This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 2210

for the current year.

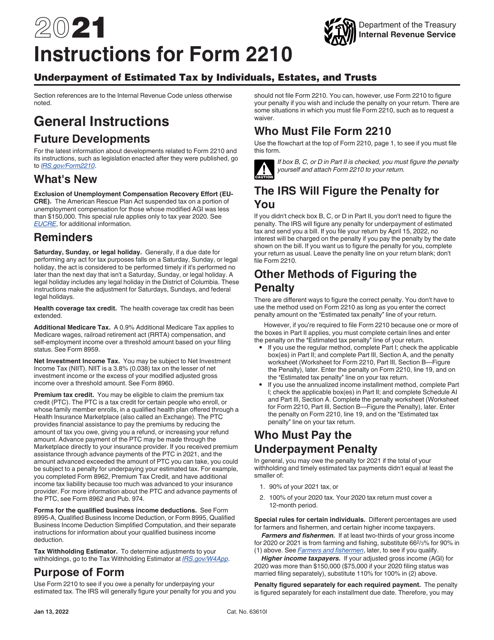

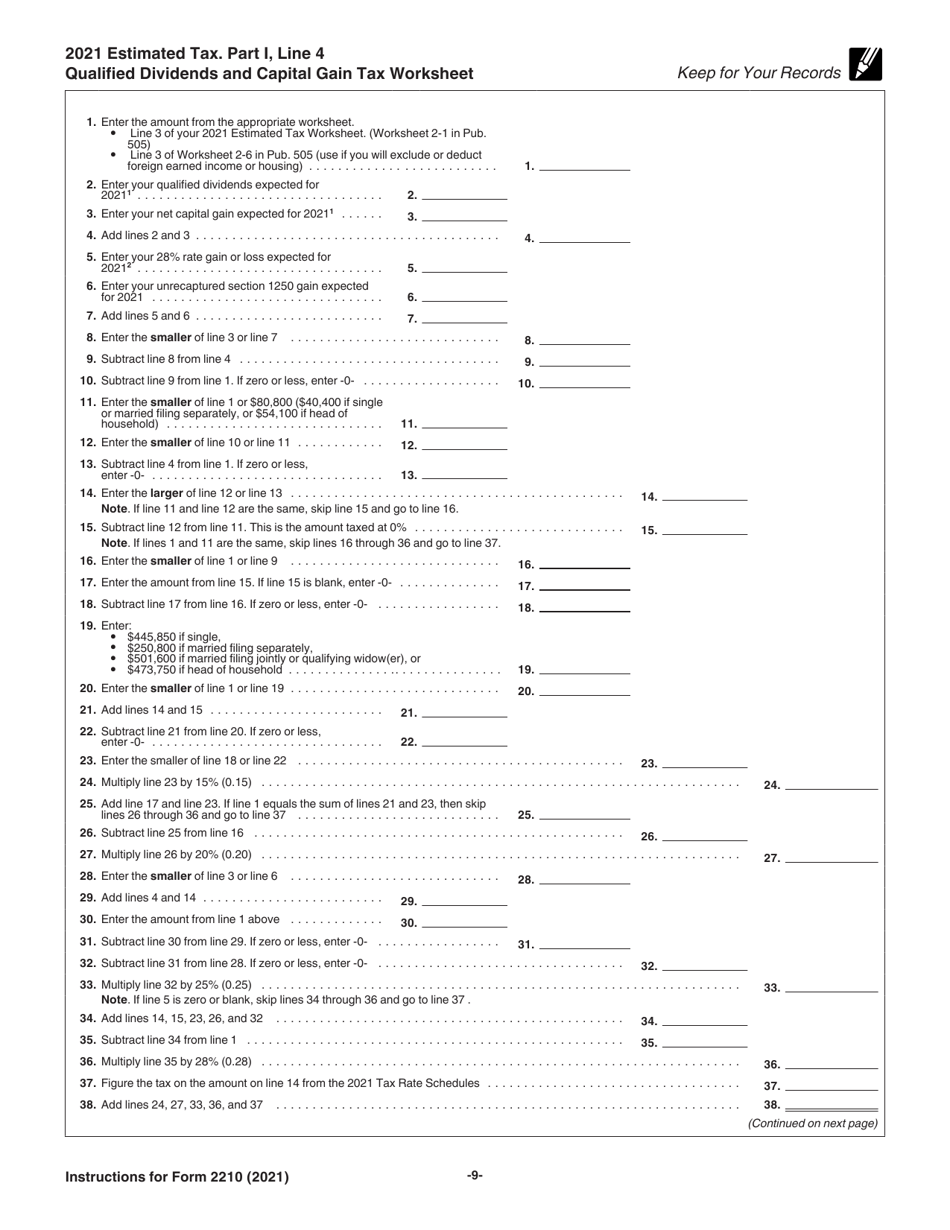

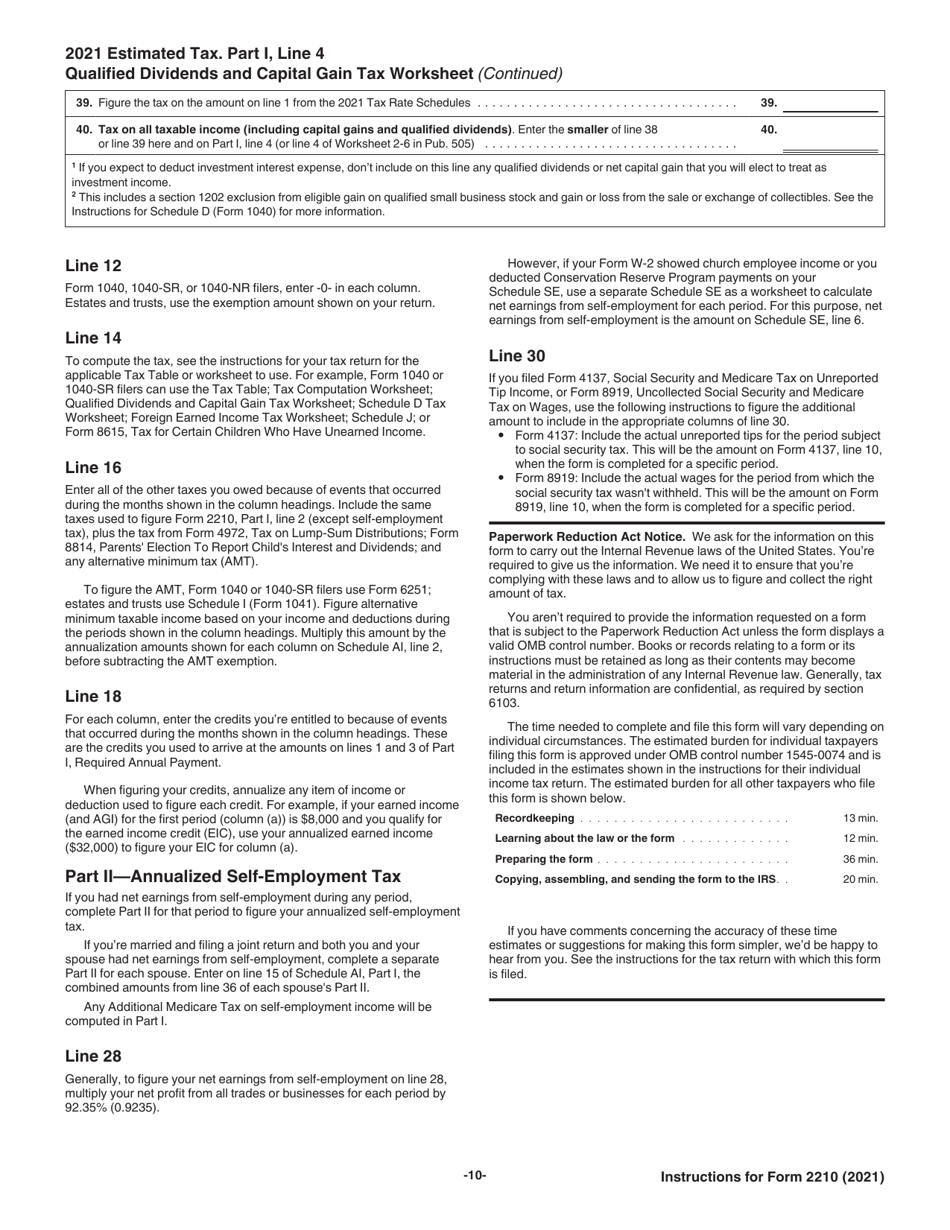

Instructions for IRS Form 2210 Underpayment of Estimated Tax by Individuals, Estates, and Trusts

This document contains official instructions for IRS Form 2210 , Underpayment of Estimated Tax by Individuals, Estates, and Trusts - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury.

