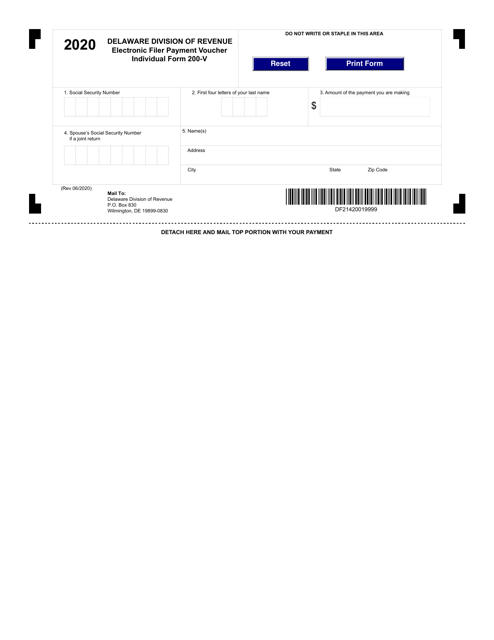

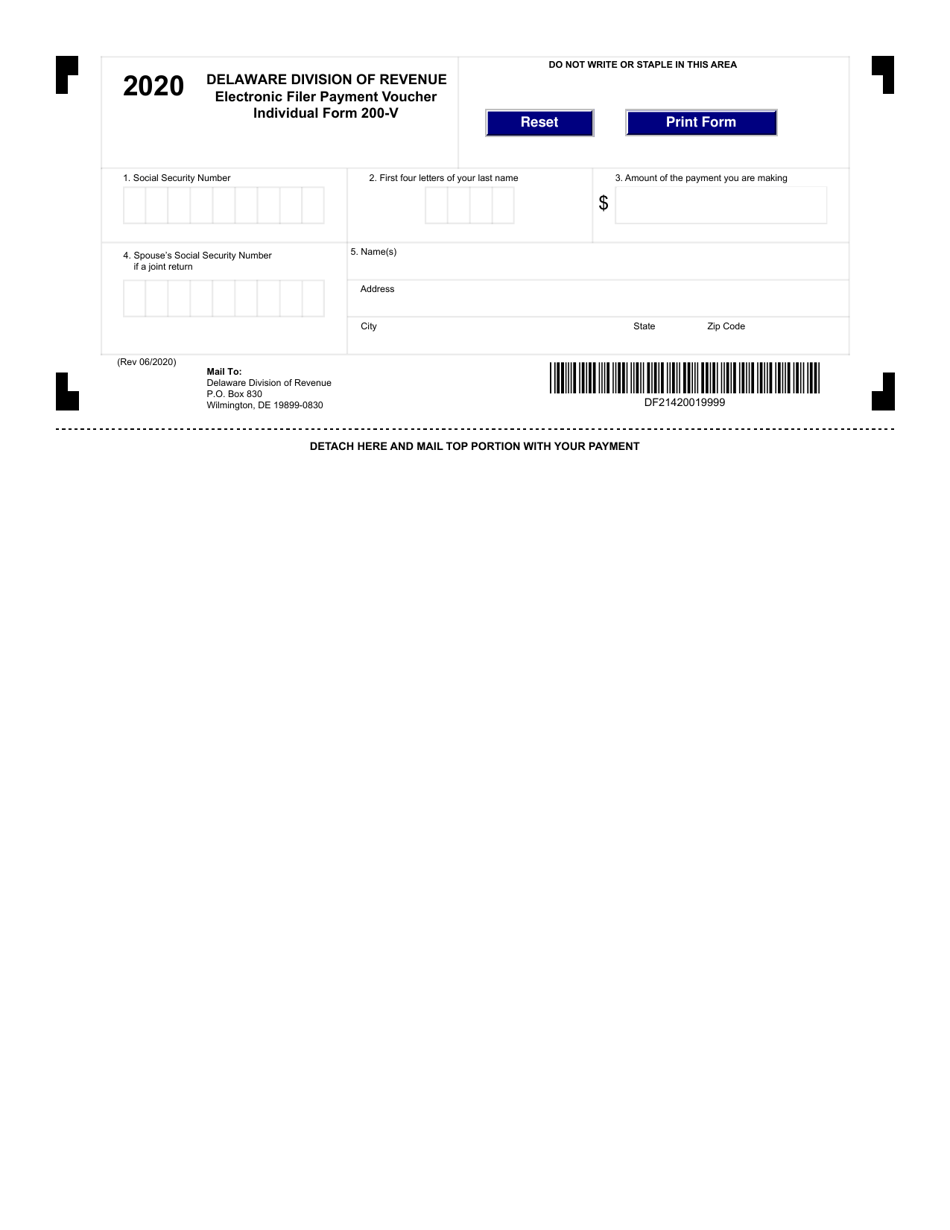

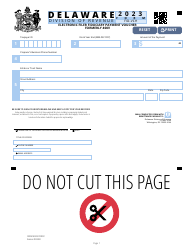

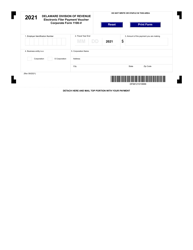

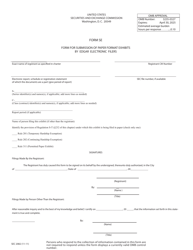

Form 200-V Electronic Filer Payment Voucher - Delaware

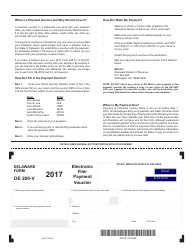

What Is Form 200-V?

This is a legal form that was released by the Delaware Department of Finance - Division of Revenue - a government authority operating within Delaware. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 200-V?

A: Form 200-V is an Electronic Filer Payment Voucher used in Delaware.

Q: How do I use Form 200-V?

A: Form 200-V is used to make a payment for electronically filed returns.

Q: What is the purpose of Form 200-V?

A: The purpose of Form 200-V is to ensure proper payment is made for electronically filed returns in Delaware.

Q: Is Form 200-V required for all taxpayers in Delaware?

A: Form 200-V is only required for taxpayers who file their returns electronically.

Q: What information is needed on Form 200-V?

A: Form 200-V requires you to provide your name, address, phone number, payment amount, and the tax period being paid.

Form Details:

- Released on June 1, 2020;

- The latest edition provided by the Delaware Department of Finance - Division of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 200-V by clicking the link below or browse more documents and templates provided by the Delaware Department of Finance - Division of Revenue.