This version of the form is not currently in use and is provided for reference only. Download this version of

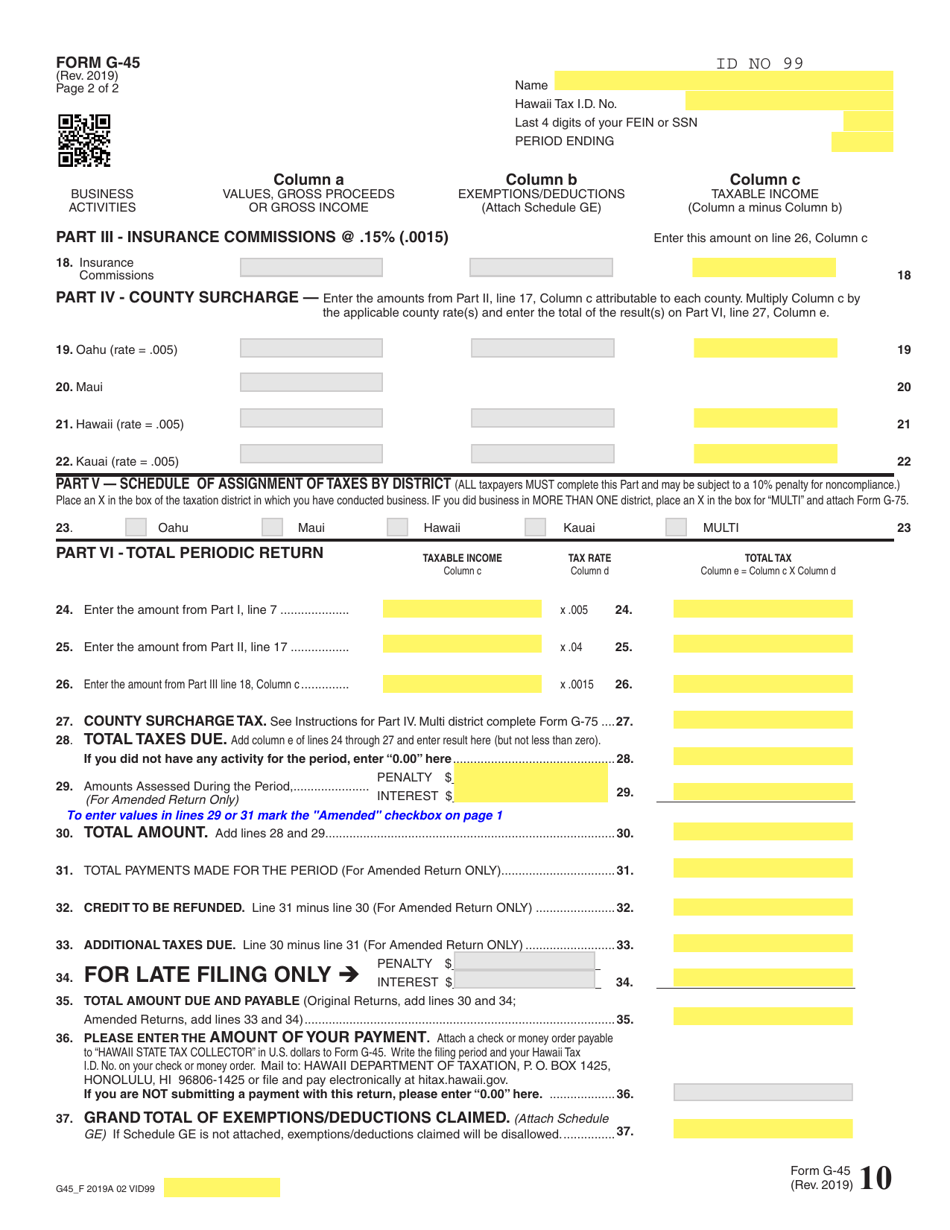

Form G-45

for the current year.

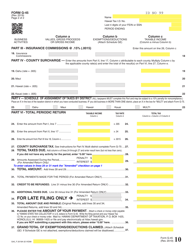

Form G-45 Periodic General Excise / Use Tax Return - Hawaii

What Is Form G-45?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form G-45?

A: Form G-45 is a periodic general excise/use tax return for businesses in Hawaii.

Q: Who needs to file Form G-45?

A: Businesses in Hawaii that are subject to the general excise tax or use tax need to file Form G-45.

Q: What is the purpose of Form G-45?

A: The purpose of Form G-45 is to report and pay the general excise tax or use tax owed by businesses in Hawaii.

Q: How often should Form G-45 be filed?

A: Form G-45 should be filed on a periodic basis, depending on the taxpayer's filing frequency. The options are monthly, quarterly, semi-annually, or annually.

Q: What information is required on Form G-45?

A: Form G-45 requires information such as business details, gross receipts, taxable sales, and any deductions or exemptions.

Q: What are the penalties for not filing Form G-45?

A: Penalties for not filing Form G-45 include late filing penalties, interest charges on unpaid taxes, and potential criminal penalties.

Q: Are there any exemptions or deductions available on Form G-45?

A: Yes, there are certain exemptions and deductions available on Form G-45. It is important to review the instructions and consult with a tax professional for guidance.

Q: What is the deadline for filing Form G-45?

A: The deadline for filing Form G-45 depends on the taxpayer's filing frequency. It is typically due by the 20th day of the month following the end of the filing period.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form G-45 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.