Form G-45 OT Instructions for Filing a One Time Use General Excise / Use Tax Return - Hawaii

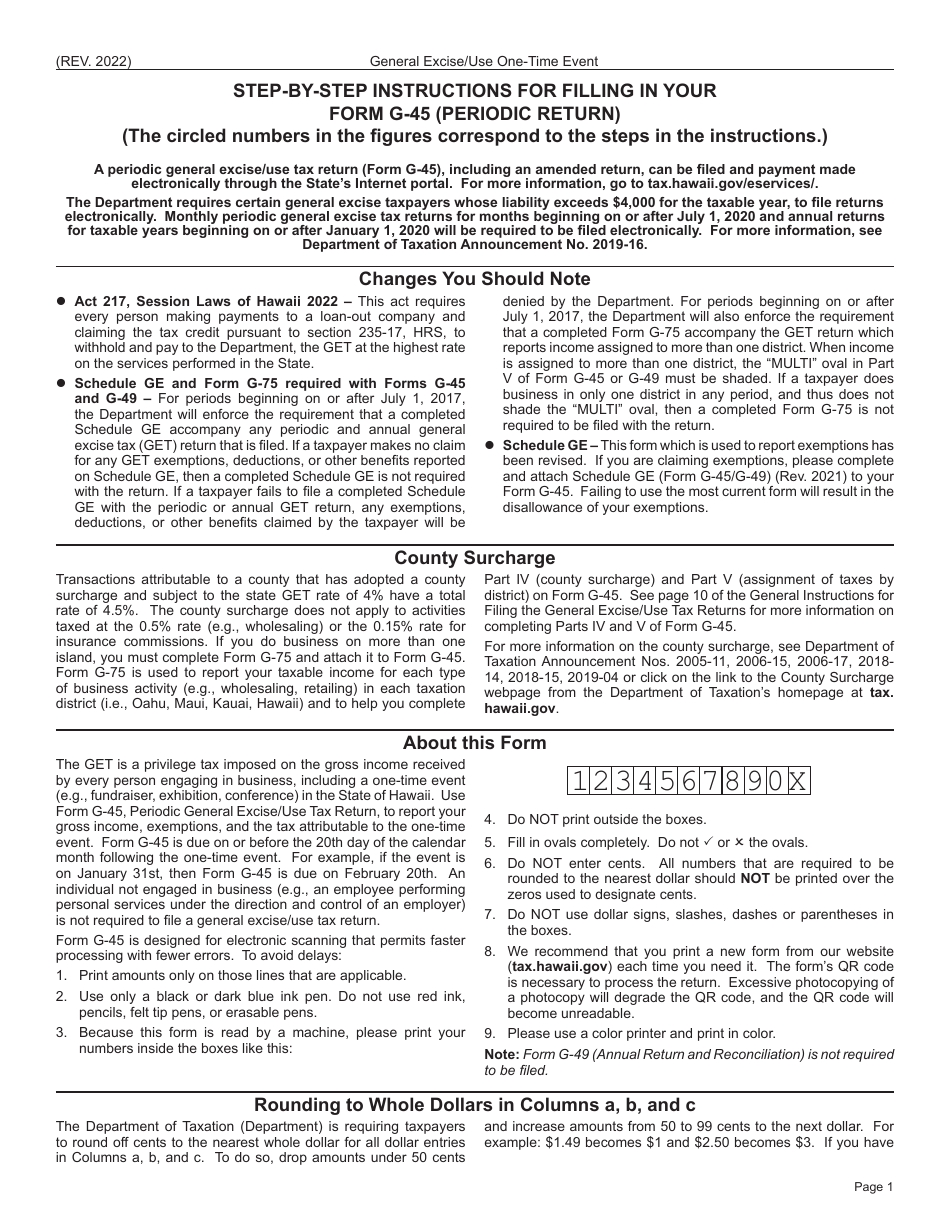

What Is Form G-45 OT?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form G-45 OT?

A: Form G-45 OT is a form used for filing a one-time use General Excise/Use Tax Return in Hawaii.

Q: What is General Excise Tax?

