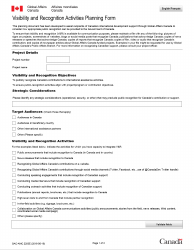

This version of the form is not currently in use and is provided for reference only. Download this version of

Form RC213

for the current year.

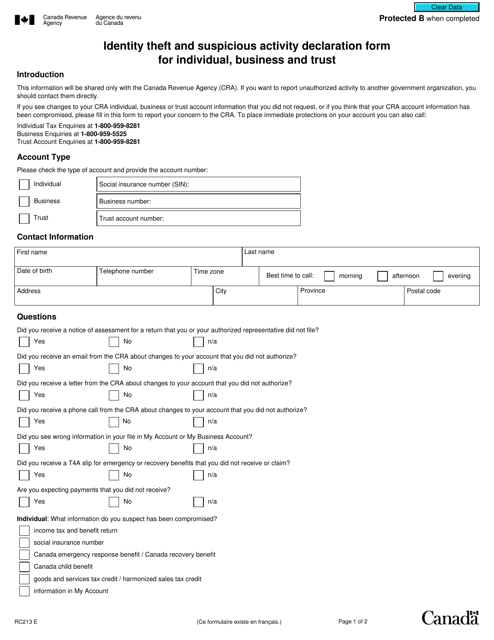

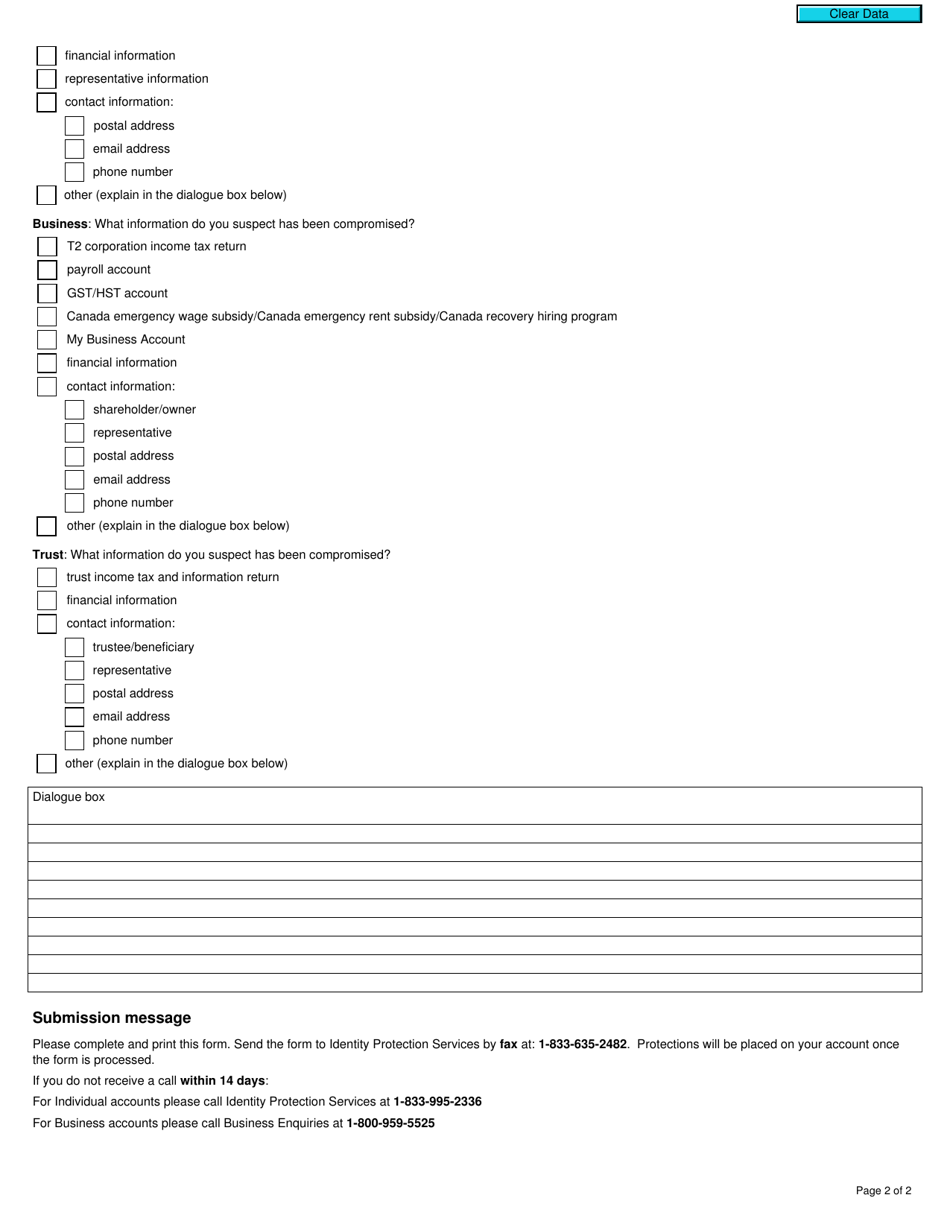

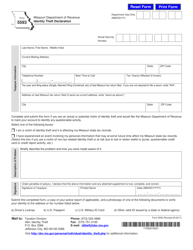

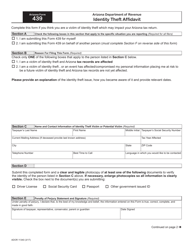

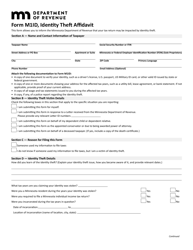

Form RC213 Identity Theft and Suspicious Activity Declaration Form for Individual, Business and Trust - Canada

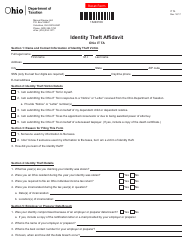

Form RC213 is the Identity Theft and Suspicious Activity Declaration Form for individuals, businesses, and trusts in Canada. This form is used to report any instances of identity theft or suspicious activities related to personal or business tax accounts. It allows individuals, businesses, and trusts to provide detailed information about any unauthorized activities or potential fraud that may have occurred. This form helps the Canada Revenue Agency (CRA) investigate and prevent identity theft and fraudulent activities.

In Canada, the Form RC213 Identity Theft and Suspicious Activity Declaration form can be filed by individuals, businesses, and trusts who have experienced identity theft or suspect any suspicious activity related to their personal or financial information. This form is filed with the Canada Revenue Agency (CRA) to report such incidents and protect against potential fraud.

FAQ

