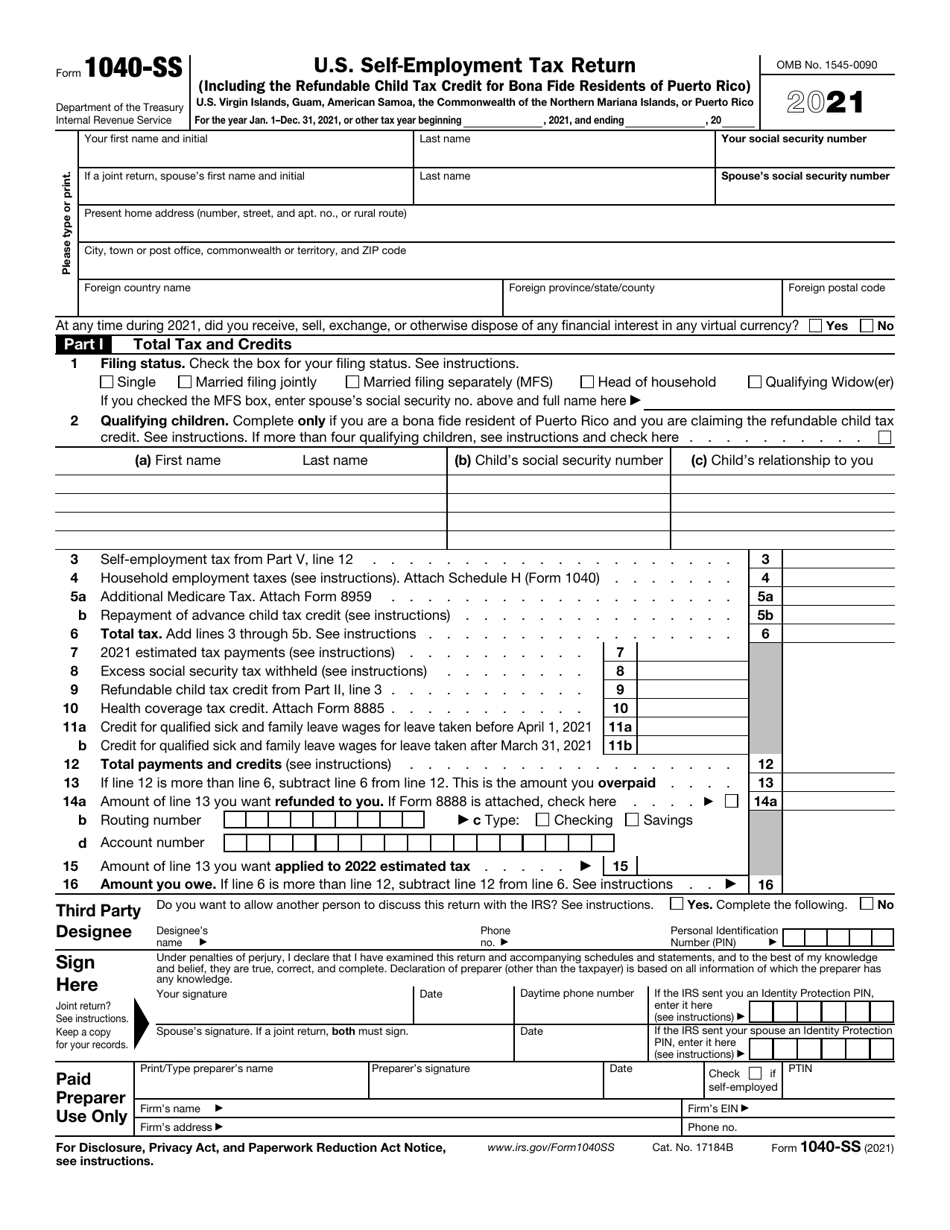

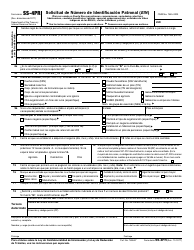

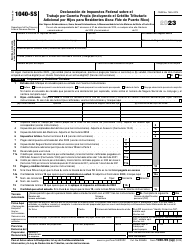

This version of the form is not currently in use and is provided for reference only. Download this version of

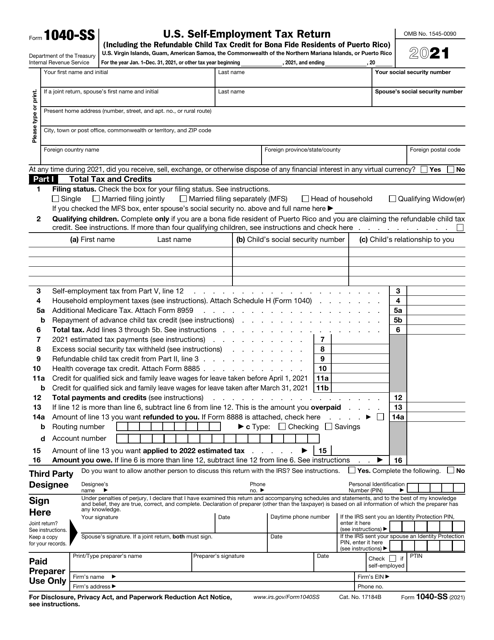

IRS Form 1040-SS

for the current year.

