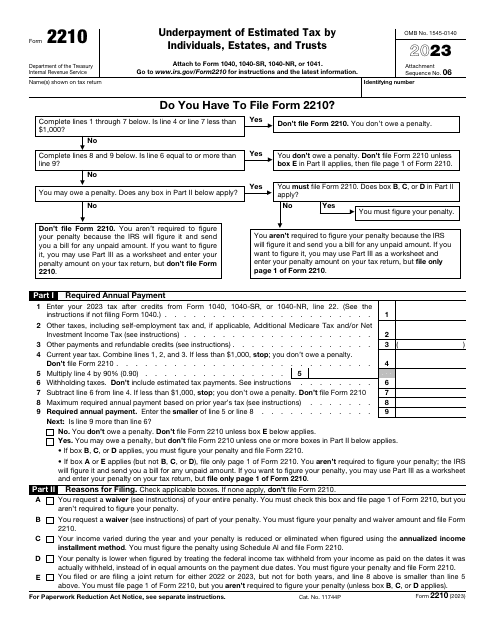

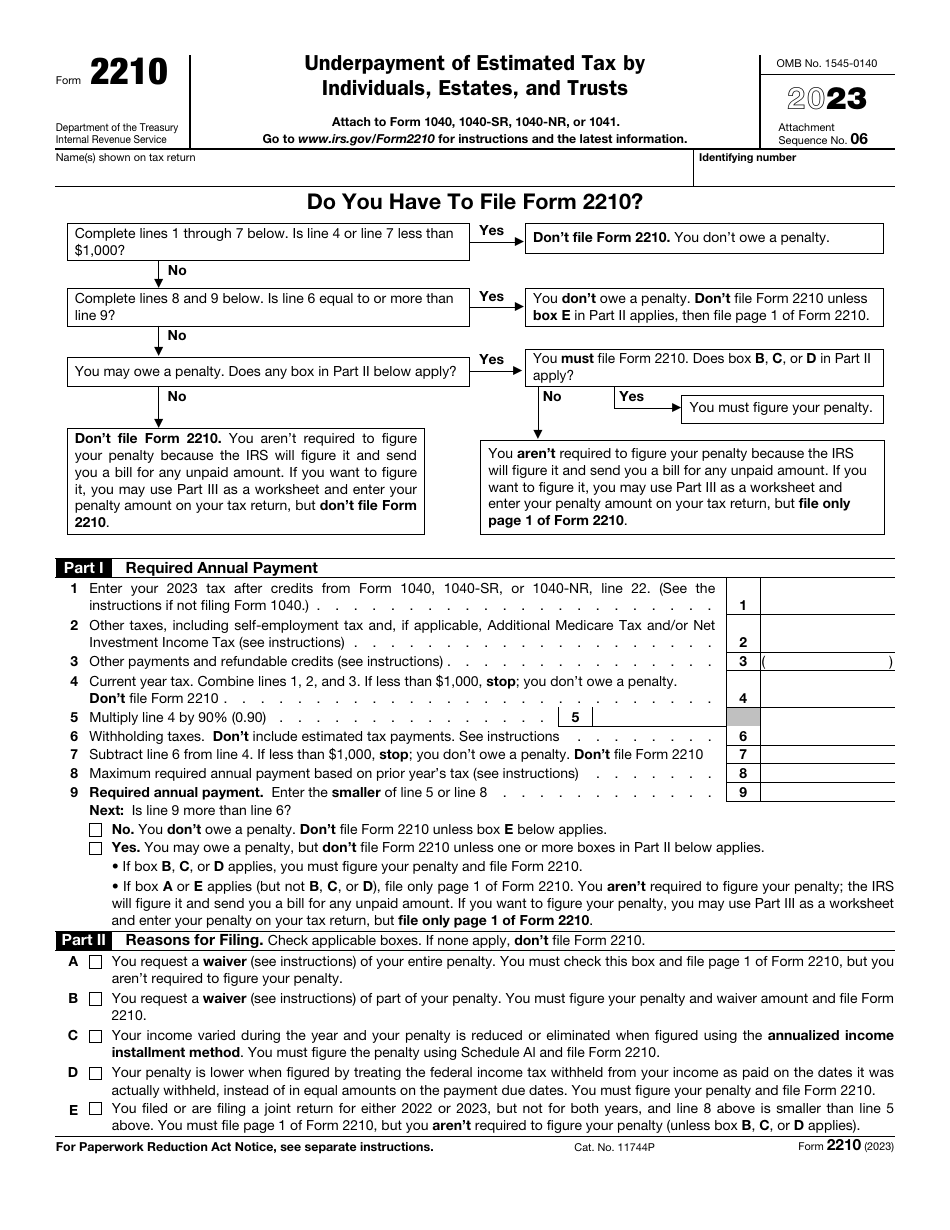

IRS Form 2210 Underpayment of Estimated Tax by Individuals, Estates, and Trusts

What Is IRS Form 2210?

IRS Form 2210, Underpayment of Estimated Tax by Individuals, Estates, and Trusts , is a fiscal instrument used by a taxpayer to find out whether they are liable for paying a penalty after underpaying their estimated tax.

Alternate Name:

- Tax Form 2210.

This form has to be attached to your tax return unless the worksheets show you there is no need to pay the penalty - figure out if you have to submit the form using guidelines on the first page of the document, carry out calculations, and request a penalty waiver if you believe you do not have to deal with a penalty because of illness, disability, or major property damage.

This statement was released by the Internal Revenue Service (IRS) in 2023 , making older editions obsolete. You can download an IRS Form 2210 fillable version through the link below.

What Is Form 2210 Used For?

Use IRS Form 2210 to learn how much tax you owe in late penalties for every tax payment due even if fiscal authorities have not sent you a bill yet. Taxpayers that pay estimated taxes are expected to file their tax paperwork four times during the year - in April, June, September, and January. If your calculations show an underpayment penalty will be imposed, you can fulfill your tax obligations by disclosing your computations to the IRS and submitting this form with your income statement - the amount of the Form 2210 penalty must be replicated on IRS Form 1040, U.S. Individual Tax Return.

There are certain exceptions when it comes to estimated tax penalties - for example, if the taxpayer became disabled or is older than 62, the penalty will be waived since they are unable to deal with estimated tax payments. The same rule applies to people that failed to pay enough tax because of a financial hardship - as long as they can show the reasonable cause behind the non-payment.

Form 2210 Instructions

Follow these Form 2210 instructions to figure out whether you owe the government a penalty for paying less estimated tax than you should have:

-

Write down your full name and taxpayer identification number . Carefully examine the chart on top of the first page - it will tell you whether you are supposed to submit this document in the first place. Make sure the regulations apply in your case and proceed to the first section of the form.

-

Compute the annual payment you are obliged to send to the IRS . List your tax after credits were applied as well as other taxes (for instance, tax on investment income and self-employment tax), refundable credits, and deducted taxes. The instrument contains formulas you need to use - they will inform the taxpayer whether the filing is needed and you will be required to pay a Form 2210 penalty.

-

Specify the reason behind submitting the paperwork . You have to read five statements and confirm at least one of them accurately describes your case - if none of the circumstances are relevant, you will not need to send the form to tax organs.

