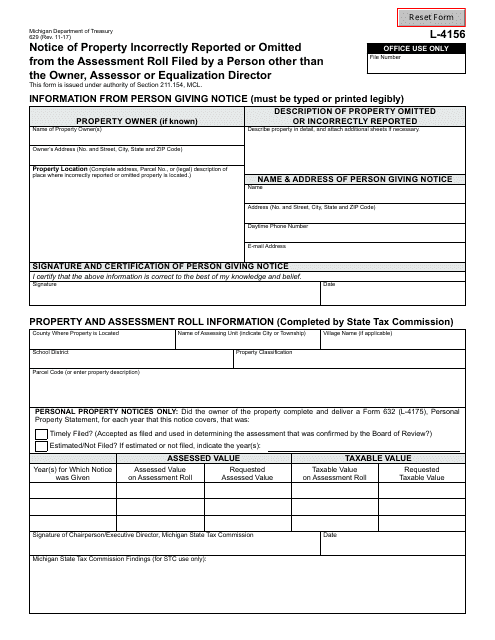

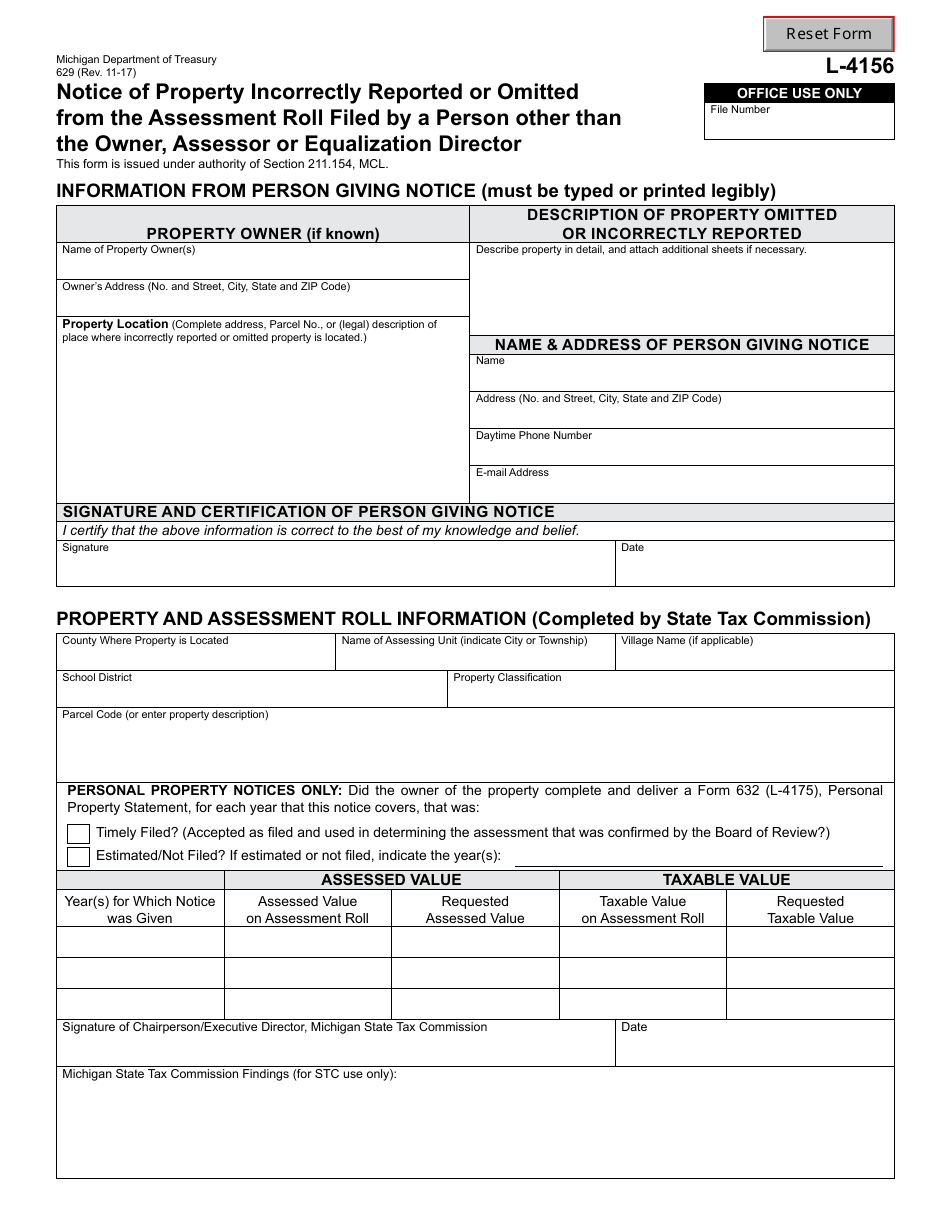

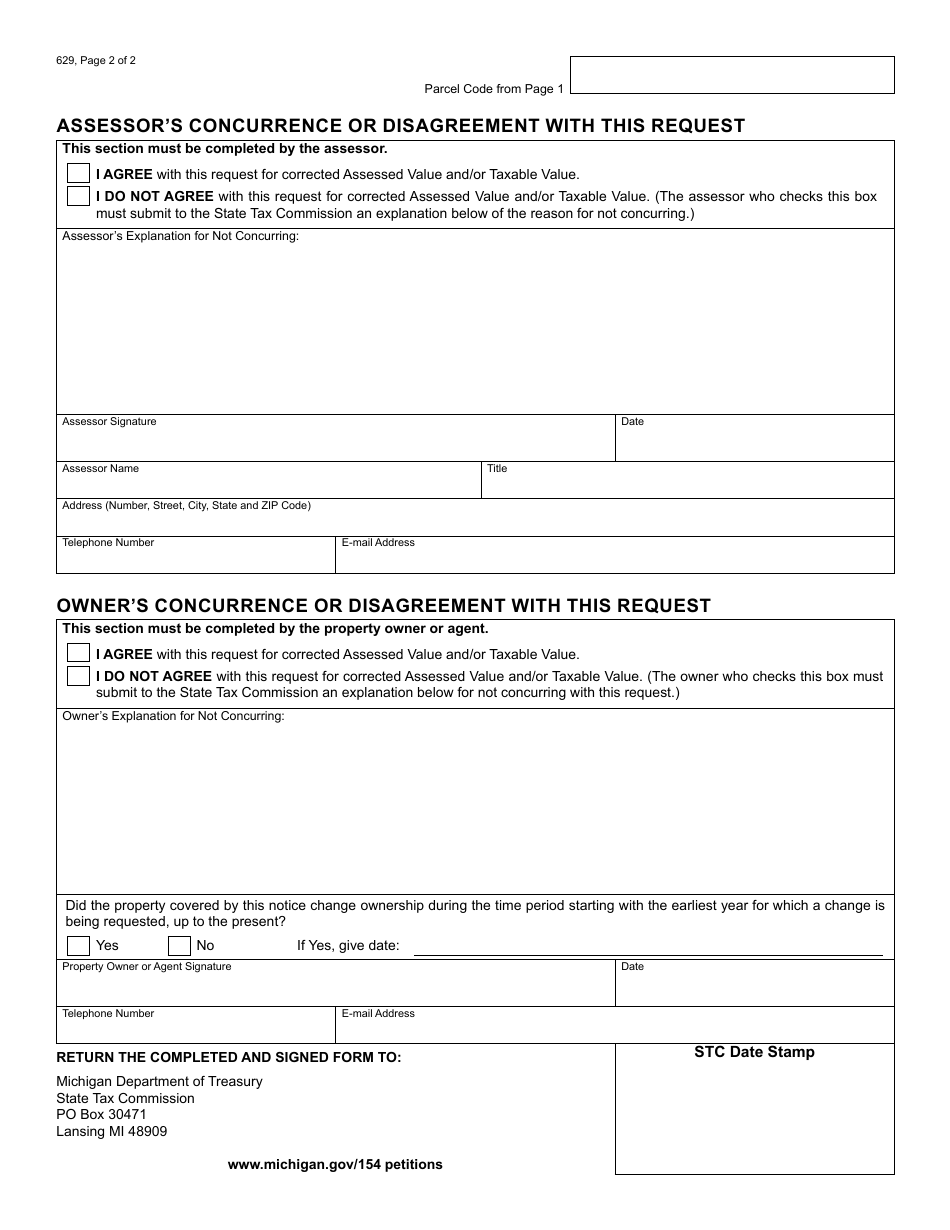

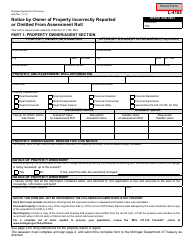

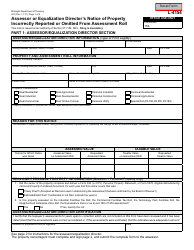

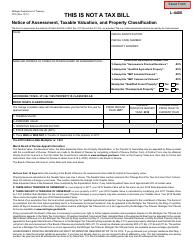

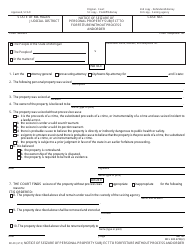

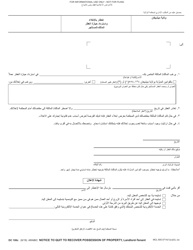

Form 629 Notice of Property Incorrectly Reported or Omitted From the Assessment Roll Filed by a Person Other Than the Owner, Assessor or Equalization Director - Michigan

What Is Form 629?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 629?

A: Form 629 is the Notice of Property Incorrectly Reported or Omitted From the Assessment Roll filed by a person other than the owner, assessor, or equalization director in Michigan.

Q: Who can file Form 629?

A: Any person other than the owner, assessor, or equalization director can file Form 629 in Michigan.

