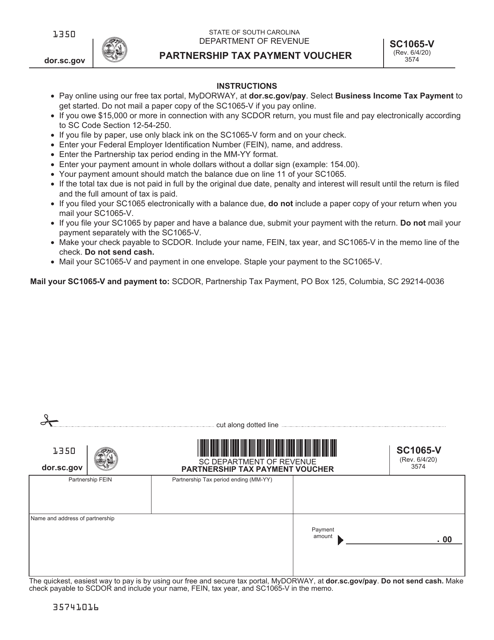

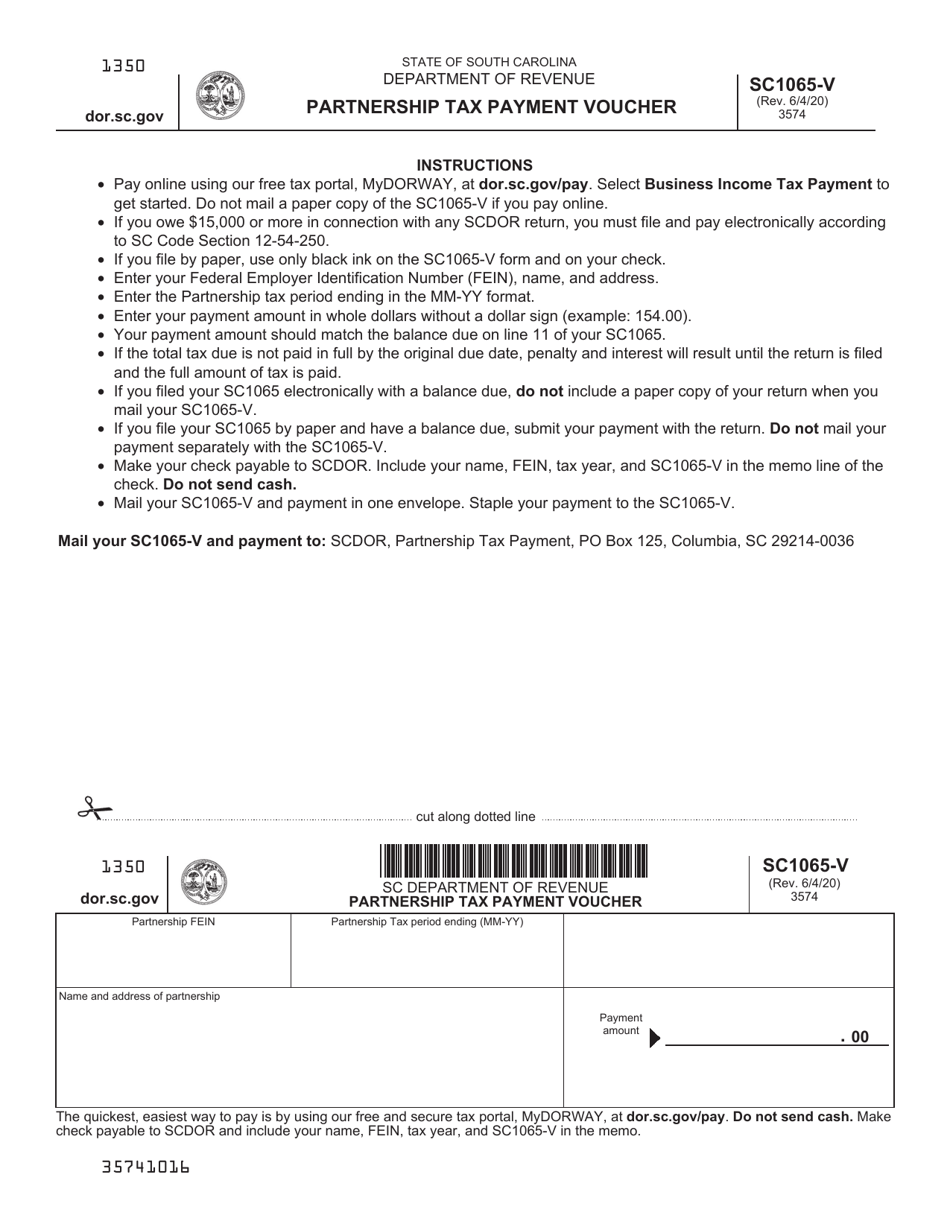

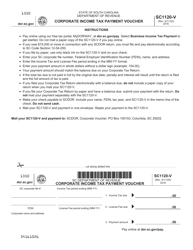

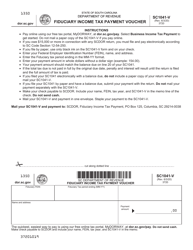

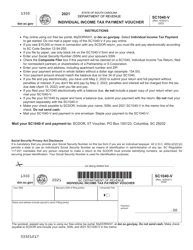

Form SC1065-V Partnership Tax Payment Voucher - South Carolina

What Is Form SC1065-V?

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SC1065-V?

A: Form SC1065-V is the Partnership Tax Payment Voucher for South Carolina.

Q: Who needs to file Form SC1065-V?

A: Partnerships in South Carolina need to file Form SC1065-V.

Q: What is the purpose of Form SC1065-V?

A: Form SC1065-V is used to make tax payments for partnership income in South Carolina.

Q: When is Form SC1065-V due?

A: Form SC1065-V is generally due on the same day as the partnership tax return in South Carolina.

Q: Are there any penalties for not filing Form SC1065-V?

A: Failure to file Form SC1065-V may result in penalties and interest.

Q: Is Form SC1065-V only for partnerships in South Carolina?

A: Yes, Form SC1065-V is specifically for partnerships operating in South Carolina.

Form Details:

- Released on June 4, 2020;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form SC1065-V by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.