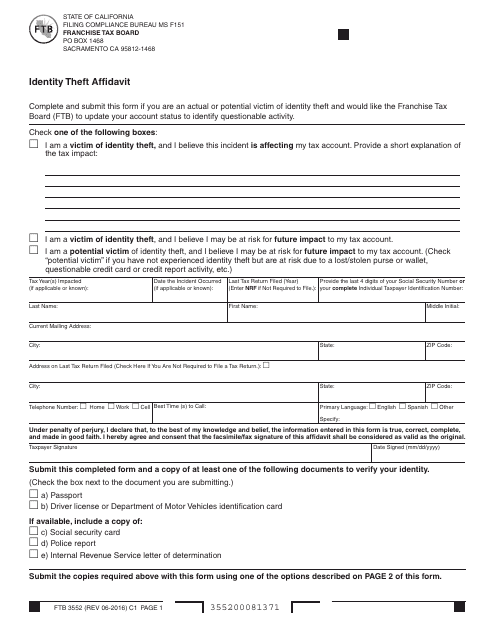

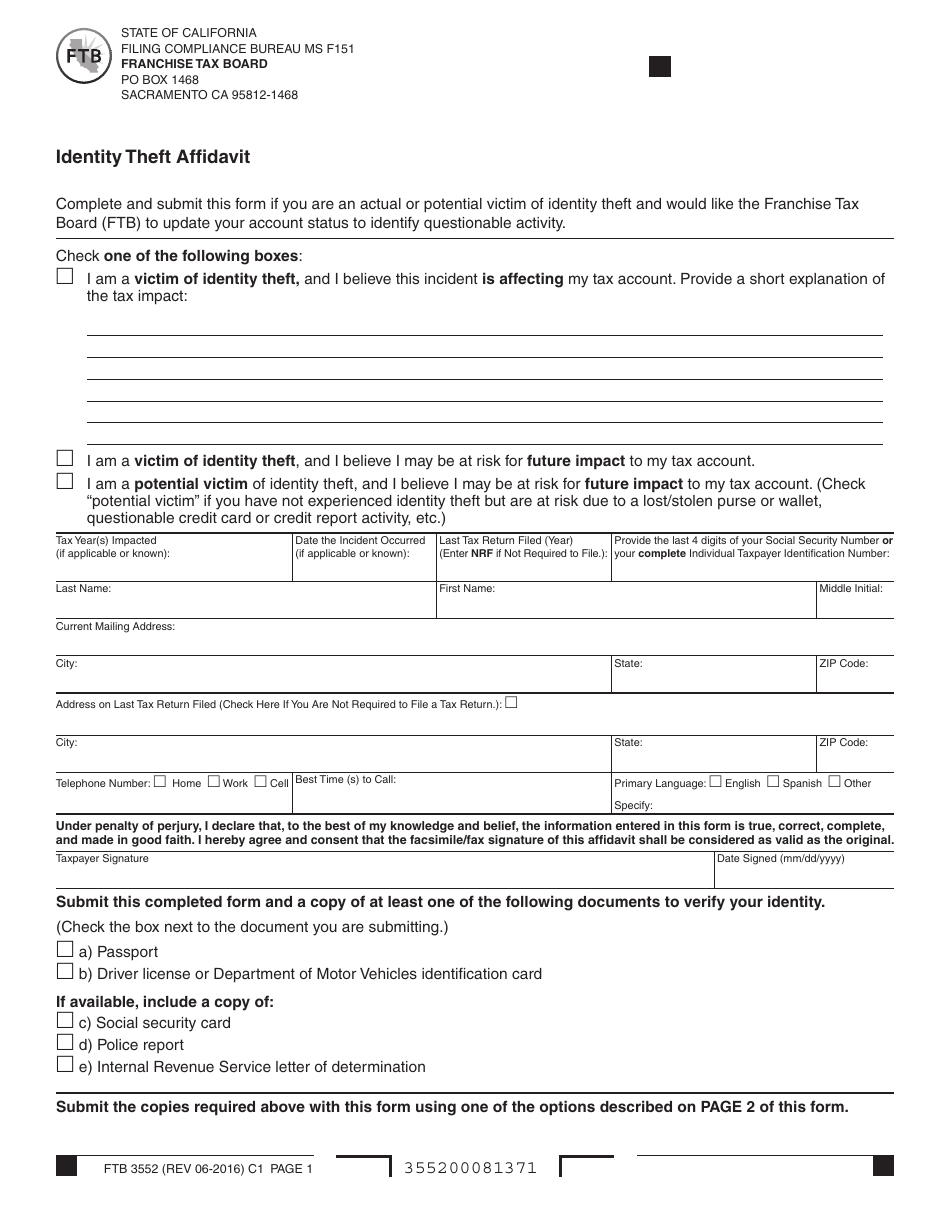

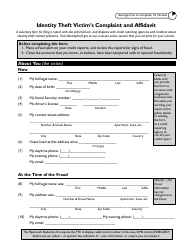

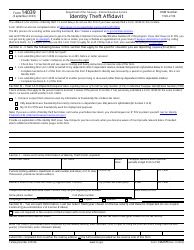

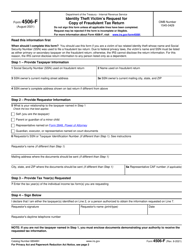

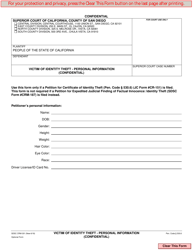

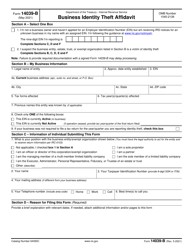

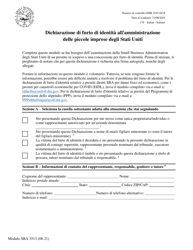

Form FTB3552 Identity Theft Affidavit - California

What Is Form FTB3552?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form FTB3552?