Q: What is the purpose of Form 629?

A: The purpose of Form 629 is to report any property that has been incorrectly reported or omitted from the assessment roll in Michigan.

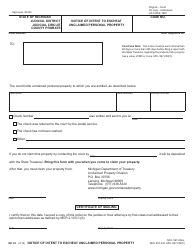

Q: What should be included in Form 629?

A: Form 629 should include detailed information about the property that has been incorrectly reported or omitted, as well as any supporting documentation.

Q: How can Form 629 be filed?

A: Form 629 can be filed by mailing it to the appropriate local unit of government in Michigan, such as the city or township assessor's office.

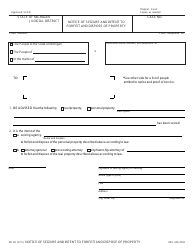

Q: Is there a deadline for filing Form 629?

A: Yes, Form 629 must be filed by the first Monday in June in Michigan.

Q: Are there any fees associated with filing Form 629?

A: No, there are no fees associated with filing Form 629 in Michigan.

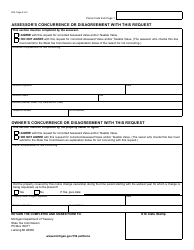

Q: What happens after Form 629 is filed?

A: After Form 629 is filed, the local unit of government will review the information and make any necessary corrections to the assessment roll.

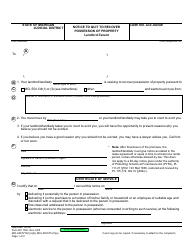

Q: Can Form 629 be used to dispute property values?

A: No, Form 629 is specifically for reporting incorrectly reported or omitted properties, not for disputing property values.

Q: Are there any penalties for filing a false Form 629?

A: Yes, there may be penalties for filing a false Form 629 in Michigan, including fines and potential legal action.

Form Details:

- Released on November 1, 2017;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 629 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.