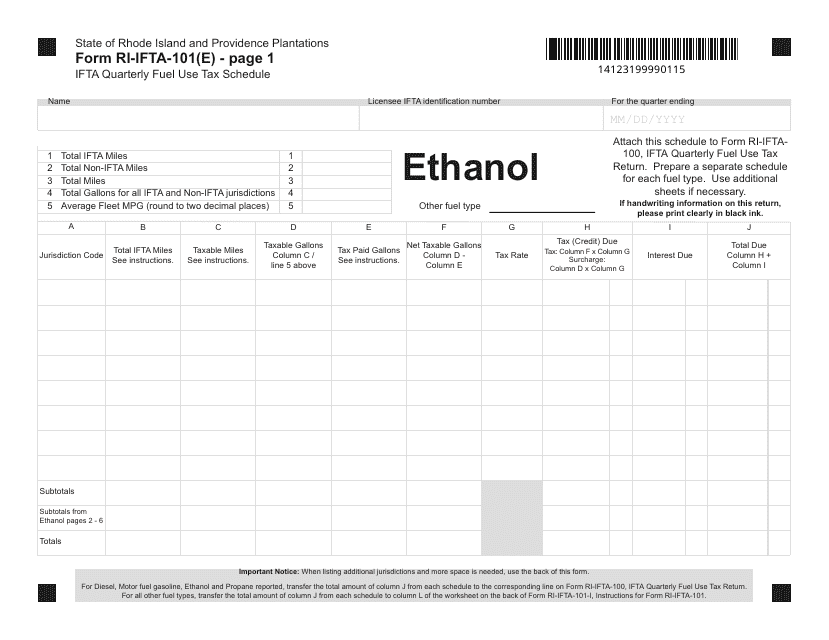

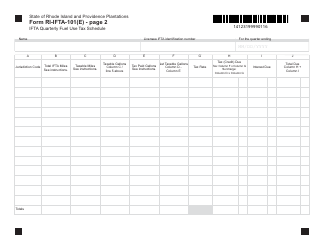

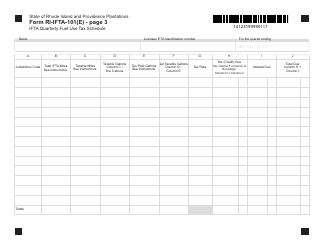

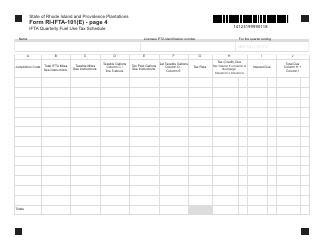

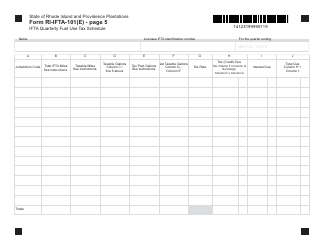

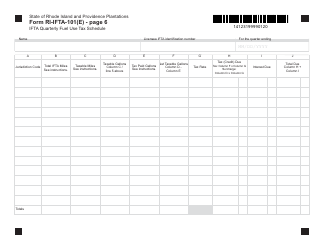

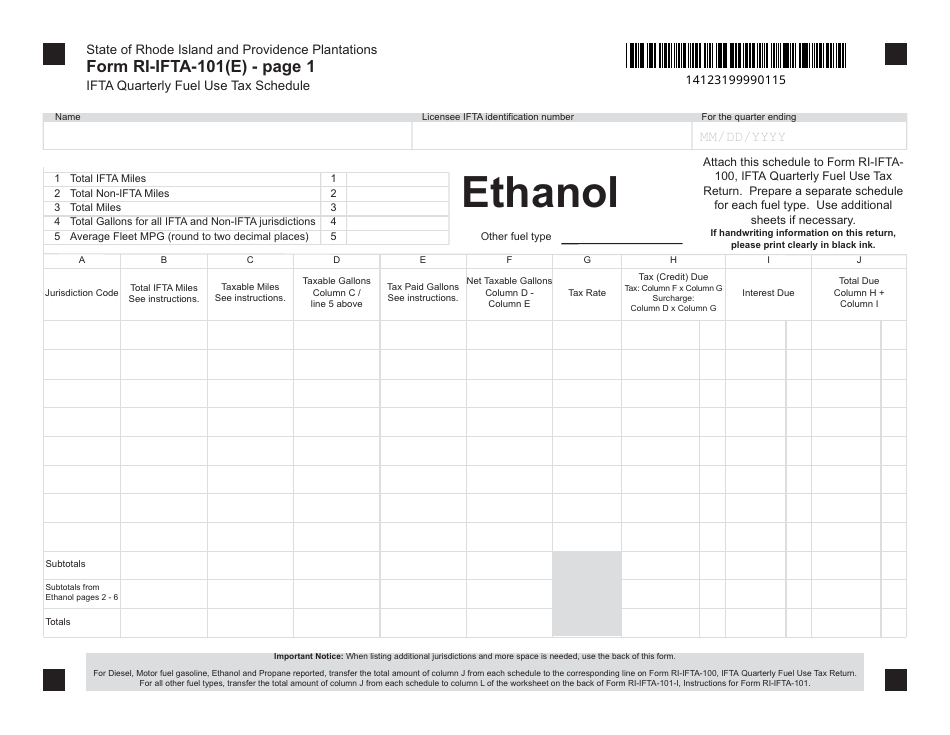

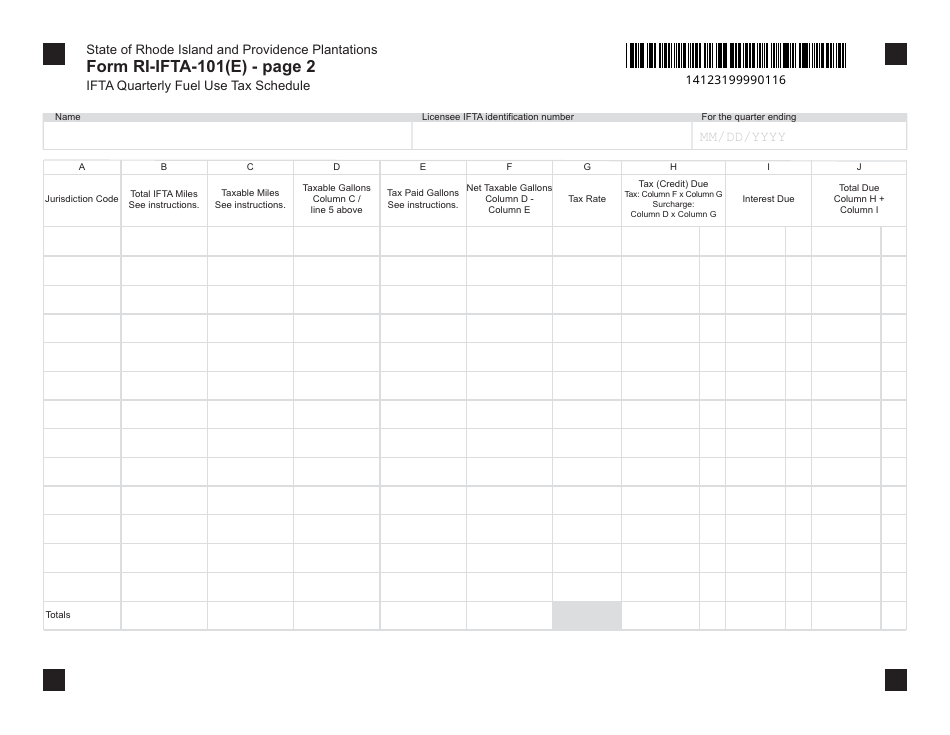

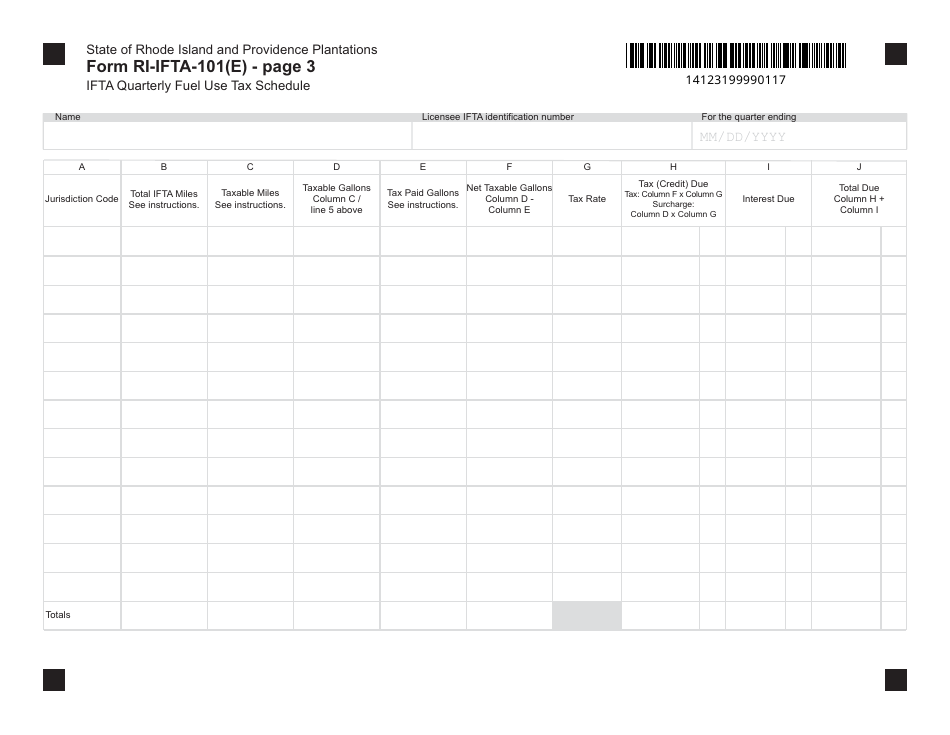

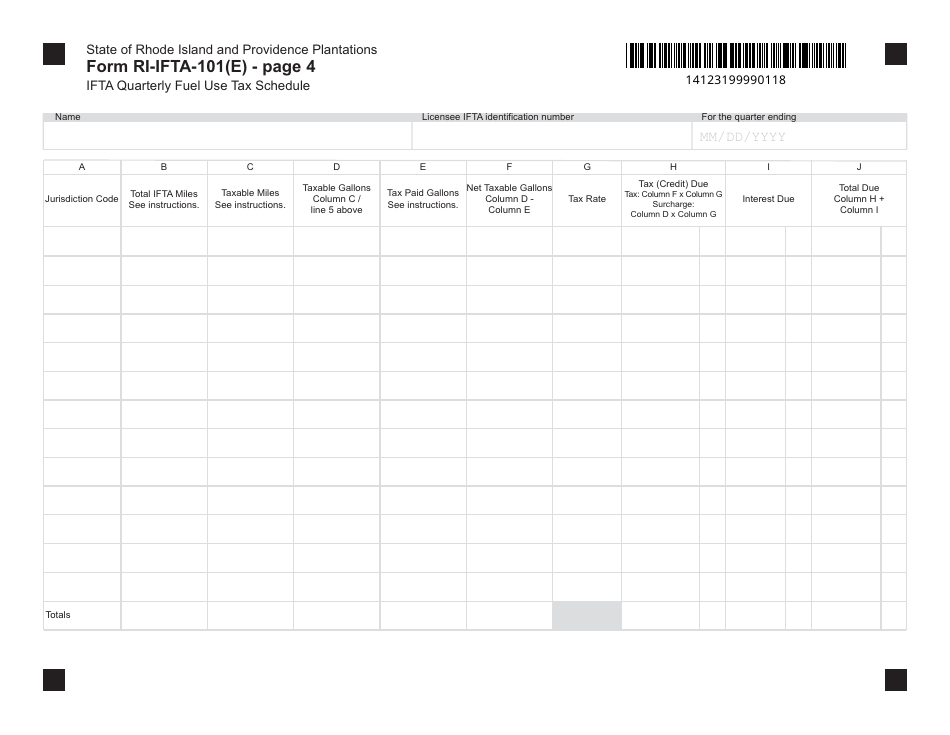

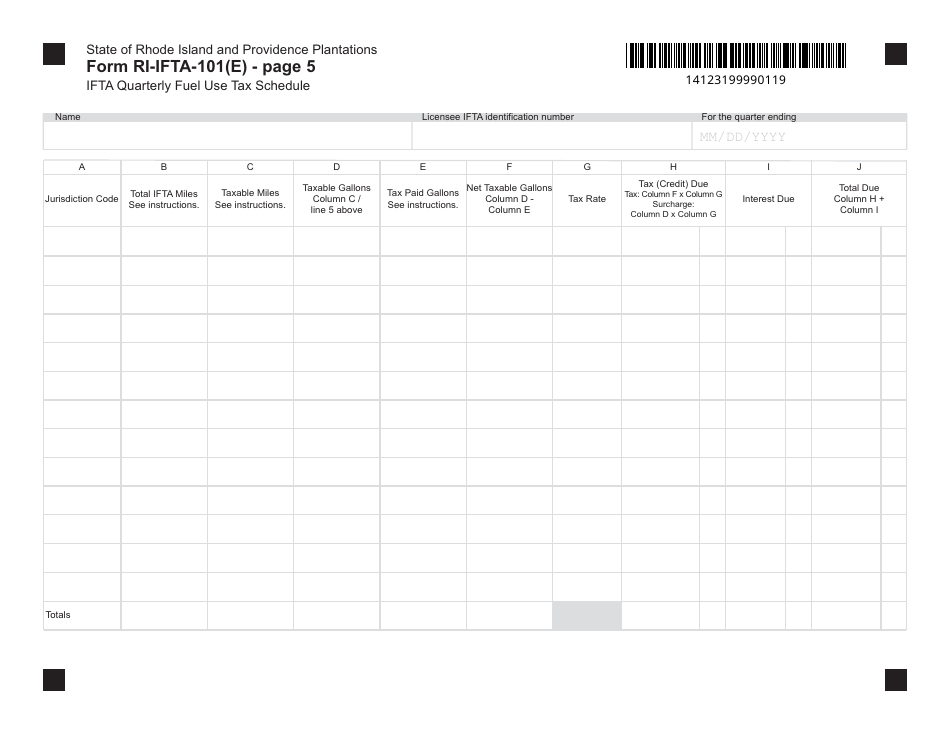