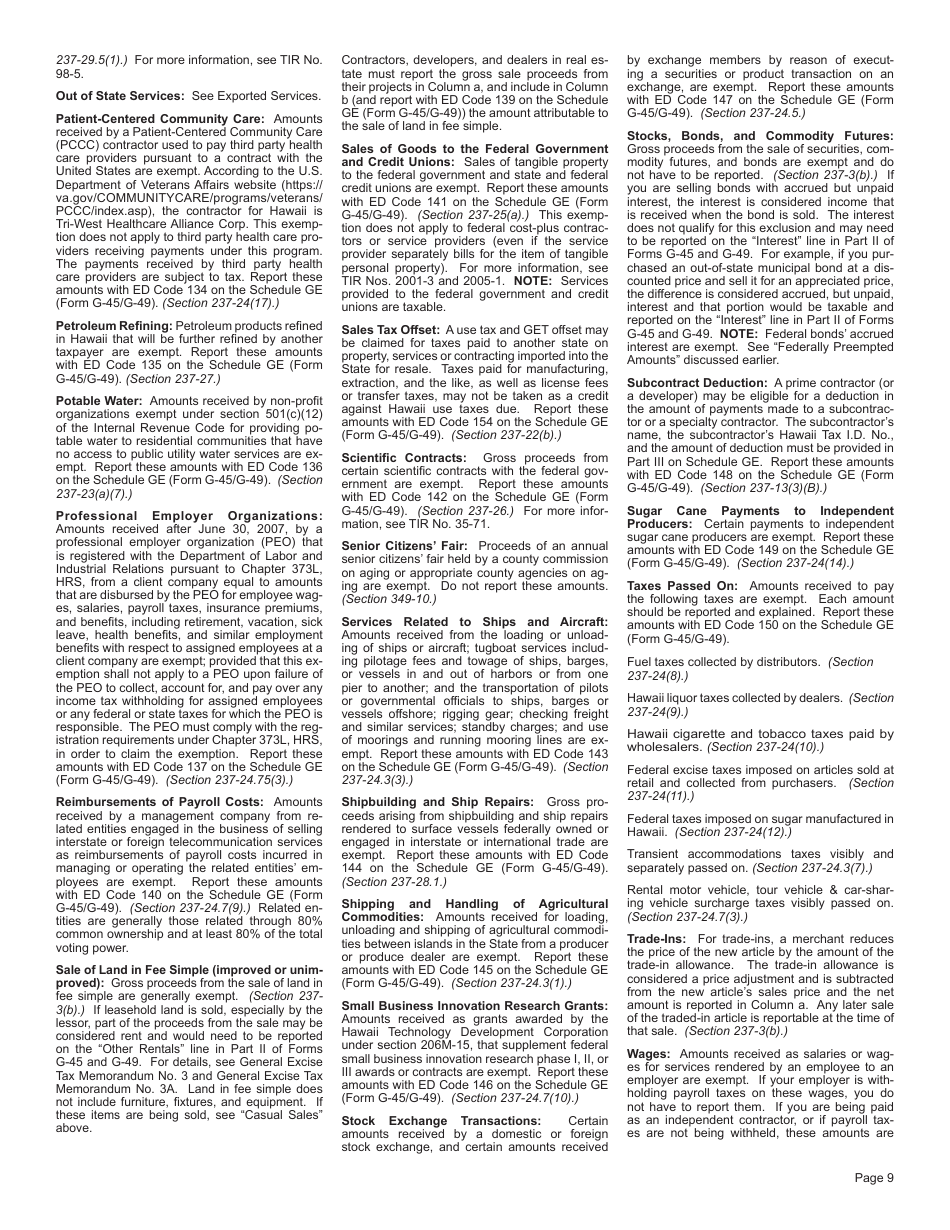

A: General Excise Tax is a tax imposed on business activities in Hawaii.

Q: What is Use Tax?

A: Use Tax is a tax imposed on the use, consumption, or possession of tangible personal property in Hawaii.

Q: Who needs to file Form G-45 OT?

A: Anyone who has made a one-time purchase or engaged in a one-time business activity subject to General Excise/Use Tax in Hawaii needs to file Form G-45 OT.