-

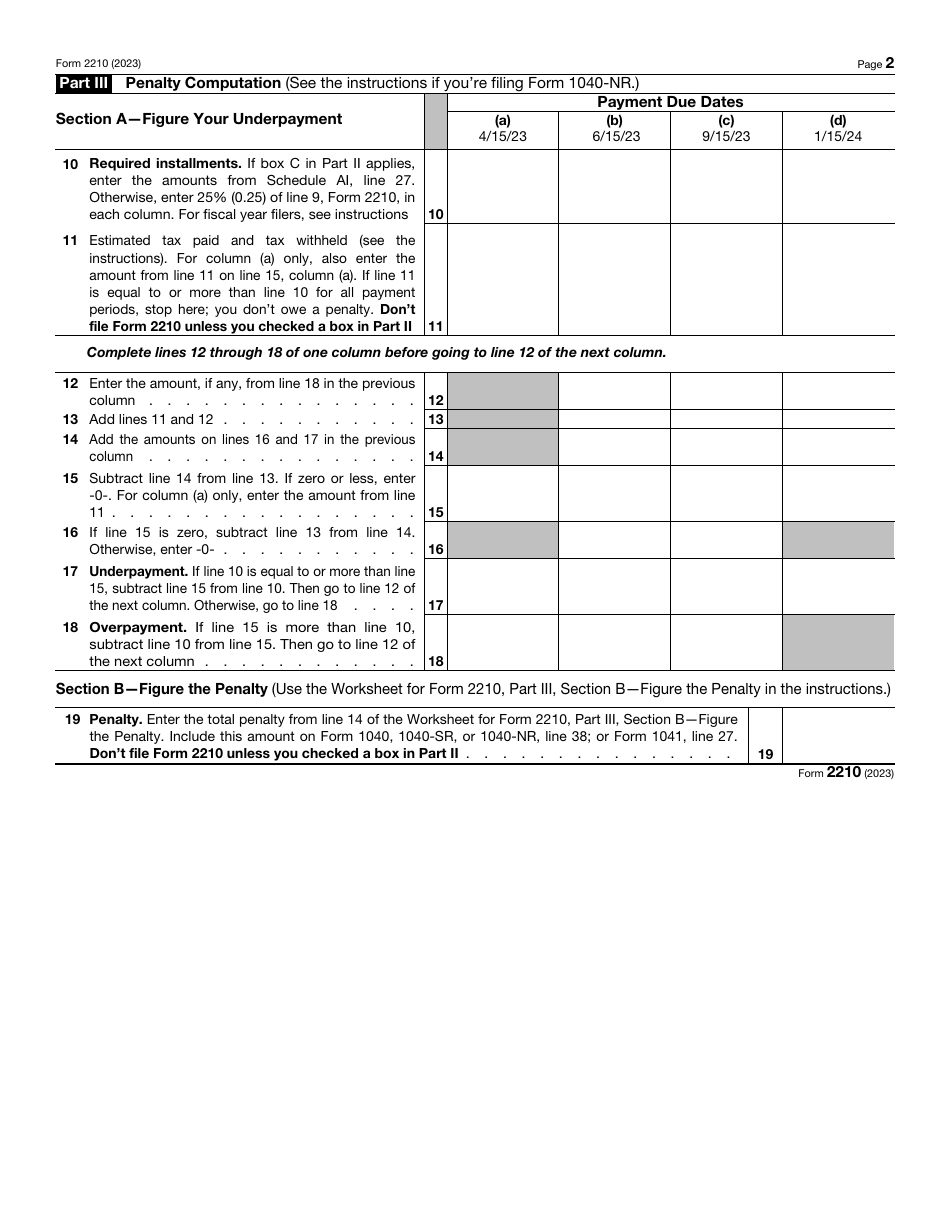

Calculate the penalty you must pay . It must be done in two steps - first, it is necessary to state the underpayment, and then you have to determine the penalty. Since you have an obligation to pay taxes every quarter, the document is divided into four columns - enter the installments you were required to pay, the tax you actually paid, and the tax that was deducted. It is likely you are dealing with overpayment in some quarters - take that into account before going further with your calculations.

