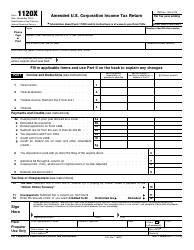

This version of the form is not currently in use and is provided for reference only. Download this version of

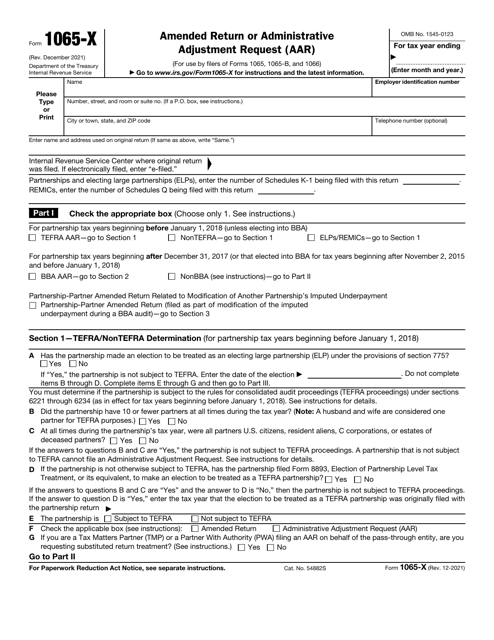

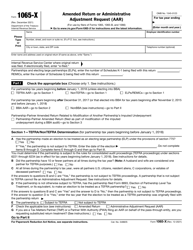