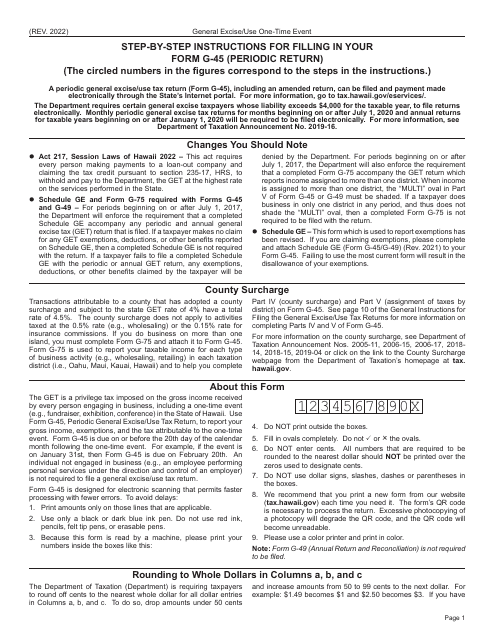

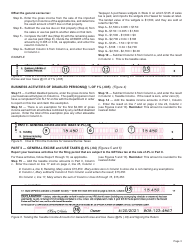

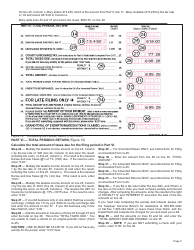

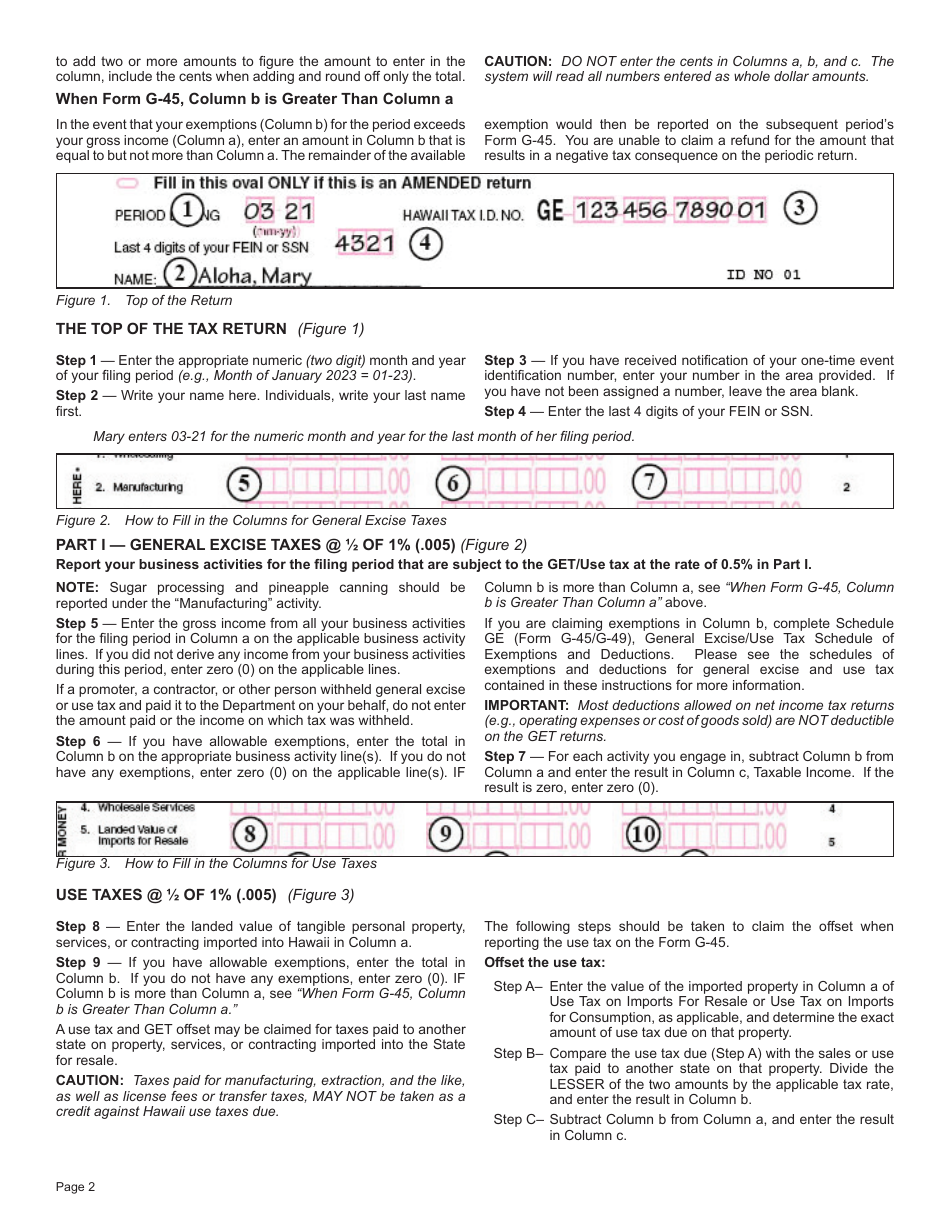

