This version of the form is not currently in use and is provided for reference only. Download this version of

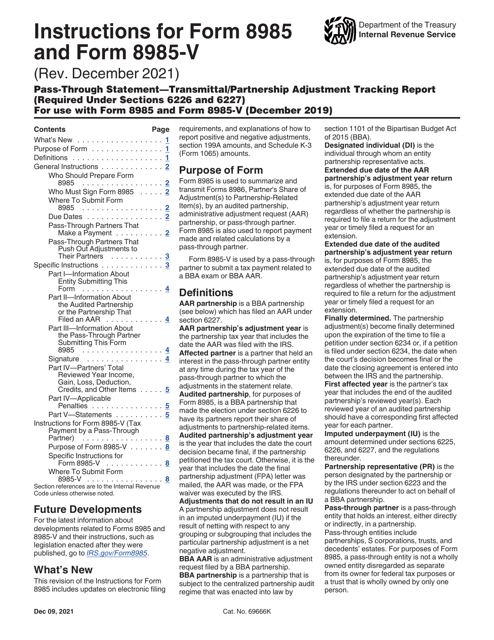

Instructions for IRS Form 8985, 8985-V

for the current year.

Instructions for IRS Form 8985, 8985-V

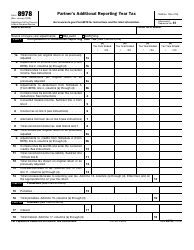

This document contains official instructions for IRS Form 8985 , and IRS Form 8985-V . Both forms are released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8985 is available for download through this link. The latest available IRS Form 8985-V can be downloaded through this link.

FAQ

Q: What is IRS Form 8985?

A: IRS Form 8985 is used to report information related to a Health Reimbursement Arrangement (HRA).

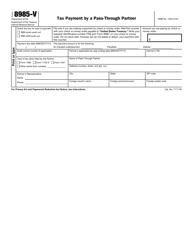

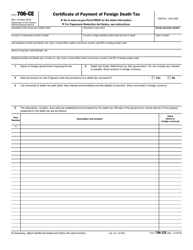

Q: What is IRS Form 8985-V?

A: IRS Form 8985-V is a payment voucher that is filed along with Form 8985 to make a payment for any tax due.

Q: When is Form 8985 due?

A: Form 8985 is generally due by the due date of the employer's federal income tax return, including extensions.

Q: How do I fill out Form 8985?

A: You must provide information about the HRA, including the plan sponsor's name, tax identification number, and the number of participating employees.

Q: Can Form 8985 be filed electronically?

A: No, Form 8985 cannot be filed electronically. It must be filed on paper and sent to the appropriate IRS address.

Q: What is the purpose of Form 8985-V?

A: Form 8985-V is a payment voucher that is used to make a payment for any tax due on Form 8985. It helps ensure that your payment is properly credited to your tax account.

Q: How do I fill out Form 8985-V?

A: Fill out your name, address, and other identification information. Enter the payment amount and attach Form 8985-V to your tax return when mailing it to the IRS.

Instruction Details:

- This 8-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.