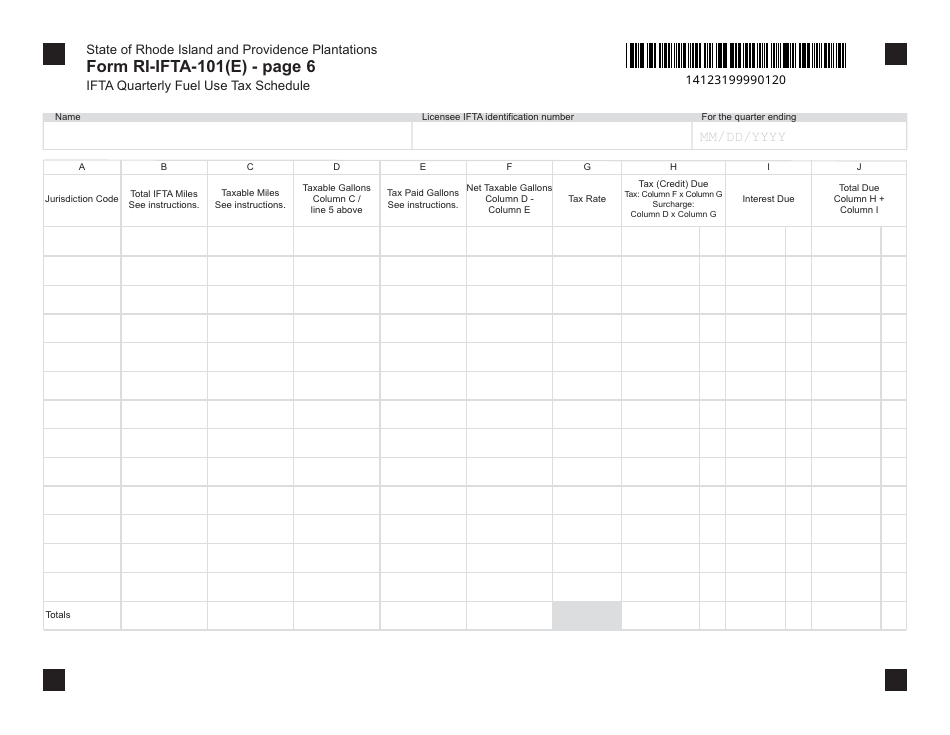

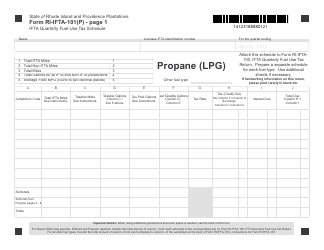

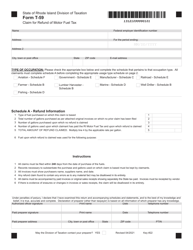

Form RI-IFTA-101(E) Ifta Quarterly Fuel Use Tax Schedule - Ethanol - Rhode Island

What Is Form RI-IFTA-101(E)?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RI-IFTA-101(E)?

A: Form RI-IFTA-101(E) is the IFTA Quarterly Fuel Use Tax Schedule specifically for reporting the use of Ethanol in Rhode Island.

Q: What is IFTA?

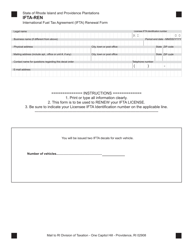

