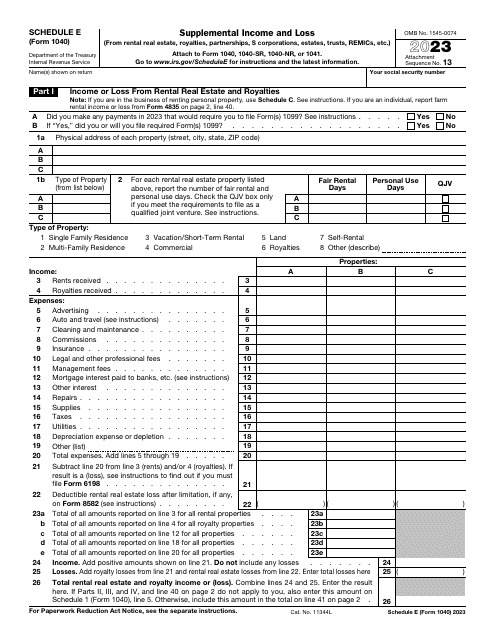

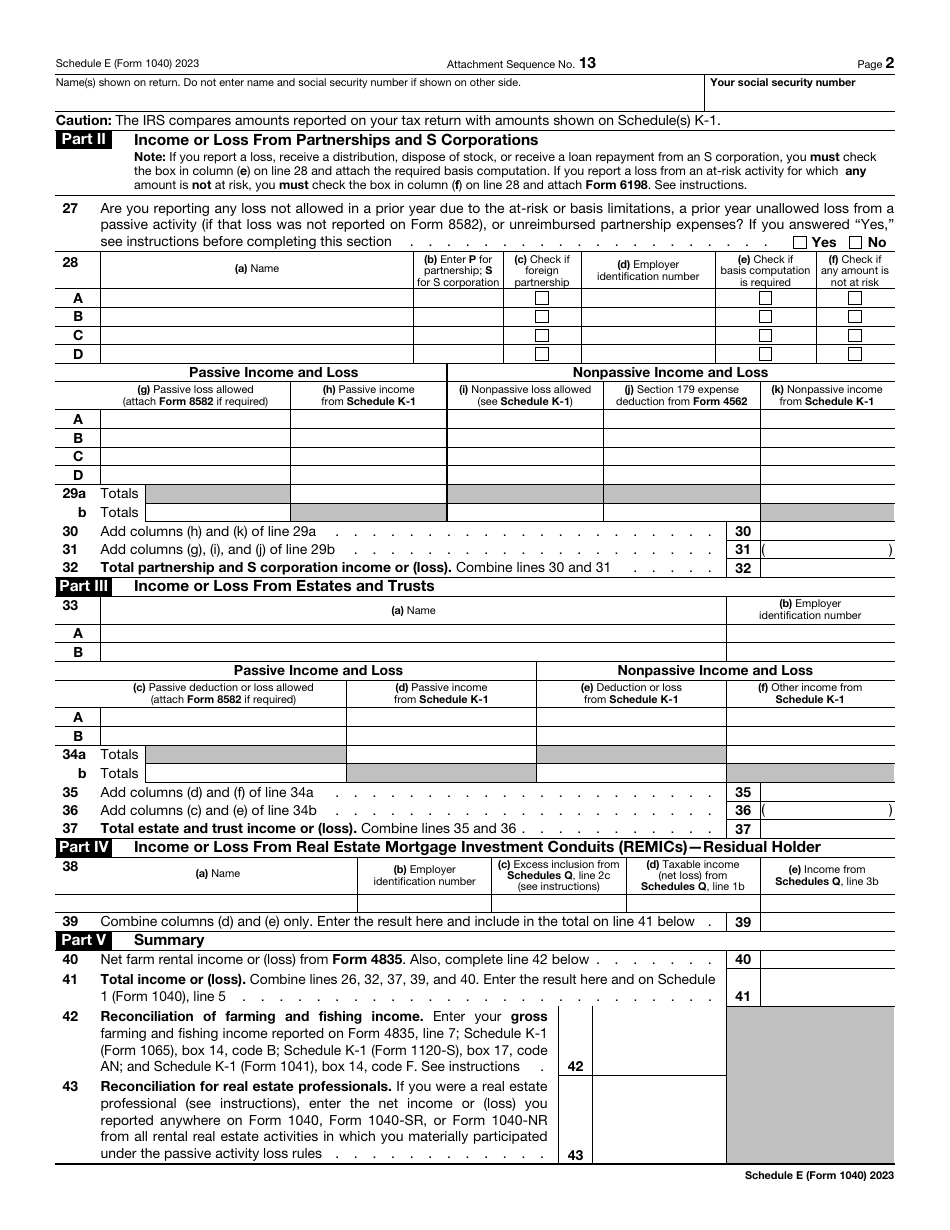

IRS Form 1040 Schedule E Supplemental Income and Loss (From Rental Real Estate, Royalties, Partnerships, S Corporations, Estates, Trusts, Remics, Etc.)

What Is IRS Form 1040 Schedule E?

IRS Form 1040 Schedule E, Supplemental Income and Loss is the document you fill out to inform the Internal Revenue Service (IRS) about the income and loss you experience from royalties, rental real estate, estates, trusts, S corporations, partnerships, and residual interests in the real estate investment conduits (REMICs). The form is regularly used by homeowners calculating tax deductions for the property they rent out. It allows them to write off different types of expenses connected with real estate renting and avoid paying extra taxes.

The schedule - also known as the supplemental income and loss form - was issued by the IRS and is revised annually. You can download the up-to-date fillable version of IRS Form 1040 Schedule E through the link below.

