This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form CT-400

for the current year.

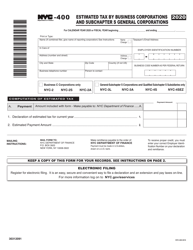

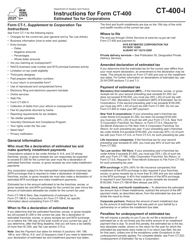

Instructions for Form CT-400 Estimated Tax for Corporations - New York

This document contains official instructions for Form CT-400 , Estimated Tax for Corporations - a form released and collected by the New York State Department of Taxation and Finance.

FAQ

Q: What is Form CT-400?

A: Form CT-400 is an estimated tax form for corporations in New York.

Q: Who needs to file Form CT-400?

A: Corporations in New York that are required to pay estimated tax need to file Form CT-400.

Q: When is Form CT-400 due?

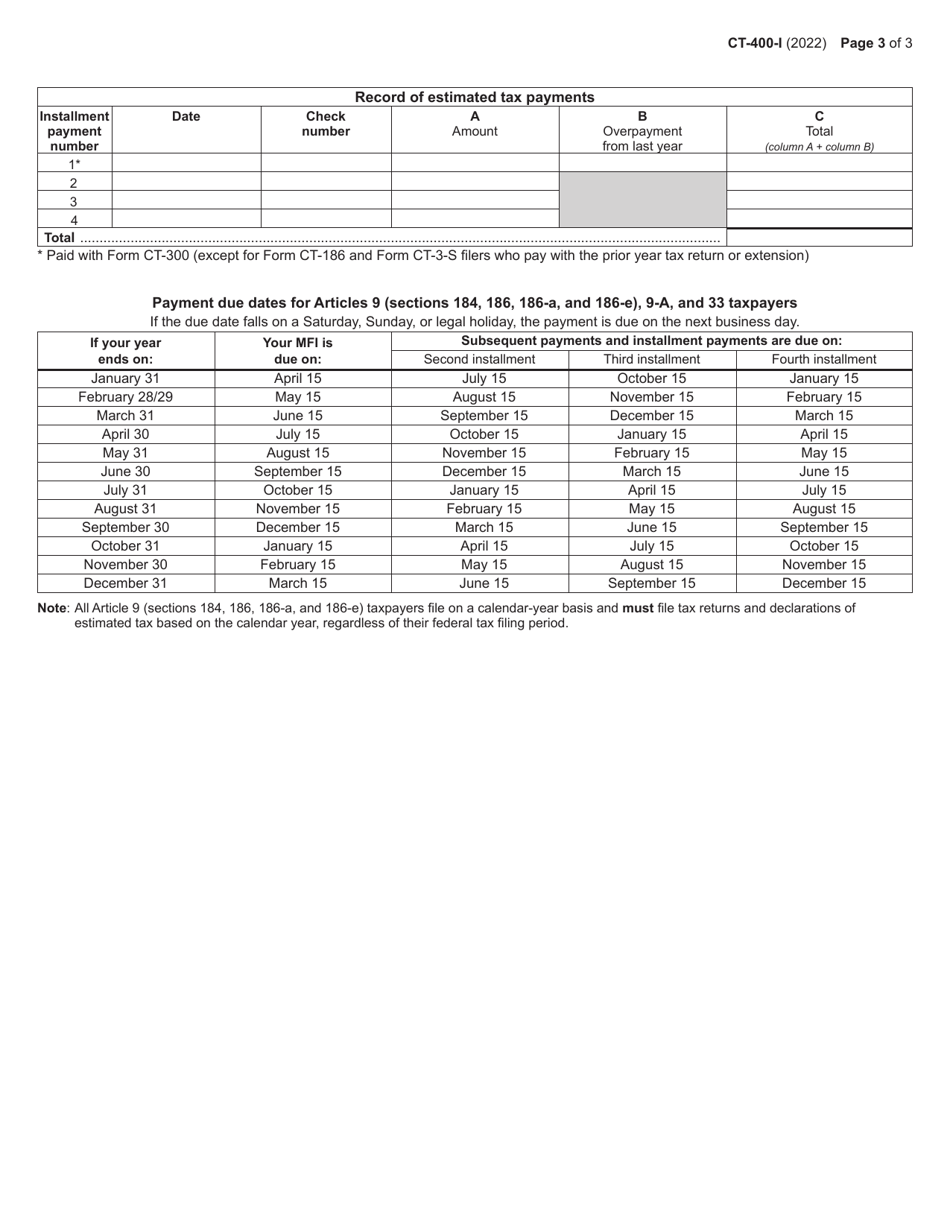

A: Form CT-400 is due on the 15th day of the 3rd, 6th, 9th, and 12th months of the corporation's tax year.

Q: How do I calculate the estimated tax?

A: The estimated tax is calculated based on the corporation's projected taxable income for the year.

Q: What happens if I don't file Form CT-400?

A: Failure to file Form CT-400 or pay the estimated tax on time may result in penalties and interest.

Q: Are there any exceptions to filing Form CT-400?

A: Certain corporations, such as S corporations and qualified New York manufacturers, may be exempt from filing Form CT-400.

Q: Can I amend a filed Form CT-400?

A: Yes, you can amend a filed Form CT-400 by submitting an amended return with the updated information.

Instruction Details:

- This 3-page document is available for download in PDF;

- Actual and applicable for this year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.