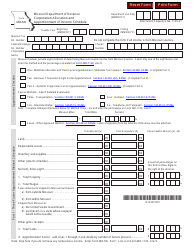

Instructions for Schedule 500A Corporation Allocation and Apportionment of Income - Washington

This document contains official instructions for Schedule 500A , Corporation Allocation and Apportionment of Income - a form released and collected by the Washington State Department of Revenue.

FAQ

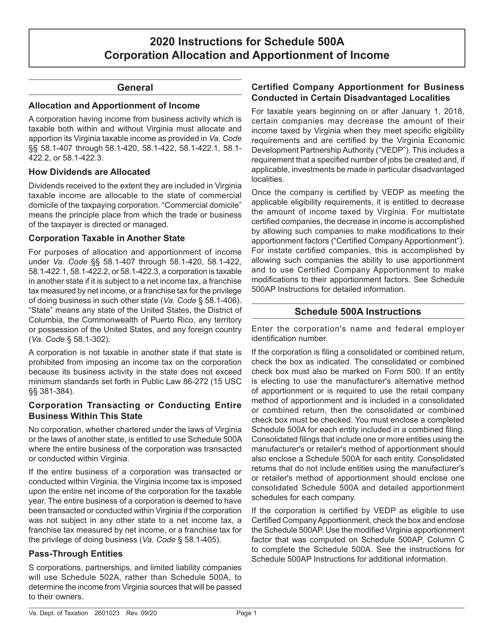

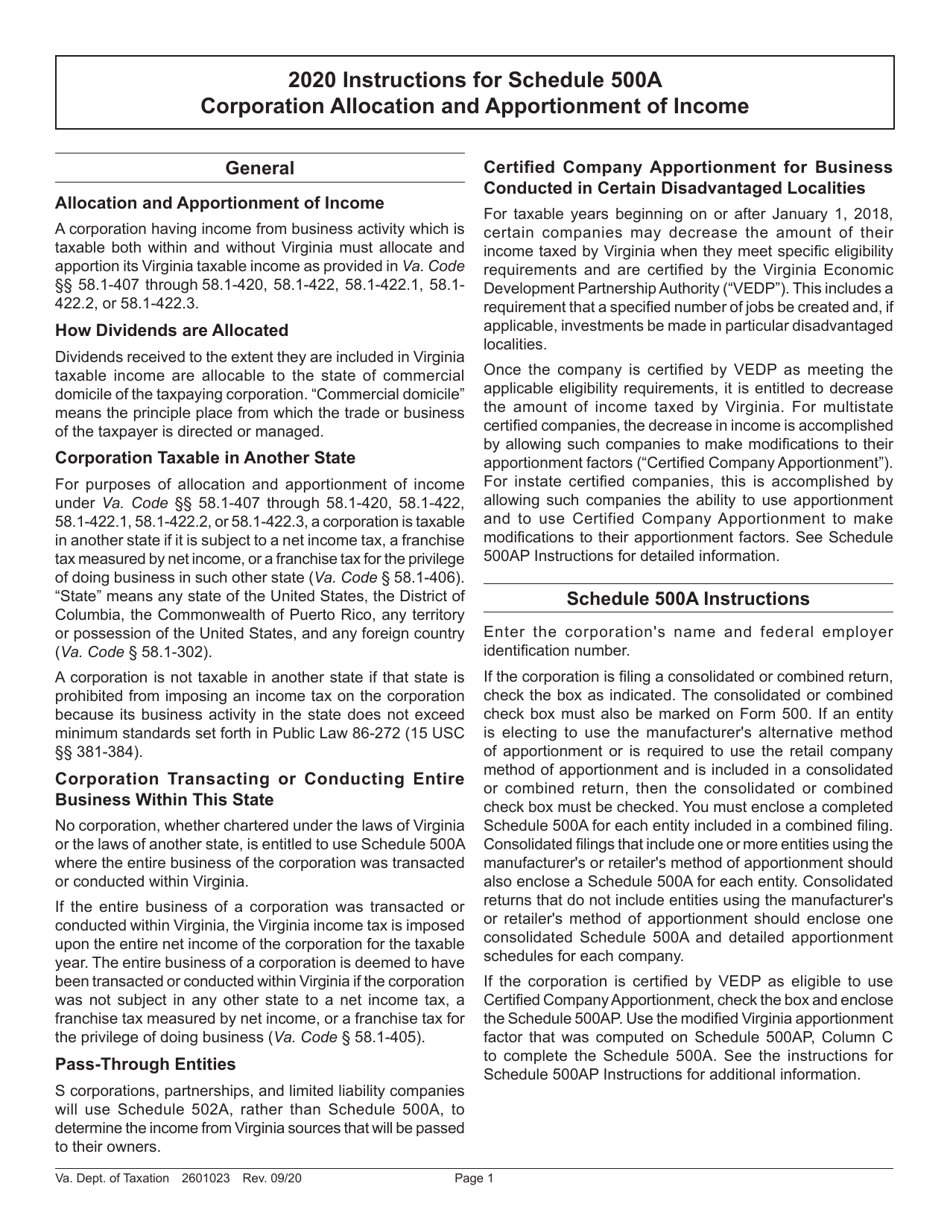

Q: What is Schedule 500A?