FAQ

Q: What is IRS Form 2210?

A: IRS Form 2210 is a form used to calculate and pay the penalty for underpayment of estimated tax by individuals, estates, and trusts.

Q: Who needs to file IRS Form 2210?

A: Individuals, estates, and trusts who have underpaid their estimated tax throughout the year need to file IRS Form 2210.

Q: When is IRS Form 2210 due?

A: IRS Form 2210 is due on the same date as your individual income tax return, typically April 15th of the following year.

Q: What is the penalty for underpayment of estimated tax?

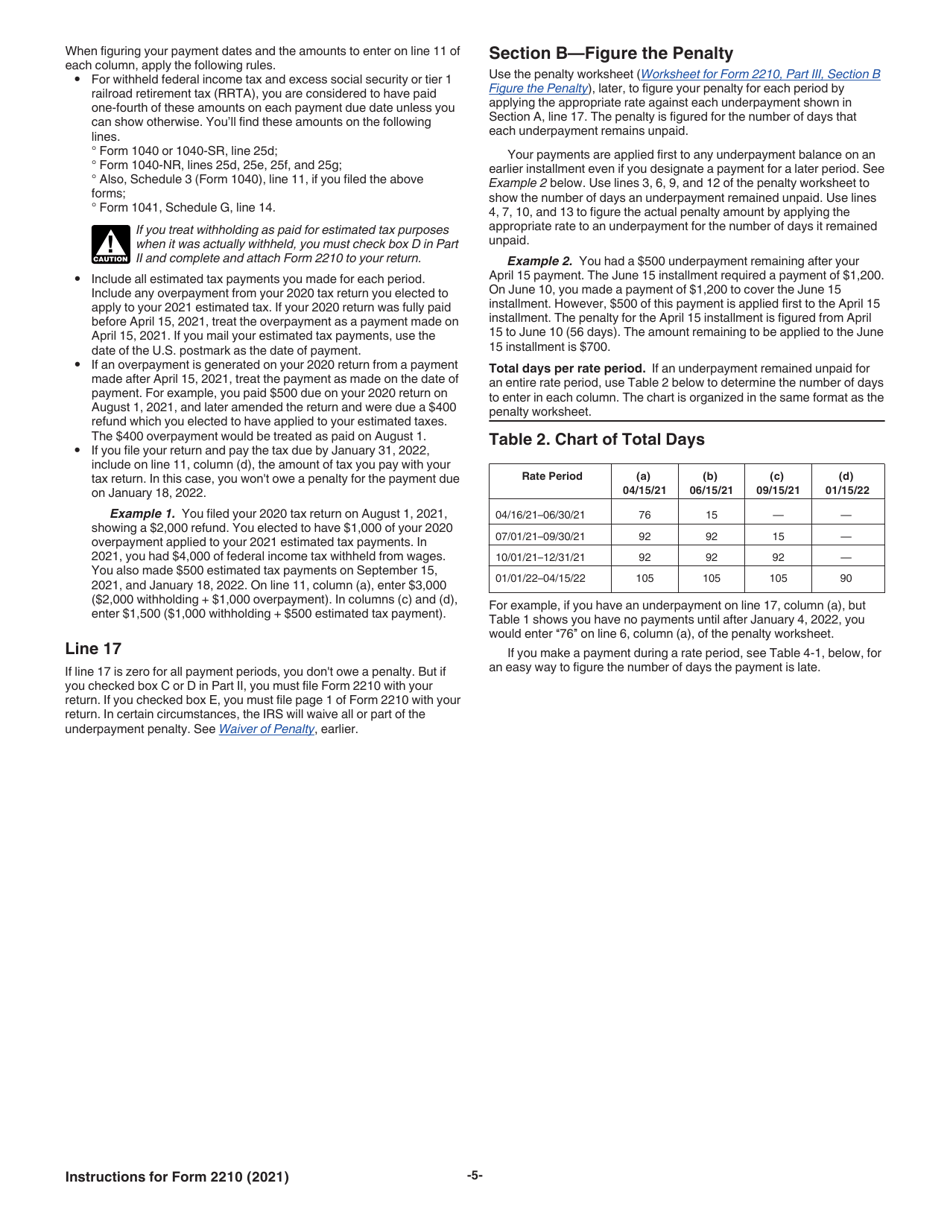