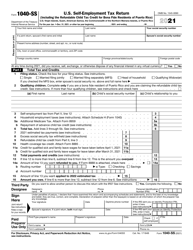

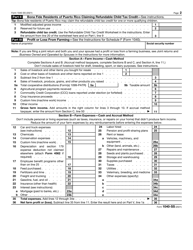

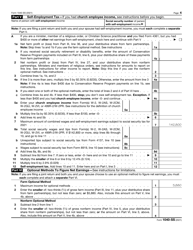

IRS Form 1040-SS U.S. Self-employment Tax Return (Including the Additional Child Tax Credit for Bona Fide Residents of Puerto Rico)

What Is IRS Form 1040-SS?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1040-SS?

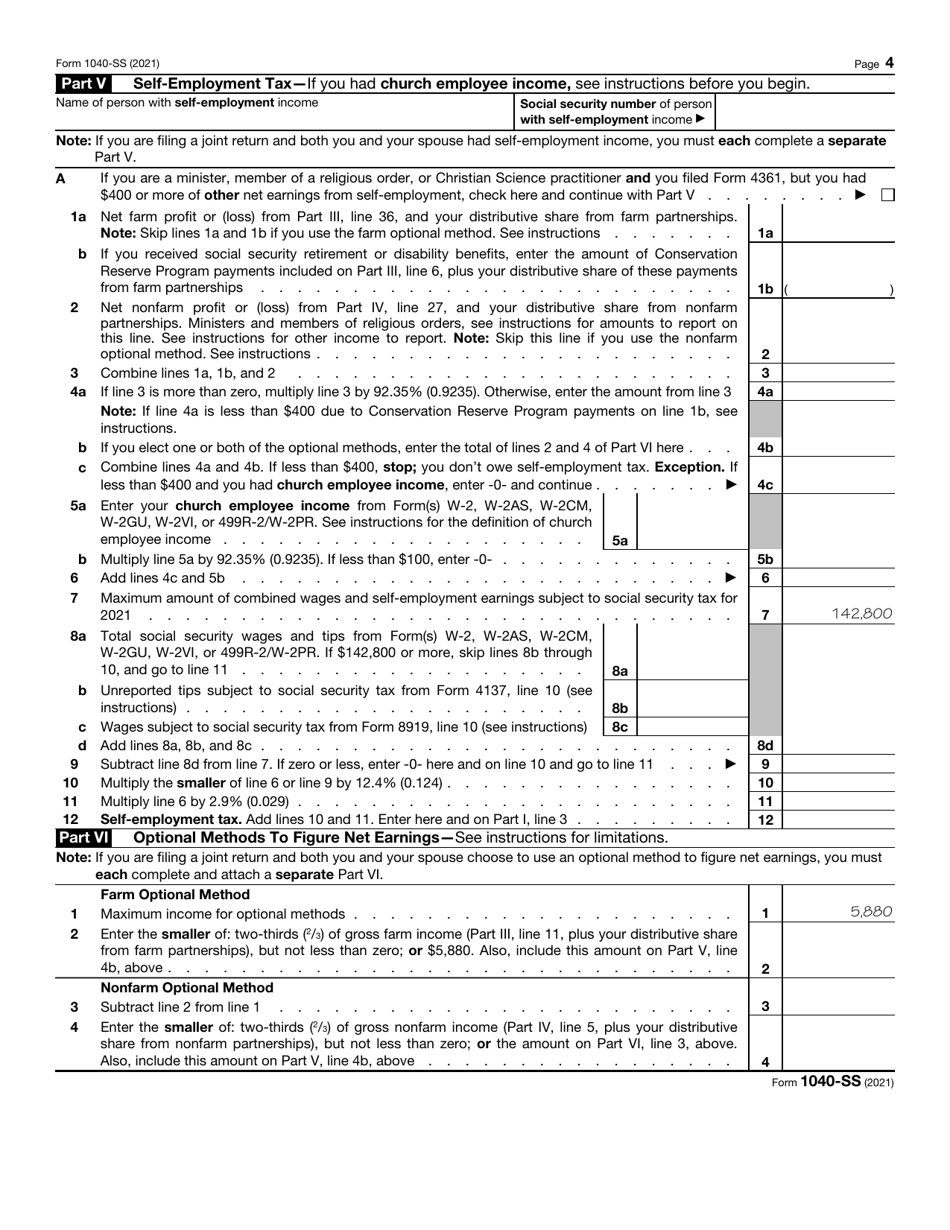

A: IRS Form 1040-SS is the U.S. Self-employment Tax Return specifically for self-employed individuals.

