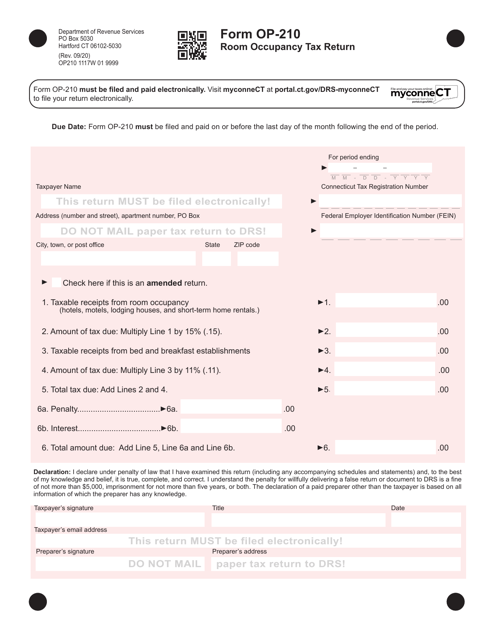

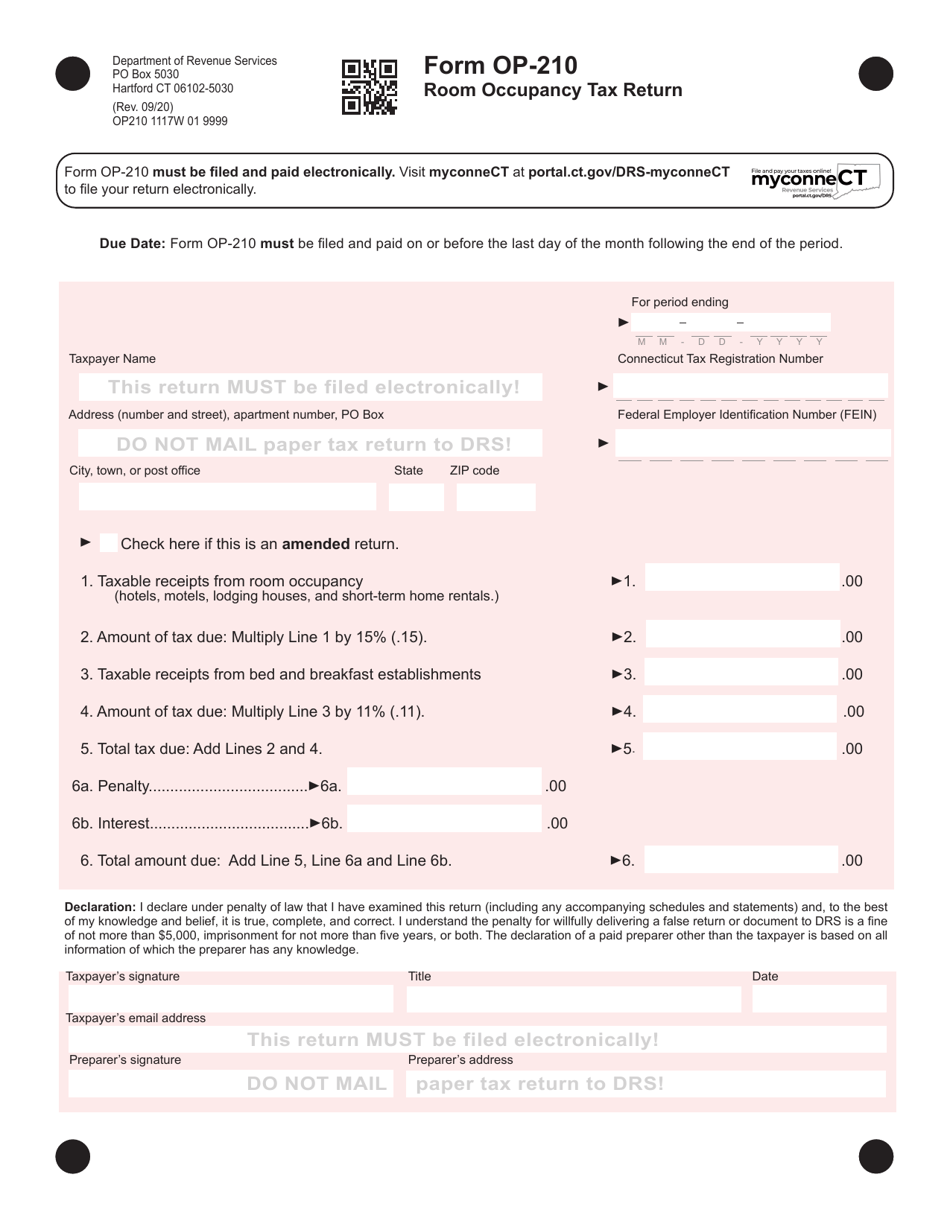

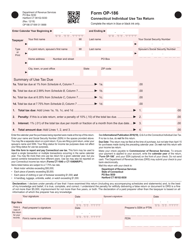

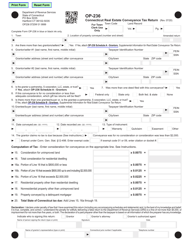

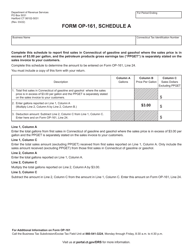

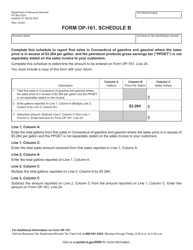

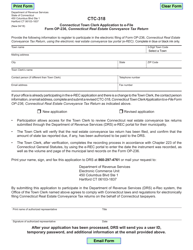

Form OP-210 Room Occupancy Tax Return - Connecticut

What Is Form OP-210?

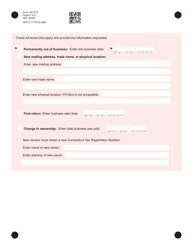

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the purpose of Form OP-210 Room Occupancy Tax Return?

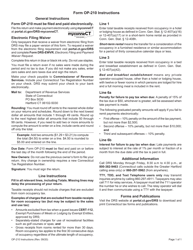