A: Form FTB3552 is the Identity Theft Affidavit used in California.

Q: What is the purpose of form FTB3552?

A: The purpose of form FTB3552 is to report identity theft to the California Franchise Tax Board.

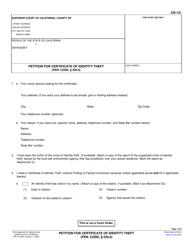

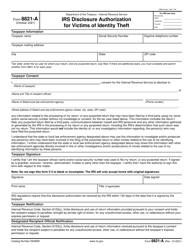

Q: What information is required on form FTB3552?

A: Form FTB3552 requires personal information, details about the identity theft incident, and supporting documentation.

Q: Is form FTB3552 only for California residents?

A: Yes, form FTB3552 is specifically for California residents.

Q: Can form FTB3552 be filed electronically?

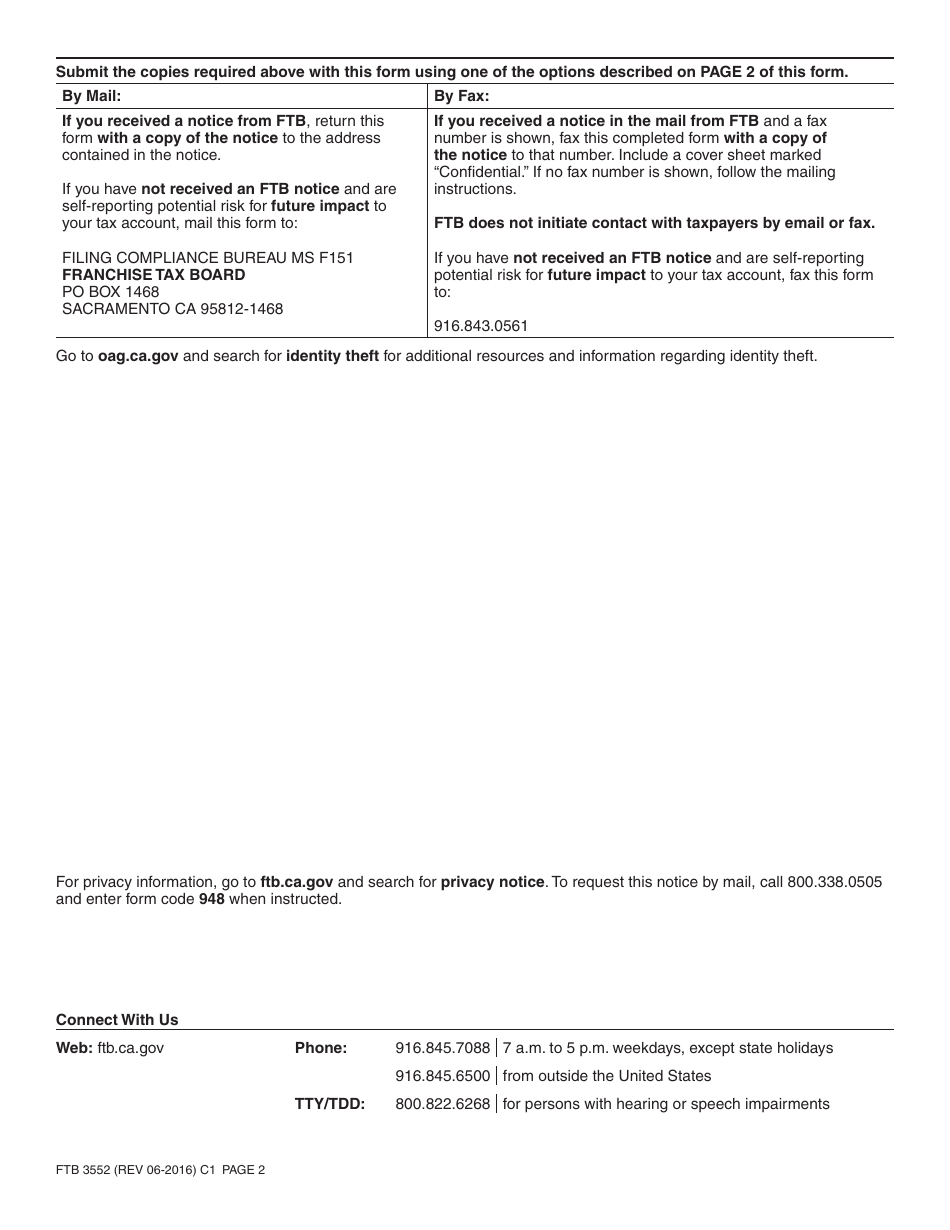

A: No, form FTB3552 must be mailed to the California Franchise Tax Board.

Q: What should I do if I suspect identity theft?

A: If you suspect identity theft, you should file a police report, contact the credit bureaus, and complete form FTB3552.

Q: Are there any fees associated with filing form FTB3552?

A: No, there are no fees associated with filing form FTB3552.

Q: Can I include multiple incidents of identity theft on one form FTB3552?

A: Yes, you can include multiple incidents of identity theft on one form FTB3552.

Q: What happens after I submit form FTB3552?

A: After you submit form FTB3552, the California Franchise Tax Board will review your information and take appropriate action.

Form Details:

- Released on June 1, 2016;

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FTB3552 by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.