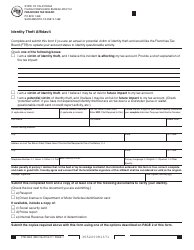

Q: What is Form RC213?

A: Form RC213 is the Identity Theft and Suspicious Activity Declaration Form in Canada.

Q: Who needs to complete Form RC213?

A: Individuals, businesses, and trusts may need to complete Form RC213 if they suspect identity theft or suspicious activity.

Q: When should Form RC213 be completed?

A: Form RC213 should be completed as soon as an individual, business, or trust becomes aware of identity theft or suspicious activity.

Q: Is Form RC213 mandatory?

A: While completing Form RC213 is not mandatory, it is strongly recommended to report identity theft or suspicious activity to the CRA.

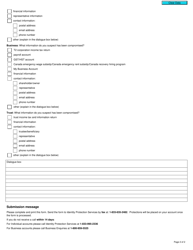

Q: What information is required on Form RC213?

A: Form RC213 requires information about the individual, business, or trust reporting the identity theft or suspicious activity, as well as details about the incident.

Q: How should Form RC213 be submitted?

A: Form RC213 can be submitted to the CRA by mail or by fax. Contact the CRA for specific submission instructions.

Q: What happens after submitting Form RC213?

A: Once Form RC213 is received, the CRA will review the information provided and take appropriate action to investigate the reported identity theft or suspicious activity.

Q: Can I get assistance in completing Form RC213?

A: If you require assistance in completing Form RC213, you can contact the CRA directly or seek help from a tax professional or legal advisor.