A: The purpose of Form OP-210 Room Occupancy Tax Return is to report and pay room occupancy tax in the state of Connecticut.

Q: Who needs to file Form OP-210 Room Occupancy Tax Return?

A: Any individual, business, or organization that rents out rooms, apartments, or other accommodations in Connecticut is required to file this form.

Q: How often do I need to file Form OP-210 Room Occupancy Tax Return?

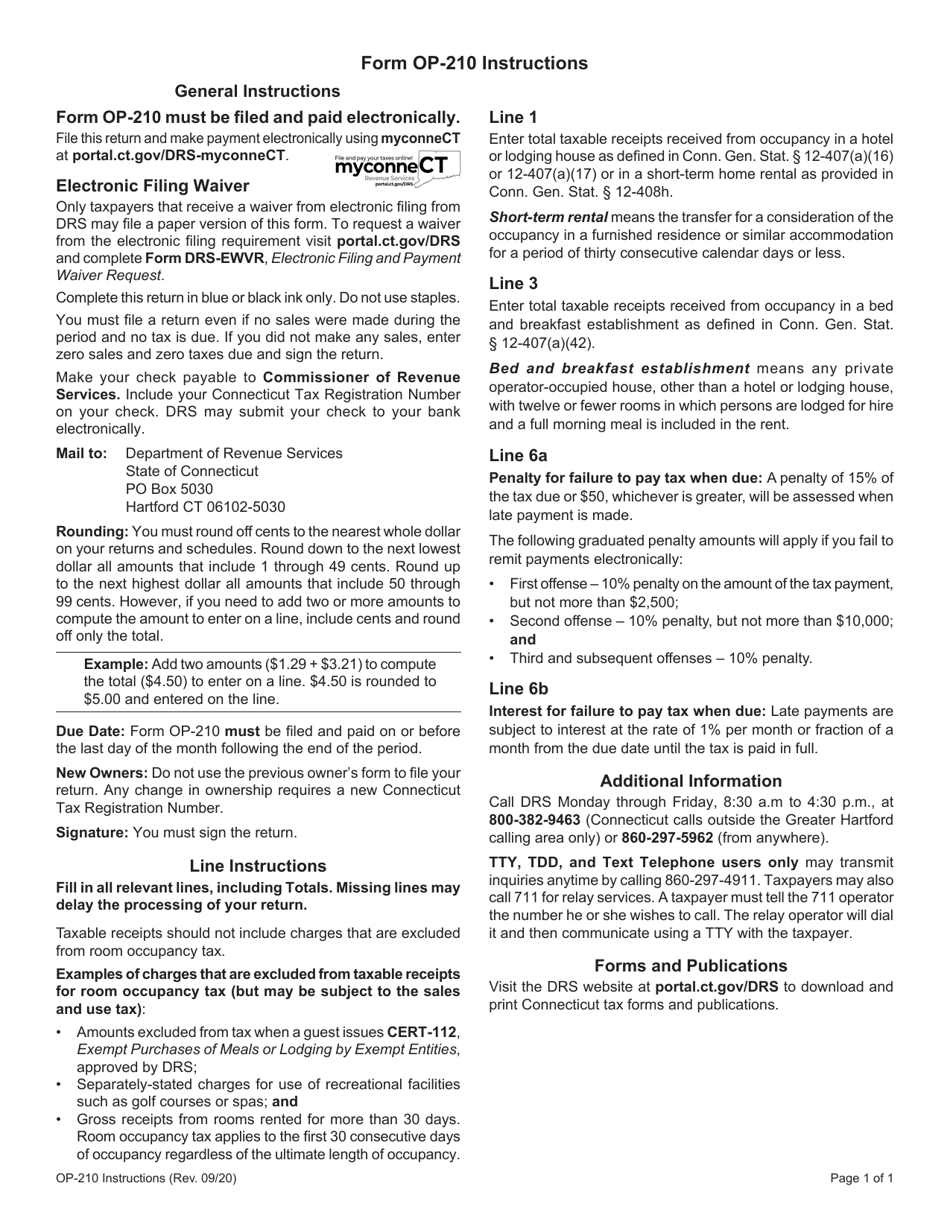

A: Form OP-210 must be filed on a quarterly basis, meaning it is due four times a year.

