This version of the form is not currently in use and is provided for reference only. Download this version of

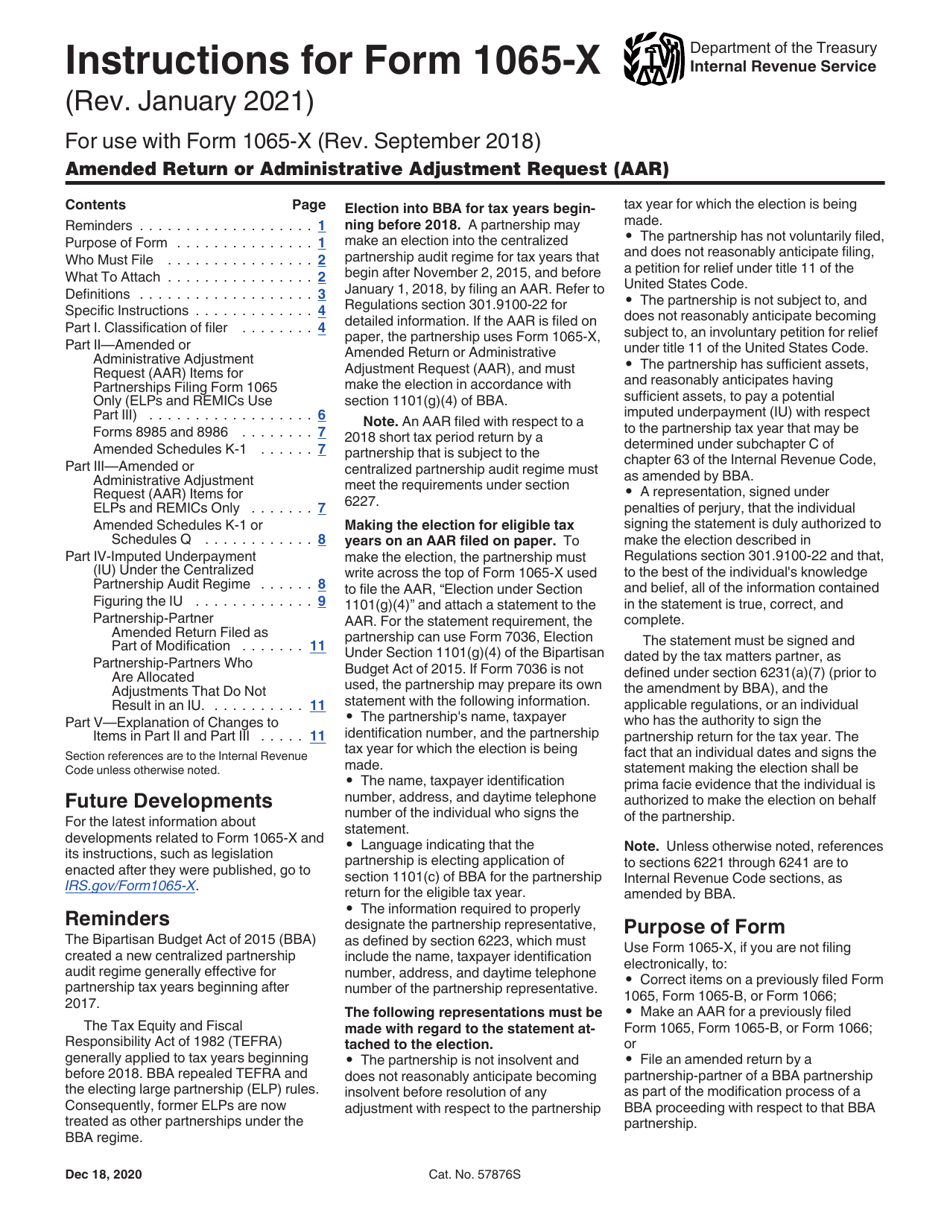

Instructions for IRS Form 1065-X

for the current year.

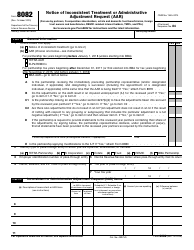

Instructions for IRS Form 1065-X Amended Return or Administrative Adjustment Request (AAR)

This document contains official instructions for IRS Form 1065-X , Amended Return or Administrative Adjustment Request (Aar) - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1065-X is available for download through this link.

FAQ

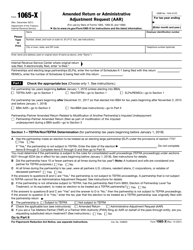

Q: What is IRS Form 1065-X?