Q: Who is required to file IRS Form 1040-SS?

A: Self-employed individuals who are residents of Puerto Rico and eligible for the Additional Child Tax Credit.

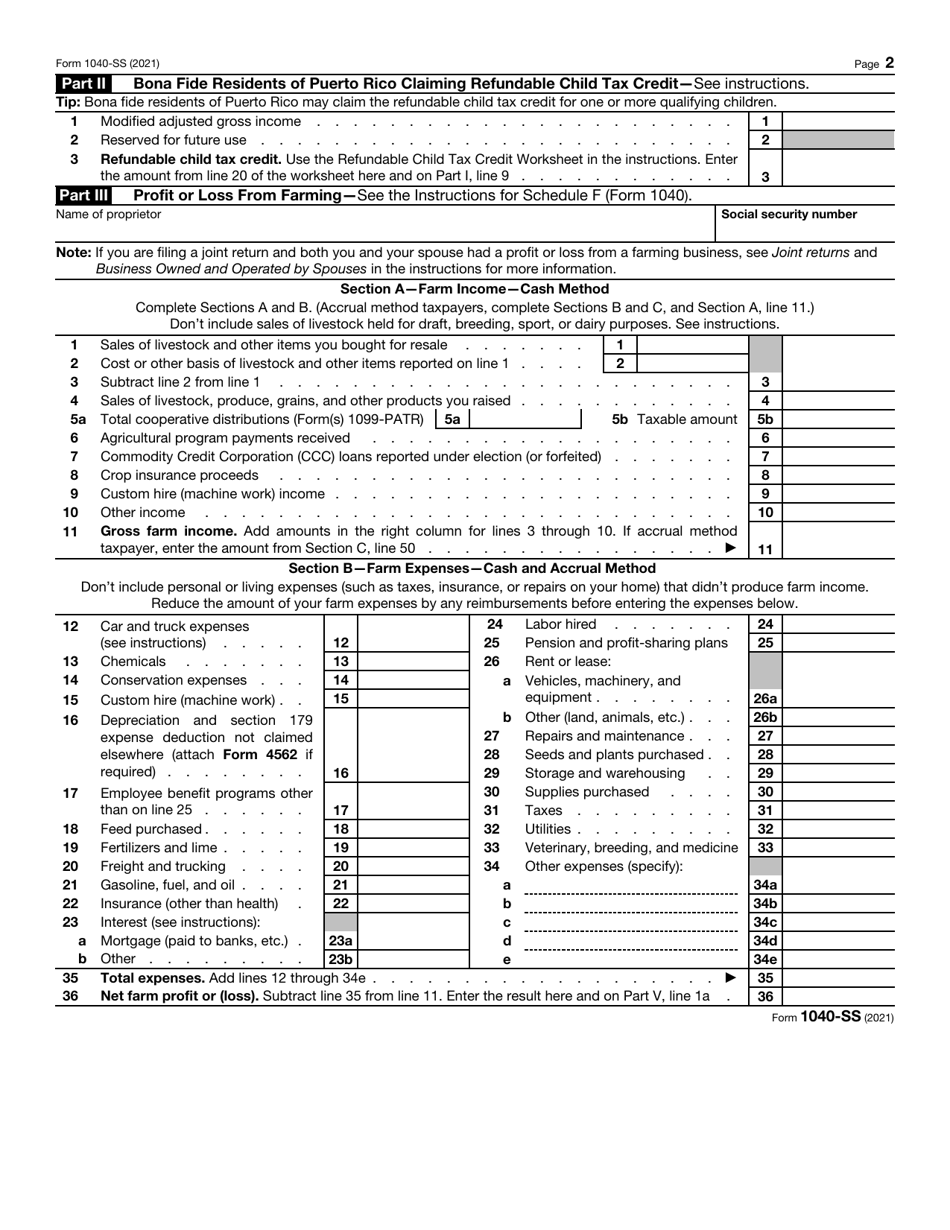

Q: What is the Additional Child Tax Credit?

A: The Additional Child Tax Credit is a refundable tax credit available to eligible taxpayers with qualifying dependent children.

