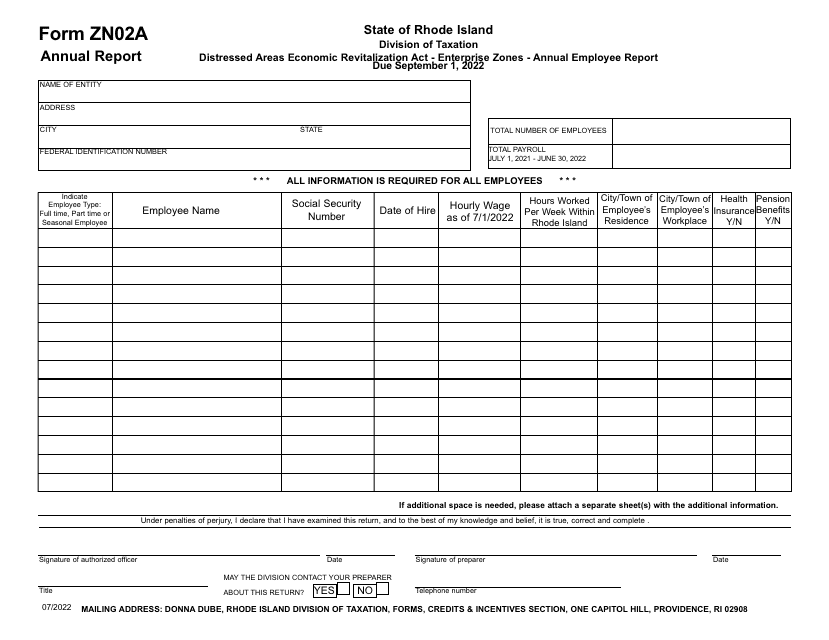

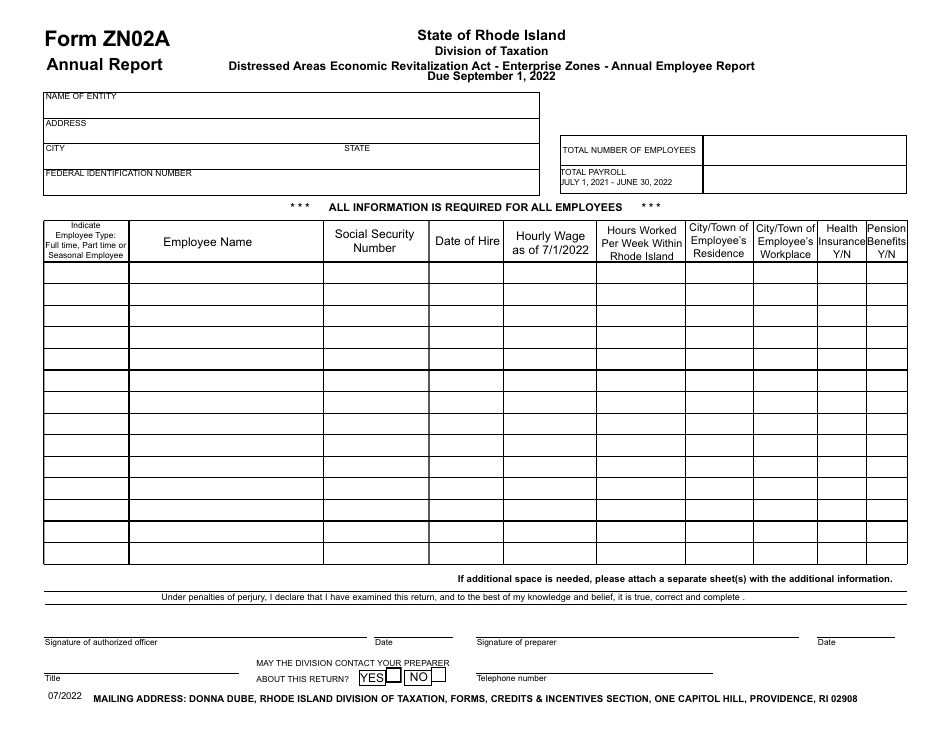

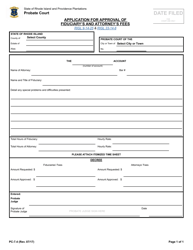

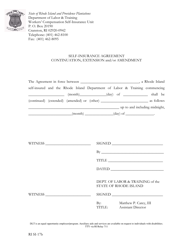

Form ZN02A Distressed Areas Economic Revitalization Act - Enterprise Zones - Annual Employee Report - Rhode Island

What Is Form ZN02A?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form ZN02A?

A: Form ZN02A is a report related to the Distressed Areas Economic Revitalization Act in Rhode Island.

Q: What is the Distressed Areas Economic Revitalization Act?

A: The Distressed Areas Economic Revitalization Act is a law aimed at revitalizing economically distressed areas.

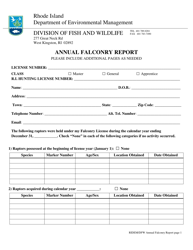

Q: What are Enterprise Zones?

A: Enterprise Zones are designated areas where businesses are given certain incentives and tax benefits to promote economic development.

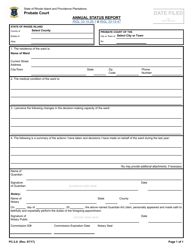

Q: What is the Annual Employee Report?

A: The Annual Employee Report is a form that businesses in Enterprise Zones need to submit to provide information about their employees.

