This version of the form is not currently in use and is provided for reference only. Download this version of

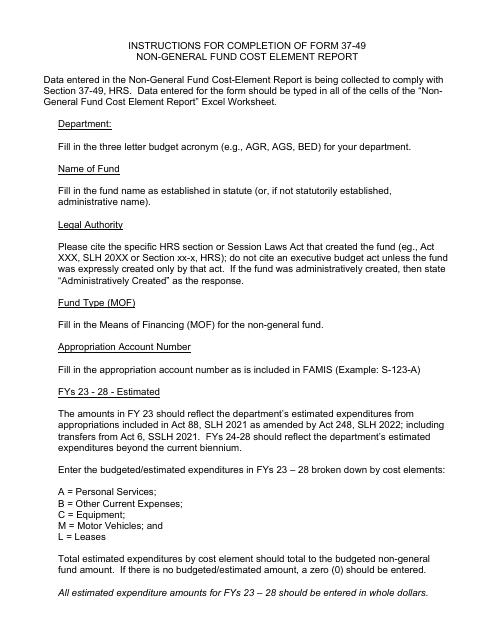

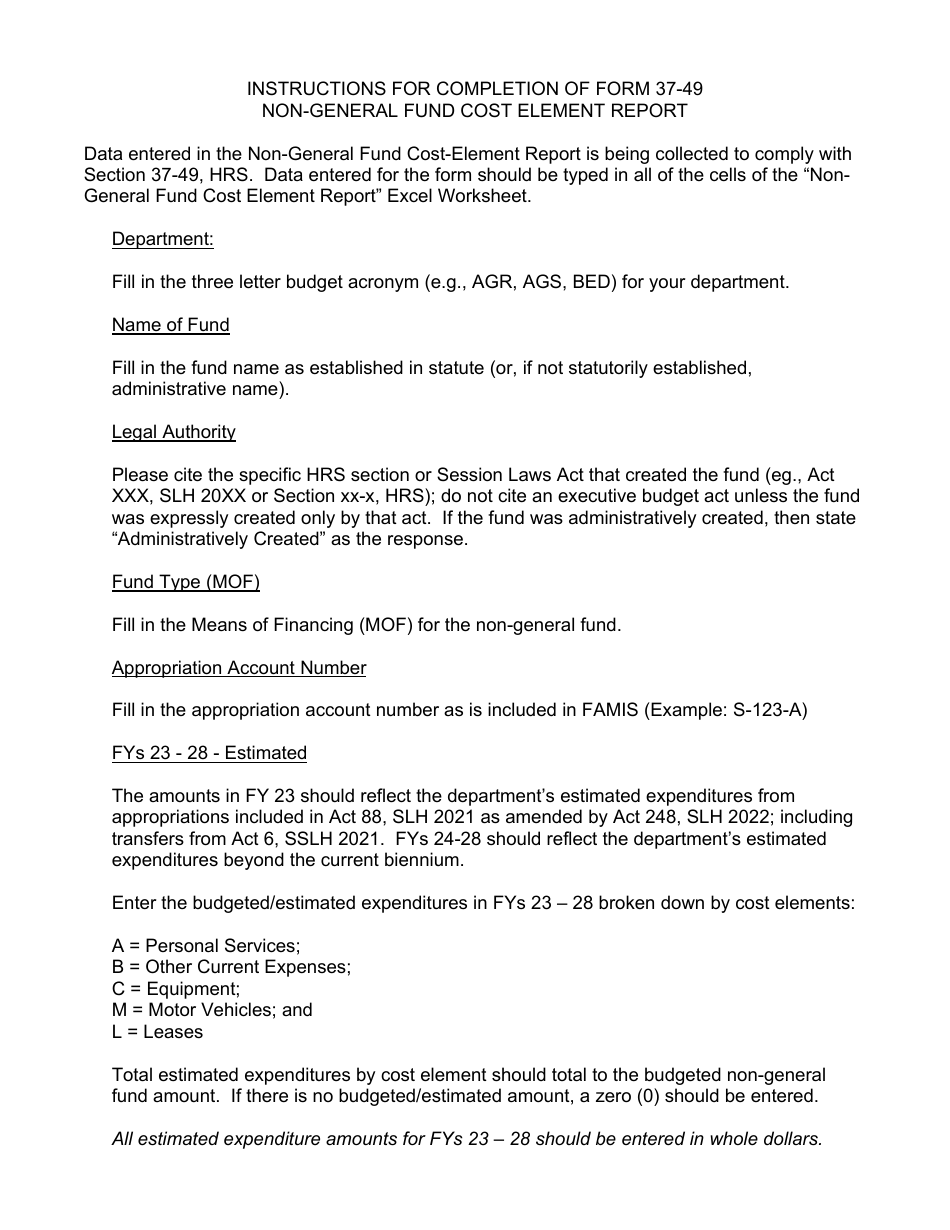

Instructions for Form 37-49

for the current year.

Instructions for Form 37-49 Non-general Fund Cost Element Report - Hawaii

This document contains official instructions for Form 37-49 , Non-general Fund Cost Element Report - a form released and collected by the Hawaii Department of Budget & Finance.

FAQ

Q: What is Form 37-49?

A: Form 37-49 is a Non-general Fund Cost Element Report specific to Hawaii.

Q: What is the purpose of Form 37-49?

A: The purpose of Form 37-49 is to report non-general fund costs in a detailed manner.

Q: Who needs to fill out Form 37-49?

A: Any entity or organization that has non-general fund costs in Hawaii needs to fill out Form 37-49.

Q: What kind of costs need to be reported on Form 37-49?

A: Any costs that are not funded through general funds need to be reported on Form 37-49.

Q: Is there a deadline for submitting Form 37-49?

A: Yes, there is a deadline for submitting Form 37-49. The deadline may vary, so it is important to check the instructions or guidelines for the specific reporting period.

Q: Are there any penalties for not submitting Form 37-49?

A: Penalties for not submitting Form 37-49 may vary depending on the governing laws and regulations. It is advisable to comply with the reporting requirements to avoid any potential penalties.

Instruction Details:

- This 1-page document is available for download in PDF;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Hawaii Department of Budget & Finance.