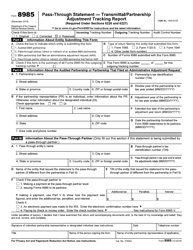

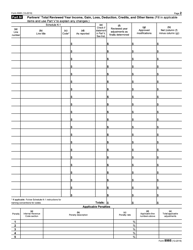

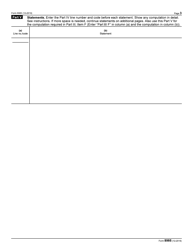

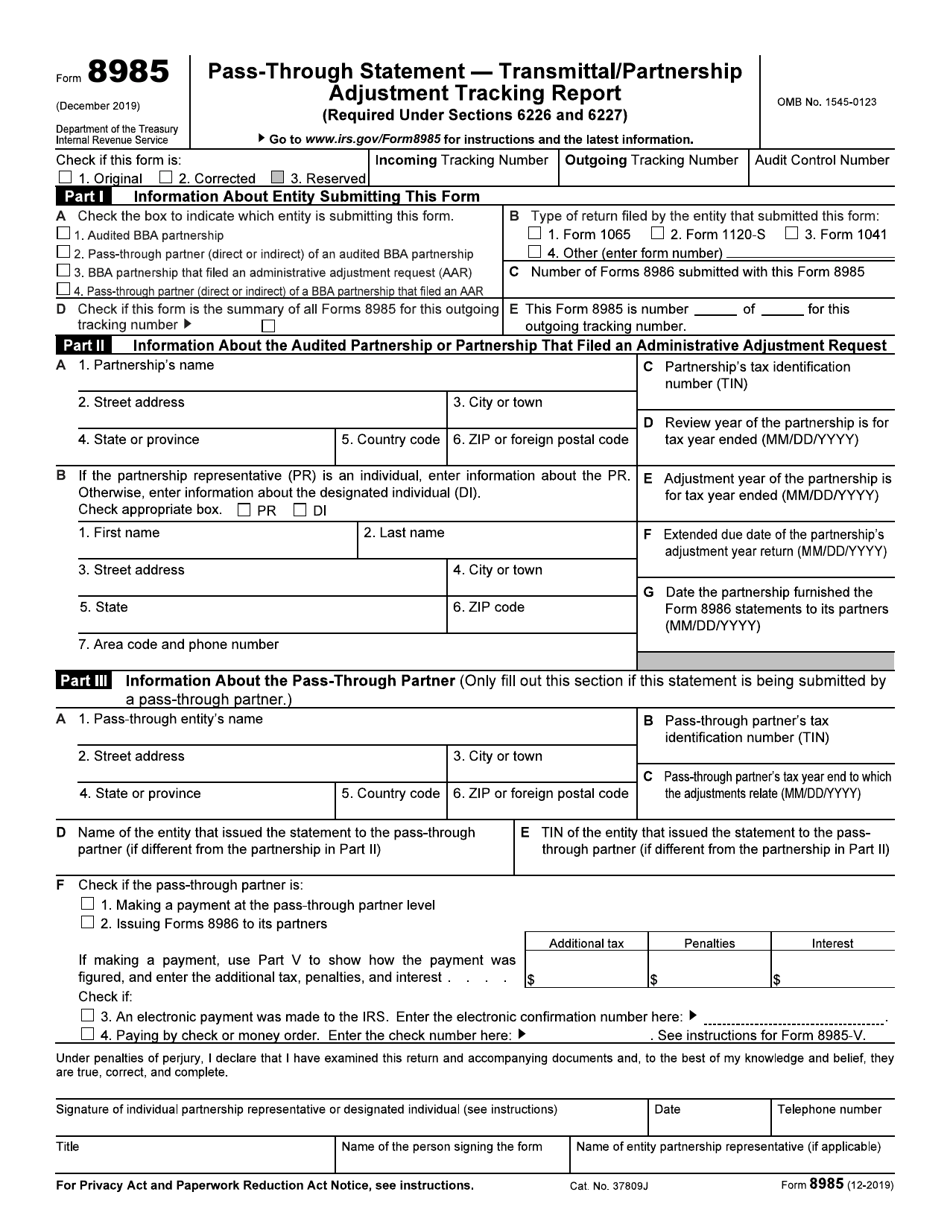

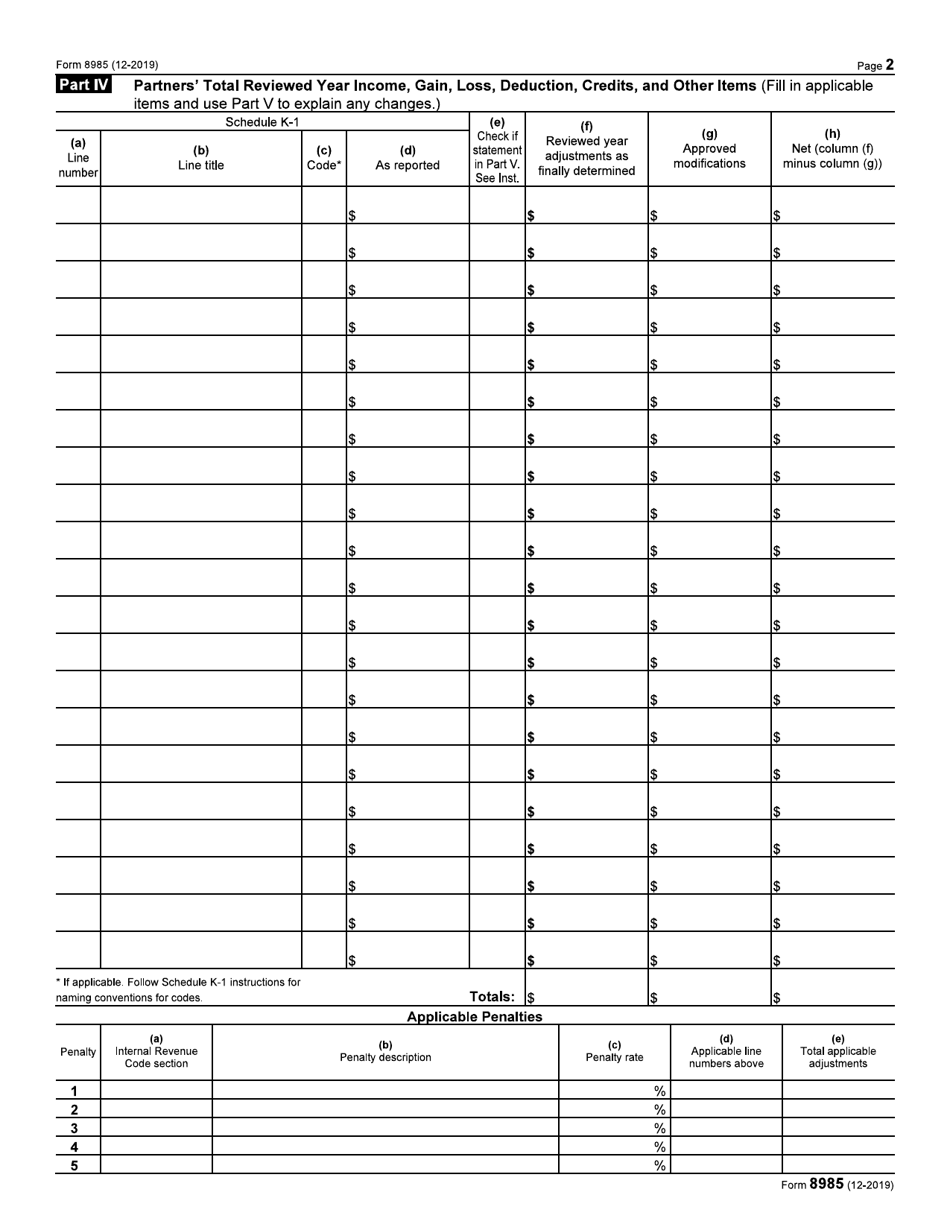

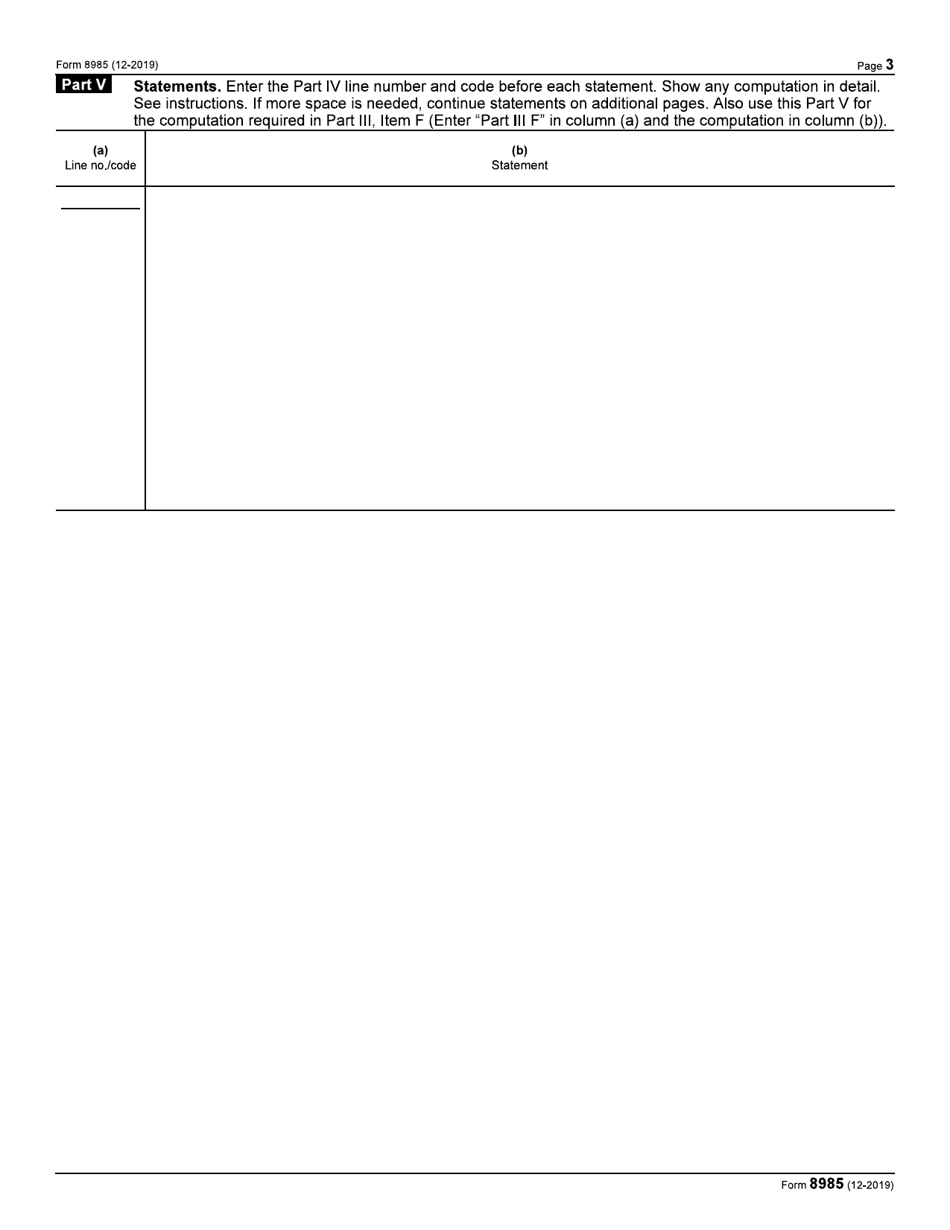

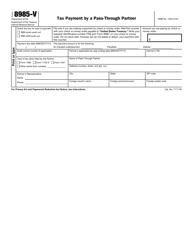

IRS Form 8985 Pass-Through Statement - Transmittal / Partnership Adjustment Tracking Report (Required Under Sections 6226 and 6227)

What Is IRS Form 8985?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on December 1, 2019. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8985?

A: IRS Form 8985 is a Pass-Through Statement - Transmittal/Partnership Adjustment Tracking Report.

Q: What is the purpose of IRS Form 8985?

A: The purpose of IRS Form 8985 is to report partnership adjustments and track them.

Q: When is IRS Form 8985 required?

A: IRS Form 8985 is required under Sections 6226 and 6227 of the Internal Revenue Code.

Q: What are Sections 6226 and 6227?

A: Sections 6226 and 6227 of the Internal Revenue Code relate to the partnership audit rules.

Q: Who is required to file IRS Form 8985?

A: Partnerships that are subject to the partnership audit rules are required to file IRS Form 8985.

Q: Are there any fees associated with filing IRS Form 8985?

A: No, there are no fees associated with filing IRS Form 8985.

Q: Can I e-file IRS Form 8985?

A: No, IRS Form 8985 cannot be e-filed. It must be filed on paper.

Q: Are there any penalties for not filing IRS Form 8985?

A: Yes, there can be penalties for not filing IRS Form 8985 or for filing it late. It is important to meet the filing requirements and deadlines.

Q: Is IRS Form 8985 specific to the United States or Canada?

A: IRS Form 8985 is specific to the United States and is not applicable to Canada.

Form Details:

- A 3-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8985 through the link below or browse more documents in our library of IRS Forms.