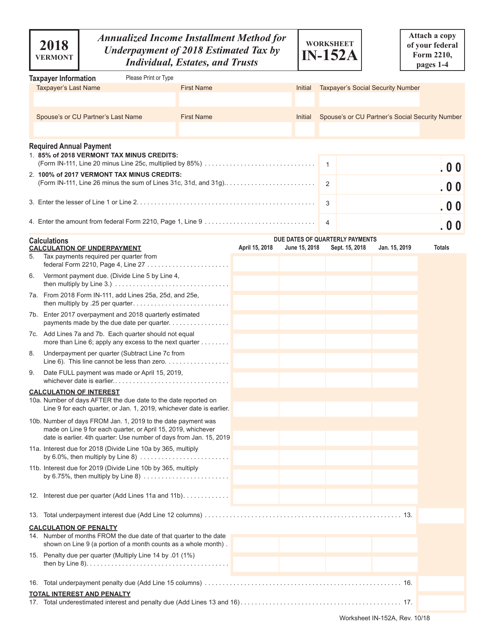

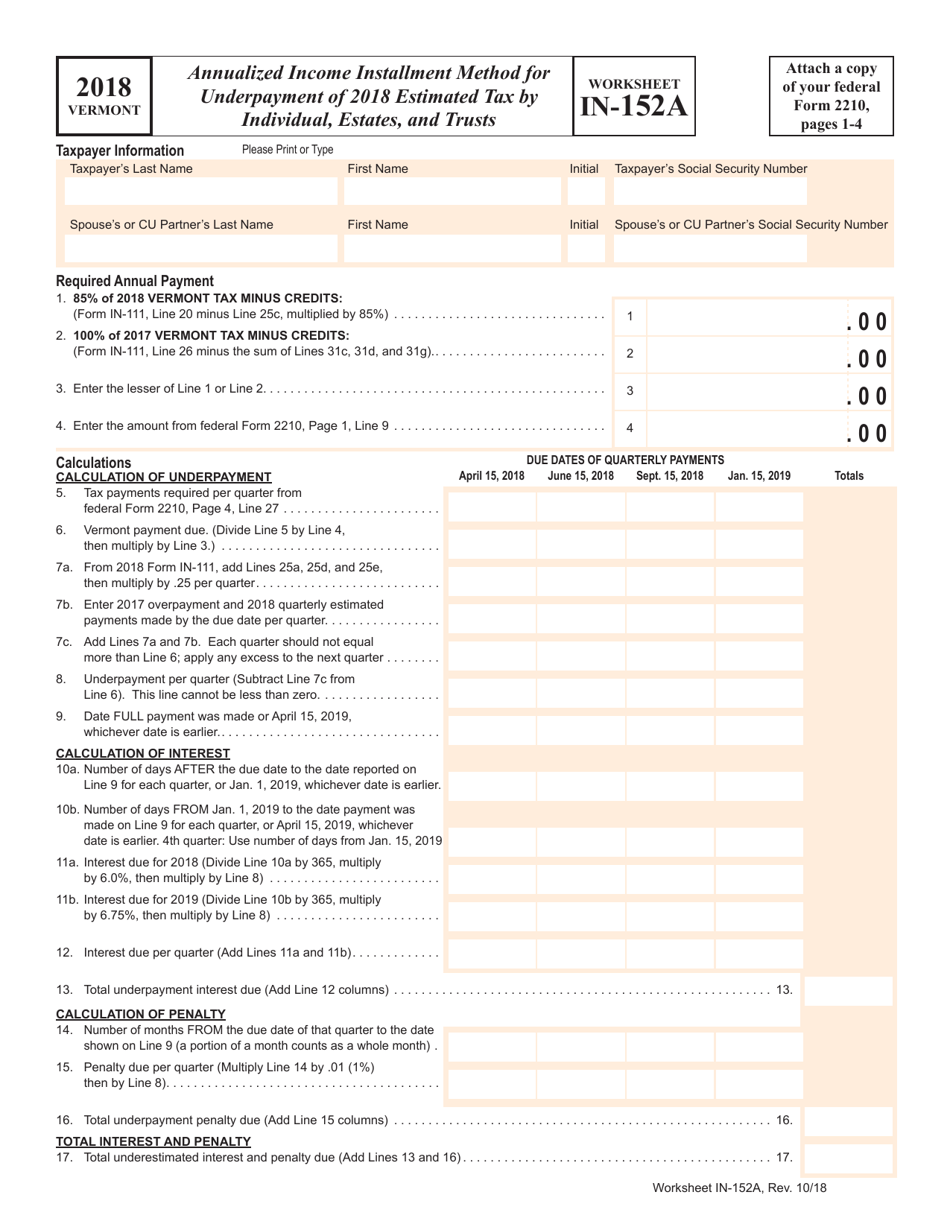

Worksheet in-152a - Annualized Income Installment Method for Underpayment of 2018 Estimated Tax by Individual, Estates, and Trusts - Vermont

Worksheet in-152a - Annualized Income Installment Method for Underpayment of 2018 Estimated Tax by Individual, Estates, and Trusts is a legal document that was released by the Vermont Department of Taxes - a government authority operating within Vermont.

FAQ

Q: What is the purpose of Worksheet IN-152A?

A: Worksheet IN-152A is used to calculate the annualized income installment for underpayment of 2018 estimated tax by individuals, estates, and trusts in Vermont.

Q: Who needs to use Worksheet IN-152A?

A: Individuals, estates, and trusts in Vermont who have underpaid their 2018 estimated tax need to use Worksheet IN-152A.

Q: What does the annualized income installment method refer to?

A: The annualized income installment method is a way to calculate your estimated tax payments based on your actual income earned throughout the year.

Q: Is Worksheet IN-152A specific to Vermont?

A: Yes, Worksheet IN-152A is specific to individuals, estates, and trusts in Vermont.

Form Details:

- Released on October 1, 2018;

- The latest edition currently provided by the Vermont Department of Taxes;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.