This version of the form is not currently in use and is provided for reference only. Download this version of

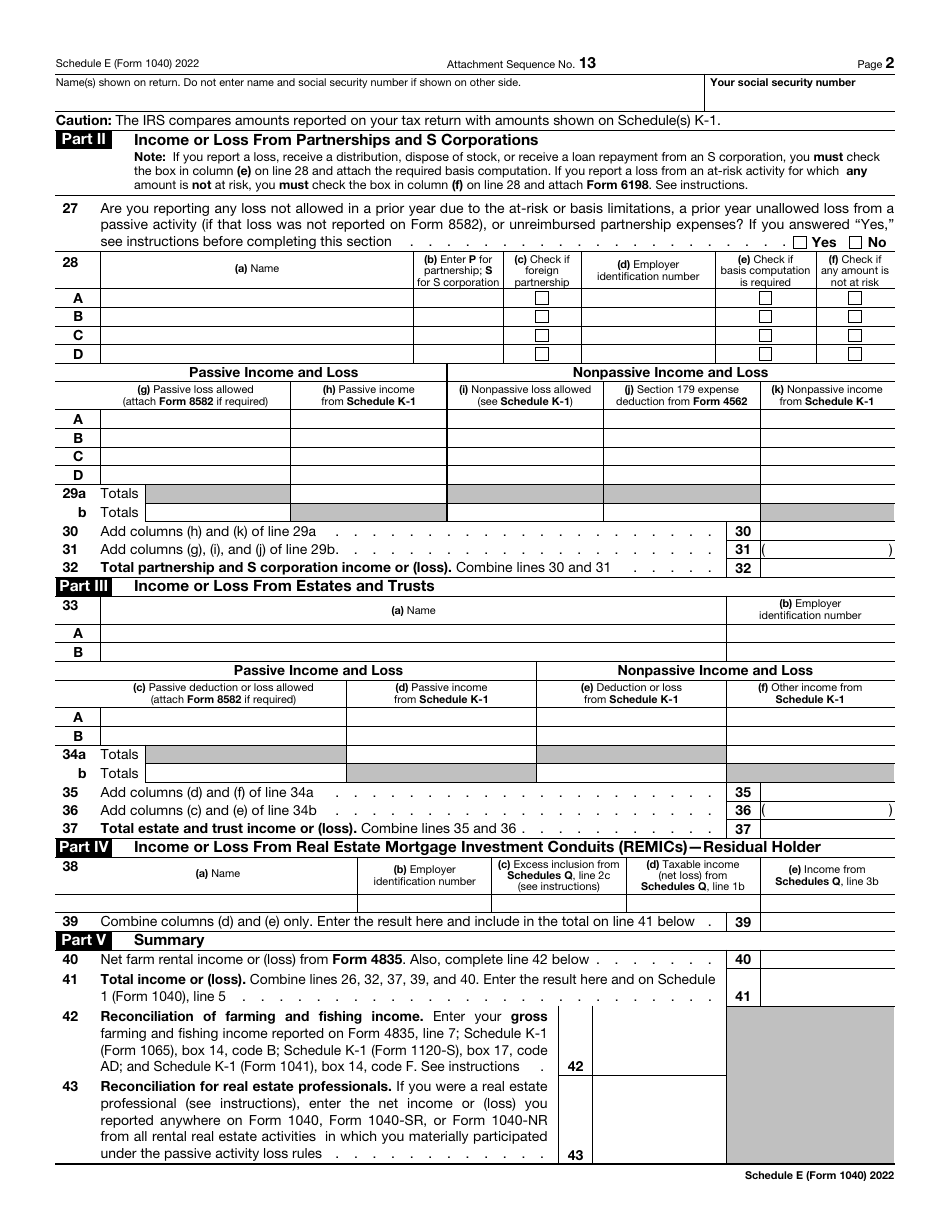

IRS Form 1040 Schedule E

for the current year.

