This version of the form is not currently in use and is provided for reference only. Download this version of

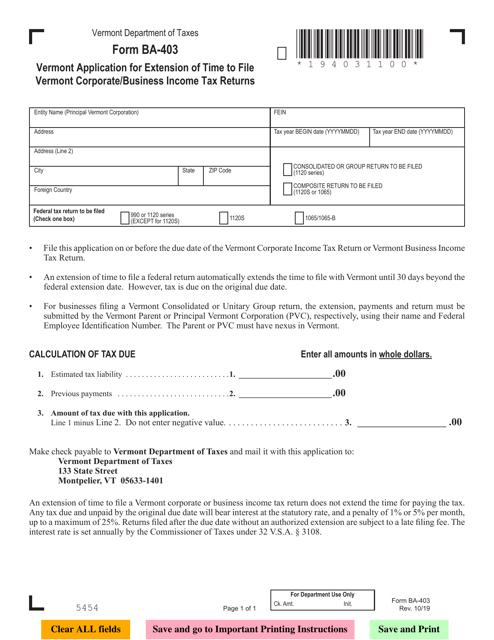

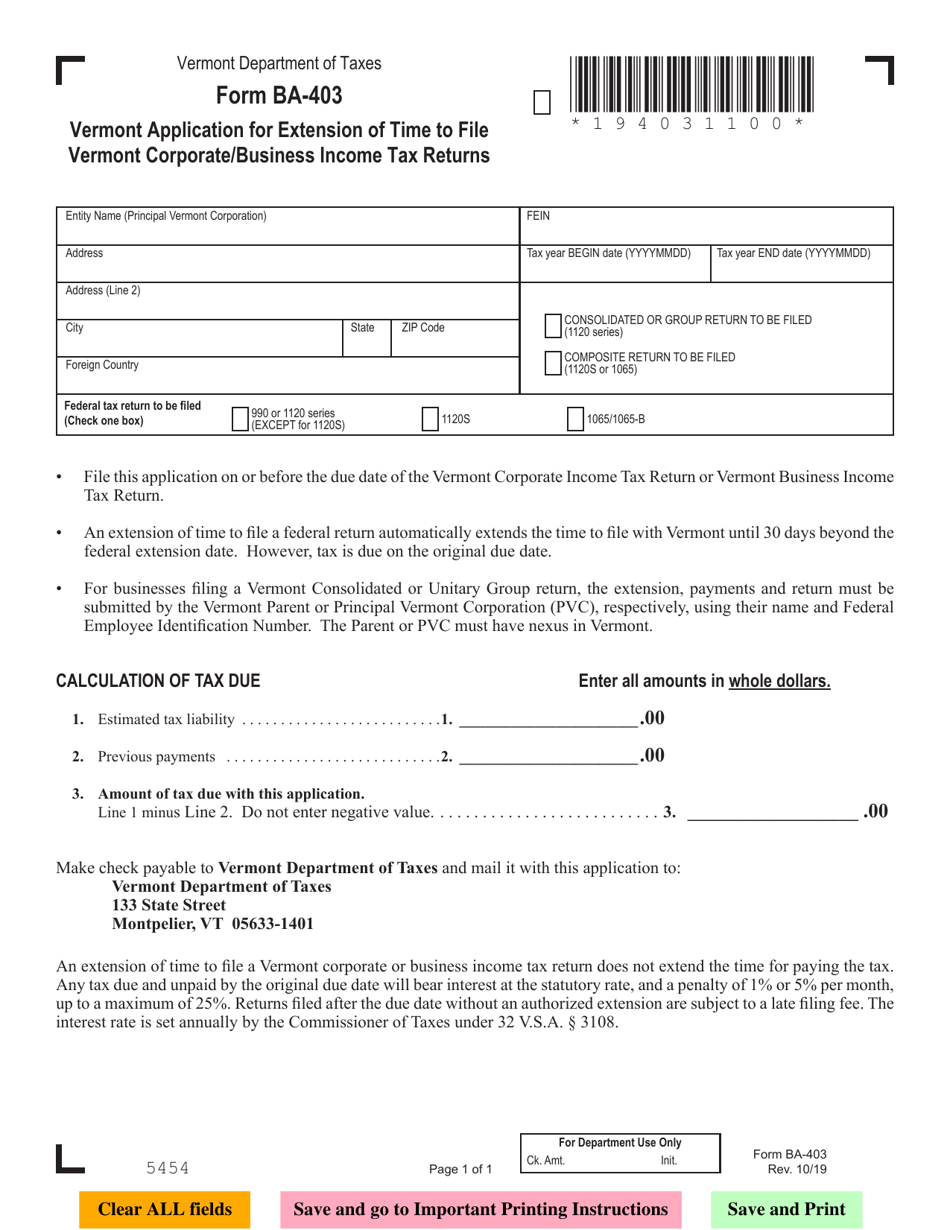

Form BA-403

for the current year.

Form BA-403 Vermont Application for Extension of Time to File Vermont Corporate / Business Income Tax Returns - Vermont

What Is Form BA-403?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form BA-403?

A: Form BA-403 is the Vermont Application for Extension of Time to File Vermont Corporate/Business Income Tax Returns.

Q: Who needs to file Form BA-403?

A: Individuals or businesses in Vermont who need extra time to file their Vermont Corporate/Business Income Tax Returns need to file Form BA-403.

Q: What is the purpose of Form BA-403?

A: The purpose of Form BA-403 is to request an extension of time to file Vermont Corporate/Business Income Tax Returns.

Q: How do I file Form BA-403?

A: Form BA-403 can be filed electronically through Vermont's tax filing system or by mail.

Q: When is Form BA-403 due?

A: Form BA-403 is due on or before the original due date of the Vermont Corporate/Business Income Tax Returns, which is typically March 15th.

Q: Is there a penalty for filing Form BA-403 late?

A: Yes, there may be penalties for filing Form BA-403 late. It is important to file for an extension before the original due date to avoid penalties.

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BA-403 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.