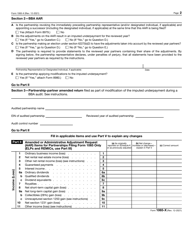

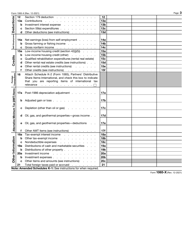

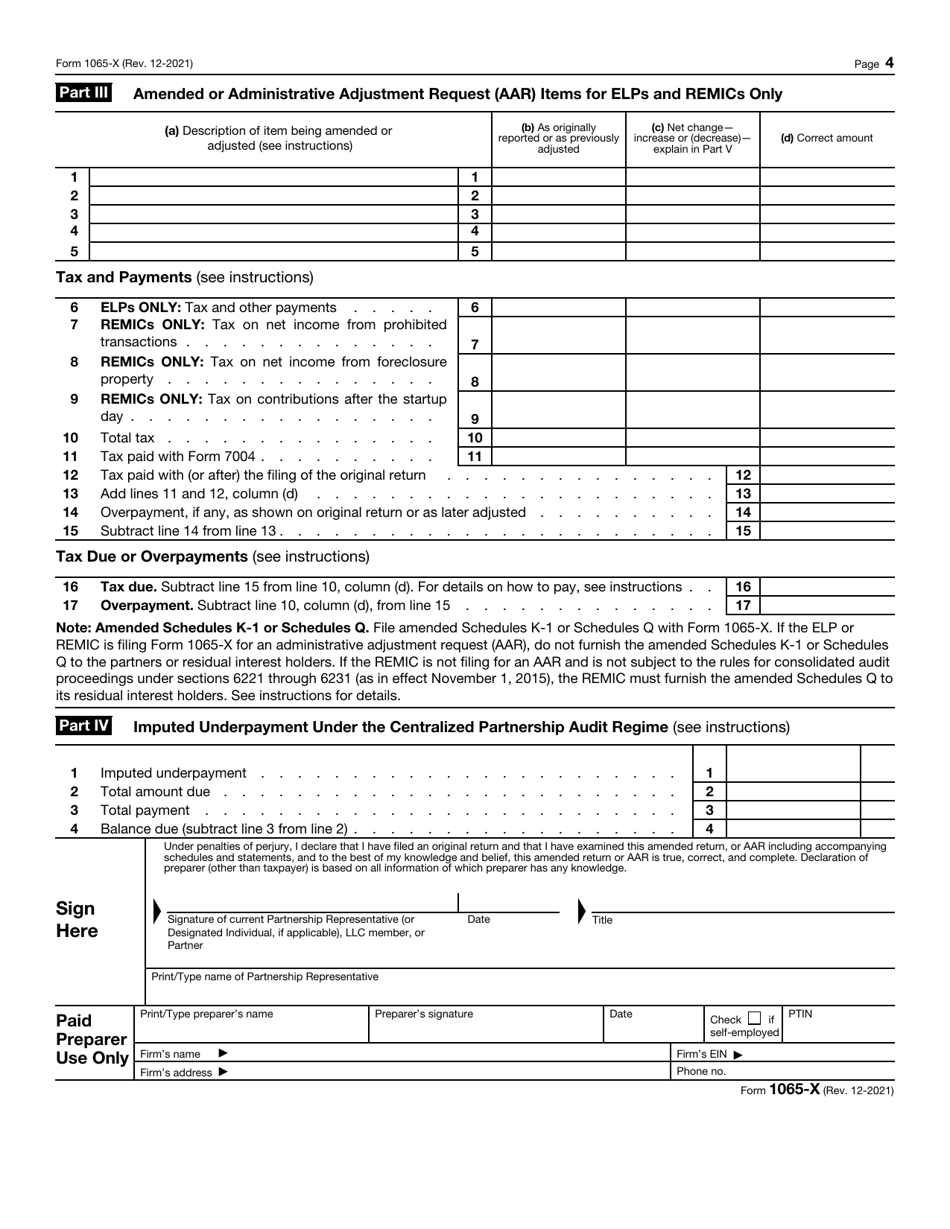

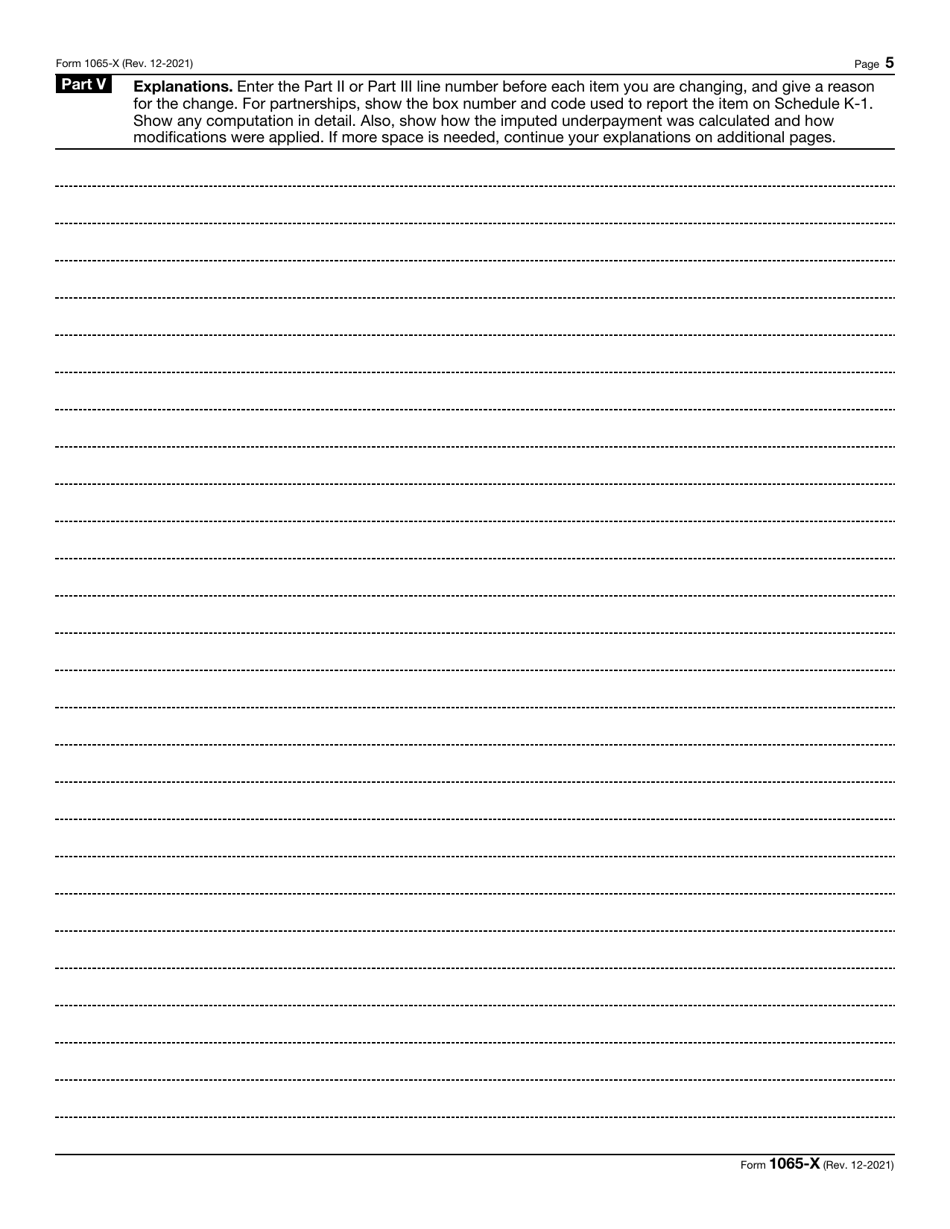

IRS Form 1065-X

for the current year.