-

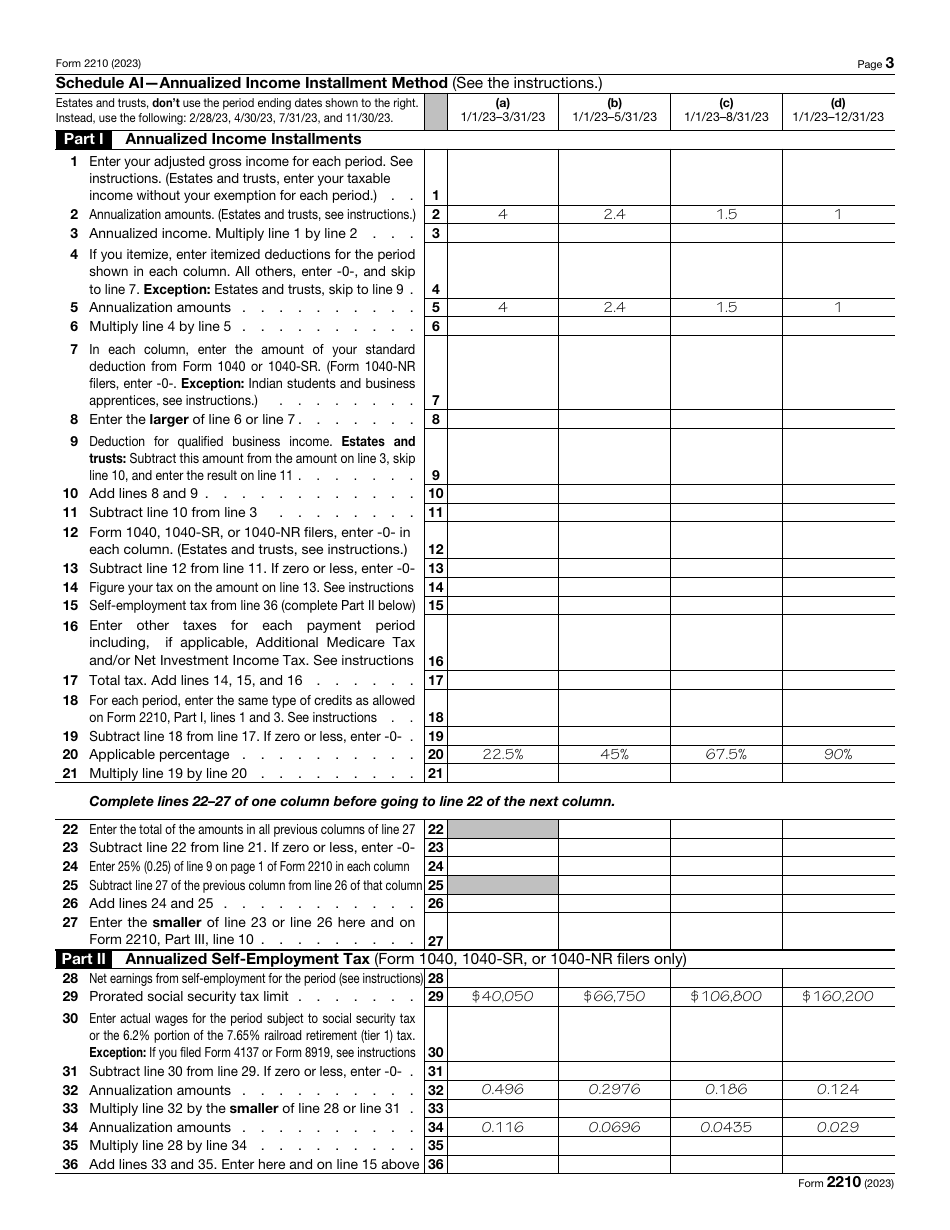

Fill out the schedule on the last page of the form if you use the alternative method to compute estimated tax installments . Once again, you should complete the table divided into four quarters - record your income for every time period and indicate the annualization amounts. The formulas included in the form will help you acknowledge how much self-employment tax you will need to pay in accordance with existing thresholds and rates.