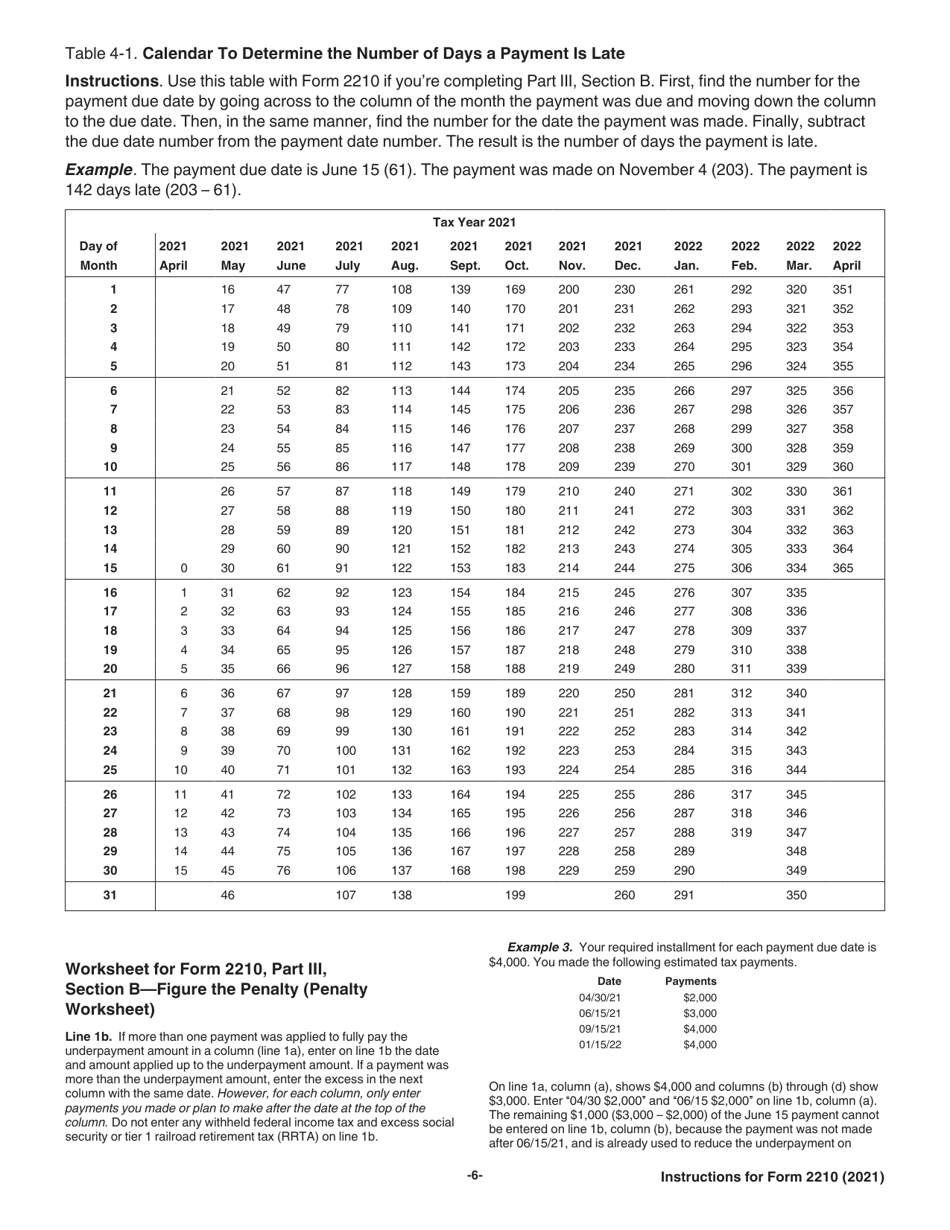

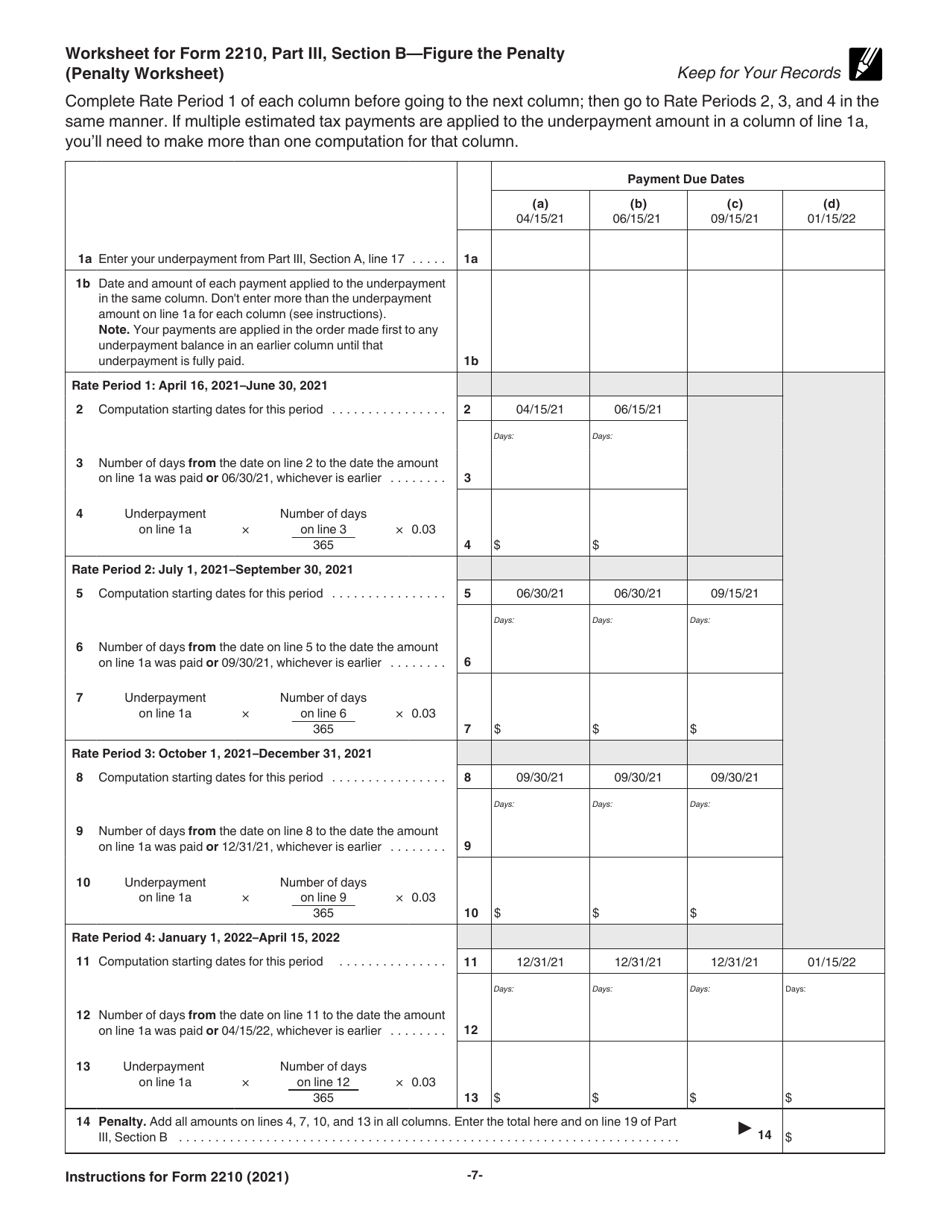

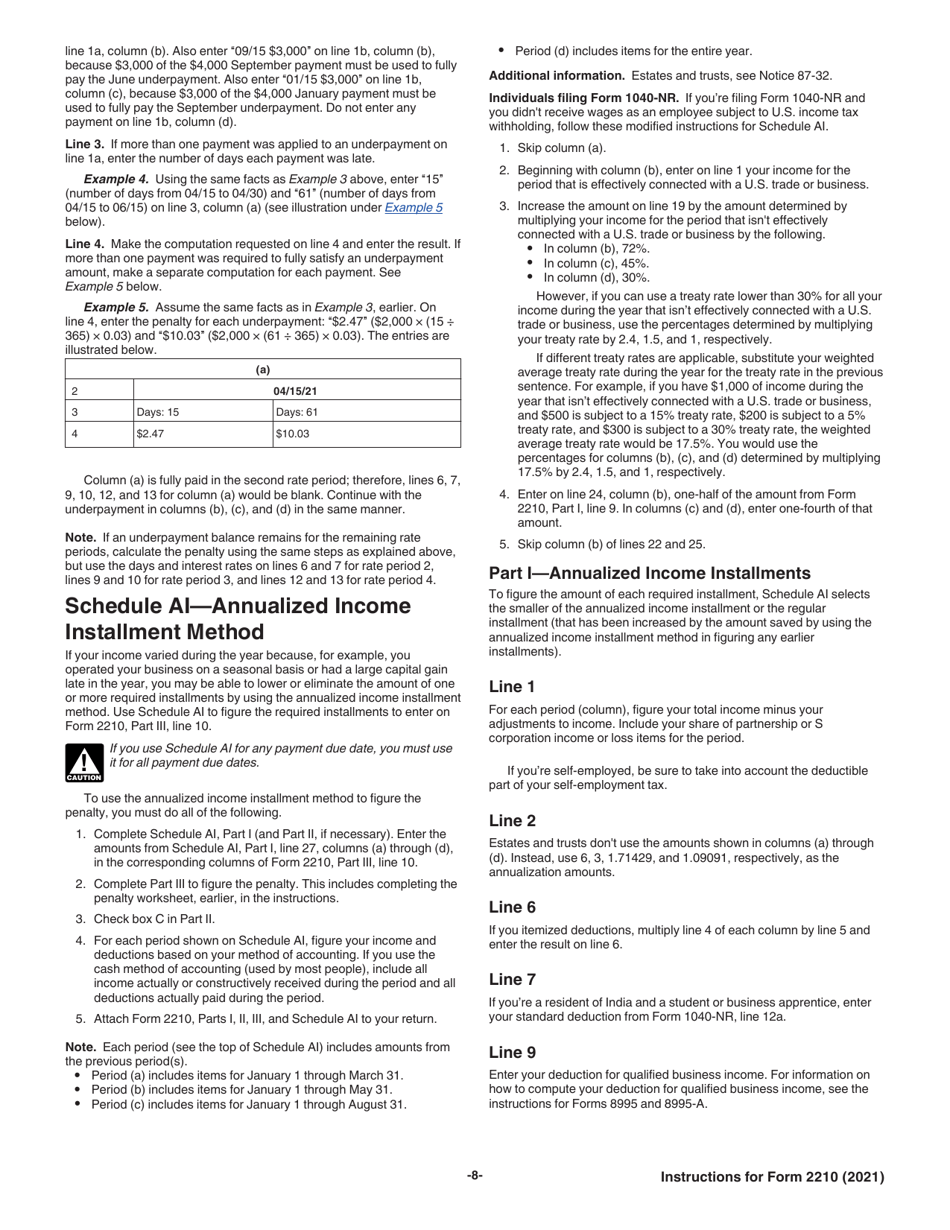

A: The penalty for underpayment of estimated tax is calculated based on the amount of tax owed and the time period during which the tax was unpaid.

Q: How do I calculate the penalty for underpayment of estimated tax?

A: You can use IRS Form 2210 to calculate the penalty. The form takes into account various factors such as the amount of the underpayment, the number of payment periods, and any applicable exceptions or exemptions.

Q: Can I request a waiver of the penalty for underpayment of estimated tax?

A: Yes, you may be eligible for a waiver of the penalty if you meet certain criteria. You can indicate your request for a waiver on IRS Form 2210.

Q: Can I e-file IRS Form 2210?

A: No, you cannot e-file IRS Form 2210. It must be filed by mail along with your individual income tax return.

Q: Are there any additional forms or schedules that need to be filed with IRS Form 2210?

A: Generally, no additional forms or schedules need to be filed with IRS Form 2210. However, depending on your specific situation, you may need to include additional documentation.

Q: What happens if I do not file IRS Form 2210?

A: If you are required to file IRS Form 2210 but fail to do so, you may be subject to penalties and interest on the underpayment of estimated tax.

Q: Can I amend IRS Form 2210 after it has been filed?

A: Yes, you can amend IRS Form 2210 if you discover an error or need to make changes. File an amended Form 2210 with the correct information.

Instruction Details:

- This 10-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.