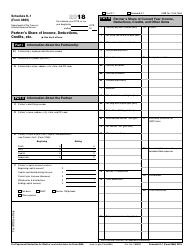

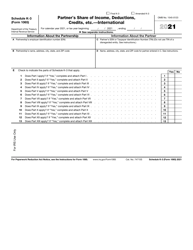

This version of the form is not currently in use and is provided for reference only. Download this version of

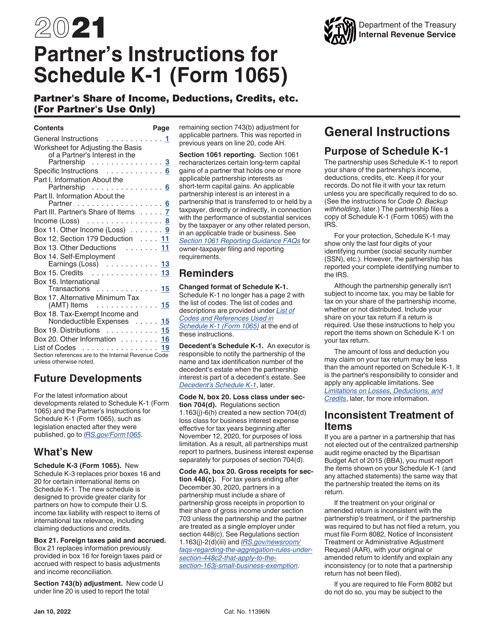

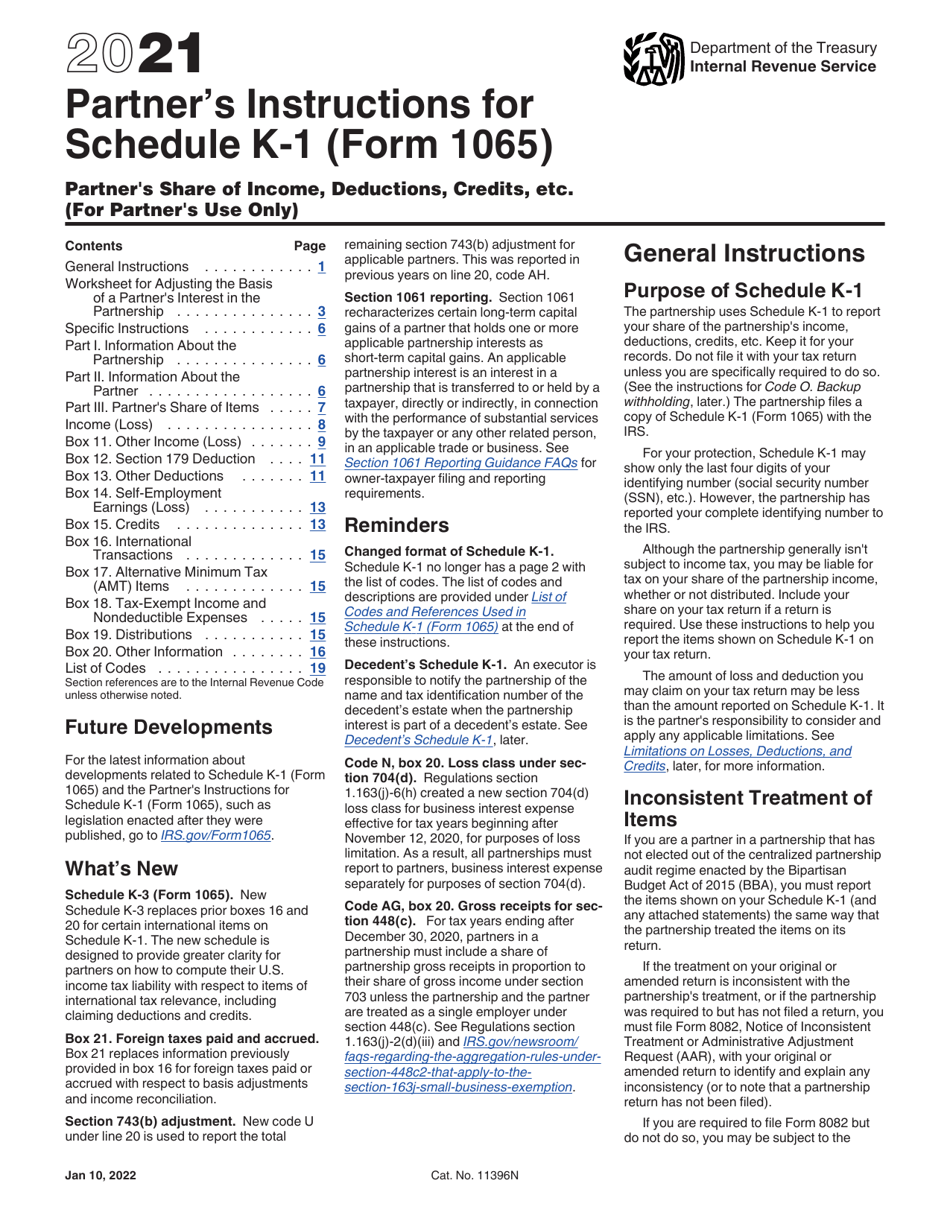

Instructions for IRS Form 1065 Schedule K-1

for the current year.

