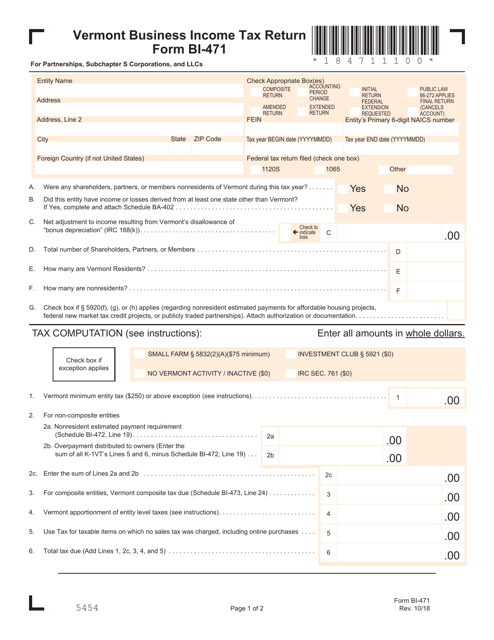

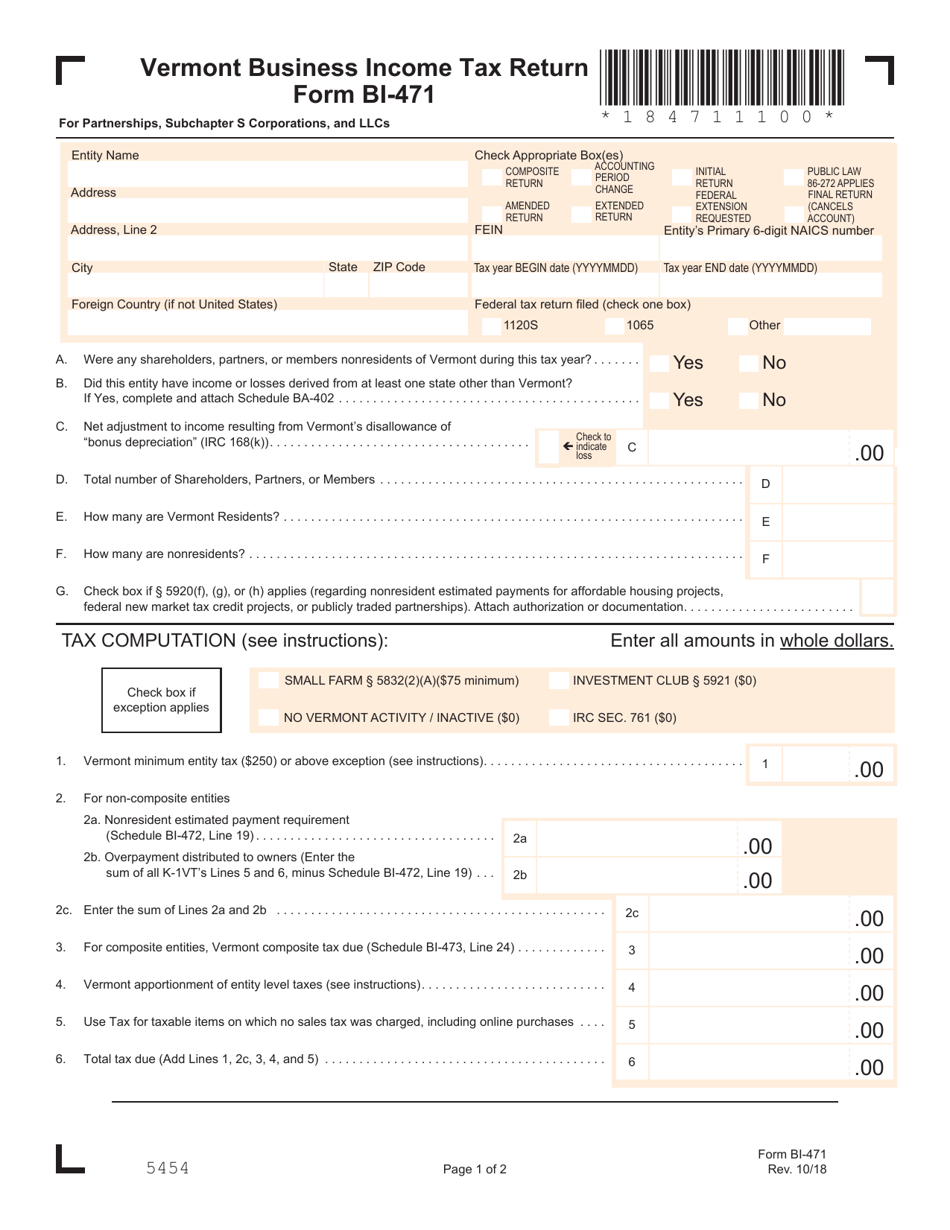

VT Form BI-471 Business Income Tax Return - Vermont

What Is VT Form BI-471?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. Check the official instructions before completing and submitting the form.

FAQ

Q: What is the VT Form BI-471?

A: The VT Form BI-471 is the Business Income Tax Return form for the state of Vermont.