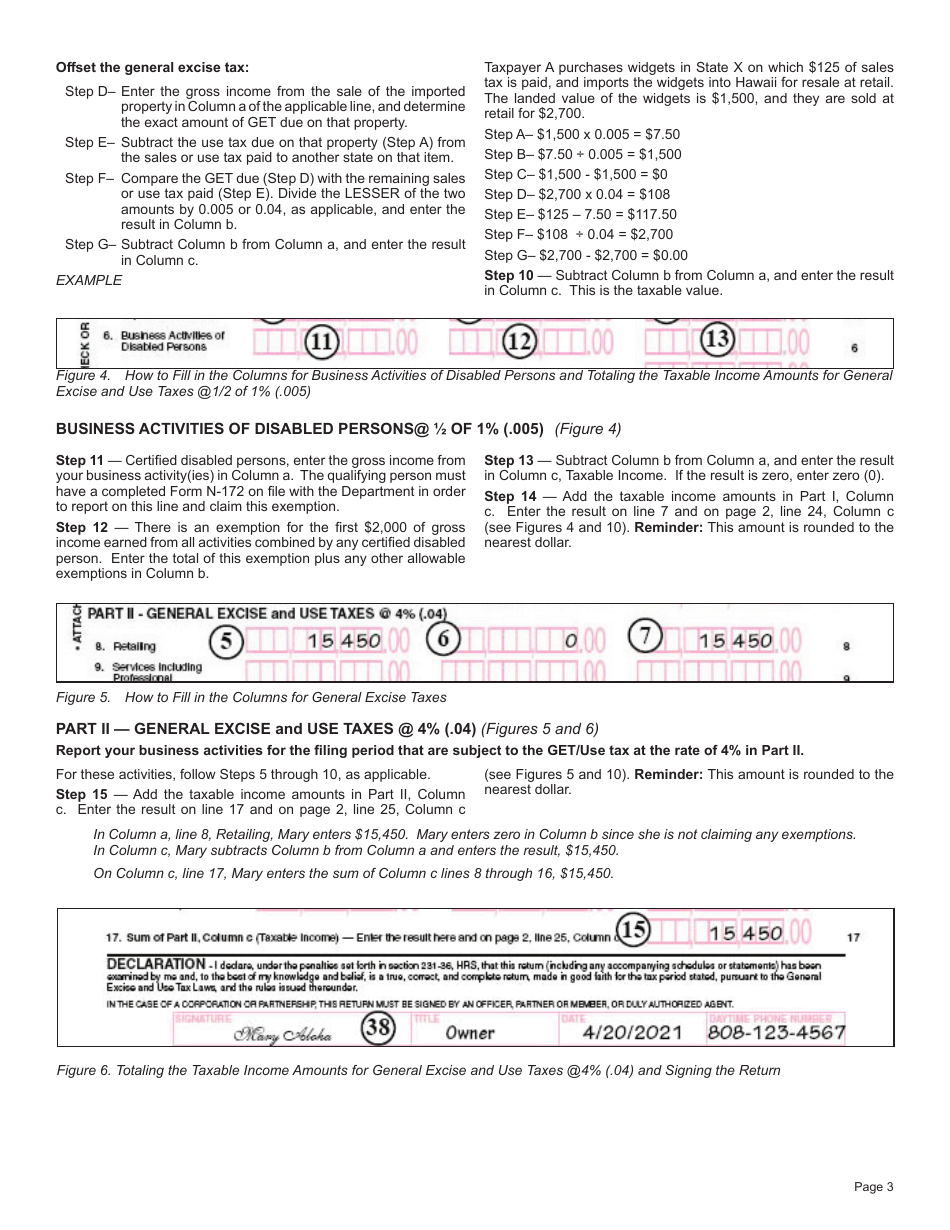

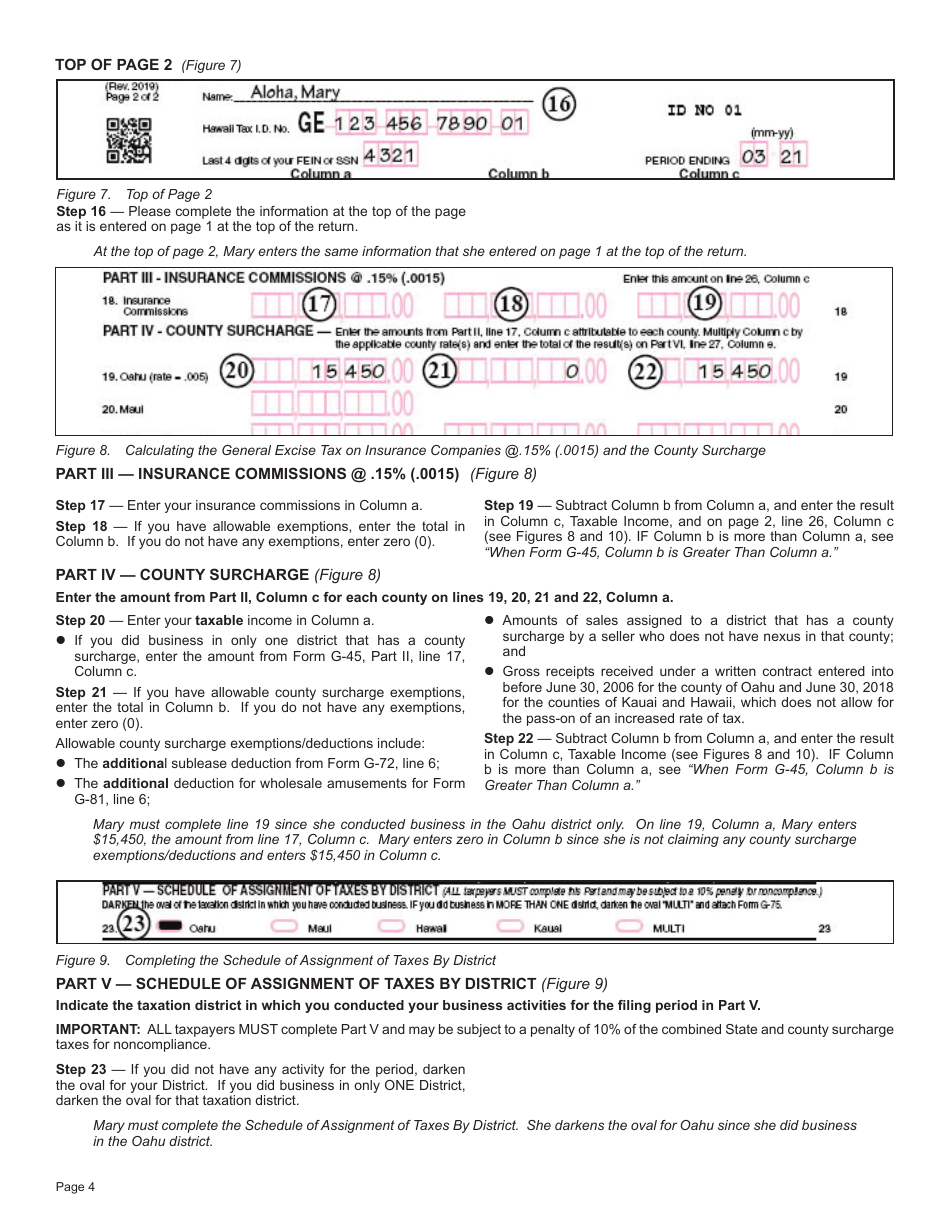

