This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1040 Schedule E

for the current year.

Instructions for IRS Form 1040 Schedule E Supplemental Income and Loss

This document contains official instructions for IRS Form 1040 Schedule E, Supplemental Income and Loss - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1040 Schedule E is available for download through this link.

FAQ

Q: What is IRS Form 1040 Schedule E?

A: IRS Form 1040 Schedule E is a tax form used to report supplemental income and loss.

Q: What types of income and loss should be reported on Schedule E?

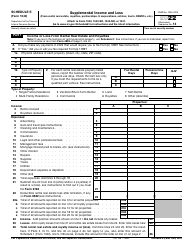

A: Schedule E is used to report rental real estate, royalty, partnership, S corporation, and estate and trust income and loss.

Q: How do I fill out IRS Form 1040 Schedule E?

A: You will need to provide details about your supplemental income and loss, including the property or partnership details, income, and expenses.

Q: Do I need to file Schedule E if I don't have any supplemental income or loss?

A: No, you don't need to file Schedule E if you don't have any supplemental income or loss.

Q: Can I e-file IRS Form 1040 Schedule E?

A: Yes, you can e-file IRS Form 1040 Schedule E if you are filing your tax return electronically.

Q: When is the deadline to file IRS Form 1040 Schedule E?

A: The deadline to file IRS Form 1040 Schedule E is generally the same as the deadline for your federal income tax return, which is April 15th.

Q: Can I claim deductions on Schedule E?

A: Yes, you can claim deductions related to your supplemental income and loss on Schedule E, such as mortgage interest, property taxes, and maintenance expenses.

Q: Are there any penalties for not filing Schedule E?

A: If you are required to file Schedule E and fail to do so, you may be subject to penalties and interest on any unreported income.

Q: Can I amend my Schedule E after I have filed it?

A: Yes, if you need to make changes to your Schedule E after you have filed it, you can file an amended tax return using IRS Form 1040X.

Instruction Details:

- This 12-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.