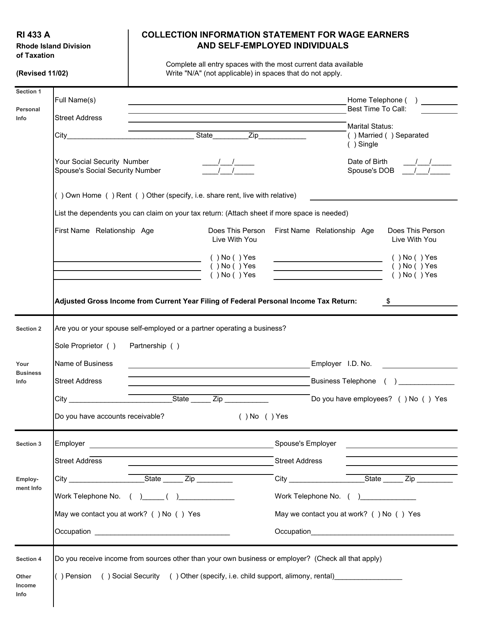

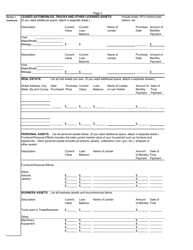

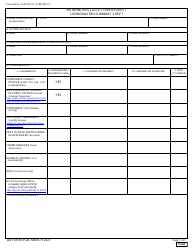

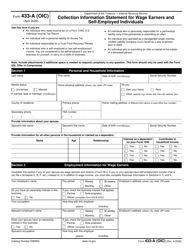

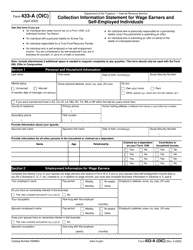

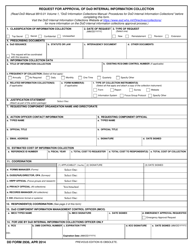

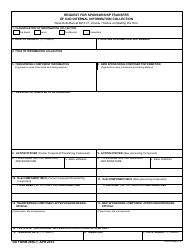

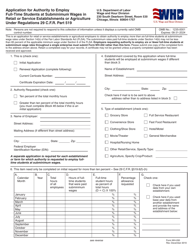

Form RI433 A Collection Information Statement for Wage Earners and Self-employed Individuals - Rhode Island

What Is Form RI433 A?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RI433?

A: Form RI433 is a Collection Information Statement for Wage Earners and Self-employed Individuals specific to Rhode Island.

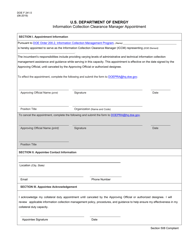

Q: Who needs to fill out Form RI433?

A: Form RI433 needs to be filled out by individuals who are wage earners or self-employed and are subject to collections by the Rhode Island Department of Revenue.

