This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Schedule 500A

for the current year.

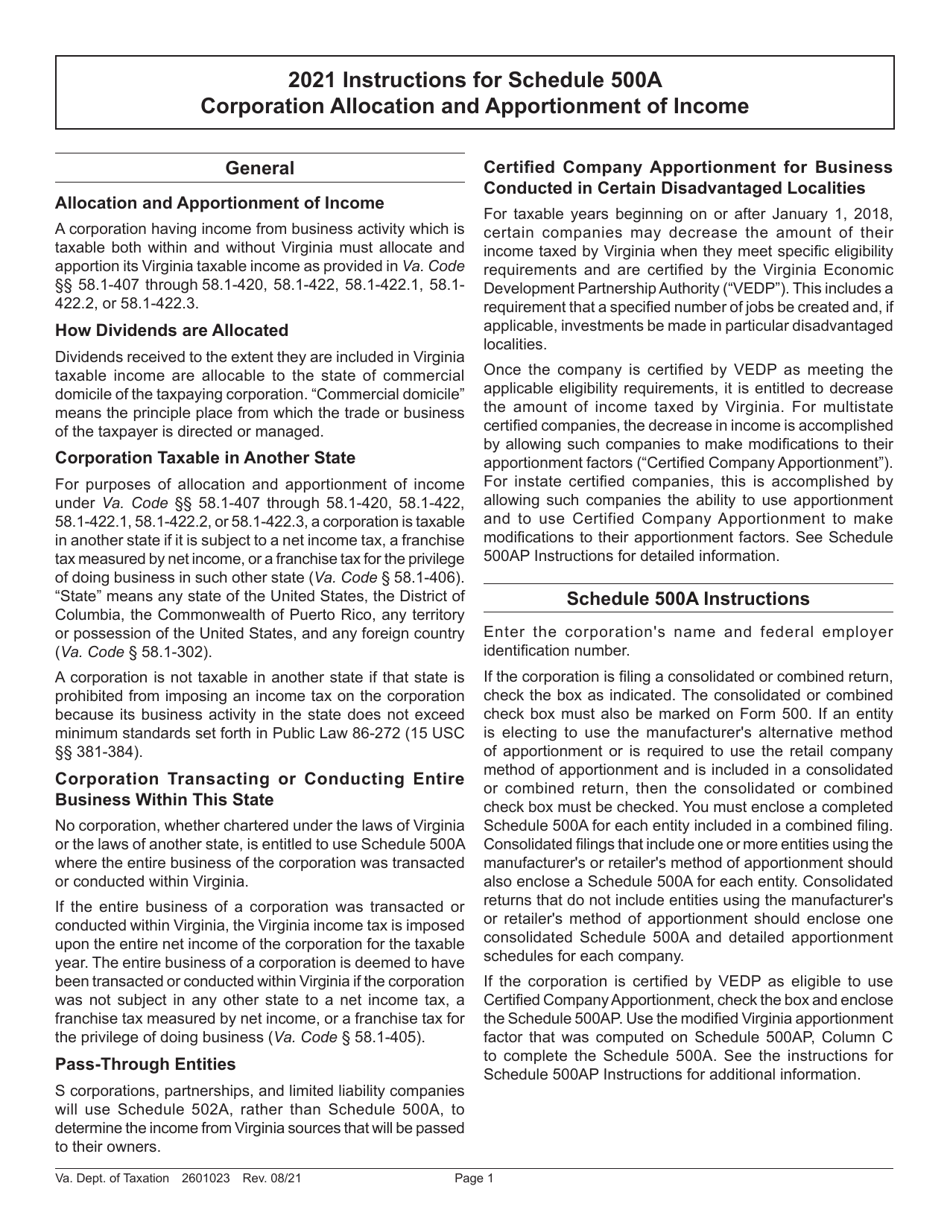

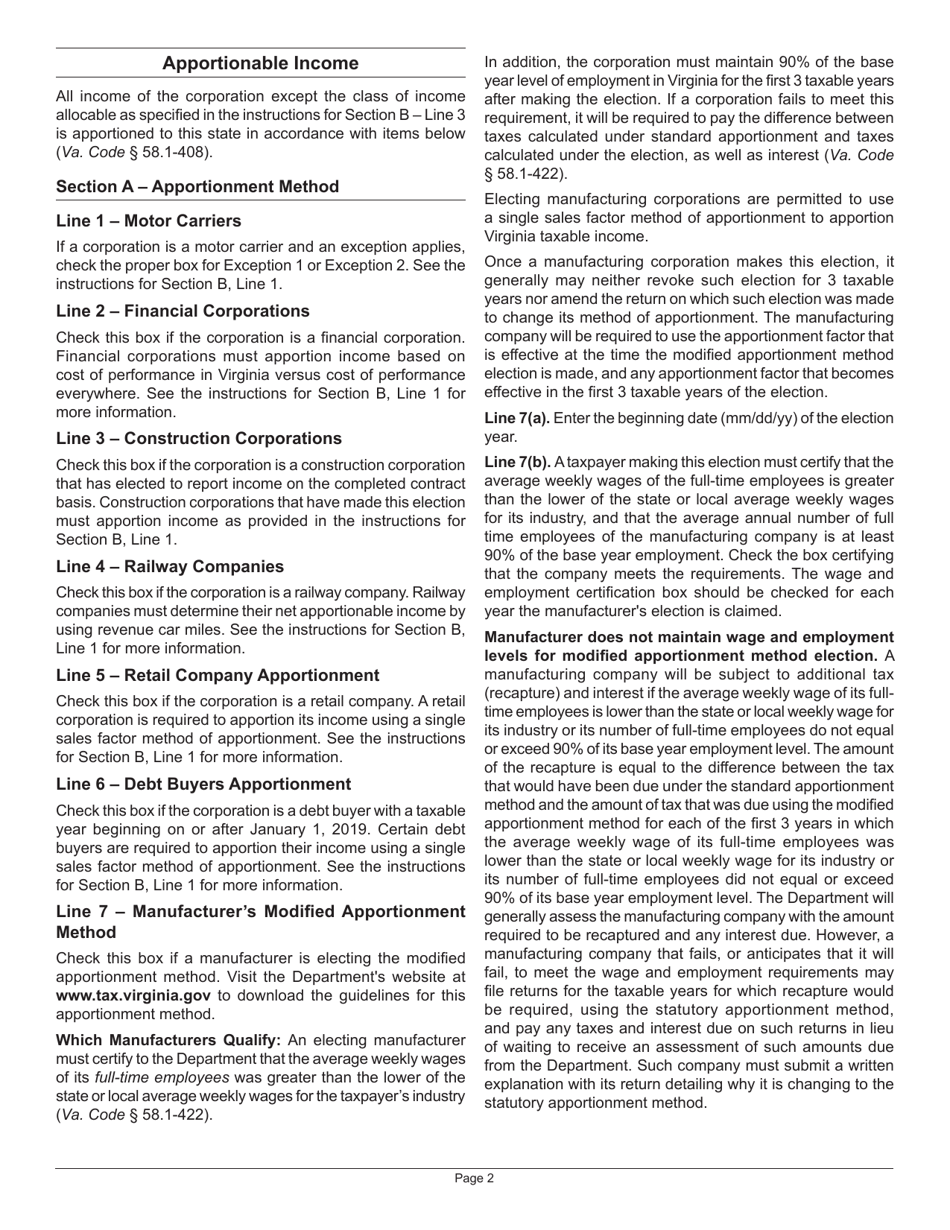

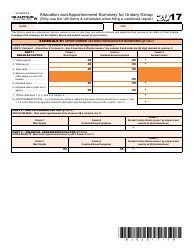

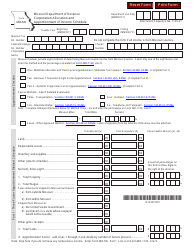

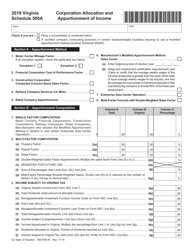

Instructions for Schedule 500A Corporation Allocation and Apportionment of Income - Virginia

This document contains official instructions for Schedule 500A , Corporation Allocation and Apportionment of Income - a form released and collected by the Virginia Department of Taxation.

FAQ

Q: What is Schedule 500A?

A: Schedule 500A is a form used by corporations in Virginia to allocate and apportion income.

Q: Why is Schedule 500A important?

A: Schedule 500A is important because it determines how a corporation's income is allocated and apportioned for tax purposes in Virginia.

Q: Who needs to file Schedule 500A?

A: Corporations in Virginia that have income from both inside and outside the state need to file Schedule 500A.

Q: What information is required on Schedule 500A?

A: Schedule 500A requires information about a corporation's income, factors of apportionment, and the calculation of its apportioned income.

Q: When is the deadline to file Schedule 500A?

A: The deadline to file Schedule 500A is generally the same as the deadline to file the corporation's income tax return in Virginia.

Q: Are there any penalties for not filing Schedule 500A?

A: Yes, there are penalties for not filing Schedule 500A or filing it late in Virginia. It is important to comply with the filing requirements to avoid these penalties.

Q: Can I get help with filling out Schedule 500A?

A: Yes, you can seek assistance from a tax professional or the Virginia Department of Taxation if you need help with filling out Schedule 500A.

Q: Is Schedule 500A used for both Virginia and federal taxes?

A: No, Schedule 500A is specific to Virginia taxes and is not used for federal tax purposes.

Q: What happens after I file Schedule 500A?

A: After you file Schedule 500A, it will be reviewed by the Virginia Department of Taxation, and they will determine if any adjustments or additional information is required.

Instruction Details:

- This 6-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Virginia Department of Taxation.