This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1094-C, 1095-C

for the current year.

Instructions for IRS Form 1094-C, 1095-C

This document contains official instructions for IRS Form 1094-C , and IRS Form 1095-C . Both forms are released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1094-C is available for download through this link. The latest available IRS Form 1095-C can be downloaded through this link.

FAQ

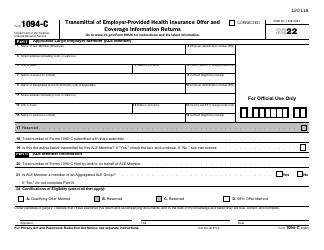

Q: What is IRS Form 1094-C?

A: IRS Form 1094-C is a form used by employers to report information about offers of health coverage made to their employees.

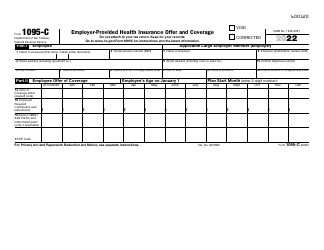

Q: What is IRS Form 1095-C?

A: IRS Form 1095-C is a form used by employers to report information about the health coverage they offer to employees.

Q: Do I need to file IRS Form 1094-C and 1095-C?

A: Employers who are Applicable Large Employers (ALEs) - generally those with 50 or more full-time employees - are required to file both forms with the IRS.

Q: When is the deadline to file IRS Form 1094-C and 1095-C?

A: The deadline to file both forms is typically the last day of February if filing by paper, or the last day of March if filing electronically.

Q: Can I file IRS Form 1094-C and 1095-C electronically?

A: Yes, employers are encouraged to file the forms electronically.

Q: What information do I need to include on IRS Form 1094-C?

A: You need to provide information about your business, including your employer identification number (EIN), and the total number of full-time employees you had during the year.

Q: What information do I need to include on IRS Form 1095-C?

A: You need to provide information about each employee who was offered health coverage, including their name, social security number, and the months they were offered coverage.

Q: Can I get an extension to file IRS Form 1094-C and 1095-C?

A: Yes, you can request an extension by filing Form 8809 with the IRS.

Q: What are the penalties for not filing IRS Form 1094-C and 1095-C?

A: The penalties for not filing or filing incorrect forms can be significant, so it's important to meet the filing deadlines and ensure the accuracy of your forms.

Instruction Details:

- This 18-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.