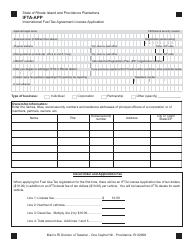

A: IFTA stands for International Fuel Tax Agreement. It is an agreement among US states and Canadian provinces that simplifies the reporting and payment of fuel taxes by interstate motor carriers.

Q: Who needs to file Form RI-IFTA-101(E)?

A: Motor carriers who operate qualified motor vehicles and use Ethanol in Rhode Island need to file Form RI-IFTA-101(E).

Q: What is the purpose of Form RI-IFTA-101(E)?

A: The purpose of Form RI-IFTA-101(E) is to report the use of Ethanol and calculate the amount of fuel usetax owed to Rhode Island.

Q: When is the deadline to file Form RI-IFTA-101(E)?

A: The deadline to file Form RI-IFTA-101(E) is the last day of the month following the end of the quarter.

Q: Are there any penalties for late filing?

A: Yes, there may be penalties for late filing, including interest charges and possible suspension of your IFTA license.

Q: How do I calculate the fuel use tax on Form RI-IFTA-101(E)?

A: You can calculate the fuel use tax by multiplying the total gallons of Ethanol used in Rhode Island by the current tax rate for Ethanol.

Q: Do I need to keep records to support my filing?

A: Yes, you need to keep records of your fuel purchases, fuel use, and mileage for a minimum of four years to support your filing.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-IFTA-101(E) by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.