This form is a part of the IRS 1040 forms. The series was designed to provide the taxpayers with a convenient way to report the IRS different ways of taxable income and losses.

IRS Form 1040 Schedule E Instructions

Submit the form with IRS Form 1040, IRS Form 1040NR, or IRS Form 1041. If you file this schedule with Form 1041, enter the employer identification number of your estate or trust in "Your Social Security Number" field.

Step-by-step instructions are as follows:

- Part I. Income or Loss from Rental Real Estate and Royalties. Use this part to report your royalty income and expenses, as well as income and expenses from rental real estate. Estates and trusts may also use this part to report farm rental income and expenses;

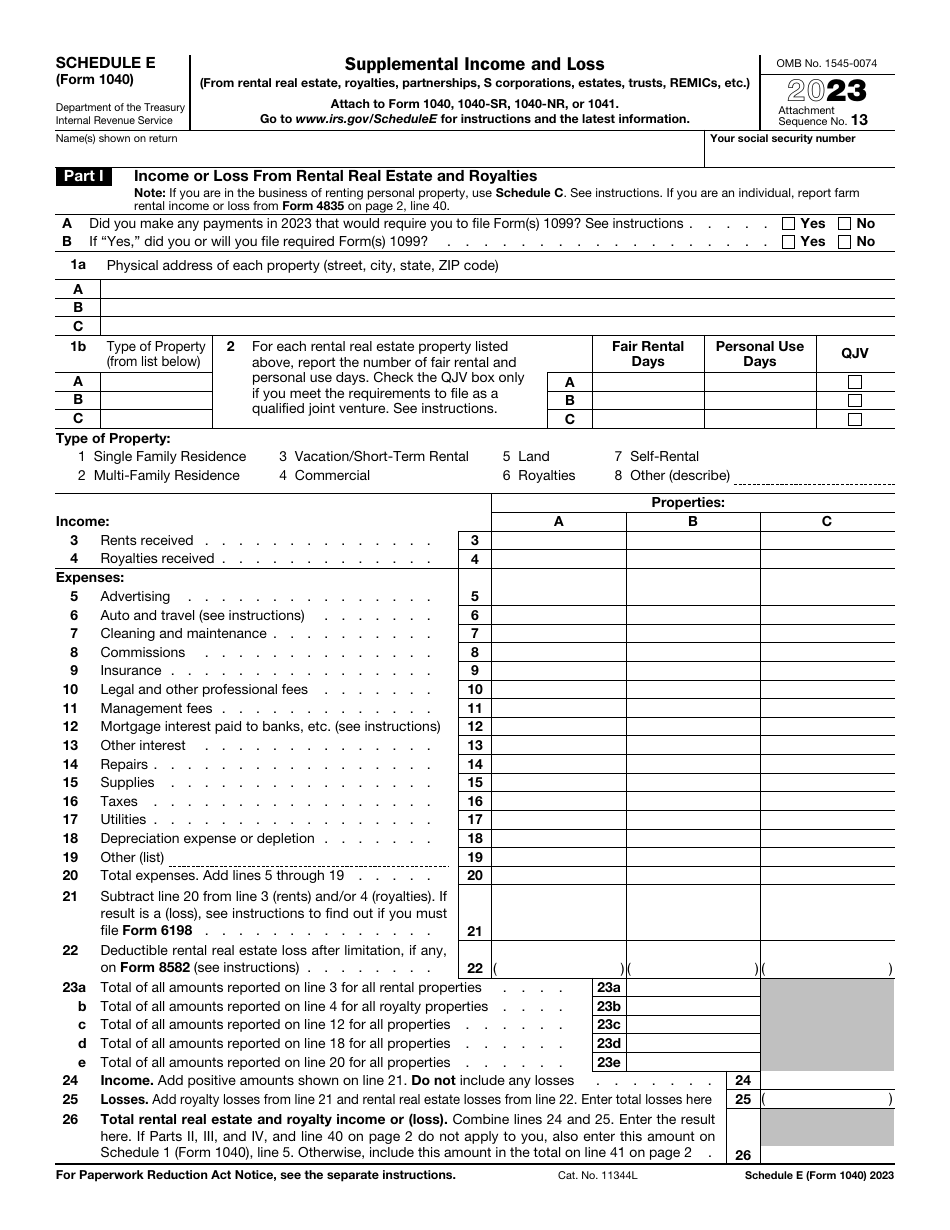

- Part II. Income or Loss from Partnership and S Corporations. Report your share of income or loss from partnership or S corporation. Your partnership or corporation should provide you with Schedule K-1 (Form 1065), as well as with the instructions that will help you to determine how to report your share of the items properly;

- Part III. Income or Loss from Estates and Trusts. Indicate your share of the income or loss from the estate or trust if you are a beneficiary of any. Use the information from Schedule K-1 and instructions you will receive from the fiduciary to complete this part properly. Do not attach the schedule you receive to this form. It is intended for your records only;

- Part IV. Income or Loss from Real Estate Mortgage Investment Conduits (REMICs) - Residual Holder. Fill out this part with the information from Schedule Q (Form 1066) you will receive from the REMIC if you are the holder of a residual interest;

- Part V. Summary. Self-explanatory.

The IRS issues official Instructions for Schedule E (Form 1040) containing the detailed guidelines and explanations to help with filing. Check them if you need any additional information.

Keep all records that may be required to substantiate the information you provided on Schedule E. The IRS may ask you to explain and prove the reported items if during the examination of your tax report any questions arise. Keeping records will help you to answer all questions fast and with minimal efforts. Otherwise, you will have to spend time trying to collect them. Note that inability to provide the IRS with the records they require may result in additional tax amounts. You may have to pay penalties as well.