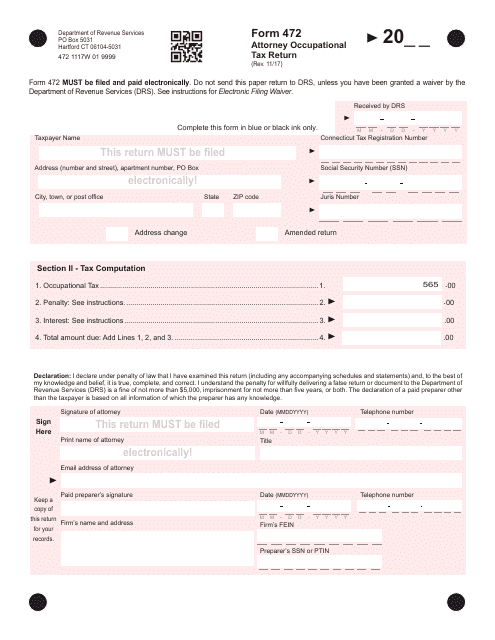

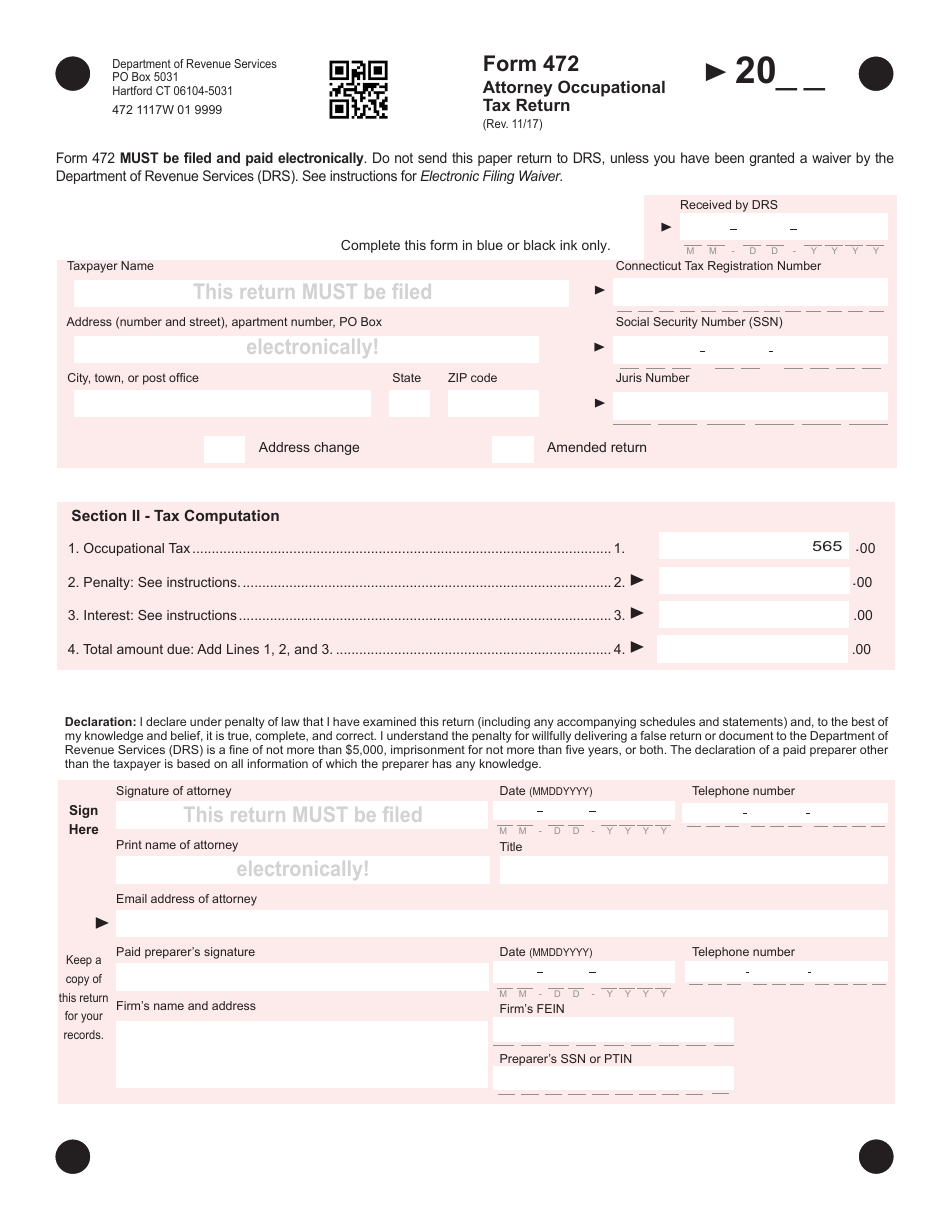

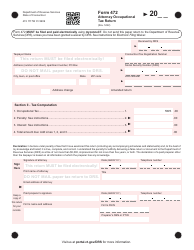

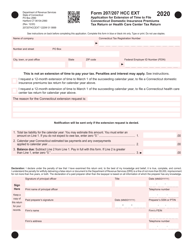

Form 742 Attorney Occupational Tax Return - Connecticut

What Is Form 742?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 742?

