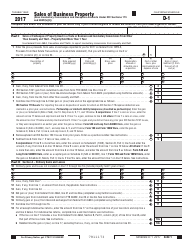

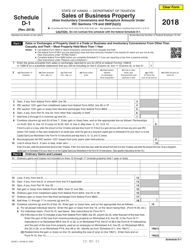

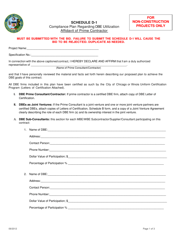

This version of the form is not currently in use and is provided for reference only. Download this version of

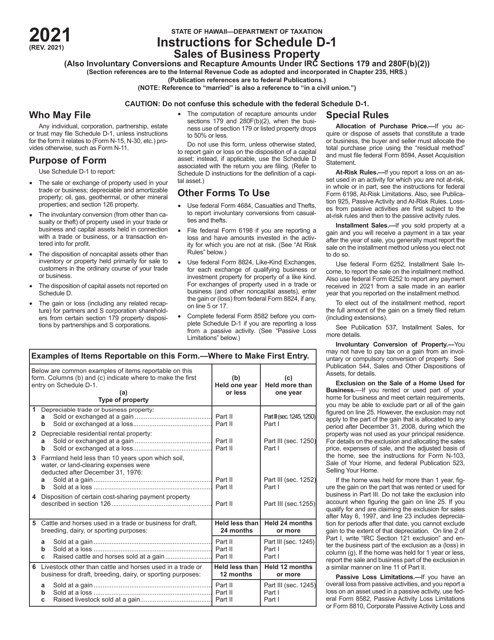

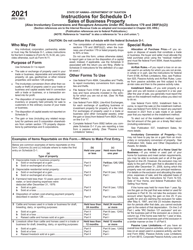

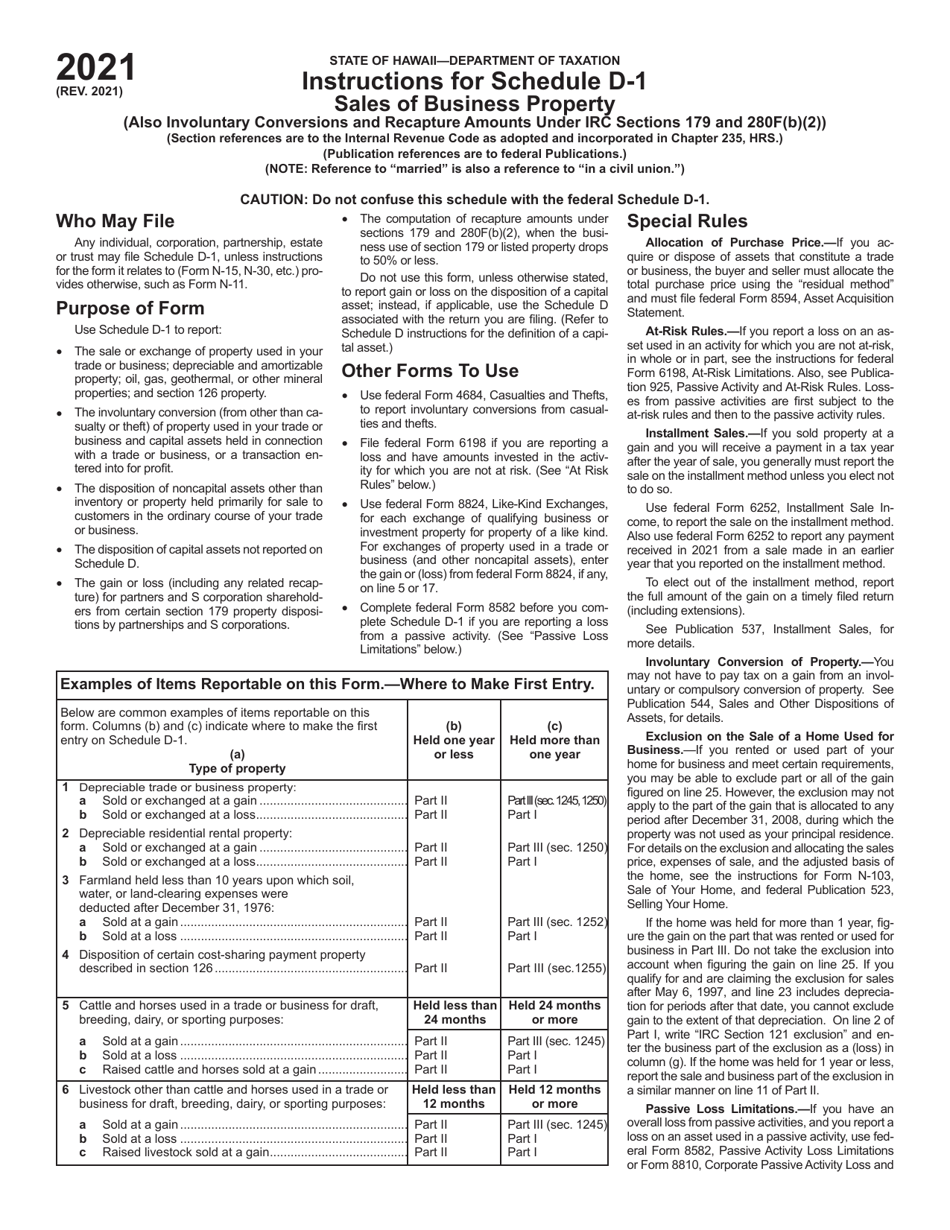

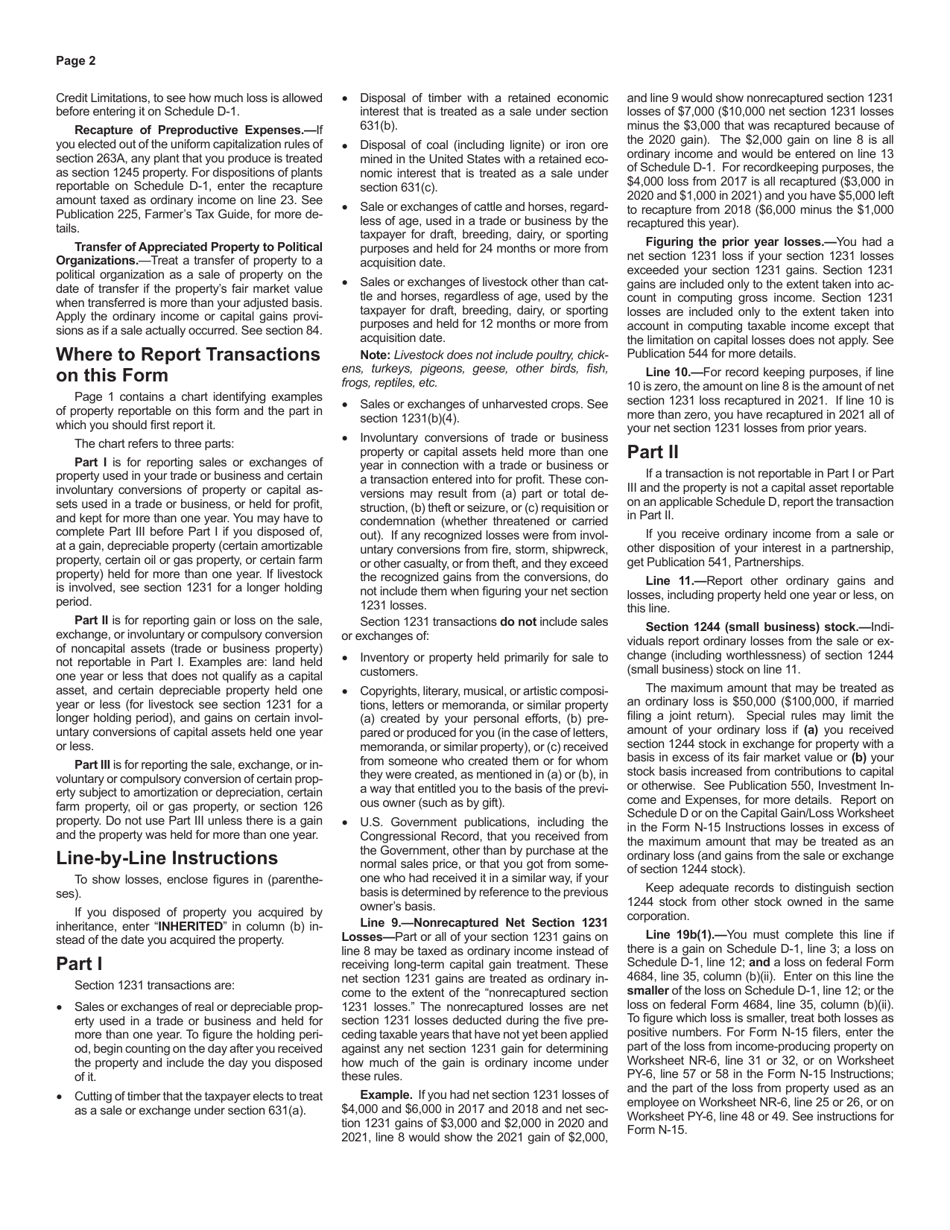

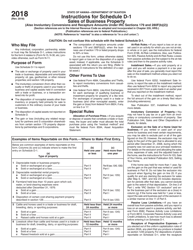

Instructions for Schedule D-1

for the current year.