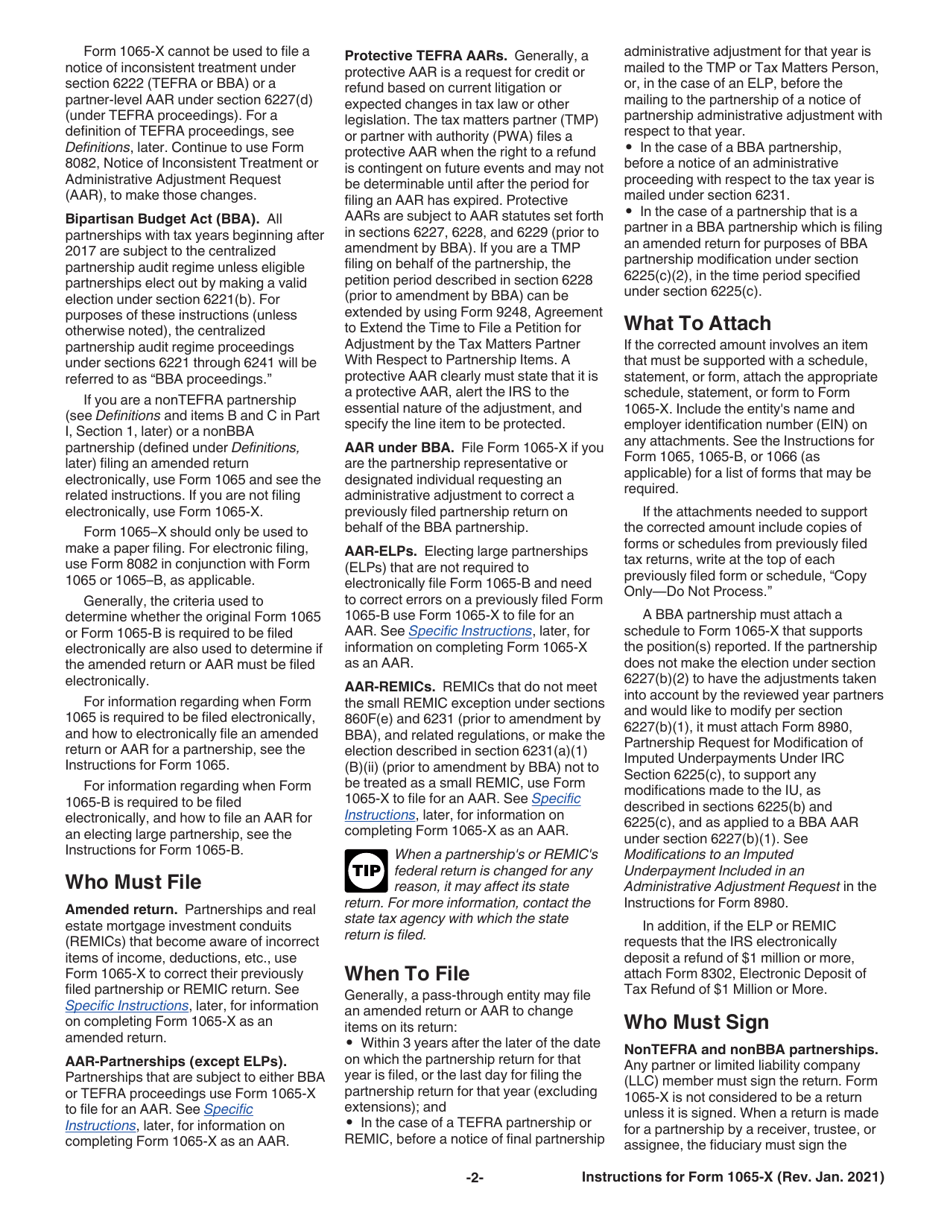

A: IRS Form 1065-X is used for filing an amended return or administrative adjustment request forpartnership income tax returns.

Q: When should I use Form 1065-X?

A: You should use Form 1065-X if you need to make changes or corrections to a previously filed Form 1065.

Q: How do I file Form 1065-X?

A: You can file Form 1065-X by mail to the address provided in the form instructions or electronically through the IRS e-file system.

Q: What information is required on Form 1065-X?

A: Form 1065-X requires you to provide information such as the tax year being amended, the reason for filing the amended return, and a detailed explanation of the changes being made.

Q: What is the deadline for filing Form 1065-X?

A: The deadline for filing Form 1065-X is generally within three years of the original due date of the partnership return or within two years of the date the tax was paid, whichever is later.

Instruction Details:

- This 11-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.