This version of the form is not currently in use and is provided for reference only. Download this version of

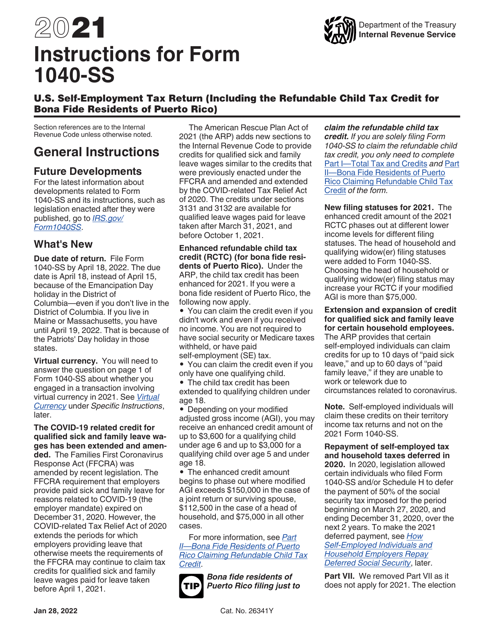

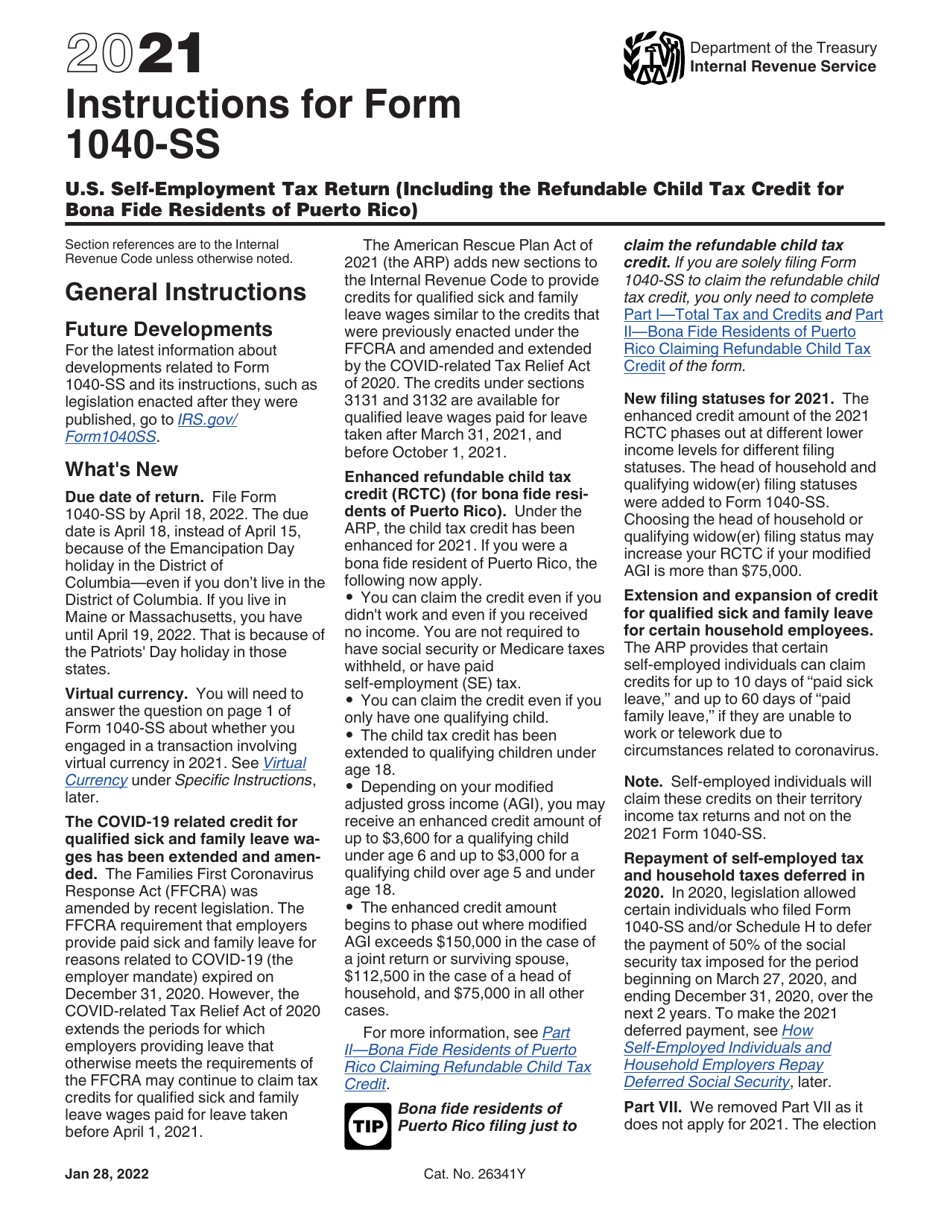

Instructions for IRS Form 1040-SS

for the current year.

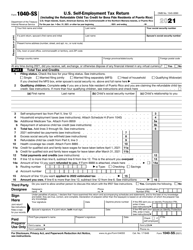

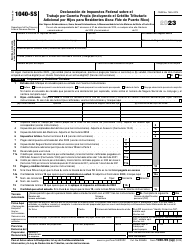

Instructions for IRS Form 1040-SS U.S. Self-employment Tax Return (Including the Refundable Child Tax Credit for Bona Fide Residents of Puerto Rico)

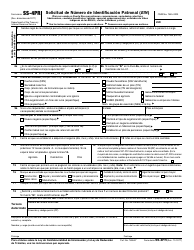

This document contains official instructions for IRS Form 1040-SS , U.S. Self-employment Tax Return (Including the Refundable Bona Fide Residents of Puerto Rico) - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1040-SS is available for download through this link.