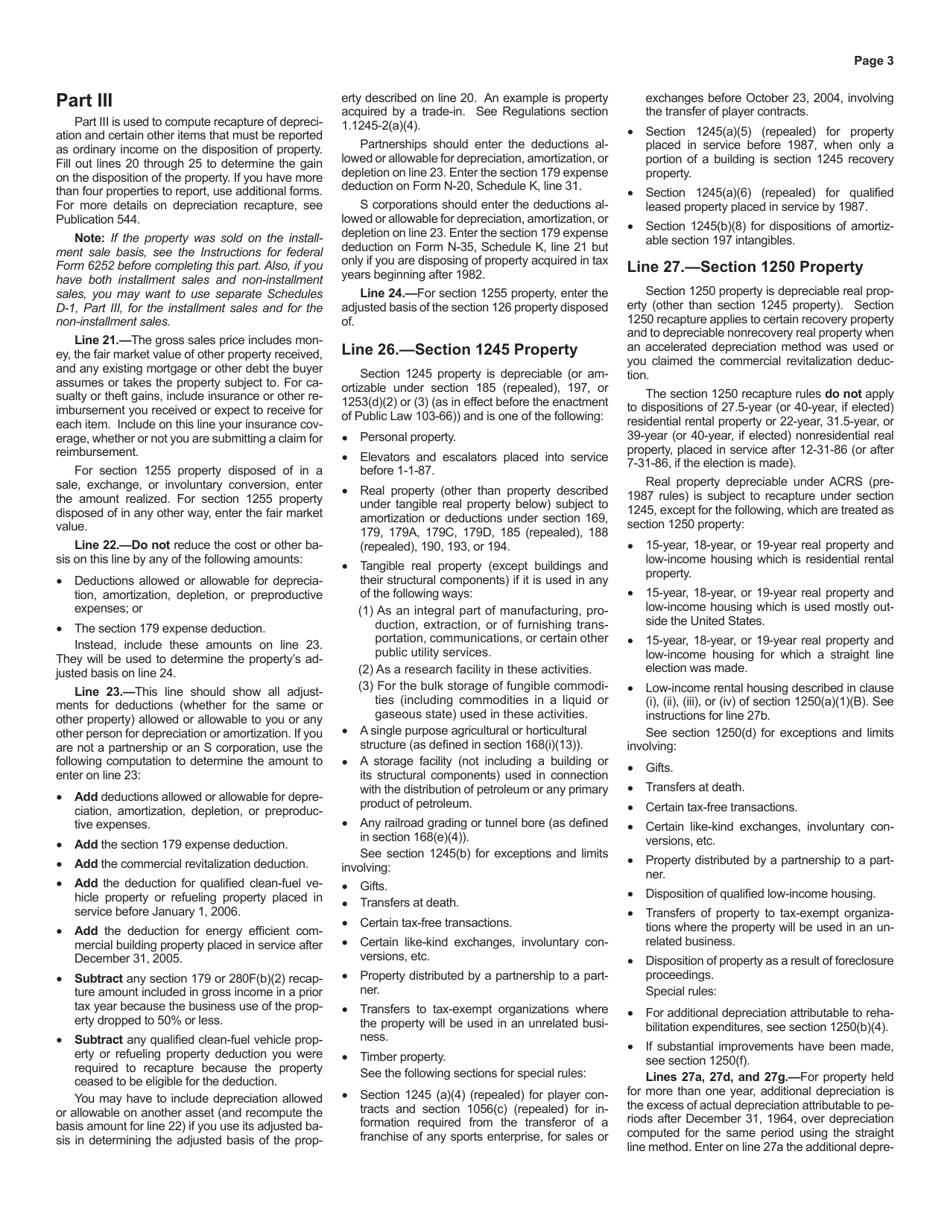

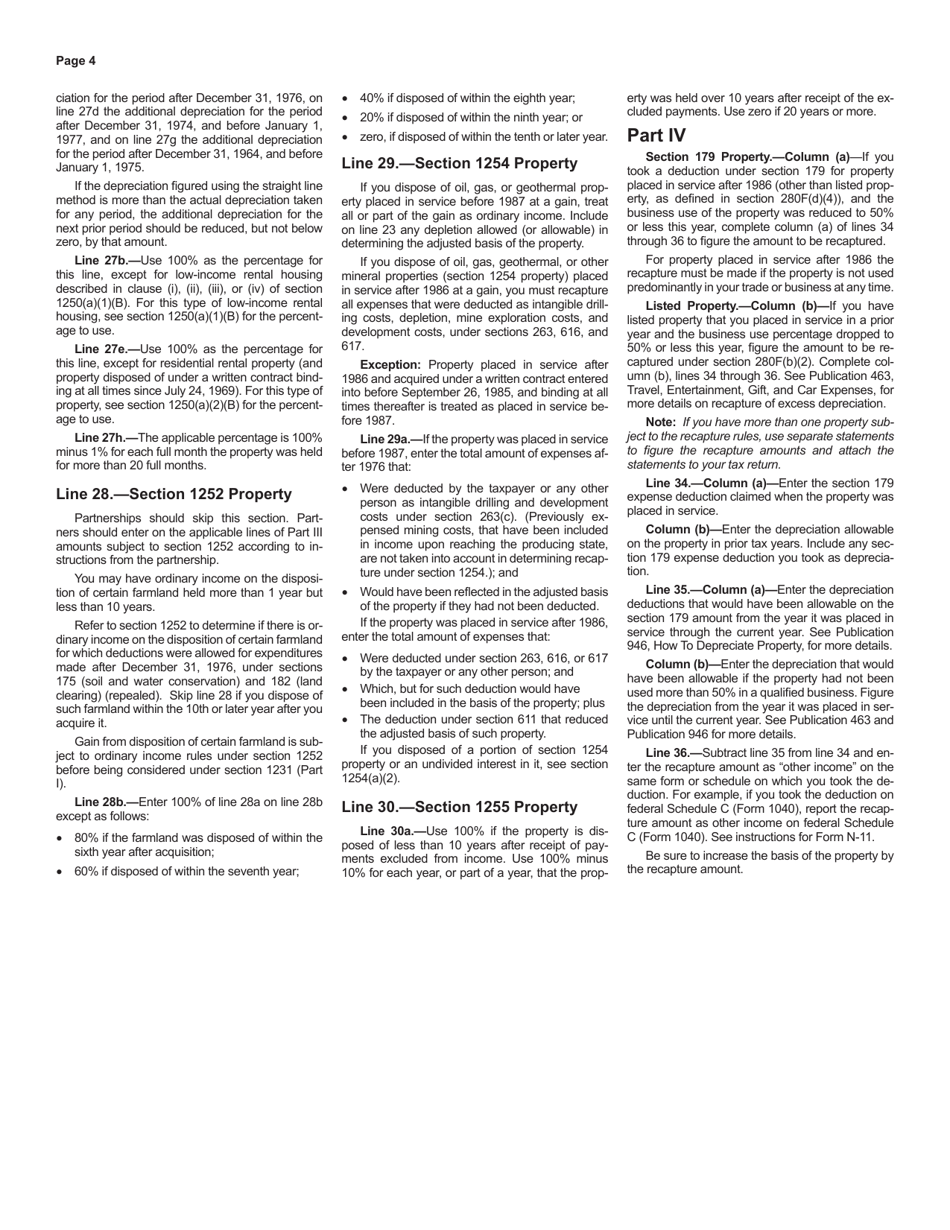

Instructions for Schedule D-1 Sales of Business Property - Hawaii

This document contains official instructions for Schedule D-1 , Sales of Business Property - a form released and collected by the Hawaii Department of Taxation.

FAQ

Q: What is Schedule D-1?

A: Schedule D-1 is a tax form used to report sales of business property in Hawaii.

Q: When do I need to file Schedule D-1?

A: You need to file Schedule D-1 if you have sold any business property in Hawaii during the tax year.

Q: What information is required on Schedule D-1?

A: You will need to provide details about the sold property, the sales price, and any related expenses.

Q: Do I need to file Schedule D-1 if I didn't sell any business property?

A: No, you only need to file Schedule D-1 if you have sold business property in Hawaii.

Q: What is the deadline for filing Schedule D-1?

A: The deadline for filing Schedule D-1 is usually the same as the deadline for filing your Hawaii state tax return.

Q: Are there any penalties for failing to file Schedule D-1?

A: Yes, failing to file Schedule D-1 or filing it late may result in penalties and interest charges.

Q: Can I e-file Schedule D-1?

A: Yes, you can e-file Schedule D-1 if you are filing your Hawaii state tax return electronically.

Q: Can I amend Schedule D-1 if I made a mistake?

A: Yes, if you made a mistake on your original Schedule D-1, you can file an amended version.

Q: Is Schedule D-1 required for personal property sales?

A: No, Schedule D-1 is specifically for reporting sales of business property in Hawaii.

Q: Can I deduct any losses from property sales on Schedule D-1?

A: Yes, you may be able to deduct losses from property sales on Schedule D-1.

Q: I sold property in multiple states, do I need multiple Schedule D-1 forms?

A: No, you only need to file one Schedule D-1 for all sales of business property in Hawaii, regardless of other states.

Q: Can I get an extension to file Schedule D-1?

A: Yes, you can request an extension to file Schedule D-1, but make sure to pay any estimated tax due by the original deadline.

Q: What should I do if I need help with Schedule D-1?

A: If you need help with Schedule D-1, you should contact the Hawaii Department of Taxation or consult a tax professional.

Instruction Details:

- This 4-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Hawaii Department of Taxation.