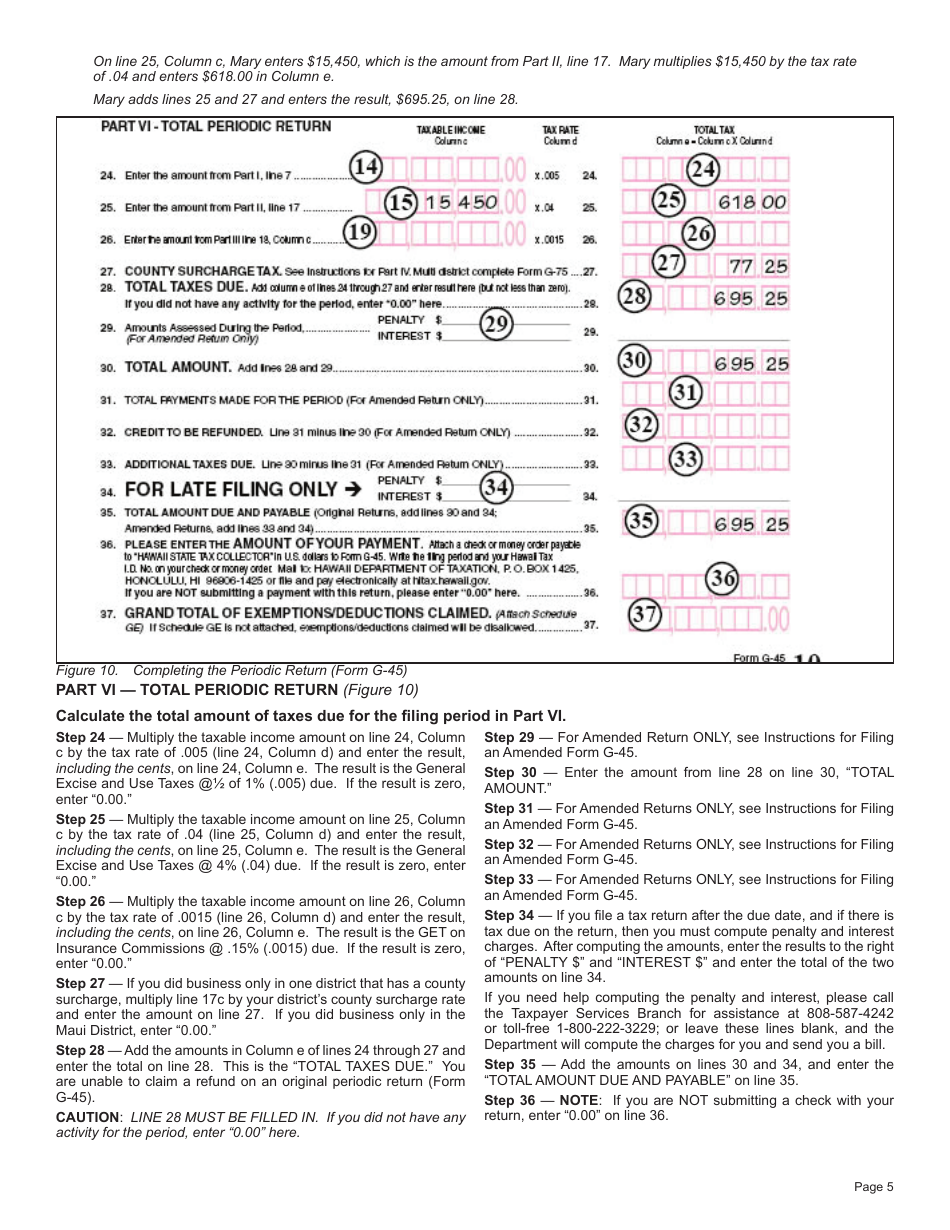

Q: How do I fill out Form G-45 OT?

