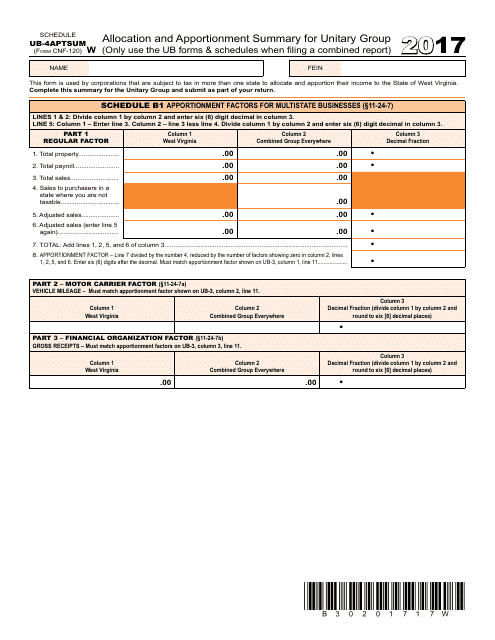

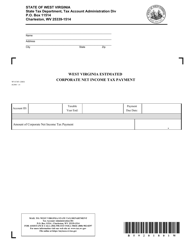

Form WV / CNF-120 Schedule UB-4APTSUM Allocation and Apportionment Summary for Unitary Group - West Virginia

What Is Form WV/CNF-120 Schedule UB-4APTSUM?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form WV/CNF-120 Schedule UB-4APTSUM?

A: Form WV/CNF-120 Schedule UB-4APTSUM is a document used for the allocation and apportionment of income for a unitary group in West Virginia.

Q: What is the purpose of Form WV/CNF-120 Schedule UB-4APTSUM?

A: The purpose of Form WV/CNF-120 Schedule UB-4APTSUM is to summarize the allocation and apportionment of income for a unitary group in West Virginia.

Q: Who needs to file Form WV/CNF-120 Schedule UB-4APTSUM?

A: Form WV/CNF-120 Schedule UB-4APTSUM needs to be filed by unitary groups in West Virginia.

Q: What information is required on Form WV/CNF-120 Schedule UB-4APTSUM?

A: Form WV/CNF-120 Schedule UB-4APTSUM requires information on the allocation and apportionment of income for the unitary group, including details on sales, property, and payroll.

Form Details:

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form WV/CNF-120 Schedule UB-4APTSUM by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.