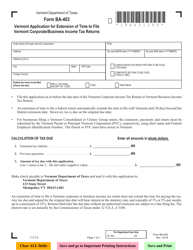

This version of the form is not currently in use and is provided for reference only. Download this version of

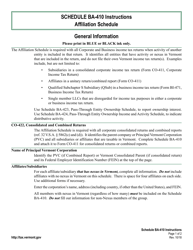

Instructions for Schedule BA-410

for the current year.

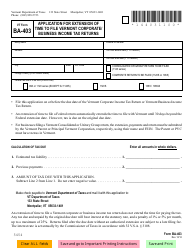

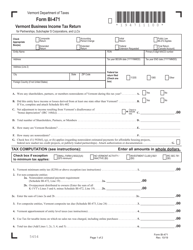

Instructions for Schedule BA-410 Vermont Corporate and Business Income Tax Affiliation - Vermont

This document contains official instructions for Schedule BA-410 , Vermont Corporate and Business Income Tax Affiliation - a form released and collected by the Vermont Department of Taxes.

FAQ

Q: What is Schedule BA-410?

A: Schedule BA-410 is a form used for Vermont Corporate and Business Income Tax Affiliation.

Q: What is Corporate and Business Income Tax Affiliation?

A: Corporate and Business Income Tax Affiliation is a method used to combine the income and expenses of related corporations for tax purposes.

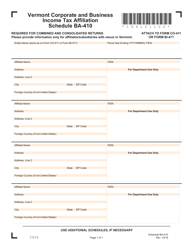

Q: Who should file Schedule BA-410?

A: Corporations that are affiliated and want to combine their income and expenses for tax purposes in Vermont should file Schedule BA-410.

Q: Is Schedule BA-410 mandatory?

A: Schedule BA-410 is mandatory for affiliated corporations that want to combine their income and expenses for tax purposes in Vermont.

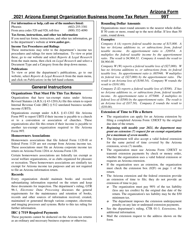

Q: Are there any supporting documents required with Schedule BA-410?

A: Yes, you will need to attach copies of federal consolidated tax returns and other supporting documents with Schedule BA-410.

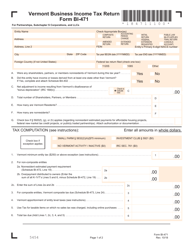

Q: When is the deadline to file Schedule BA-410?

A: Schedule BA-410 should be filed by the due date of the Vermont corporate income tax return, which is typically the 15th day of the fourth month after the end of the tax year.

Q: Is there a fee to file Schedule BA-410?

A: No, there is no fee to file Schedule BA-410.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Vermont Department of Taxes.