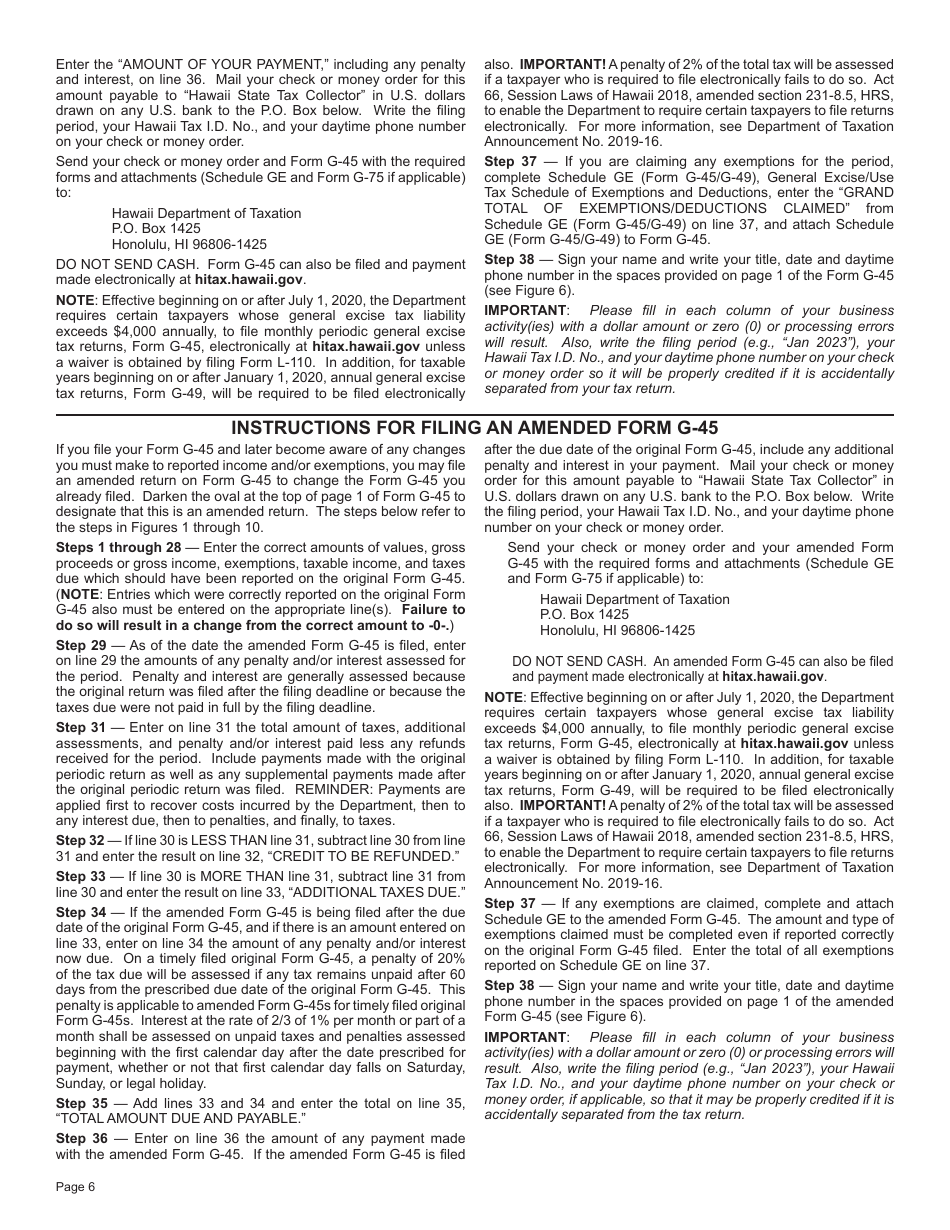

A: You need to provide your business information, purchase information, and calculate the tax due. The instructions on the form provide detailed guidance.

Q: When is Form G-45 OT due?

A: Form G-45 OT is due on the 20th day of the month following the month in which the tax became due.

Q: What happens if I don't file Form G-45 OT?

A: If you don't file Form G-45 OT and pay the required tax, you may be subject to penalties and interest charges by the Hawaii Department of Taxation.

Q: Is Form G-45 OT only applicable to businesses?

A: No, Form G-45 OT is applicable to both businesses and individuals who have made a one-time purchase or engaged in a one-time business activity subject to General Excise/Use Tax in Hawaii.

Form Details:

- Released on January 1, 2022;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form G-45 OT by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.