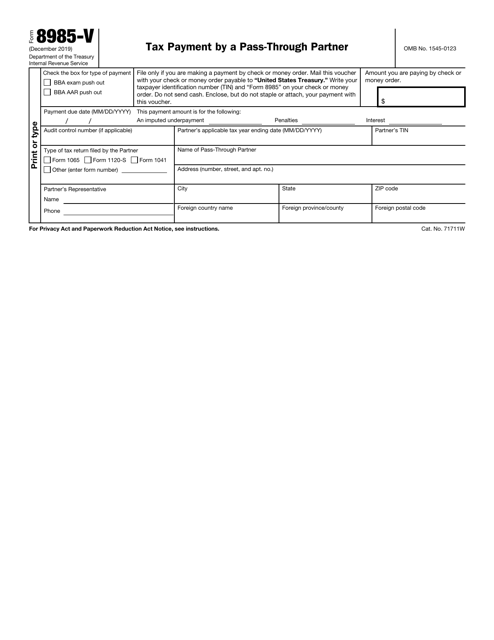

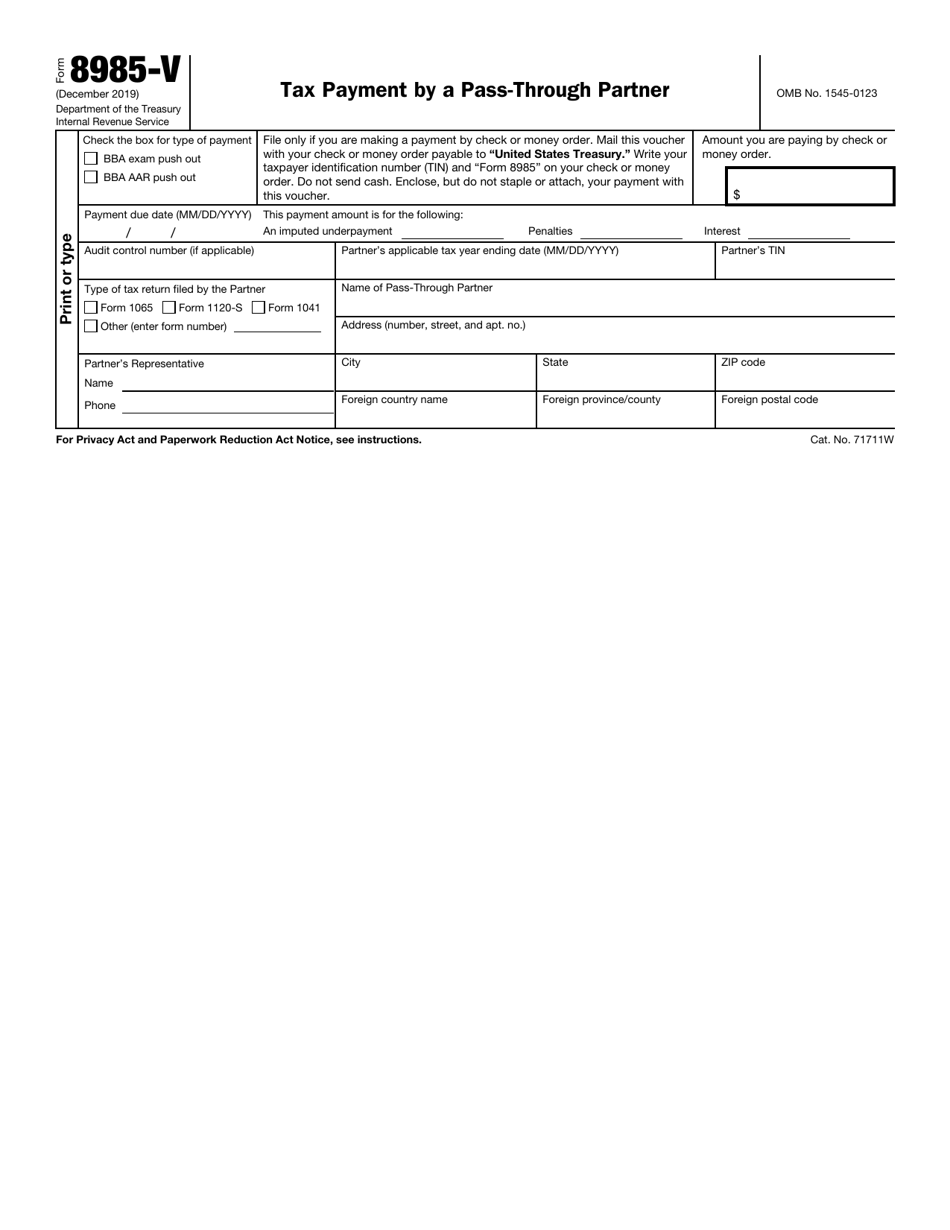

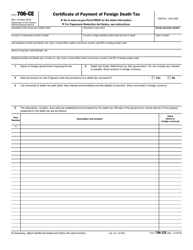

IRS Form 8985-V Tax Payment by a Pass-Through Partner

What Is IRS Form 8985-V?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on December 1, 2019. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8985-V?

A: IRS Form 8985-V is a tax payment form used by pass-through partners to submit their tax payments.

Q: Who uses IRS Form 8985-V?

A: Pass-through partners use IRS Form 8985-V to submit their tax payments.

Q: What is a pass-through partner?

A: A pass-through partner is an entity that passes its income or losses to its partners or shareholders.

Q: How do I use IRS Form 8985-V?

A: You can use IRS Form 8985-V by completing the required information and sending it along with your tax payment.

Q: Can I submit IRS Form 8985-V electronically?

A: No, IRS Form 8985-V cannot be submitted electronically and must be mailed to the designated IRS address.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8985-V through the link below or browse more documents in our library of IRS Forms.