Q: What is a bona fide resident of Puerto Rico?

A: A bona fide resident of Puerto Rico is someone who meets the residency requirements and has established Puerto Rico as their permanent home.

Q: What is the purpose of IRS Form 1040-SS?

A: The purpose of IRS Form 1040-SS is to report self-employment income and calculate the self-employment tax owed by eligible self-employed individuals in Puerto Rico.

Q: Is IRS Form 1040-SS only for residents of Puerto Rico?

A: Yes, IRS Form 1040-SS is specifically for residents of Puerto Rico who are self-employed and eligible for the Additional Child Tax Credit.

Q: Do I need to file IRS Form 1040-SS if I am not self-employed?

A: No, IRS Form 1040-SS is only required for self-employed individuals in Puerto Rico who are eligible for the Additional Child Tax Credit.

Form Details:

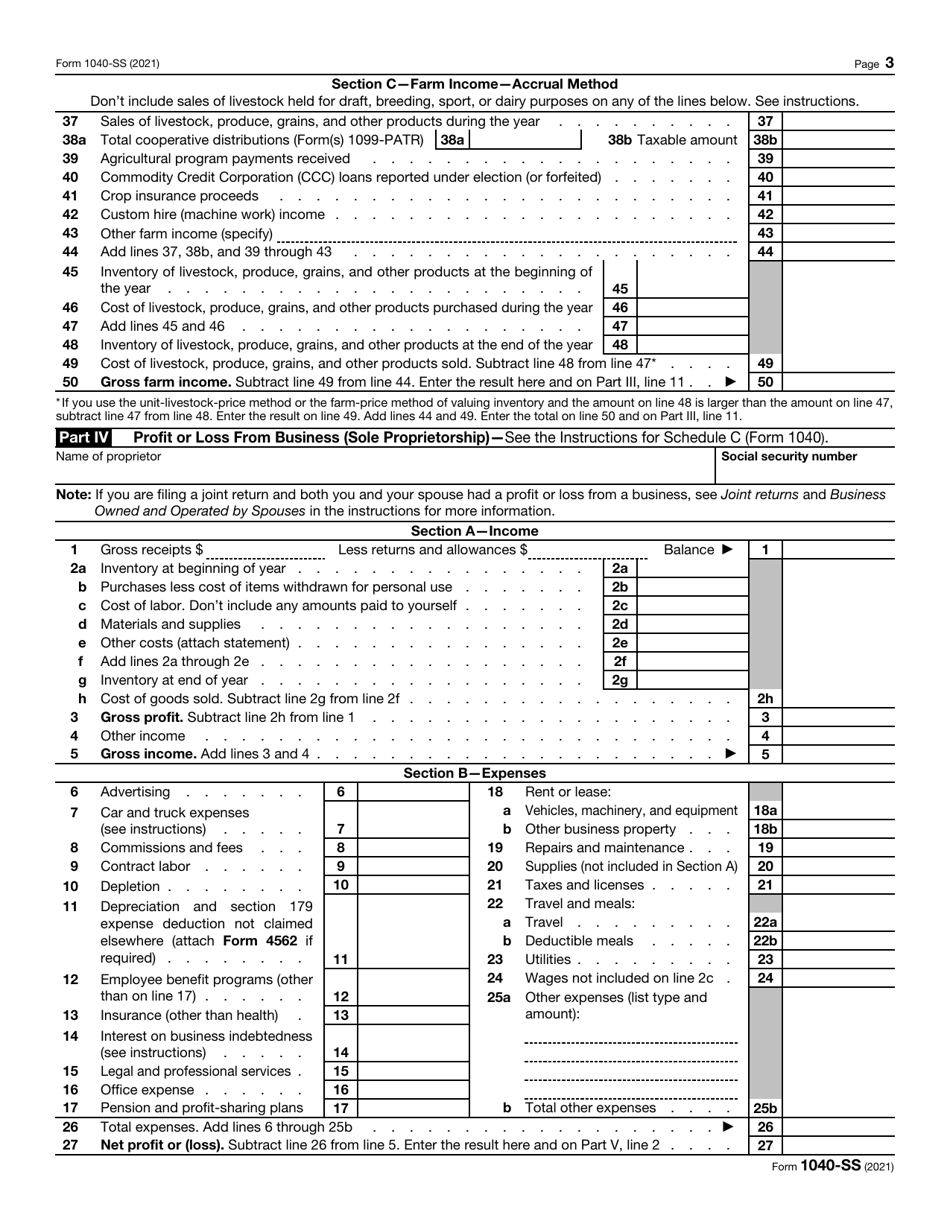

- A 4-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1040-SS through the link below or browse more documents in our library of IRS Forms.