A: Form 742 is the Attorney Occupational Tax Return.

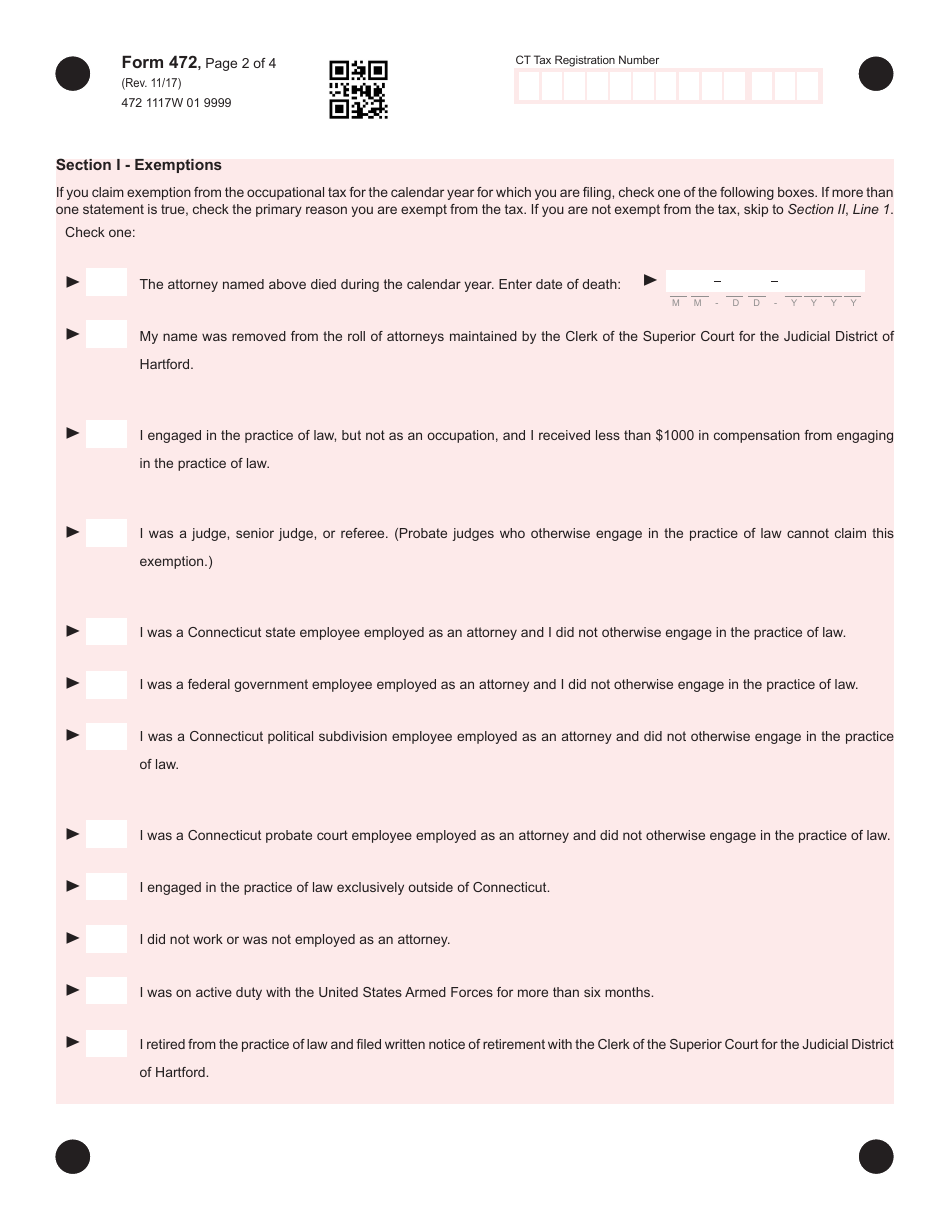

Q: Who needs to file Form 742?

A: Attorneys who practice law in Connecticut need to file Form 742.

Q: What is the purpose of Form 742?

A: The purpose of Form 742 is to report and pay the occupational tax for attorneys in Connecticut.

Q: When is Form 742 due?

A: Form 742 is due on or before June 30th of the tax year.

Q: Is Form 742 also required for attorneys in other states?

A: No, Form 742 is specific to attorneys practicing law in Connecticut.

Q: What happens if I don't file Form 742?

A: If you don't file Form 742 or pay the occupational tax, you may incur penalties and interest.

Form Details:

- Released on November 1, 2017;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 742 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.