A: Schedule 500A is a form used for the allocation and apportionment of income for corporations in the state of Washington.

Q: Who needs to fill out Schedule 500A?

A: Corporations that have income from business activities within Washington and other states must fill out Schedule 500A.

Q: What is the purpose of Schedule 500A?

A: The purpose of Schedule 500A is to determine how much of a corporation's income is attributable to Washington for tax purposes.

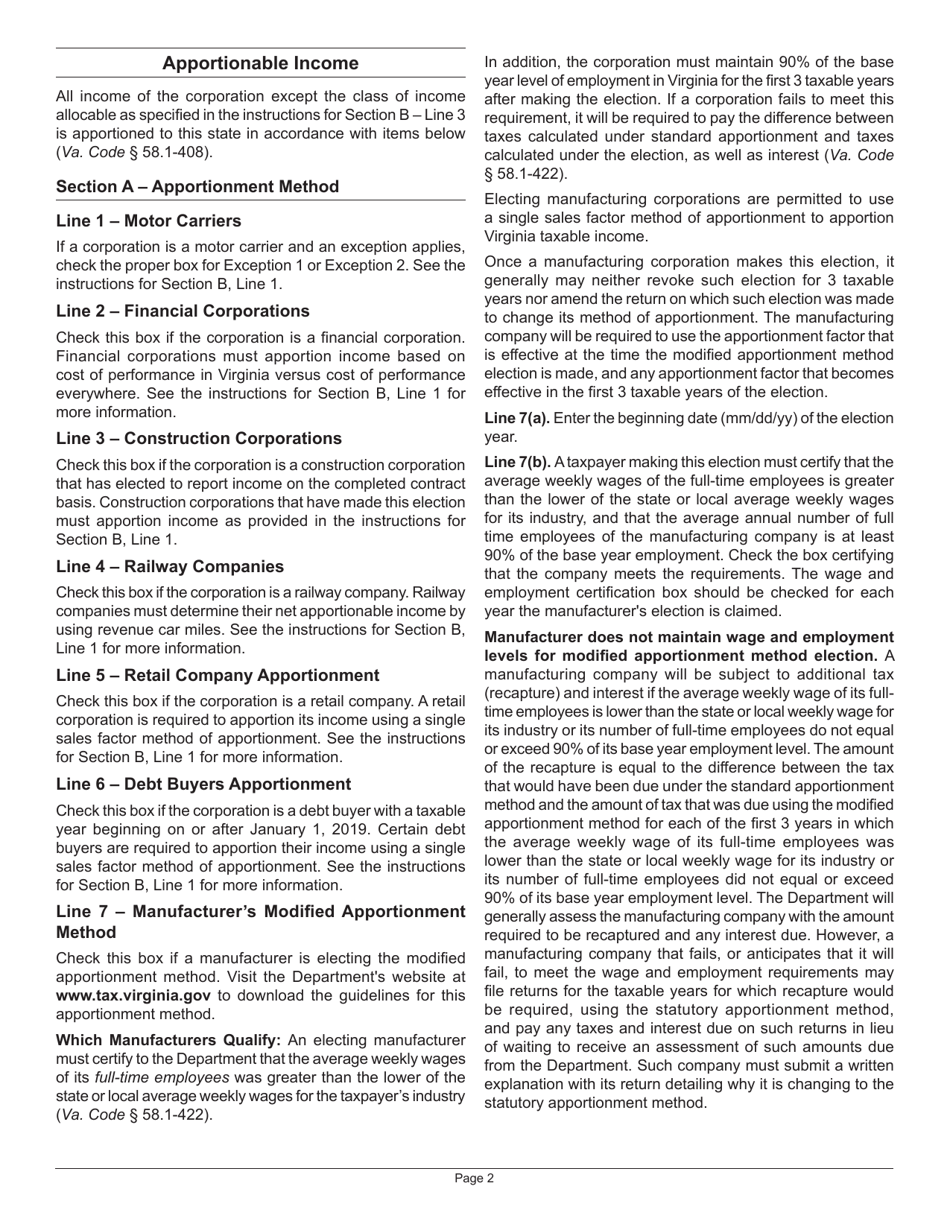

Q: What information is required on Schedule 500A?

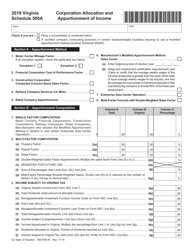

A: On Schedule 500A, corporations need to provide details about their total business income, sales, and property both in Washington and in other states.

Q: Are there any specific instructions for filling out Schedule 500A?

A: Yes, there are specific instructions provided by the Washington Department of Revenue that should be followed when filling out Schedule 500A.

Q: Is Schedule 500A the only form required for corporate incomeallocation and apportionment in Washington?

A: No, in addition to Schedule 500A, corporations may also need to file other forms depending on their specific circumstances, such as Schedule 500B or 500C.

Instruction Details:

- This 6-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Washington State Department of Revenue.