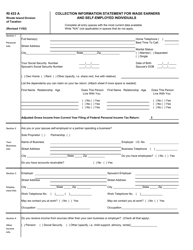

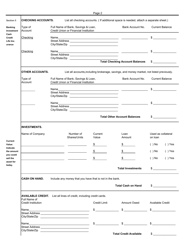

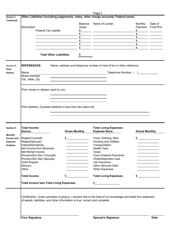

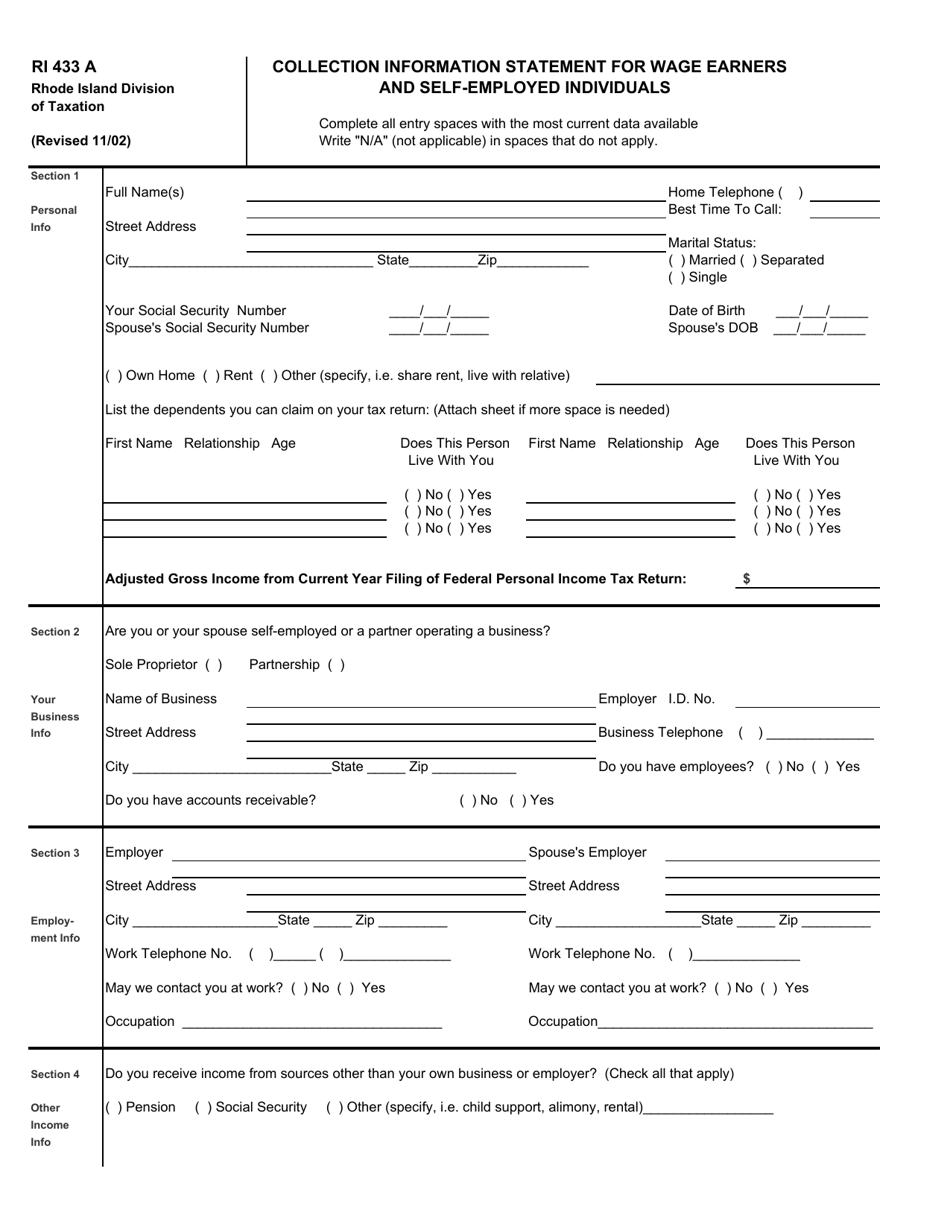

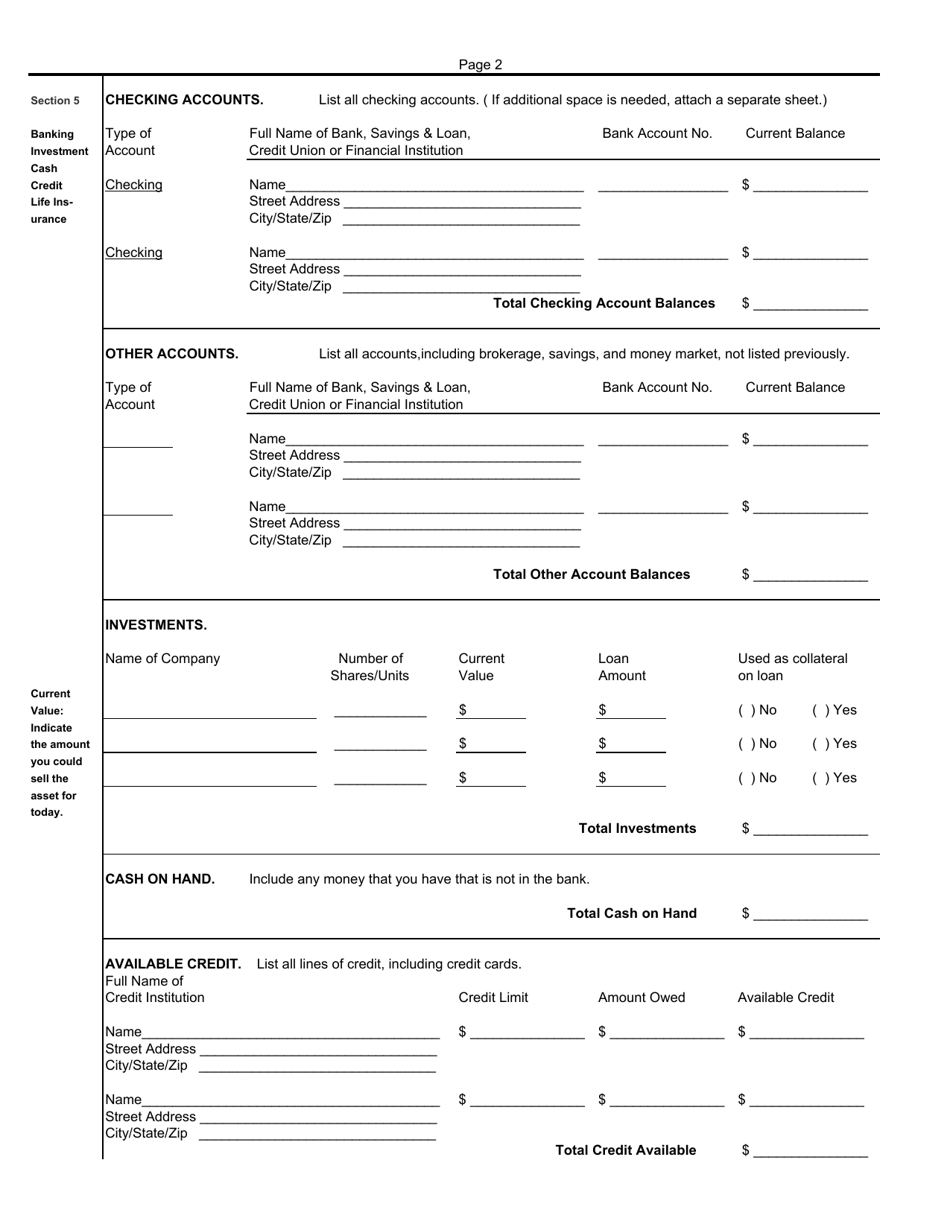

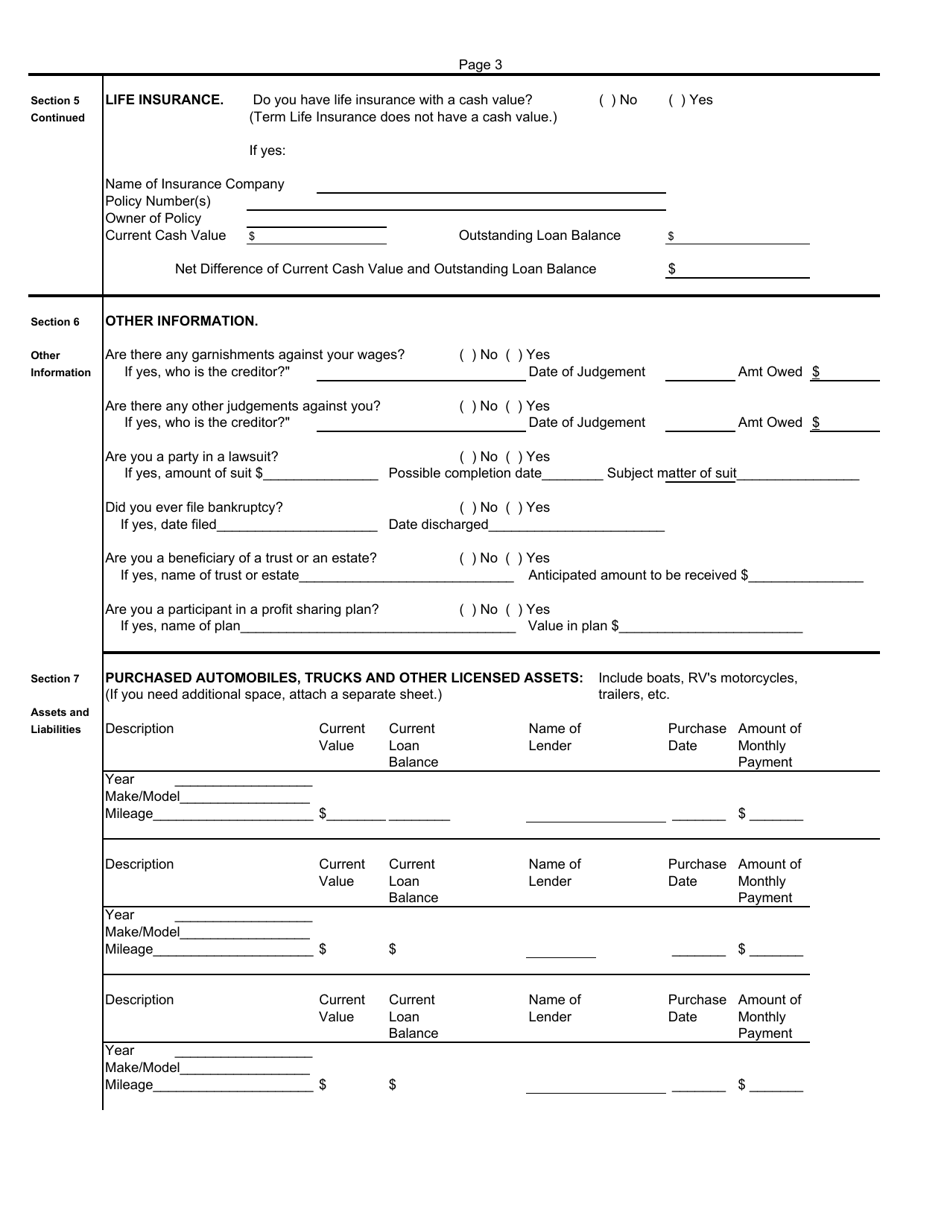

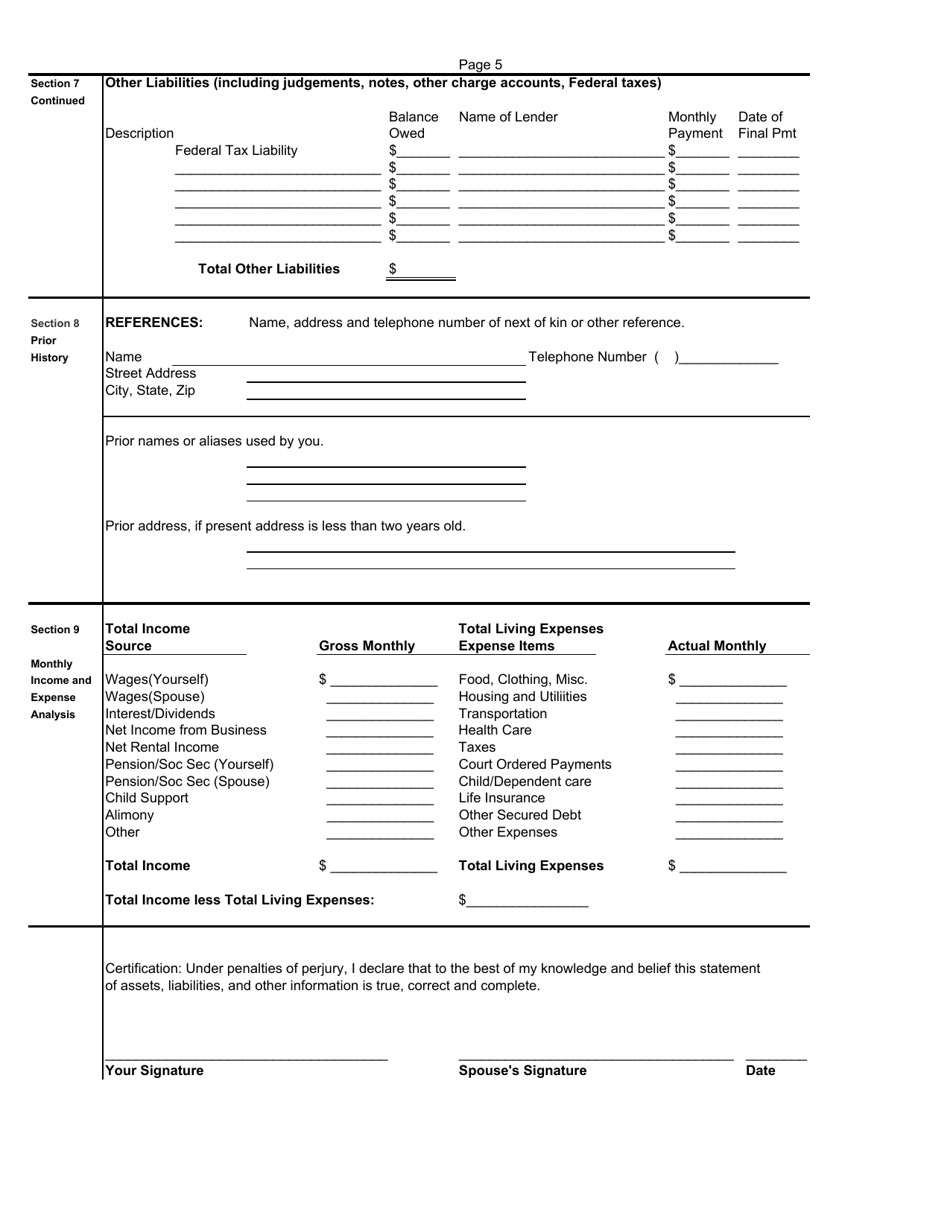

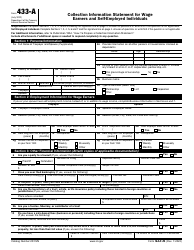

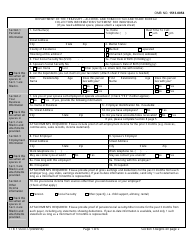

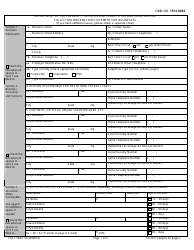

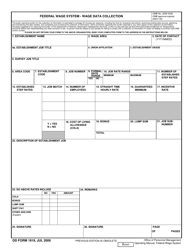

Q: What information is required on Form RI433?

