This version of the form is not currently in use and is provided for reference only. Download this version of

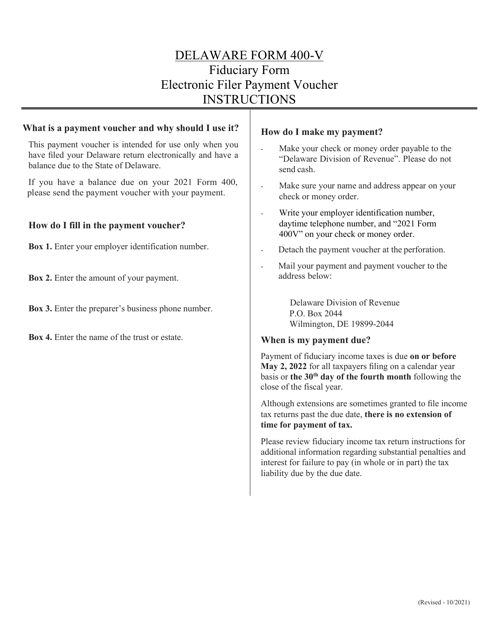

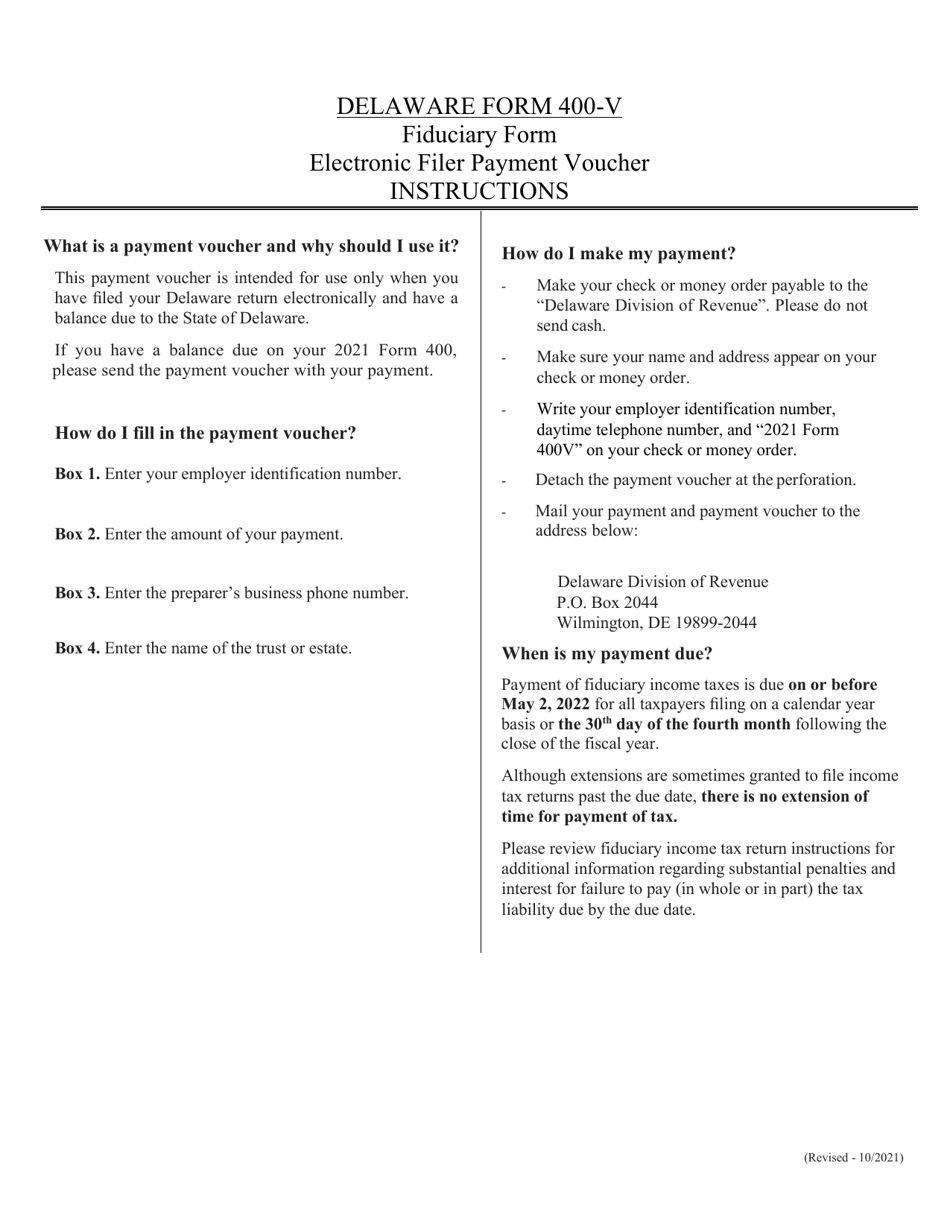

Instructions for Form 400-V

for the current year.

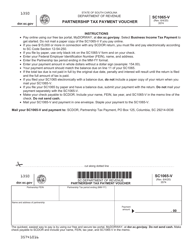

Instructions for Form 400-V Electronic Filer Payment Voucher - Delaware

This document contains official instructions for Form 400-V , Electronic Filer Payment Voucher - a form released and collected by the Delaware Department of Finance - Division of Revenue.

FAQ

Q: What is Form 400-V?

A: Form 400-V is an Electronic Filer Payment Voucher used in Delaware.

Q: Who needs to use Form 400-V?

A: Individuals or businesses who are required to make electronic payments to the State of Delaware.

Q: What is the purpose of Form 400-V?

A: Form 400-V is used to accompany electronic payments made to the State of Delaware.

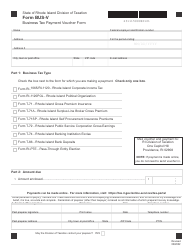

Q: What information is required on Form 400-V?

A: Form 400-V requires the taxpayer's name, social security number or business identification number, tax period, and payment amount.

Q: Is there a deadline for filing Form 400-V?

A: Yes, Form 400-V must be filed by the due date of the tax payment it accompanies.

Q: Can I pay my Delaware taxes by check?

A: No, electronic payment is the only method accepted for most taxes in Delaware.

Q: What if I can't pay the full amount owed?

A: If you are unable to pay the full amount owed, you should still file Form 400-V and pay as much as you can. Contact the Delaware Division of Revenue to discuss payment options.

Q: Are there any penalties for late payment?

A: Yes, late payment may result in penalties and interest being assessed on the unpaid balance.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Delaware Department of Finance - Division of Revenue.