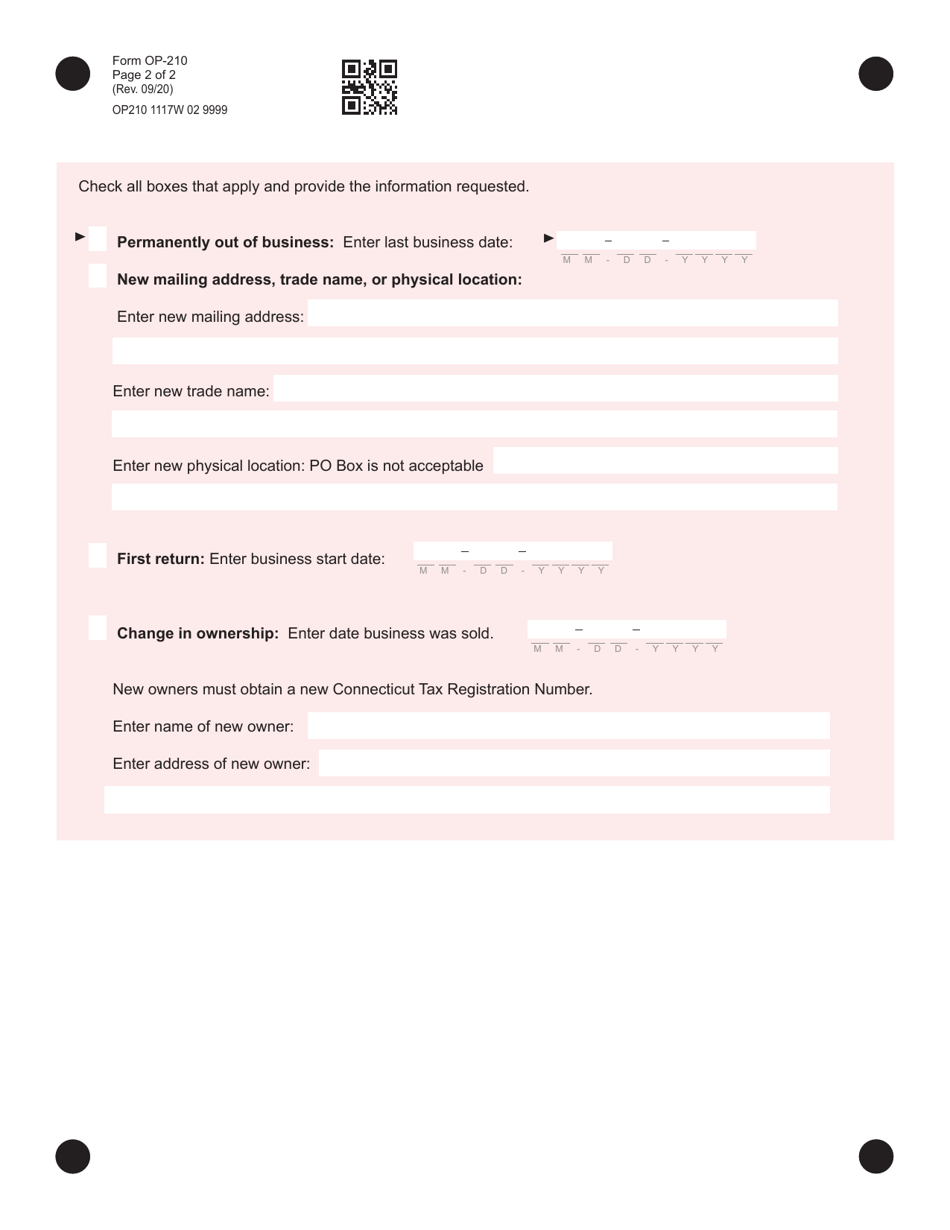

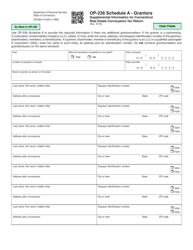

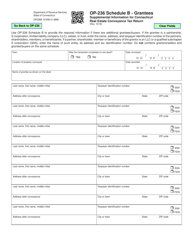

Q: What information do I need to provide on Form OP-210 Room Occupancy Tax Return?

A: You will need to provide details about the number of rental units, the number of nights rented, the rental income received, and any exemptions or deductions you qualify for.

Q: Are there any penalties for not filing Form OP-210 Room Occupancy Tax Return?

A: Yes, failure to file or pay the room occupancy tax on time may result in penalties and interest charges.

Form Details:

- Released on September 1, 2020;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form OP-210 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.