Q: Who needs to fill out the VT Form BI-471?

A: Any business operating in Vermont that has taxable income or loss needs to fill out the VT Form BI-471.

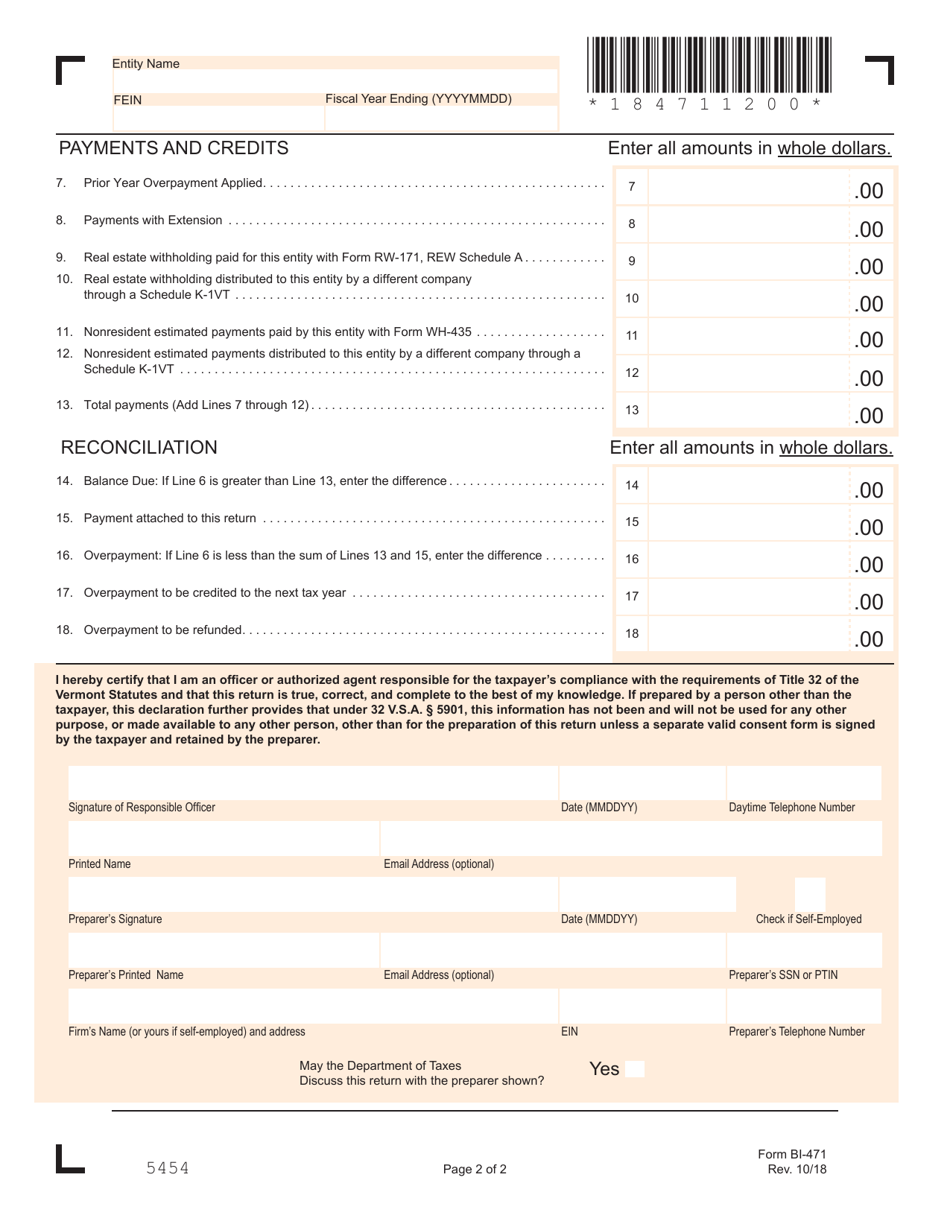

Q: What information is required on the VT Form BI-471?

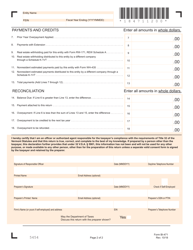

A: The VT Form BI-471 requires you to provide information about your business, income, deductions, and credits.

Q: When is the deadline to file the VT Form BI-471?

A: The deadline to file the VT Form BI-471 is the same as the federal income tax deadline, which is usually April 15th.

Q: Are there any penalties for not filing the VT Form BI-471?

A: Yes, there are penalties for not filing the VT Form BI-471, including late filing penalties and interest on unpaid taxes.

Q: Can I e-file the VT Form BI-471?

A: Yes, you can e-file the VT Form BI-471 if you meet certain criteria and use approved tax software.

Q: Do I need to include any supporting documents with the VT Form BI-471?

A: You may need to include supporting documents, such as schedules and forms, depending on your specific tax situation.

Q: Is the VT Form BI-471 the only tax form I need to file for my business in Vermont?

A: No, depending on the type of business you have, you may need to file additional forms, such as the VT Form BI-472 or VT Form BI-473.

Form Details:

- Released on October 1, 2018;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of VT Form BI-471 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.