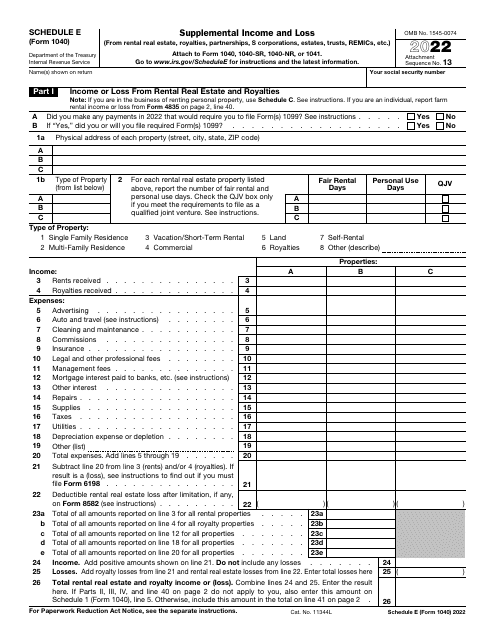

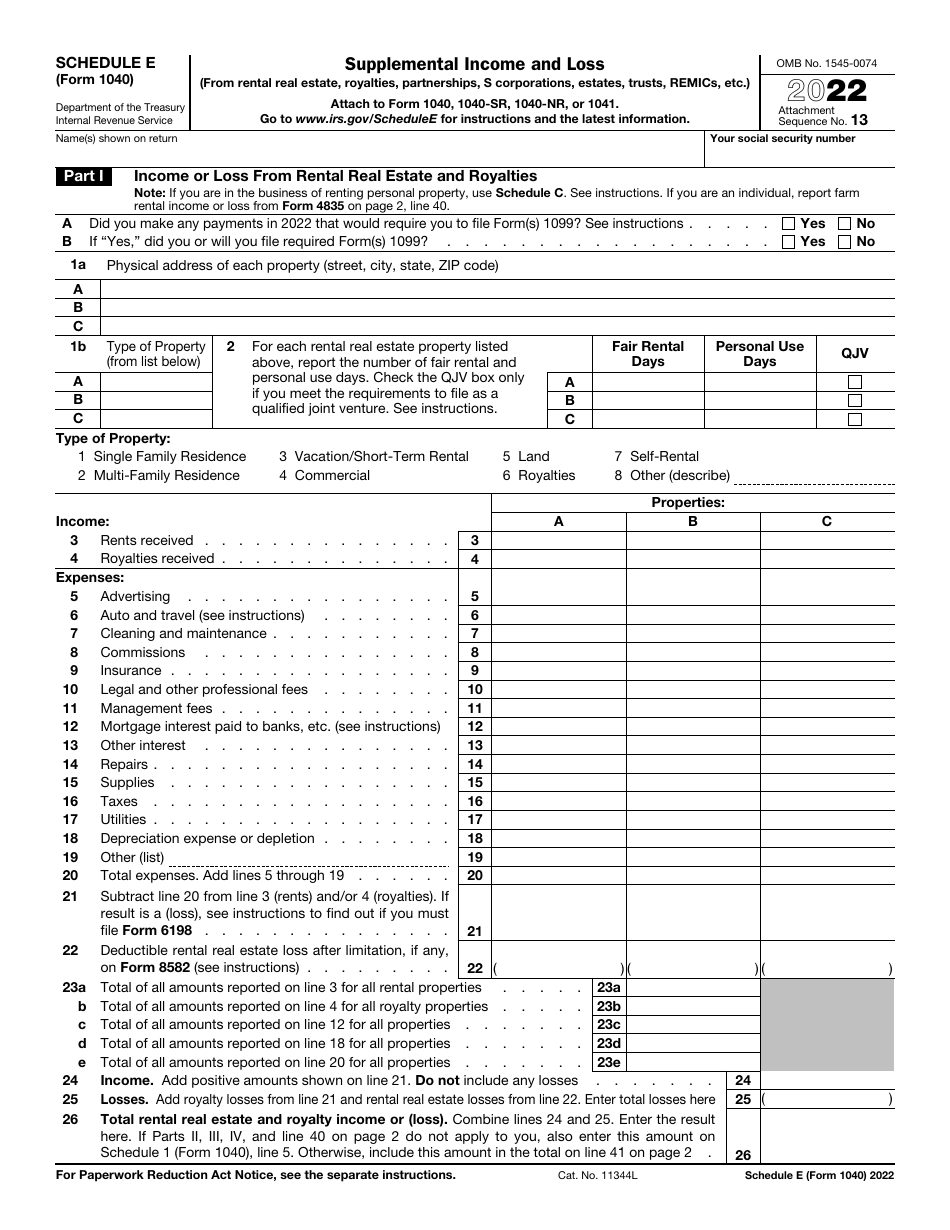

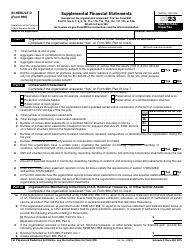

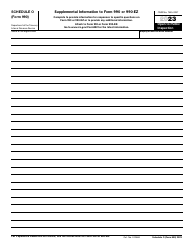

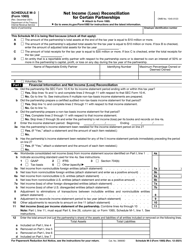

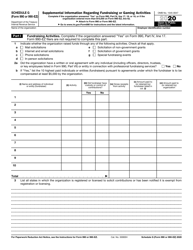

IRS Form 1040 Schedule E Supplemental Income and Loss

What Is IRS Form 1040 Schedule E?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 1040, U.S. Individual Income Tax Return. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1040 Schedule E?

A: IRS Form 1040 Schedule E is a tax form used to report supplemental income and loss from rental real estate, royalties, partnerships, S corporations, estates, trusts, and residual interests in real estate mortgage investment conduits.

Q: What types of supplemental income and loss are reported on Schedule E?

A: Supplemental income and loss from rental real estate, royalties, partnerships, S corporations, estates, trusts, and residual interests in real estate mortgage investment conduits are reported on Schedule E.

Q: Do I need to file Schedule E?

A: You need to file Schedule E if you have supplemental income or loss from rental real estate, royalties, partnerships, S corporations, estates, trusts, or residual interests in real estate mortgage investment conduits.

Q: What information do I need to complete Schedule E?

A: To complete Schedule E, you will need information about your rental real estate, royalties, partnerships, S corporations, estates, trusts, or residual interests in real estate mortgage investment conduits, including income and expenses.

Q: Is Schedule E the same as Form 1040?

A: No, Schedule E is not the same as Form 1040. Schedule E is an additional form that you attach to your Form 1040 to report supplemental income and loss.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1040 Schedule E through the link below or browse more documents in our library of IRS Forms.