FAQ

Q: What is IRS Form 1040-SS?

A: IRS Form 1040-SS is the U.S. Self-employment Tax Return specifically designed for self-employed individuals.

Q: Who should file IRS Form 1040-SS?

A: Self-employed individuals who are bona fide residents of Puerto Rico should file IRS Form 1040-SS.

Q: What is the purpose of IRS Form 1040-SS?

A: The purpose of IRS Form 1040-SS is to report self-employment income and calculate self-employment tax for individuals in Puerto Rico.

Q: What is self-employment tax?

A: Self-employment tax is a tax imposed on self-employed individuals to fund Social Security and Medicare.

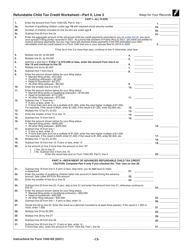

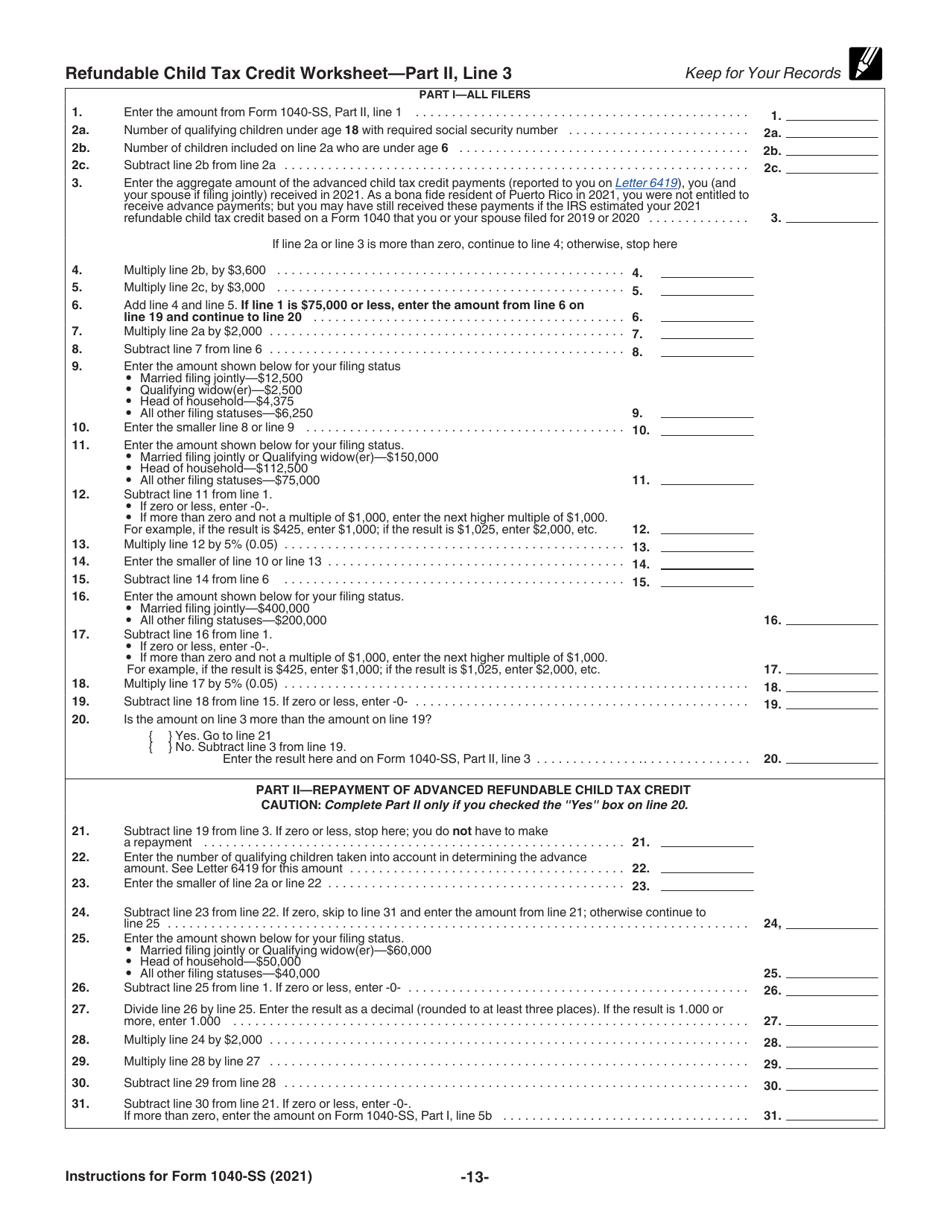

Q: What is the Refundable Child Tax Credit?

A: The Refundable Child Tax Credit is a tax credit intended to provide additional financial support to families with qualifying children.

Q: Who is eligible for the Refundable Child Tax Credit?

A: Families in Puerto Rico with qualifying children may be eligible for the Refundable Child Tax Credit.

Q: What are the requirements to be a bona fide resident of Puerto Rico?

A: To be a bona fide resident of Puerto Rico, you must meet certain residency requirements and be physically present in Puerto Rico for a specified period of time.

Instruction Details:

- This 23-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.