Q: Why do businesses need to file the Form ZN02A?

A: Businesses in the Enterprise Zones need to file the Form ZN02A to comply with the reporting requirements of the Distressed Areas Economic Revitalization Act.

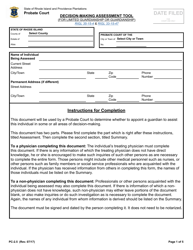

Q: Who needs to file the Form ZN02A?

A: Businesses operating within the designated Enterprise Zones in Rhode Island need to file the Form ZN02A.

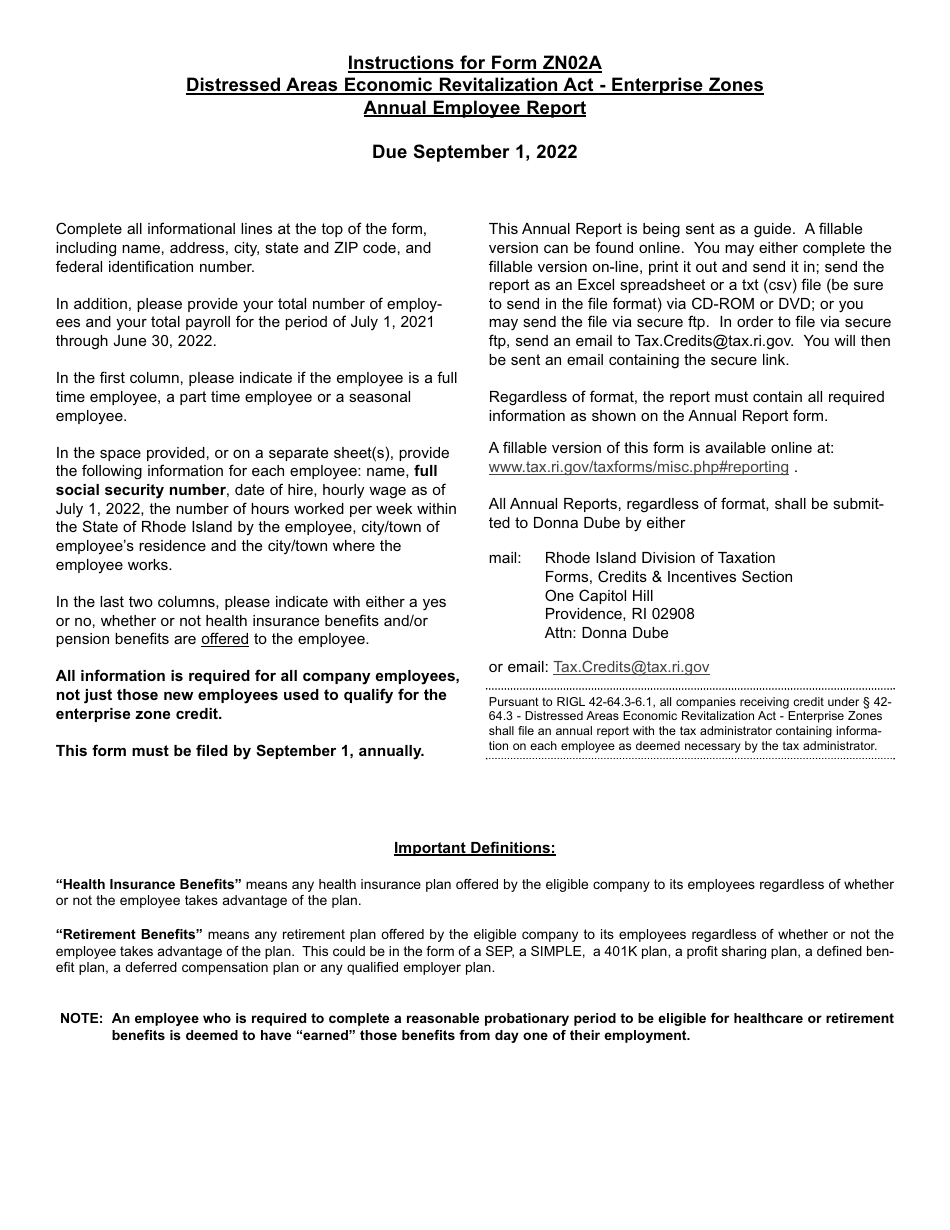

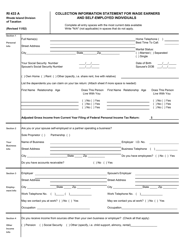

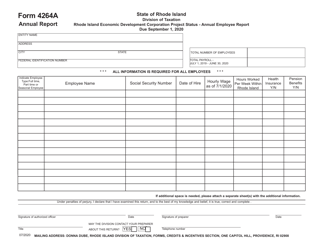

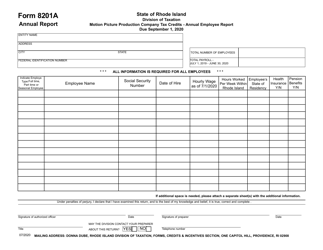

Q: What information is required in the Form ZN02A?

A: The Form ZN02A requires businesses to report information such as the number of employees, their wages, and other relevant data.

Q: Is there a deadline for filing the Form ZN02A?

A: Yes, the Form ZN02A needs to be filed annually by a certain deadline, as specified by the Rhode Island Department of Economic Development.

Form Details:

- Released on July 1, 2022;

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ZN02A by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.