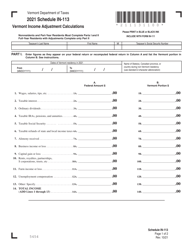

This version of the form is not currently in use and is provided for reference only. Download this version of

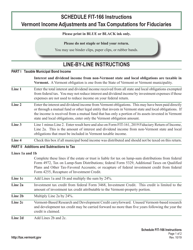

Instructions for Schedule FIT-166

for the current year.

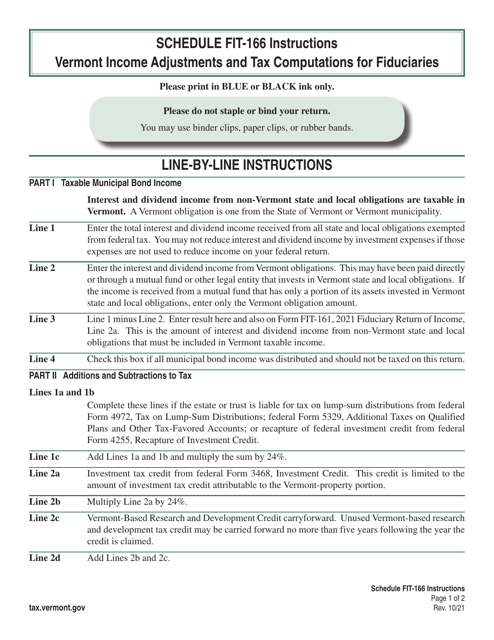

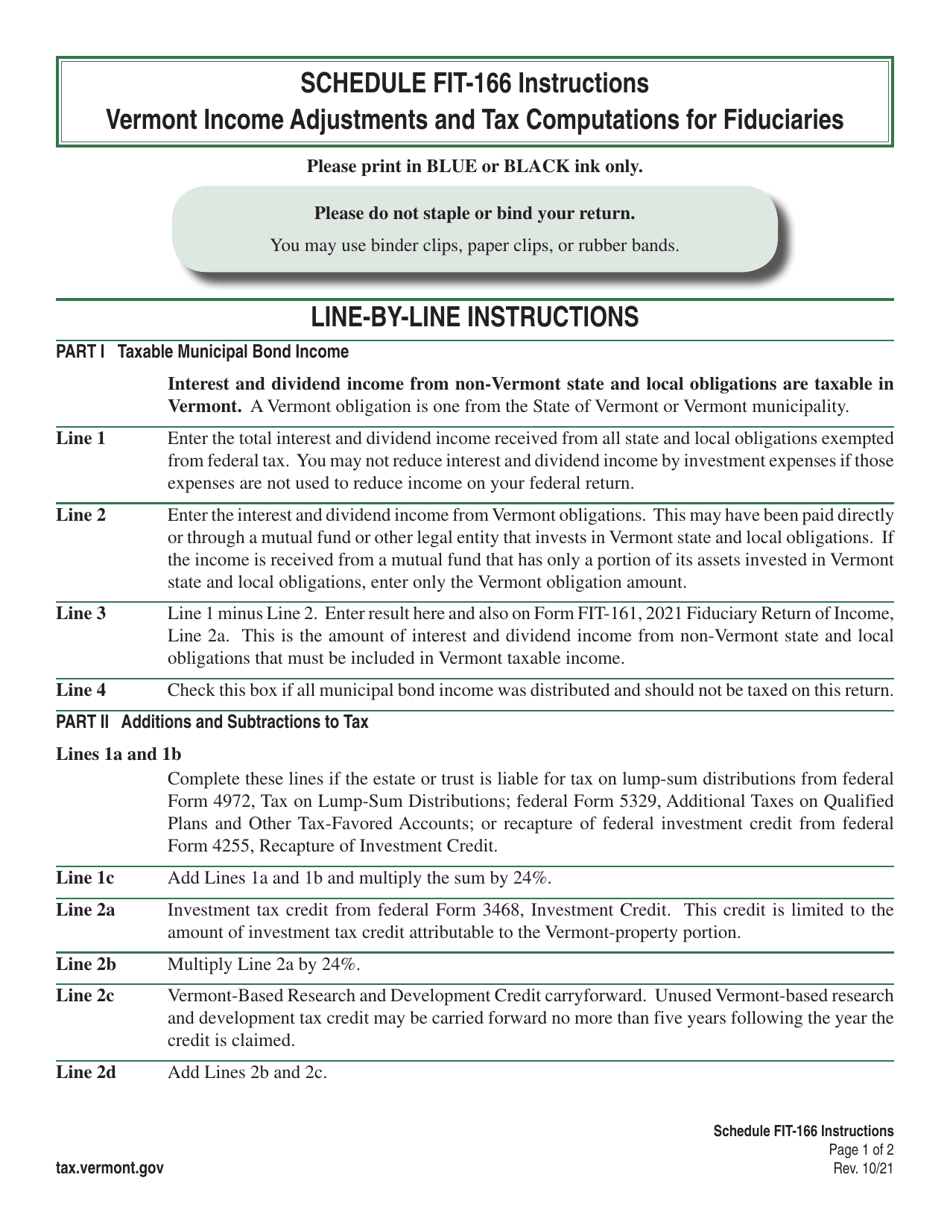

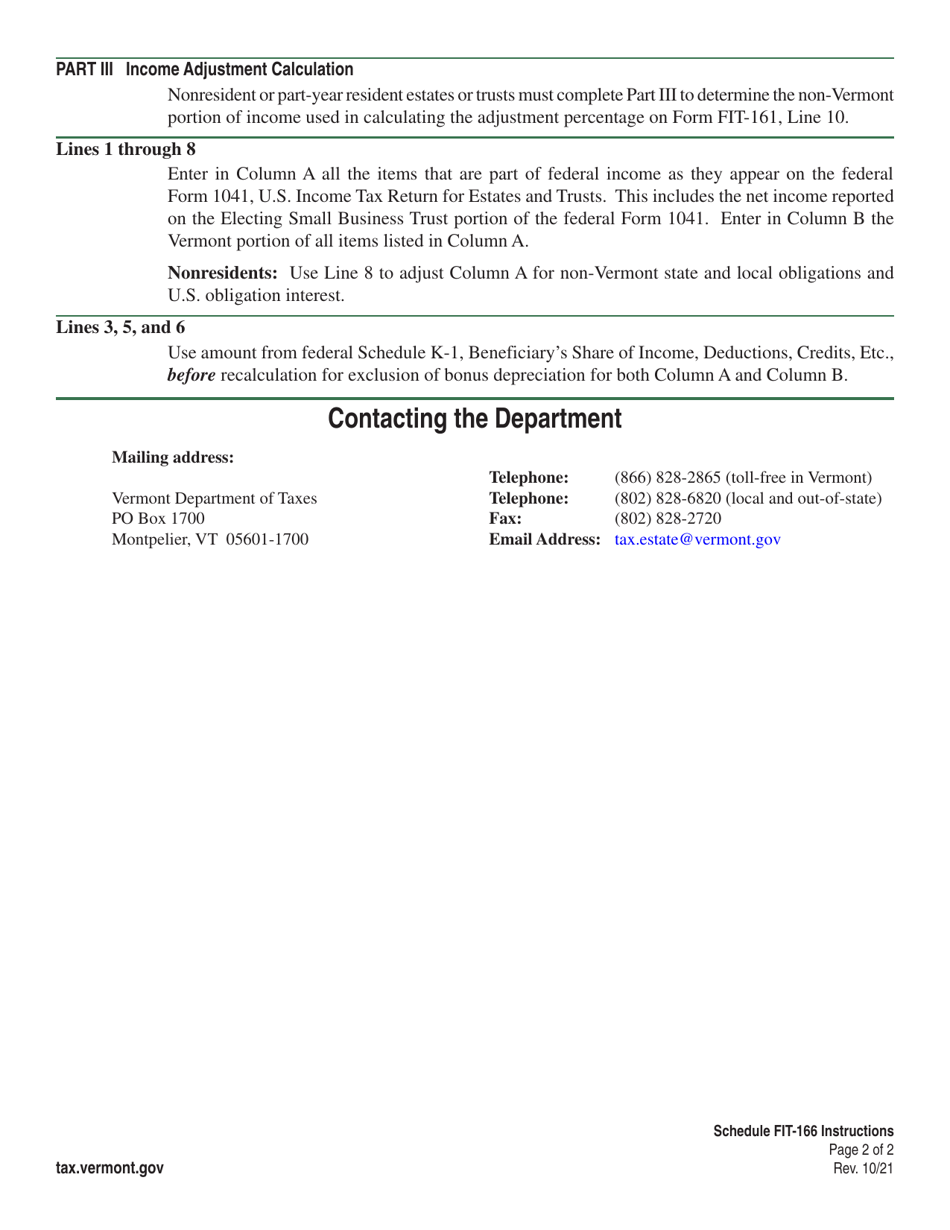

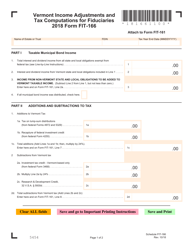

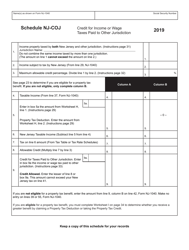

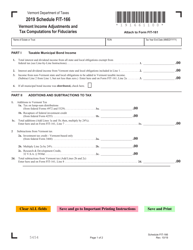

Instructions for Schedule FIT-166 Vermont Income Adjustments and Tax Computations for Fiduciaries - Vermont

This document contains official instructions for Schedule FIT-166 , Vermont Tax Computations for Fiduciaries - a form released and collected by the Vermont Department of Taxes.

FAQ

Q: What is Schedule FIT-166?

A: Schedule FIT-166 is a form used by fiduciaries in Vermont to report income adjustments and calculate taxes.

Q: Who needs to file Schedule FIT-166?

A: Fiduciaries in Vermont need to file Schedule FIT-166 if they have income adjustments or need to calculate taxes.

Q: What are income adjustments?

A: Income adjustments refer to any deductions or additions to the fiduciary's income that need to be accounted for.

Q: How do I calculate taxes using Schedule FIT-166?

A: Schedule FIT-166 provides the necessary formulas and tables to calculate taxes based on the fiduciary's income and adjustments.

Q: Are there any specific instructions for completing Schedule FIT-166?

A: Yes, there are detailed instructions provided with the form that guide fiduciaries on how to fill it out properly.

Q: Is there a deadline for filing Schedule FIT-166?

A: Yes, the deadline for filing Schedule FIT-166 in Vermont is typically the same as the deadline for filing the fiduciary income tax return, which is usually April 15th.

Q: Can I e-file Schedule FIT-166?

A: Yes, Vermont allows fiduciaries to e-file Schedule FIT-166.

Q: What if I made a mistake on my Schedule FIT-166?

A: If you made a mistake on your Schedule FIT-166, you can file an amended return to correct any errors.

Q: Do I need to include any supporting documentation with Schedule FIT-166?

A: Yes, you may need to attach certain supporting documentation, such as schedules and forms, depending on your specific situation.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Vermont Department of Taxes.