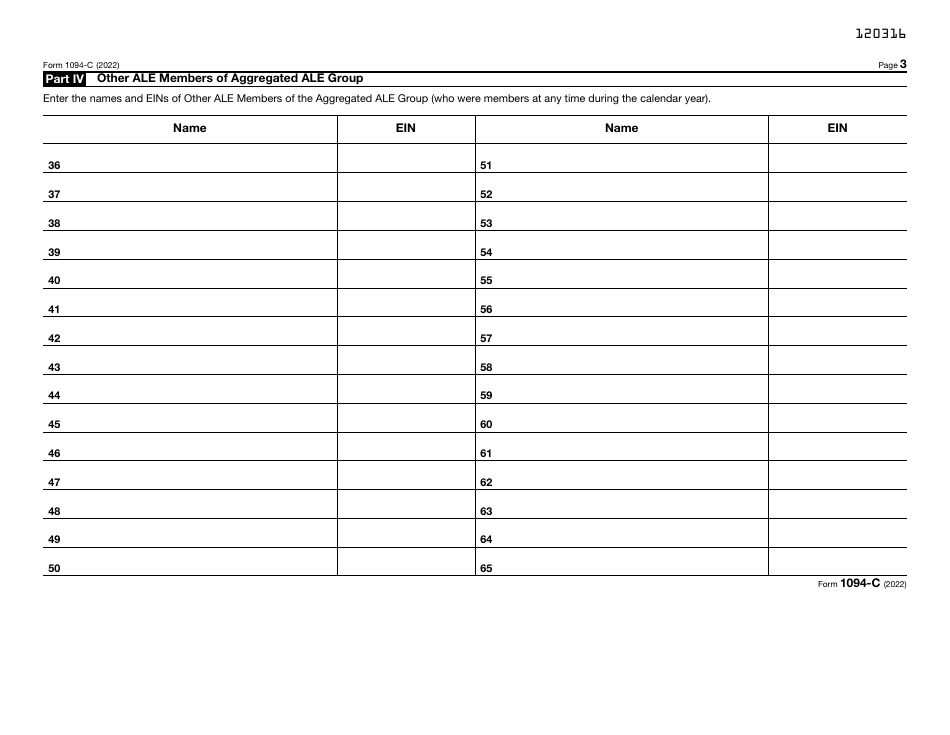

- A 3-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1094-C through the link below or browse more documents in our library of IRS Forms.