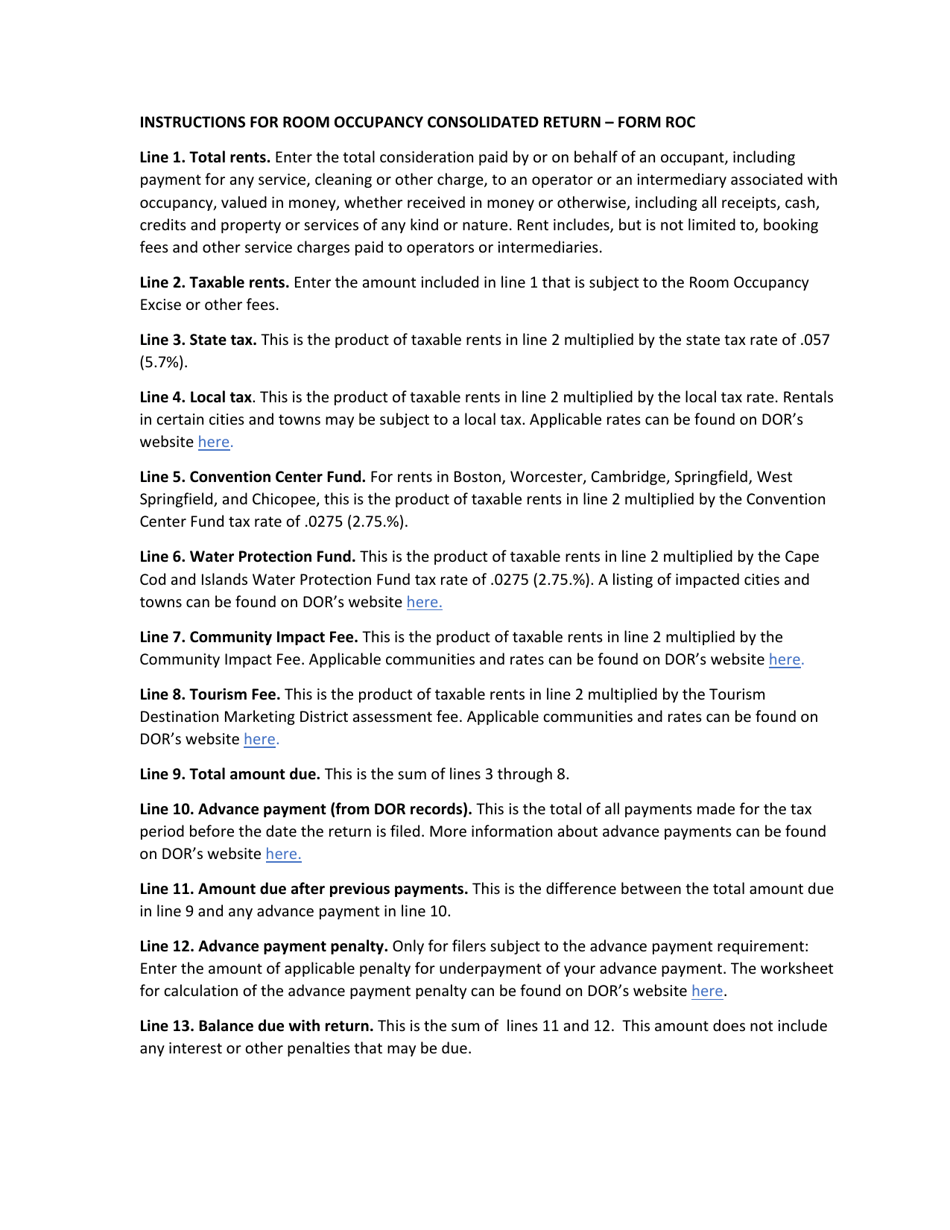

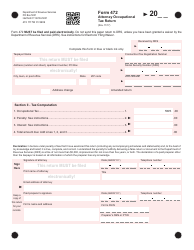

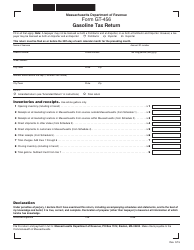

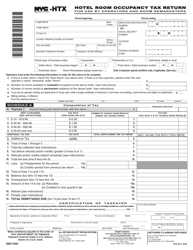

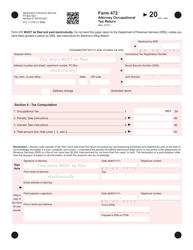

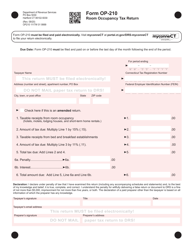

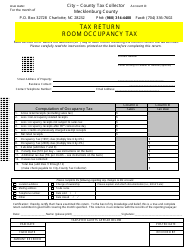

Instructions for Form ROC Room Occupancy Tax Return - Massachusetts

This document contains official instructions for Form ROC , Room Occupancy Tax Return - a form released and collected by the Massachusetts Department of Revenue.

FAQ

Q: What is Form ROC?

A: Form ROC is the Room Occupancy Tax Return.

Q: Who needs to file Form ROC?

A: Anyone who rents out rooms or lodging facilities in Massachusetts needs to file Form ROC.

Q: What is the purpose of Form ROC?

A: The purpose of Form ROC is to report and remit the room occupancy tax collected from guests.

Q: When is Form ROC due?

A: Form ROC is due on a quarterly basis, with the due dates falling on the last day of the calendar month following the end of the quarter.

Q: How do I file Form ROC?

A: Form ROC can be filed either electronically or by mail. Electronic filing is recommended for faster processing.

Q: What information do I need to complete Form ROC?

A: To complete Form ROC, you will need information such as the total room revenue, taxable room revenue, and the amount of room occupancy tax collected.

Q: Are there any penalties for late filing of Form ROC?

A: Yes, there are penalties for late filing of Form ROC, including interest charges on the tax amount owed.

Q: Can I claim any exemptions on Form ROC?

A: Yes, certain exemptions may apply, such as exempting rooms rented for less than 90 consecutive days to the same occupant.

Q: Who can I contact for more information about Form ROC?

A: For more information about Form ROC, you can contact the Massachusetts Department of Revenue.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Massachusetts Department of Revenue.