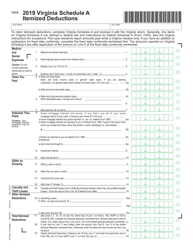

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Schedule A

for the current year.

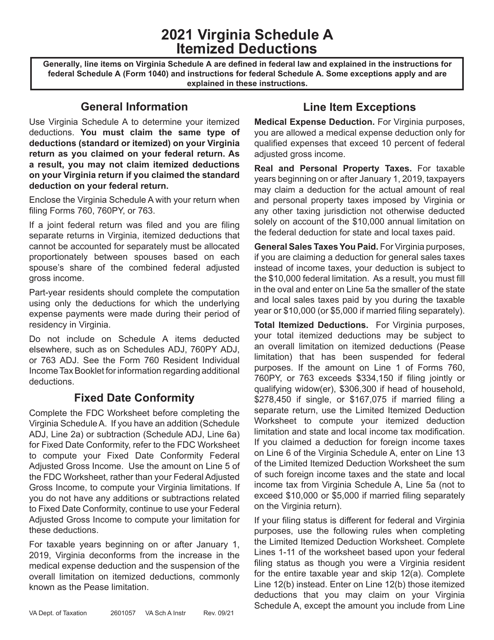

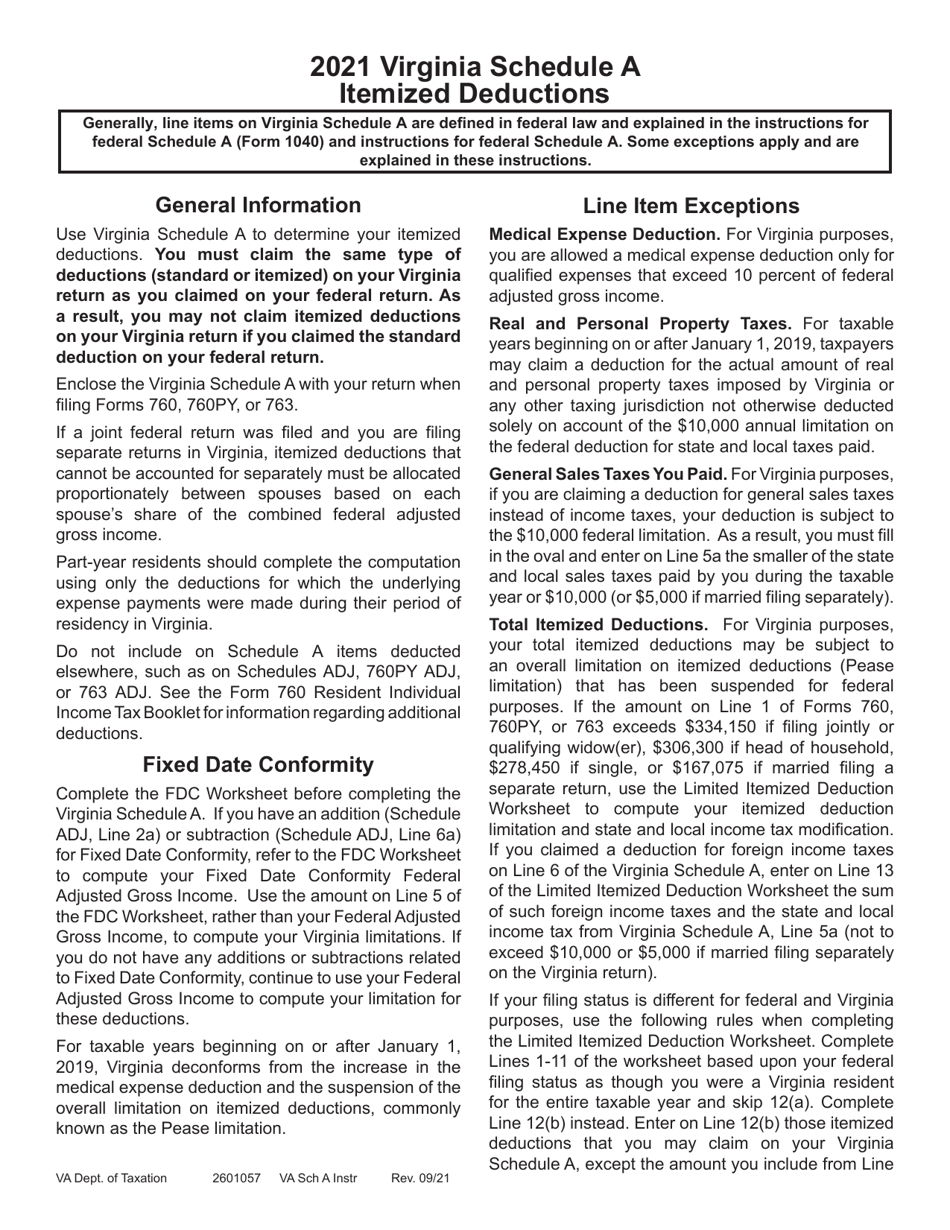

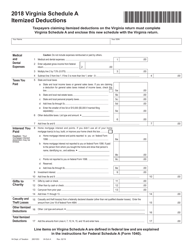

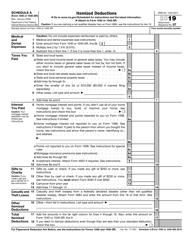

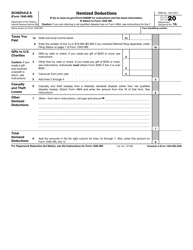

Instructions for Schedule A Itemized Deductions - Virginia

This document contains official instructions for Schedule A , Itemized Deductions - a form released and collected by the Virginia Department of Taxation.

FAQ

Q: What is Schedule A?

A: Schedule A is a tax form that itemizes deductions for Virginia state taxes.

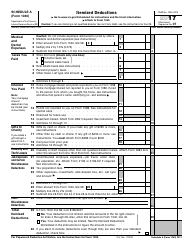

Q: What deductions can be claimed on Schedule A?

A: Common deductions include medical expenses, state and local taxes, mortgage interest, and charitable contributions.

Q: How do I determine if I should itemize deductions?

A: Compare your total itemized deductions to the standard deduction. If your itemized deductions are higher, it is beneficial to itemize.

Q: What is the standard deduction for Virginia?

A: The standard deduction for Virginia varies based on filing status. For the tax year 2021, it ranges from $3,000 to $6,000.

Q: What documentation is needed to support deductions on Schedule A?

A: You should keep adequate records, such as receipts, invoices, and other documents that support your claimed deductions.

Q: Can I claim both the standard deduction and itemized deductions?

A: No, you must choose between claiming the standard deduction or itemizing deductions.

Q: Are there any limitations on itemized deductions?

A: Yes, there are limitations on certain deductions like medical expenses and state and local taxes.

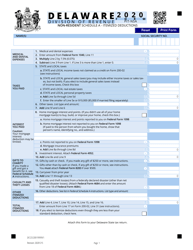

Q: Is Schedule A the same for federal and Virginia taxes?

A: No, Schedule A for Virginia state taxes is different from Schedule A for federal taxes.

Q: Can I e-file Schedule A?

A: Yes, Virginia allows taxpayers to e-file Schedule A as part of their state tax return.

Instruction Details:

- This 2-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Virginia Department of Taxation.