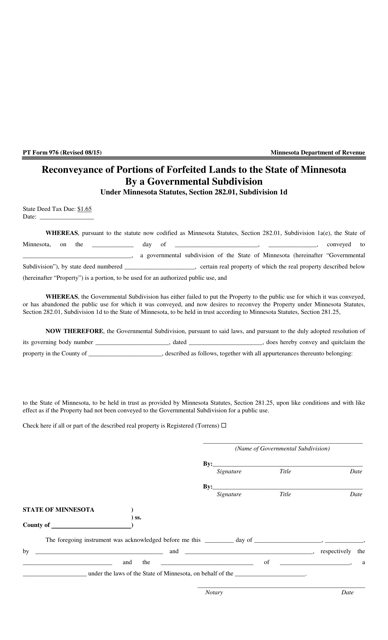

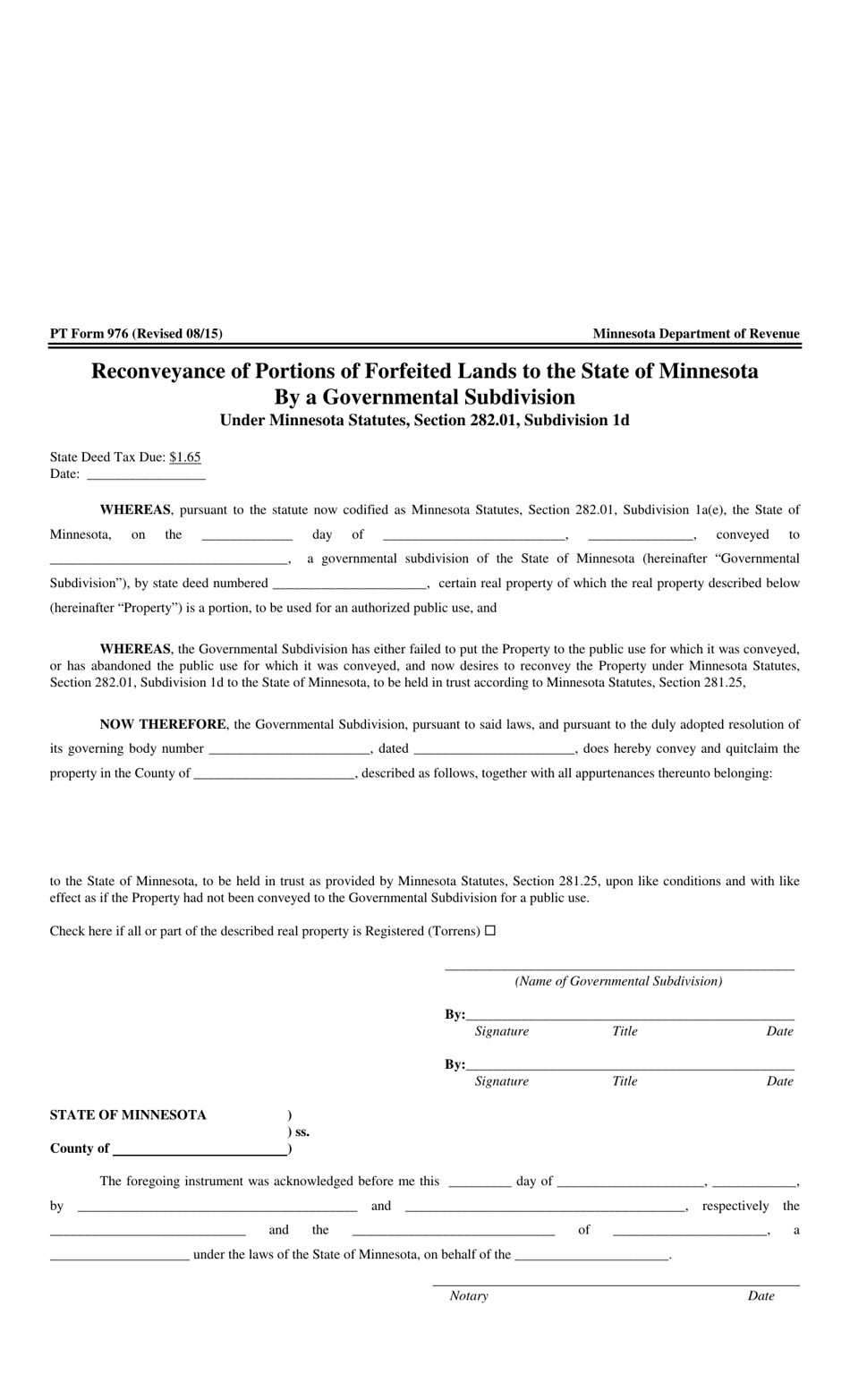

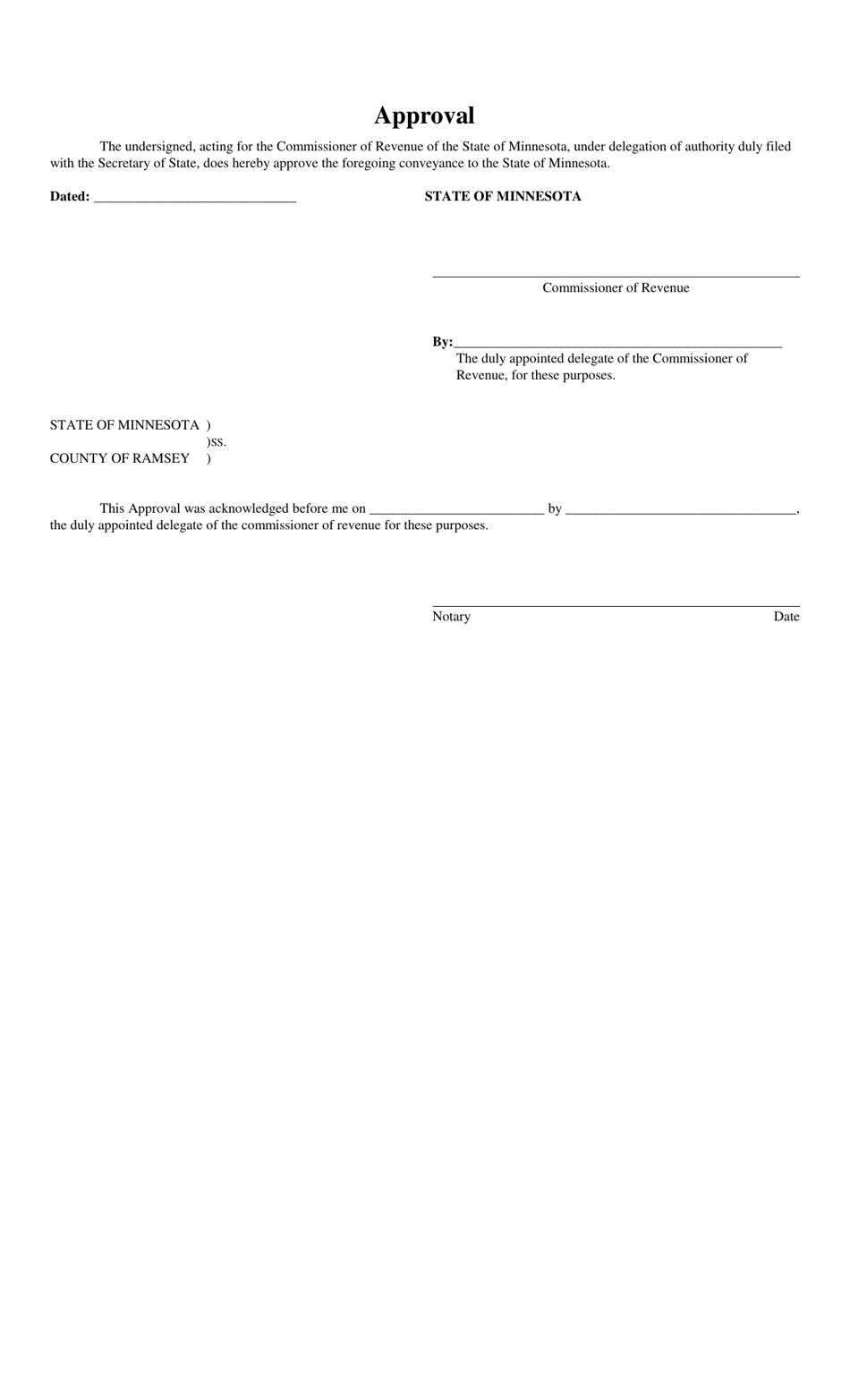

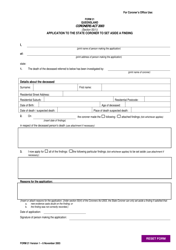

PT Form 976 Reconveyance of Portions of Forfeited Lands to the State of Minnesota by a Governmental Subdivision - Minnesota

What Is PT Form 976?

This is a legal form that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is PT Form 976?

A: PT Form 976 is a document used for the reconveyance of portions of forfeited lands to the State of Minnesota by a governmental subdivision in Minnesota.

Q: Who uses PT Form 976?

A: PT Form 976 is used by a governmental subdivision in Minnesota when they are reconveying portions of forfeited lands to the State of Minnesota.

Q: What is the purpose of PT Form 976?

A: The purpose of PT Form 976 is to facilitate the transfer of portions of forfeited lands from a governmental subdivision to the State of Minnesota.

Q: Does PT Form 976 apply only to Minnesota?

A: Yes, PT Form 976 is specific to the state of Minnesota.

Q: What is meant by 'forfeited lands' in PT Form 976?

A: Forfeited lands refer to lands that have been taken by the government due to non-payment of taxes or other reasons.

Q: Who is the recipient of the portions of forfeited lands in PT Form 976?

A: The State of Minnesota is the recipient of the portions of forfeited lands in PT Form 976.

Q: Is PT Form 976 required for all types of land transfers in Minnesota?

A: No, PT Form 976 is specifically for the reconveyance of portions of forfeited lands to the State of Minnesota by a governmental subdivision.

Q: Are there any fees associated with PT Form 976?

A: Specific fees may apply, and it is advisable to consult with the relevant authorities or legal experts for accurate fee information.

Q: Can PT Form 976 be filled out electronically?

A: The availability of electronic filing options may vary, so it is recommended to check with the relevant authorities or legal experts for the latest information.

Form Details:

- Released on August 1, 2015;

- The latest edition provided by the Minnesota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of PT Form 976 by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.