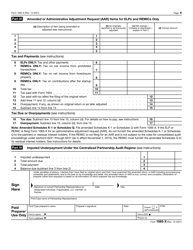

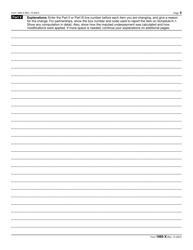

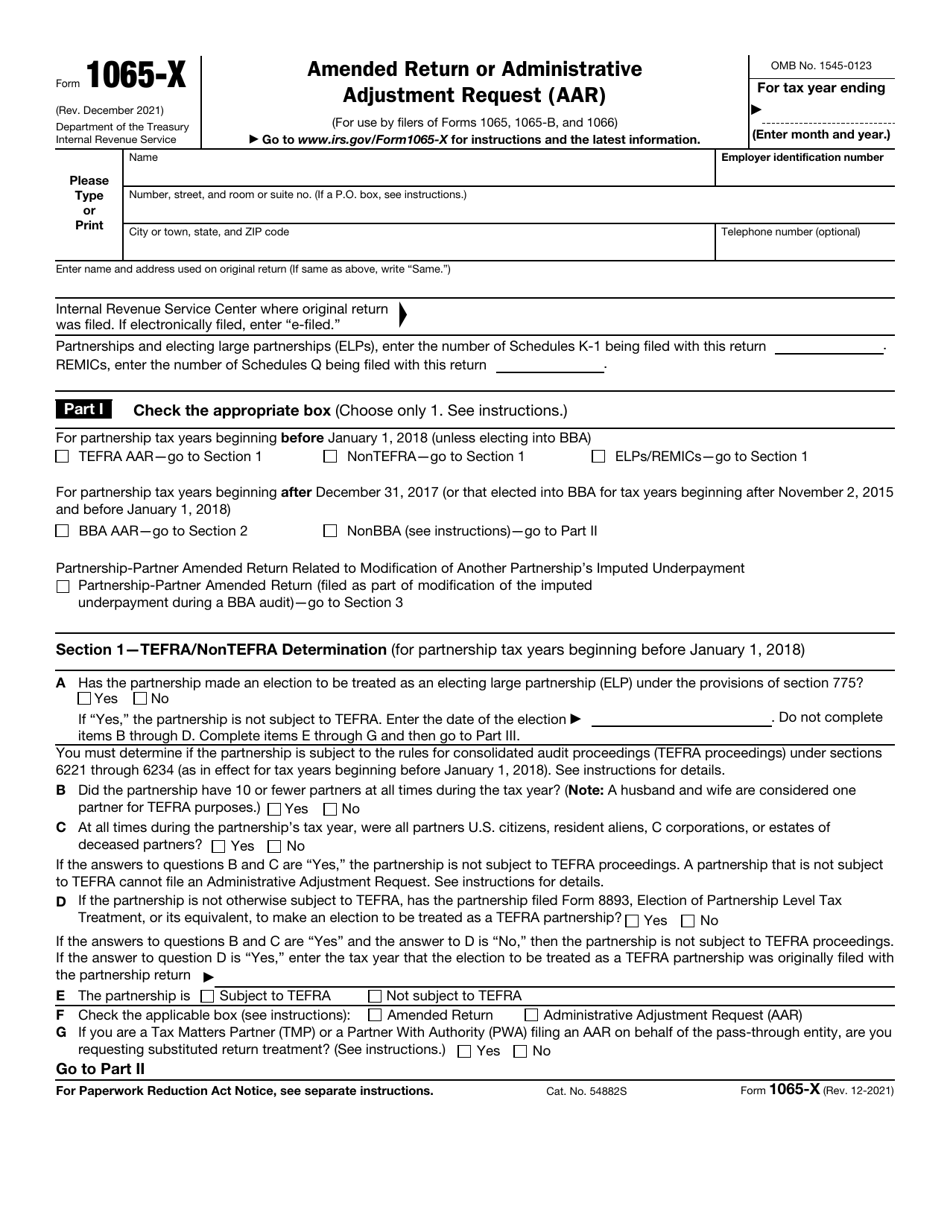

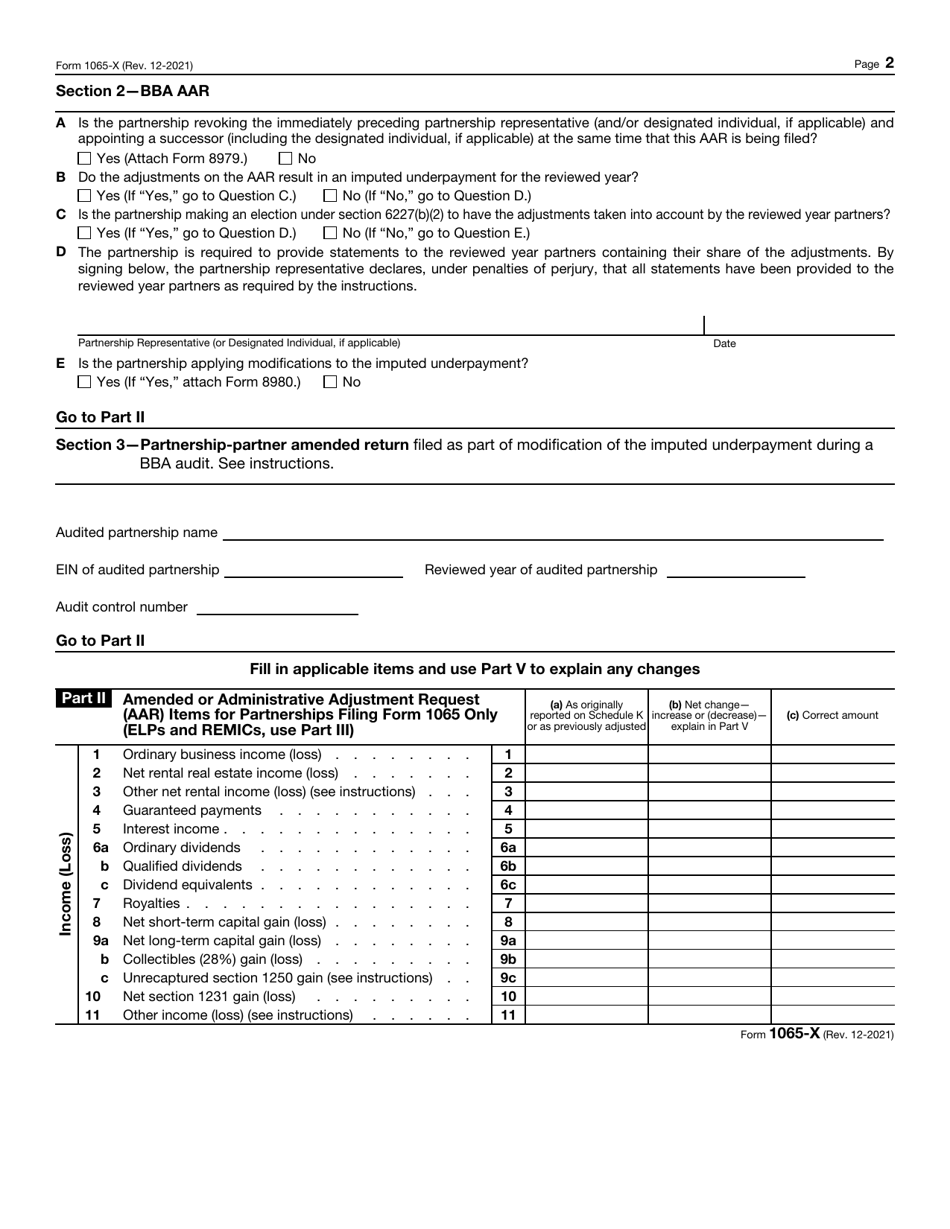

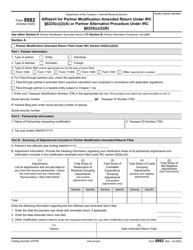

IRS Form 1065-X Amended Return or Administrative Adjustment Request (AAR)

What Is IRS Form 1065-X?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on December 1, 2021. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1065-X?

A: IRS Form 1065-X is a form used for filing an amended return or requesting an administrative adjustment for partnerships.

Q: When should I use Form 1065-X?

A: You should use Form 1065-X when you need to correct information on your previously filed Form 1065, U.S. Return of Partnership Income.