A: Form RI433 requires information such as personal details, employment information, income details, assets, debts, and expenses.

Q: How do I fill out Form RI433?

A: Form RI433 should be filled out accurately and completely, providing all the required information in the appropriate sections. It is important to double-check the form before submission.

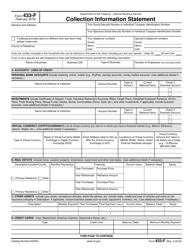

Q: What is the purpose of Form RI433?

A: The purpose of Form RI433 is to gather financial information from wage earners and self-employed individuals in Rhode Island who are in collections to determine their ability to payoutstanding debts.

Q: Is Form RI433 confidential?

A: Yes, the information provided on Form RI433 is confidential and protected by state and federal laws.

Q: What happens after submitting Form RI433?

A: After submitting Form RI433, the Rhode Island Department of Revenue will review the information provided to determine the appropriate collection actions or payment arrangements.

Q: Are there any fees associated with submitting Form RI433?

A: No, there are no specific fees associated with submitting Form RI433. However, you may still be responsible for outstanding debts and associated penalties.

Q: Can I request help or clarification while filling out Form RI433?

A: Yes, if you need assistance or have questions about filling out Form RI433, you can contact the Rhode Island Department of Revenue directly for guidance.

Form Details:

- Released on November 1, 2002;

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RI433 A by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.