This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1099-R, 5498

for the current year.

Instructions for IRS Form 1099-R, 5498

This document contains official instructions for IRS Form 1099-R , and IRS Form 5498 . Both forms are released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury.

FAQ

Q: What is IRS Form 1099-R used for?

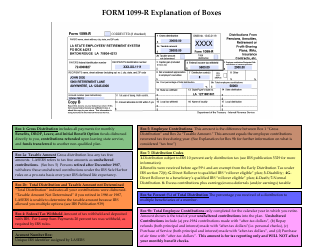

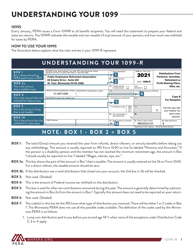

A: IRS Form 1099-R is used to report distributions from pensions, annuities, retirement plans, or profit-sharing plans.

Q: What is IRS Form 5498 used for?

A: IRS Form 5498 is used to report contributions made to an individual retirement account (IRA), including traditional, simplified employee pension (SEP) IRAs, and savings incentive match plan for employees (SIMPLE) IRAs.

Q: How do I fill out IRS Form 1099-R?

A: To fill out IRS Form 1099-R, you will need to provide information about the recipient of the distribution, the plan or issuer, the amount distributed, and any applicable taxes withheld.

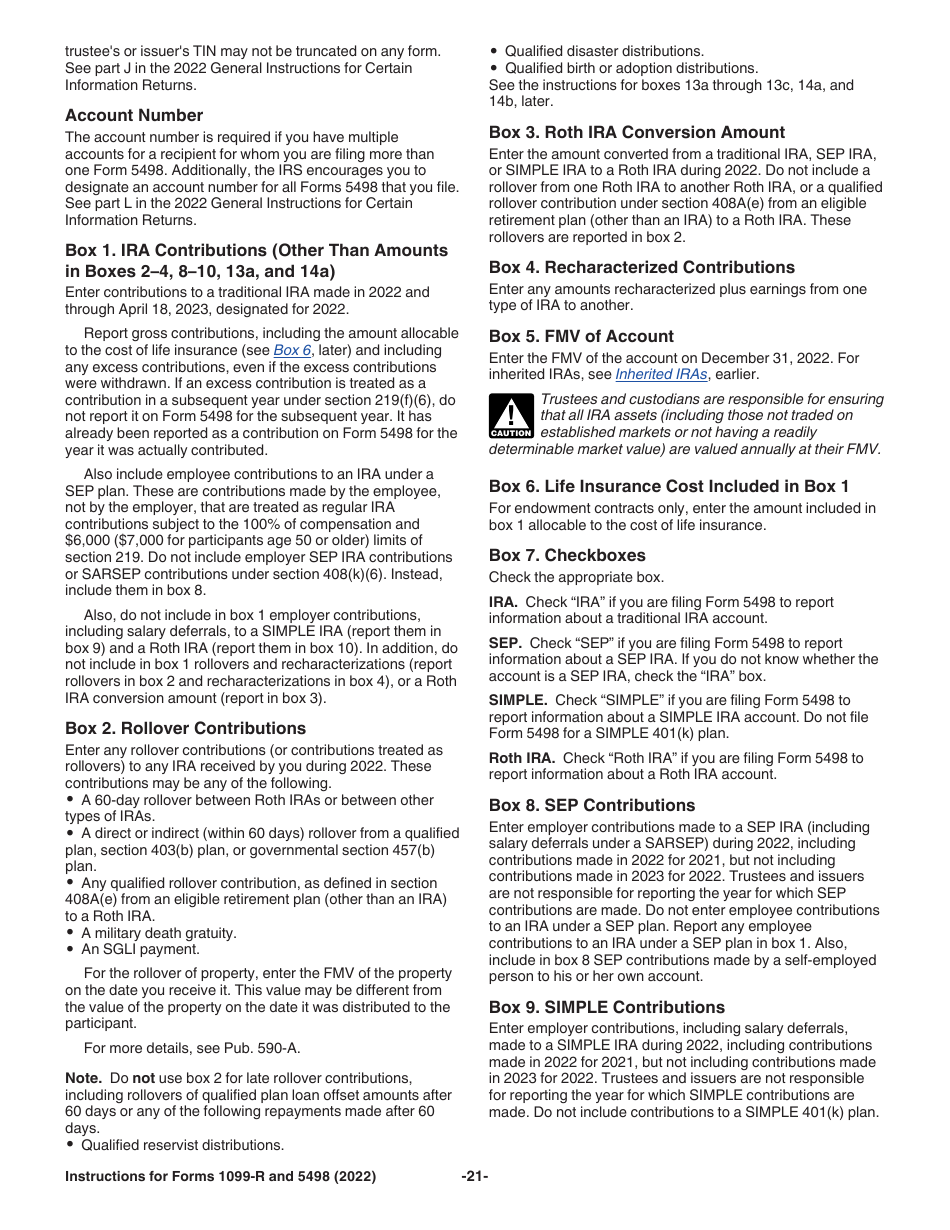

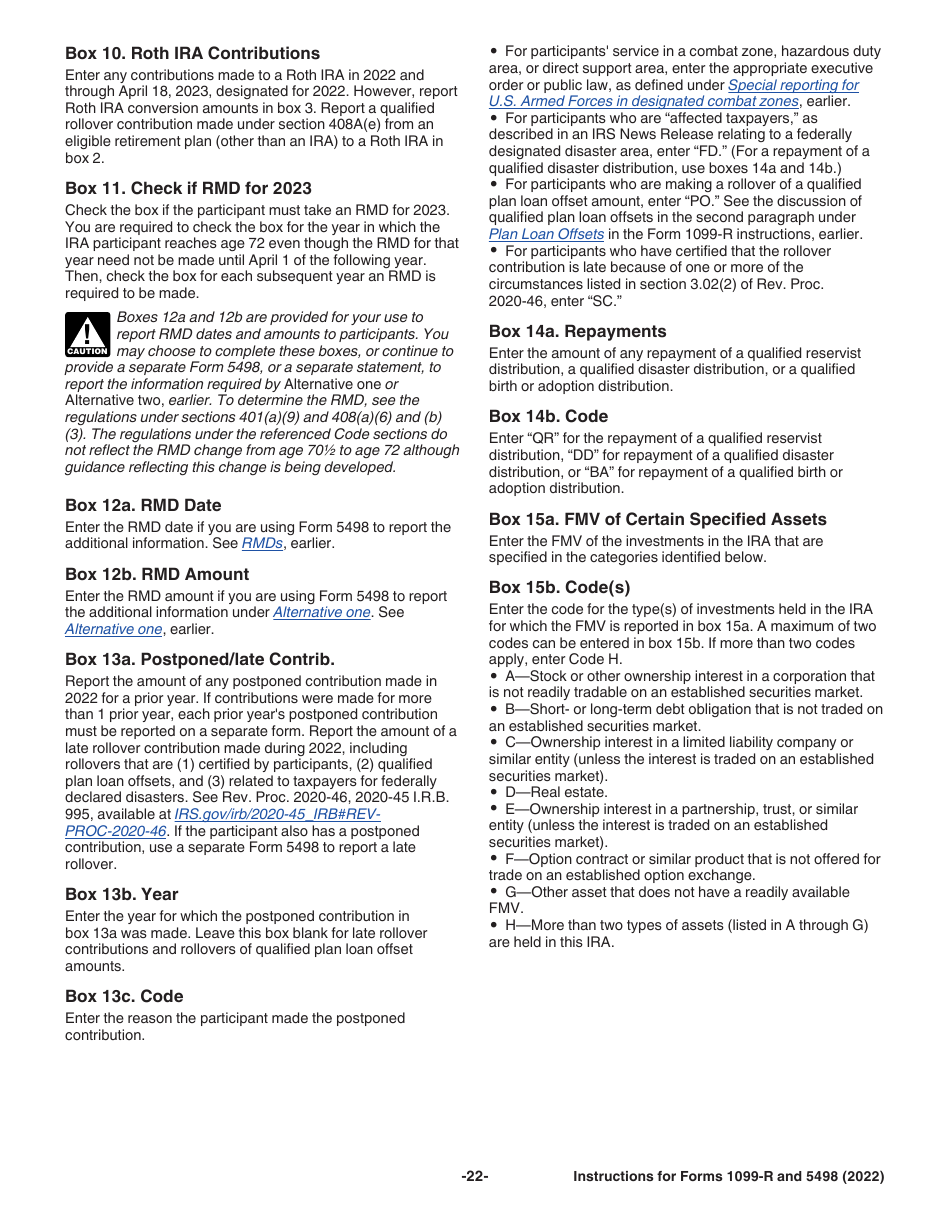

Q: How do I fill out IRS Form 5498?

A: To fill out IRS Form 5498, you will need to provide information about the account owner, the financial institution, the contributions made during the tax year, and the fair market value of the account.

Q: When are IRS Forms 1099-R and 5498 due?

A: Both IRS Forms 1099-R and 5498 are due to be filed with the IRS by January 31st following the tax year being reported.

Q: Do I need to send copies of IRS Forms 1099-R and 5498 to recipients?

A: Yes, you are generally required to send copies of IRS Forms 1099-R and 5498 to the recipients by January 31st of the following year.

Q: Can I file IRS Forms 1099-R and 5498 electronically?

A: Yes, you can file both IRS Forms 1099-R and 5498 electronically through the IRS FIRE (Filing Information Returns Electronically) system.

Q: What should I do if I make a mistake on IRS Forms 1099-R or 5498?

A: If you make a mistake, you should correct it as soon as possible by filing corrected forms with the IRS and providing corrected copies to the recipients.

Q: Do I need to report distributions and contributions on my tax return?

A: Yes, you generally need to report distributions from Form 1099-R and contributions to Form 5498 on your tax return.

Instruction Details:

- This 23-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.