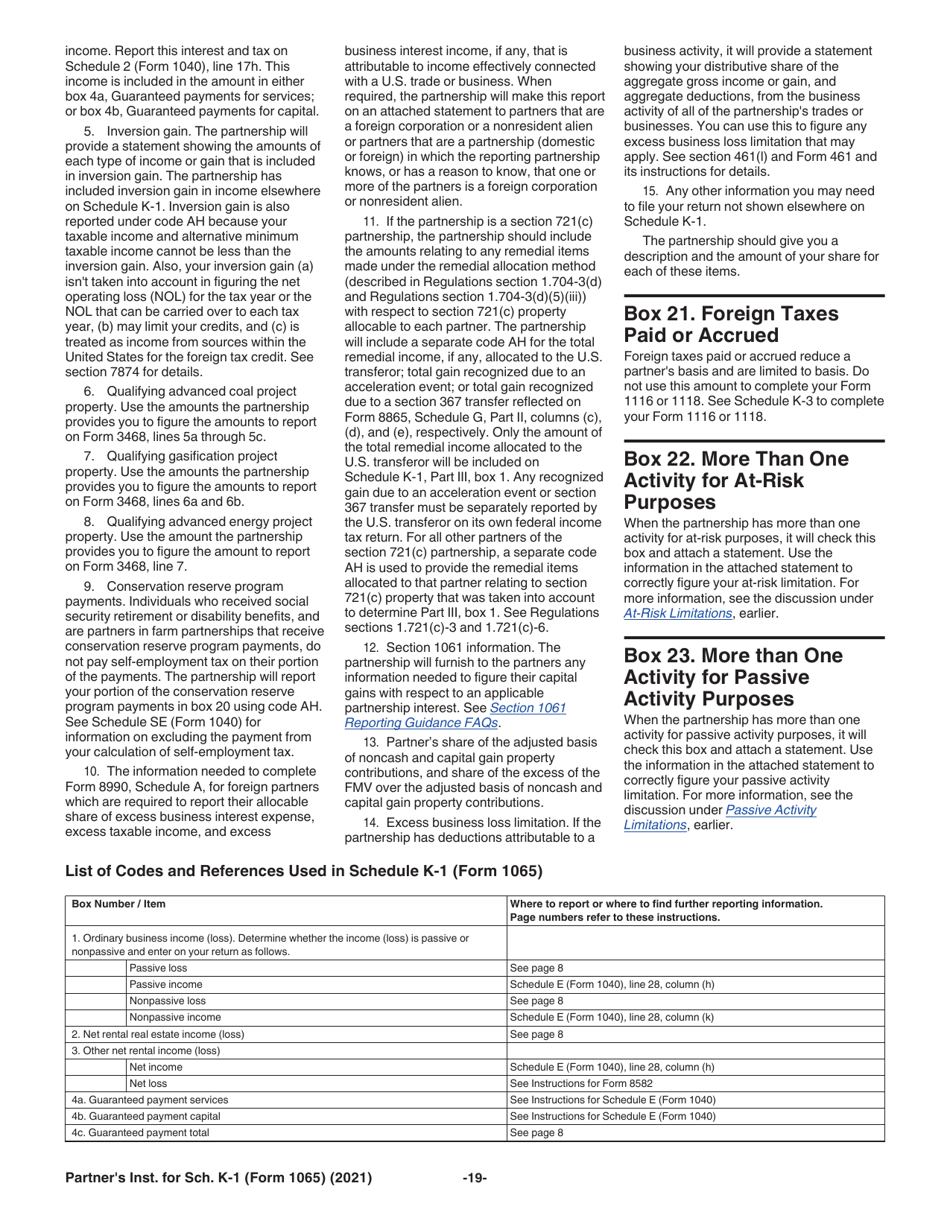

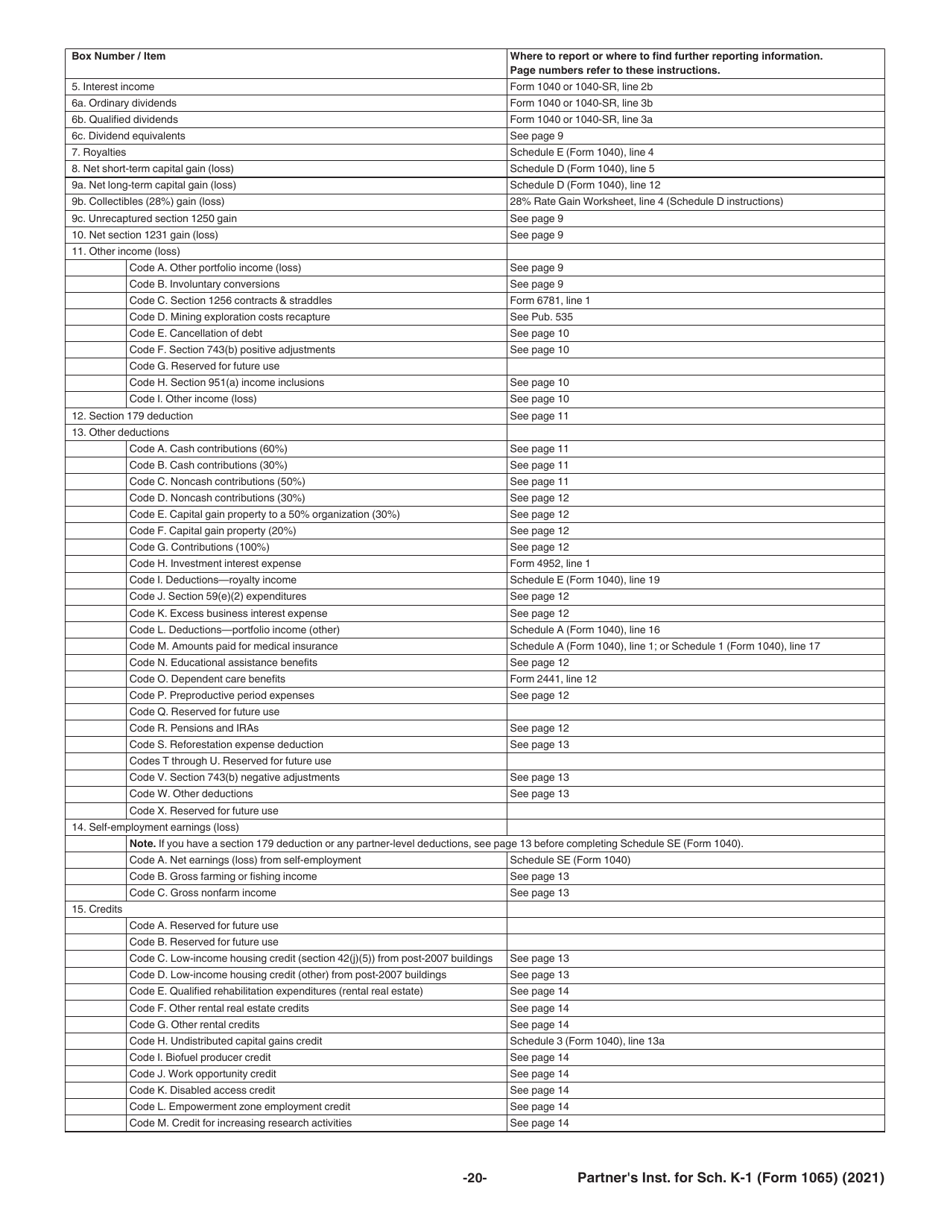

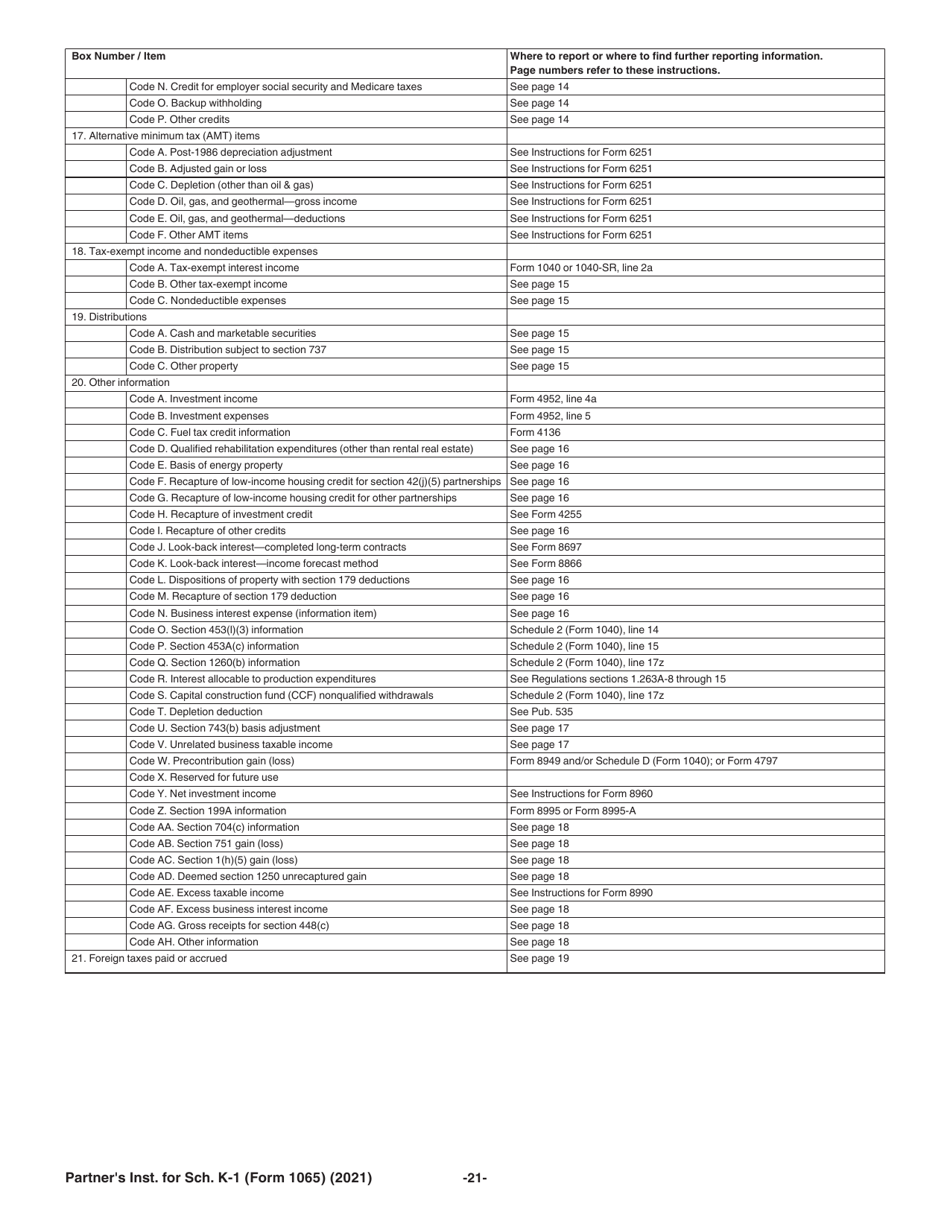

Instructions for IRS Form 1065 Schedule K-1 Partner's Share of Income, Deductions, Credits, Etc.

This document contains official instructions for IRS Form 1065 Schedule K-1, Partner's Share of Income, Deductions, Credits, Etc. - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury.

FAQ

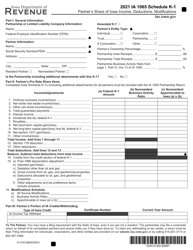

Q: What is Form 1065 Schedule K-1?

A: Form 1065 Schedule K-1 is a tax form used by a partnership to report each partner's share of income, deductions, credits, and other items.

Q: Who needs to file Form 1065 Schedule K-1?

A: Partnerships need to file Form 1065 Schedule K-1 to report each partner's share of income, deductions, credits, and other items.

Q: When is Form 1065 Schedule K-1 due?

A: Form 1065 Schedule K-1 is due on the same day as the partnership's tax return, which is typically March 15th.

Q: What information is needed to complete Form 1065 Schedule K-1?

A: You will need the partnership's identification number, each partner's name and address, and each partner's share of income, deductions, credits, and other items.

Q: Are there any penalties for not filing Form 1065 Schedule K-1?

A: Yes, there can be penalties for not filing Form 1065 Schedule K-1, including potential fines and interest charges.

Q: Can I file Form 1065 Schedule K-1 electronically?

A: Yes, Form 1065 Schedule K-1 can be filed electronically using the IRS's e-file system.

Instruction Details:

- This 21-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.