Q: What is an amended return?

A: An amended return is a corrected version of a previously filed tax return.

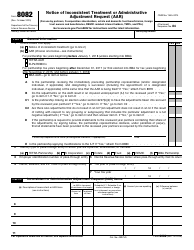

Q: What is an administrative adjustment request (AAR)?

A: An administrative adjustment request (AAR) is a request to the IRS to make a change to your tax return outside of the normal tax return filing process.

Q: Can I electronically file Form 1065-X?

A: No, Form 1065-X must be submitted by mail to the IRS.

Q: Do I need to attach any other forms or documents with Form 1065-X?

A: It depends on the changes you are making. The instructions for Form 1065-X will indicate if any additional forms or documents are required.

Q: Is there a deadline for filing Form 1065-X?

A: Yes, generally you must file Form 1065-X within three years from the date you filed your original Form 1065 or within two years from the date you paid the tax, whichever is later.

Q: Can I use Form 1065-X to request a refund?

A: No, you cannot use Form 1065-X to request a refund. If you are seeking a refund, you must file a separate claim using Form 1040-X, Amended U.S. Individual Income Tax Return.

Q: Can I get help with filling out Form 1065-X?

A: Yes, you can seek assistance from a tax professional or use the IRS resources and instructions provided for Form 1065-X.

Form Details:

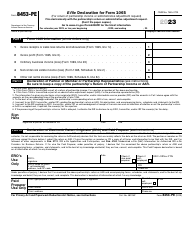

- A 5-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1065-X through the link below or browse more documents in our library of IRS Forms.